Source: Bill Powers for Streetwise Reports 01/08/2020

Bill Powers of Mining Stock Education sits down with Kevin Drover, CEO of Aurcana, to talk about the company’s production plans for its high-grade project in Colorado.

Aurcana Corporation (AUN:TSX.V; AUNFF:OTCQX) has 100% ownership of the world’s highest-grade silver mine (P&P): the Revenue-Virginius mine in Ouray, Colorado, USA. This fully permitted mine will also be one of the lowest-cost silver producers in the world at only US$8/oz Ag (AISC) after byproduct credits. Aurcana is currently (Q1 2020) securing the final capex needed to commence production, which it expects to accomplish in Q4 2020. In this interview, Aurcana CEO Kevin Drover provides an overview of the Revenue-Virginius mine and Aurcana’s investment value proposition.

Kevin Drover has over 40 years of both domestic and international experience. He was previously VP Worldwide Operations at Kinross Gold and possesses experience in all aspects of mining industry operations, process re-engineering, project development and corporate management.

Bill Powers: I would like to welcome Aurcana Corporation president and CEO, Kevin Drover. I’ve met Kevin at the last two Beaver Creek Precious Metals Summits and have been following the company and getting updates annually at the Precious Metals Summit. So, Kevin, it’s your first time on Mining Stock Education, welcome. Please begin provide an overview of this mine that I’ve referenced with the highest grade proven and probable silver reserves in the world?

Kevin Drover: Well, thank you, Bill. Yes, this mine, it’s located in Colorado in the San Juan Mountains near the town of Ouray, and it’s up at about 10,000 feet, in that range, and it is extremely high grade. Our Proven and Probable reserves are 21 million ounces at 37 ounces of silver equivalent per ton. And I don’t know of any other mine in the world, at least that I’m aware of, with a Proven and Probable reserve of that grade. And the exploration potential of this property is quite significant as well for the future.

Bill: And you own this project 100% outright?

Kevin: We own the project 100%. We own this one, and this mine is essentially fully built. It is fully permitted. There’s a feasibility study completed and it’s ready to go. Technically, there’s nothing left to do with this mine but to put it into production and we, of course, are seeking funding to do that now.

We also have a fully-permitted, fully-built mill in place, 1,500 ton a day mill, located at the Shafter Mine in Texas and that’s near the town of Marfa, Texas. It’s currently on care and maintenance, but at some point we will need to revisit that one as well. It needs some additional technical work and that’s not our focus right now. Our primary focus is to get the Revenue-Virginius mine back into production as soon as possible.

Bill: What are some of the highlights of the Revenue-Virginius mine? The feasibility study that you referenced?

Kevin: Well, first, maybe I can just step back a second and just talk about the resources and reserves. We have a Measured and Indicated resource of 30 million ounces at 30 ounces per ton. An Inferred resource, of course, which you cannot include in your feasibility study, but it’s still an Inferred resource of 13.2 million ounces at 40 ounces per ton and ,of course, our Proven and Probable reserves are 21 million ounces at 37 ounces per ton. Currently, it’s at six and a half year mine life, an average production rate of 3.1 million ounces per year. Our all-in sustaining cost of production after byproduct credits is $8 an ounce. If you look at byproducts and convert them to silver equivalent, our all-in sustaining cost is $10.71 per ounce, which is one of the lowest cost silver producers in the world by far.

Our pre-production capital needs are $37 million. We’ve recently raised approximately $7 million in August and September, so our needs are somewhat less than that $37 million on a go-forward basis. The NPV on this project at 5% using an $18.50/ounce silver price, which is not far from where we are today, is $75 million and the IRR is 71%. Time to production from full funding is seven months.

Bill: And of your total resource, what percentage of that is actually silver?

Kevin: Probably the best way to look at that would be from a revenue perspective and silver generates 71% of the revenue. Gold will produce 8% of the revenue, lead 15% and zinc 6%. There is some copper here, but it’s not a high enough grade to make sense for us to start up our copper circuit. We do have a copper circuit in the mill, but on some of the other veins that we have, we may look at producing a copper concentrate, but right now we won’t do that.

Bill: So you’re in Colorado, you have your permit, so there’s nothing on the environmental front or the permitting front that you have to worry about. The main hurdle here is just securing the funding in order to bring the mine into production?

Kevin: That’s correct. Yes. There’s no permits required whatsoever to go into production. Our environmental, social and government relations are excellent. Our guys down there have done a fantastic job with our environmental folks in that area and of course, we’re not far from Telluride, Colorado, and it’s a primary ski area, but the guys on the ground down there have done a fantastic job. We’ve had environmental groups to the site. We’ve had most of the senators, local county commissioners, mayor and such visit our site. We enjoy a good relationship with them.

We won the Colorado environmental stewardship award last year and we continue to pay a lot of attention to our health, safety, environmental, government and community relations. The community has been extremely supportive of us down there and so we continue to enjoy that and we want to make sure that that continues on into the future as we get up and running.

Bill: Kevin, is there anything more of pertinence regarding your treasury and how you might obtain this CAPEX money that you could share with investors?

Kevin: We’re looking for a debt facility at the moment and we’ve been somewhat successful. We’re going down the road on a couple of a different routes in terms of raising that. Gary Lindsey (Investor Relations) and I were recently through Europe and we have talked to a number of entities that appear to be interested in taking a deep look at this operation here.

So, we’re rather hopeful that we’re going to be able to find the funds, certainly within the next quarter, which is what we are targeting. And there will be a debt facility. We will do some more equity as well in the next little bit here, and between those two we think we’ll have sufficient funding to be able to fully restart the project.

