Source: Bob Moriarty for Streetwise Reports 12/29/2019

Bob Moriarty of 321gold unwraps the people and projects he believes makes these companies compelling investments.

In my experience everyone tends to make investing wisely way too complicated. Simple works, complicated doesn’t.

I think the first site visit I went on was to a gold project in Xinjiang province in Western China over eighteen years ago. The gold bull was but a calf. Site visits had totally stopped after the Bre-X scandal in 1996. The sponsor of the trip managed to assemble the most highly qualified and experienced writers and geos in the business for the visit. And then there was me.

My qualifications consisted of having a new gold site, doing some writing and having run a small placer gold operation in Alaska in 1980. By the way, don’t ever get involved in any market after the top; it’s a loser’s game. Every other person on the trip had far more in the way of qualifications than I did.

I used the trip as a way of measuring other writers and professionally qualified geologists to see how they viewed projects. I didn’t say much and certainly didn’t want to advertise my ignorance by asking stupid questions.

One of the first properties of the company was a gold mine that had been mined for six hundred years. There were literally thousands of dumps of waste rock covering dozens of acres of ground, and they had to have tens of thousands of uneconomic rock. You see, to mine at a profit (and believe it or not, everyone used to mine at a profit—when they couldn’t profit, they stopped mining) that long ago, they had to have very rich rock and they tossed everything aside that wasn’t what we now consider very high-grade material.

When I got back to Miami and was preparing an article, I got into contact with the president of the company, who happened to be a professionally qualified geologist with lots of initials after his name signifying something, I’m sure.

I asked him what the grade was of the numerous piles of waste rock. He replied that he didn’t know. I asked how much an assay would cost. He said, “$50.” Since there were literally tens of thousands of tons of already broken-up rock at surface that might contain gold, it seemed reasonable to me that it would be nice to know the average grade. The business class airfares the company had just spent ran into medium six figures, so $50 for an assay didn’t seem like much to me.

The president of the company had what he believed was a perfectly rational answer as to why it wouldn’t be worth spending thousands of dollars on a sample program of what he called waste rock. “We don’t know exactly where the waste rock came from,” he said smugly.

I persisted, “You don’t know it’s waste rock, first of all, and you know exactly where it came from: it came from the holes right next to the hundreds of piles of rock. You can map the sample and it will give you a lot of information a lot cheaper than a drill program.”

Eventually I convinced him that a $25,000 program could provide data cheaper than anything else he could do. He took 500 samples and sent them off to the lab. Months later I hadn’t heard anything back so I followed up with a phone call. “What kind of average grade did you come up with?” I asked.

“Well, er, hmm. . .It wasn’t really a scientific test because we don’t know exactly where the ore (notice the change in terminology here from ‘waste’ to ‘ore’) came from, so I don’t think we learned much,” he mumbled.

I persisted, “What was the average grade?” “Well, er, hmmm. . .it was just over 2 grams a ton.”

Two grams a ton of gold at surface in Western China was economic ore and what could be the start of a successful mining program as there were many thousands of tons of what was now ore.

I learned something important with that episode. Many people in the mining business confuse the journey with the destination. Profitable mining is the destination. Exploration is not the destination; it just gets you eventually to profitable mining if everything works out.

In other words, don’t ignore the obvious just because it’s cheap and easy. That would be a great lesson for investors.

Quinton Hennigh is my best friend in mining. We have spent a lot of time together since meeting for the first time in October of 2008. I realized then that I didn’t really have to know jack about mining if I knew someone who did know something. Quinton does. He knows a lot. Five minutes chatting about a project with him is worth a semester in a boring classroom being preached to by someone who doesn’t know the difference between a journey and a destination.

Irving Resources Inc. (IRV:CSE; IRVRF:OTCBB) began its Japan journey in early 2016 and in mid-December of 2016 announced their first assays. I’ll quote the interesting bit from the release: “At the Honpi (‘Main Vein’ in English) occurrence, rock chip samples collected from float boulders of vein material returned exceptional assays including 480 gpt gold (Au) and 9,660 gpt silver.”

