Benchmark iron ore prices climbed on Tuesday after trade data showed Chinese imports of the steelmaking raw material topped 1 billion tonnes for the third year in a row as Beijing’s efforts to stimulate the economy pays off.

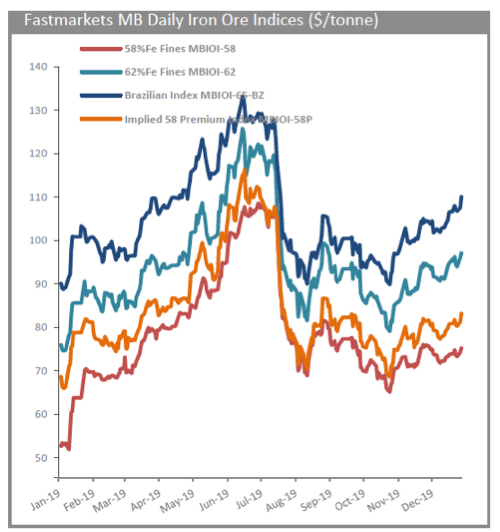

The Chinese import price of 62% Fe content ore was pegged at $97.03 per dry metric tonne according to Fastmarkets MB, a more than 4-month high. Iron ore prices averaged $91.85 in December.

China’s iron ore purchases in December totalled 101.3m tonnes, up nearly 12% from July and 17% from last year customs data showed, marking the highest level of imports since September 2018.

Full year iron ore imports was the second best on record at 1.069 billion tonnes, up 0.5% from last year and within shouting distance of 2017’s record 1.075 billion tonnes.

Iron ore peaked in July last year just shy of $126 a tonne, the highest since January 2014, but declined over the summer months as fears of a shortage on the seaborne market receded.

The price of iron ore is up 30% following a dam burst at Vale’s Brumadinho operations in Brazil in January 2019 that killed nearly 300 people. In response, the world no 1 producer initially suspended 93m tonnes of output.

However, the Rio de Janeiro-based company managed to bring much of that capacity back online and ended the year with only around a 5% drop in output to an estimated 310m tonnes.

Before the disaster Vale was flagging strong growth with a medium term target of roughly 400m tonnes in annual production thanks to its $14 billion S11D project that on its own adds 95m tonnes in new capacity.