The rally in the price of copper continued on Tuesday after trade data showed Chinese imports of refined metal at the best level since March 2016 and concentrate shipments setting a fresh all-time high.

In afternoon trading in New York, copper for delivery in March hit $2.8745 a pound ($6,337 a tonne), the highest since end-April 2019.

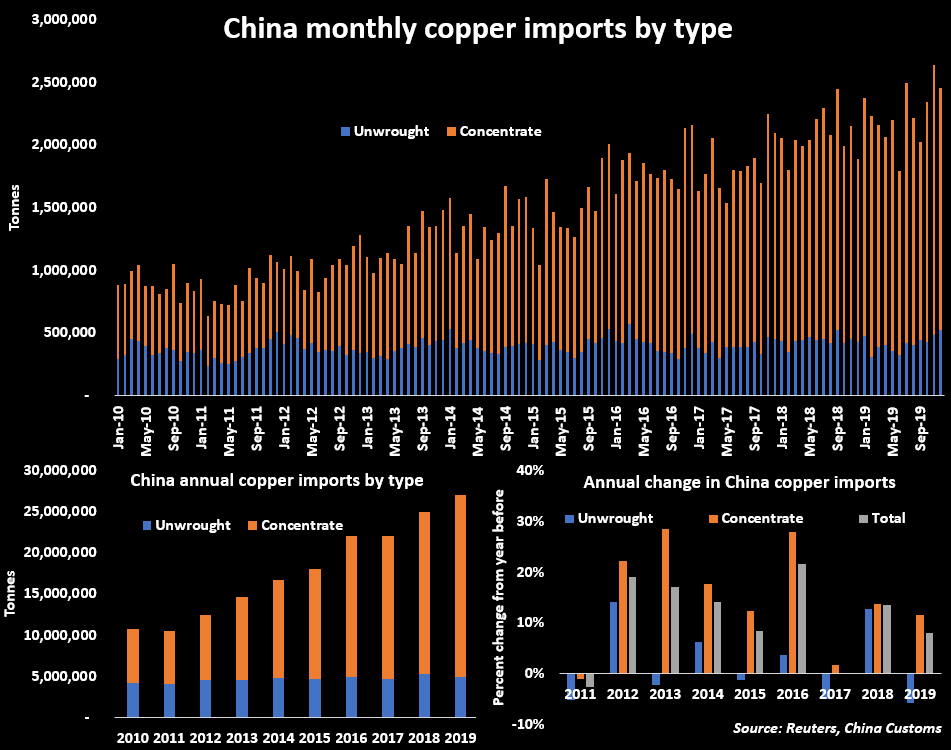

China consumes half the world’s copper, and trade data released overnight showed the country’s imports of unwrought copper totalled 527,000, a 23% jump compared to December last year.

For all of 2019, imports of unwrought copper were still down 6% from a year earlier, falling just shy of 5 million tonnes. Last year China imported a record 5.3m tonnes of refined copper.

December cargoes boosted year-to-date volumes to just under 22m tonnes, an annual gain of 11.6% and the third record year in a row.

Imports of copper concentrate were lower in December compared to the previous month, but continued to rise sharply from December last year, up 32% to 1.93 million tonnes. November was a record month at 2.16m tonnes.

December cargoes boosted year-to-date volumes to 21.99 million tonnes, an annual gain of 11.6% and the third record year in a row.

Despite the strong imports, Bloomberg reported on Monday, inventories at warehouses tracked by the three international exchanges – New York, Shanghai and London – have shrunk by about 37% since July to just shy of 300,000 tonnes, equivalent to just 1.2% of global consumption.

China put in place a complete ban on certain types of scrap copper imports at the start of 2019 on top of a 25% tariff on imports from the United States, one of its main suppliers, instituted in August.

With scrap imports falling by nearly 60% last year and global mine output flat, Chinese smelters found themselves competing for feedstock. Spot treatment and refining charges (TC/RCs) — paid to smelters to process copper concentrate into refined metal — fell sharply last year improving profitability for miners.

Fundamentally strong

In it’s 2020 outlook, BMO said long-term fundamentals of the copper market “remain intact”:

We still see potential for low- to medium-single-digit growth in demand, helped by increased penetration in areas such as renewable energy and electric vehicles, while the supply side still faces major secular challenges and has a great tendency to disappoint. Moreover, with new assets generally dilutive to the existing asset base, the cost curve continues to steepen over time.

However, miners do like building copper projects, and there are a number of them in the pipeline, which will have to be absorbed. We are drawing ever closer to the point when such projects will be delivered, and thus the current copper deficit is running out of time to yield significantly higher prices.

BMO’s long term price for copper is $3.25 a pound, or $7,165 per tonne. The investment bank also warns that substitution (new aluminium alloys targeting market share in voltage cables) and optimism over long term prices driving further project approvals could limit the tailwinds for the copper market.