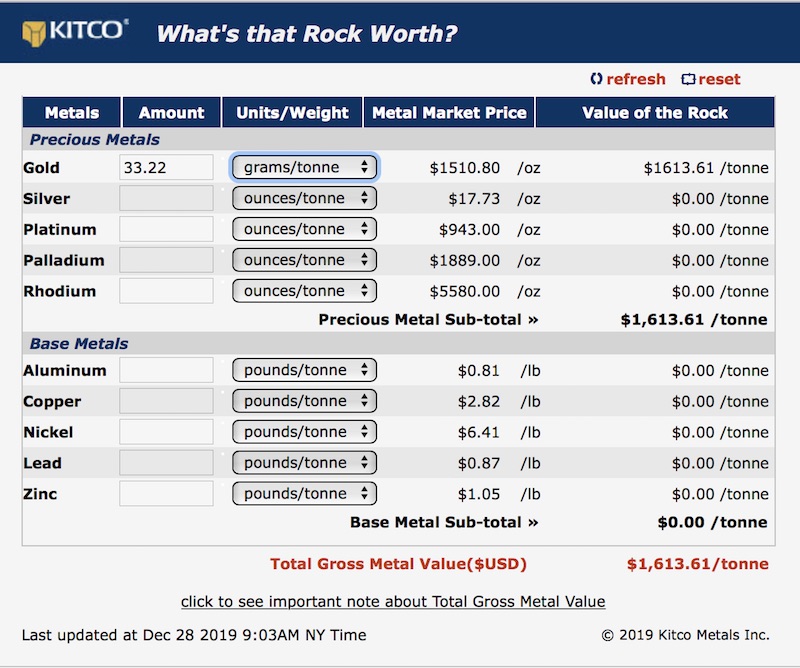

The fact is that for most investors, those numbers are interesting but don’t mean much. So let me feed them into a handy metal-in-the-ground calculator from Kitco that every investor should bookmark and use.

Now everyone can understand what $28,841.94 rock is. It’s a home run out of the park. There were other samples grading multi-ounce gold in the release so clearly this wasn’t a one-off. Japan is home to the highest-grade gold mine in the world. It’s certainly home to a lot of volcanic activity. Irving’s Hokkaido project is a classic epithermal hot spring deposit with multiple pulses of both silver and gold.

The highest-grade gold and silver shouldn’t be at surface; it should be 300–500 meters deep. so getting $29,000 rock at surface means the system was spitting out pieces of high-grade rock that made it to surface.

Folks, this isn’t rock science. First of all, everyone knew Quinton Hennigh was part of the deal. That’s a high credibility plus, and then right off the bat they found ultra bonanza rock that shouldn’t have been at surface. That’s can’t happen in a vacuum.

I went into their private placement (PP) at $0.40/share and still own the shares. Every press release since then has added to what we know about the system, and it’s all been positive. If you want to make your fortune investing in junior mining stocks, you should invest based on solid results when it appears to be risky. Smart investors knew everything they needed to know in December 2016. Everything since has been a cherry on top of whipped cream on a sweet apple pie.

As far as I am concerned, I knew what I needed to know in 2016, but for those who need convincing and are willing to pay 700% more for the shares, Irving managed to put in a deep hole that got down to where the main body should be in hole 10. Those results should be out in mid-February.

LLion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX) is another zero-brainer, run by a serial investing genius named Wally Berukoff who keeps building companies and selling them for a fortune. In early March of 2019, with $12 million in the bank, a resource of high-grade 5+ g/t gold of over 900,000 ounces and a market cap of about $50 million, Wally made an interesting addition to the company. He announced bringing in Quinton Hennigh as a technical advisor.

In all candor, with that kind of ounces and a tiny market cap, being fully permitted and with $12 million in the bank, this wasn’t all that hard a choice for me. When Wally brought in Quinton, I knew I had a fistful of aces. Wally has been running the company slow but steady. Quinton managed to convince him to speed it up. Raise some money and start poking holes in to the ground.

Actually, while Lion One is a gimme, I do have a competitive advantage. When I first met Quinton in October of 2008 we were driving up to Wyoming to look at Rattlesnake Hills, another alkaline deposit. As president of Evolving Gold at the time, he needed a home run project and Rattlesnake filled the bill. Evolving went from $0.15/share in the dismal days of late 2008 to $1.65/share a year later. Quinton just loves alkaline deposits. Like porphyry deposits they tend to be large. Unlike porphyry deposits, they tend to be very rich.