Bill: What about expansion potential? Do you own the full strike length and are there other veins that you could potentially target to increase your resources?

Kevin: There are significant vein systems in this particular area. This is a very prolific area of the San Juan Mountains. Over the course of the last century and a half, there’s probably been thousands of mines in this region here. We are currently the only one with a mill that’s fully permitted and ready to go into operation.

The Virginius vein that we have is rather prolific. It’s the highest-grade vein, relatively cleanest and easiest to mine. It’s rather vertical. There was one area on the Virginius vein and basically one claim that we didn’t own that interrupted our ownership of the Virginius vein. We’ve recently acquired that vein and signed an agreement. The closing of that should be relatively soon, within the next month or thereabouts. And that is contiguous to our operation where we’re actually going to be first restarting the mining.

We intend this coming spring to do a drill program on that. This is one area up there that you can drill from surface, for the most part. There are no other areas that you can really drill from surface in this particular area. So, we’re pretty excited that we’ve been able to acquire that claim and that we will start a drill program. The goal of this drill program will be to add another couple of years of mine life to the operation along with the target that we already have as we develop the underground mine up toward the Monongahela, which is the area where we will be mining first.

Bill: And typically, with these underground mines in Colorado in the mountains, you kind of have that six to eight-year runway and then you keep that six to eight-year runway often, don’t you, as you just drill and expand?

Kevin: That’s absolutely correct. These narrow vein mines, I mean they’re narrow vein, but they’re very high grade of course and almost impossible to drill from surface and in order to drill them from underground, you actually have to do a significant amount of development in order to get yourself in a position where you can access the vein so you can point your drill in the right direction. And it’s very, very costly. Not just this mine, but any narrow vein mine in the world.

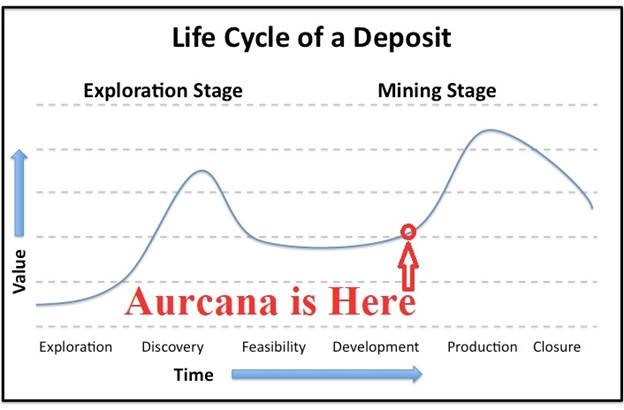

For instance, I used to work for Dome Mines in Timmins, Canada. And Dome Mines was a mine that ran for 120 years and it had only about two years of reserves for those 120 years. So, nobody spends that huge amount of money upfront to put all of these reserves out in front of you when you know all you’re going to do is you follow the vein. Right now we have six and a half years. We believe within the next year to year and a half, we’ll have closer to 10 years. We’ll add a couple of years from this Blue Grass claim. We think we will convert some of our Inferred that’s underground and if you look on page 17 of our presentation (see chart below), you’ll see there the green area that’s outlined by the red. We believe we’ll convert that into Measured and Indicated within the next year and that as well will add about two years of reserve. So, we’re looking at close to 10 years of reserves by the time we really get into operation and that’s quite a long time in the narrow vein environment.

Bill: Kevin, we’ve mentioned some of the unique factors and highlights of the Revenue-Virginius Mine, but are there any other market comparables that you could point out for investors?

Kevin: Yes. As a matter of fact, there are. If you were to go in our presentation to page 20 (see chart below), probably the best one to look at is the comparable valuations of enterprise value to M and I resource, silver equivalent ounces. And if you look there, you’ve got Excellon, Great Panther, Alexco, Endeavour and Aurcana. And if you look at that, we’re at 45 cents per enterprise value per silver equivalent ounce. You look at Endeavor, they’re at $1.17, Alexco, which probably is more comparable to us, they’re not operating at this stage of the game. I believe they’re still waiting on one permit and they’re at $1.34. I think what this chart tells you is that you can you buy a dollar stock here for about 30 cents as of today.

Bill: Are there any other monetization opportunities within the company? Assets that you could sell to self-fund?

Kevin: Yes, there are. And we have some options in that regard. As I said at the outset, the Shafter project is certainly not core to us. We’ve had some offers to purchase. We’ve had some offers to purchase just the milling facility itself. The mill is designed for 1,500 tons a day. We see Shafter more as a 500-600 ton a day operation in the future. So, the mill is probably not the right mill to start with and I certainly believe we could monetize the mill. We may or may not do that, but it is one of our options that we do have here.

Bill: Please share a little bit about your background and what makes you qualified to advance this project?

Kevin: I’ve been doing this for close to 45 years, I guess. At this stage, I’ve worked in most places around the world. My background is in operations. I work with Kinross as Vice President of Operations. Ran six of their mines in the Northern Hemisphere around the world for a number of years. Spent a lot of time in Russia. Built mines, restarted mines in countries like Nicaragua, Costa Rica, Peru, Russia, United States, Canada, and I’ve been doing this a very long time and I guess if there’s one claim to fame from my perspective, is that what I’ve typically done most of my life has gone into operations. I restarted them and get the production going, get the cost down, and those things are the focus that we have here, is we get ourselves funded, we will get this thing restarted, we will control our costs. We don’t have any control over the price of the metal that we sell. What we do have control over is how we operate and how we spend our money and we’re going to spend it very, very wisely going forward.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Aurcana Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Aurcana Corp. is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

( Companies Mentioned: AUN:TSX.V; AUNFF:OTCQX,

)