The world’s largest copper producer, Chile’s Codelco, has issued

in New York 10-year dollar-denominated bonds to secure funding for its

multibillion-dollar upgrade projects and refinance debt.

The state-owned copper giant has also reopened a 30-year

bond issued last year as part of a fresh funding strategy that includes taking

out loans and selling non-structural assets.

“A favourable debt market, with rates at historically

low levels, makes it attractive to pre-finance our cash needs of 2021,” Codelco’s

vice president of administration and finance, Alejandro Rivera, said

in the statement.

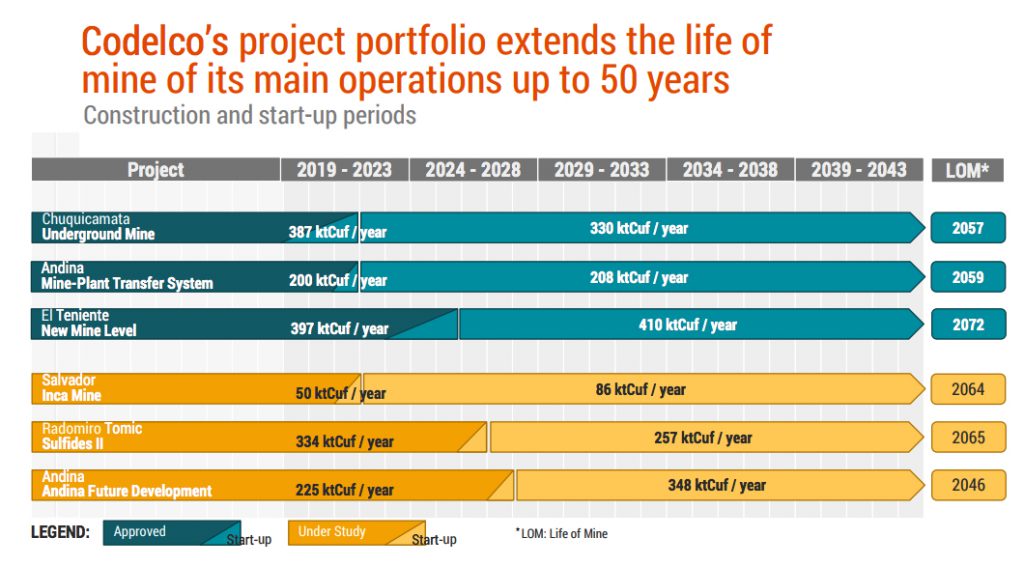

The company’s objective is to secure financing for its sprawling

10-year, $40 billion mines overhaul as many of its aging operations have been

dogged by declining ore grades and increasing costs.

Codelco has already kicked off one of its most ambitious

plans — the $5.6 billion conversion of the giant Chuquicamata open

pit mine into an underground operation.

The next major mine overhaul is a $5.5 billion new level at

El Teniente underground mine, the company’s largest, which fell under chief

executive Octavio Araneda’s mandate in his previous role of vice-president of

operations at the company’s central and southern divisions.

In the copper giant’s pipeline of so-called structural

projects are also a $1.3 billion expansion at the Andina mine, a $1 billion

upgrade at Salvador and the expansion of Radomiro Tomic, which doesn’t have an

estimated capital expenditure yet.

This is the fourth time since 2017 that Codelco issues

long-term debt to refinance its short- and medium-term debt as the sector

continues to face low copper prices.

The company, which produces nearly 10% of the world’s

copper, returns all its profits to the state and is funded by a mix of

capitalization and debt.