When Quinton climbed on board Wally’s train, I started buying Lion One shares. After he twisted Wally’s arm and got him to understand that the road to riches consisted of spending $10 million doing a lot of exploration and deep drilling. I frankly think that anyone who didn’t recognize what an outstanding investment Lion One was by early 2019 shouldn’t really be investing. It was the low-hanging fruit. No other junior in the world controls an alkaline deposit all by itself.

When Wally announced a $10 million private placement in November of 2019, I jumped in with both feet. My reward came a month later, some two weeks ago, when the initial assays came back from the first deep hole showing 4.29 meters of 33.22 g/t gold. For those who want to play with the Rocks in the Box machine again, here is the link once more.

The most interesting pick I have ever made, and it’s one few investors would be able to duplicate, was that of Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX). And my rationale would be out of the box for just about everyone.

Let me tell you a little story. . .(that used to start, “Meanwhile back at the ranch. . .”)

In 1976 I was making a living delivering small planes built in the U.S. all over the world. I ended up with about 240 trips of Cessnas and Pipers and Beech aircraft over every ocean. I was working for a slave driver based in Lakeland, Florida. One day he sent me out to California to pick up a used Rockwell 685 aircraft previously owned by a Las Vegas singing star who needed to have his wife flown to LA for medical treatment once a month.

In technical terms, the 685 aircraft was a piece of crap. But it was a high-wing piece of crap. A fellow in Australia named Lang Hancock wanted a pressurized aircraft with a high wing so he could play prospector all over Australia and Southeast Asia. Hancock just happened to be the fellow behind turning the Pilbara into the world’s richest iron deposit.

I ended up flying the plane from the U.S. to Australia. It was an adventure all by itself. Did I mention that the 685 aircraft was a piece of crap? Worse, the slave driver I worked for forced me to bring along on the flight as copilot the son-in-law of Lang Hancock, who was married to his only daughter, now Gina Rinehart.

Now given a choice between a copilot and a wet soggy sandwich, I would opt for the wet soggy sandwich in a heartbeat, but we had an interesting and adventurous flight. For about forty hours of flying over a period of about ten days he regaled me with tales of how rich the Pilbara region of Western Australia was in both grade and quantity of iron.

You see, the iron that had been dissolved in a saltwater basin covering the Pilbara region 3 billion years ago came out of solution when single cell creatures began to produce oxygen.

And the funny thing is that when Quinton and I were driving up to Rattlesnake in October 2008, he sorta told me a similar story. Except Quinton said gold would do the same thing in the presence of carbon as oxygen increased. You see, minerals will precipitate out of solution when the right combination of temperature or pressure or chemistry takes place.

Hmmm!

We met with Mark Creasy in June 2009 and chatted out the theory. Mark believed the Pilbara had a “shit pot” of gold. That’s the technical term for it. And then we went up and spent some time in the field with Mark’s geos swigging $1,200 a bottle wine. (That’s another story all by itself.)

Mark and Quinton finally came to terms on a deal. Quinton formed the company, raised some money at $0.25/share for those who were believers and I did my first story on them seven years ago.

When we did our tour in late 2009, Quinton found me a piece of carbon and in that instant I became a believer. You see, you cannot have the world’s biggest and richest iron deposit without having the world’s richest and biggest gold deposit if the metals come out of solution in the same way.

Everything since then has done nothing for me except convince me I had it exactly right when I said, “You are getting 700 square miles of a Wits model deposit for about $5 million. It doesn’t get any better than that. It is easily a ten-bagger. It could be a 100-bagger. It’s going to be big.”

There is no question; there have been some exceptional technical issues to sort out. The company actually had three totally different deposits: one more or less conventional at Beaton’s Creek with just short of a million ounces of gold; a hard-rock deposit at Karratha that is impossible to measure because of the nature of the nuggety gold; and a near-surface, nuggety, alluvial deposit that might extend from Egina all the way into the Indian Ocean.

I knew in 2009 the gold was there. I said so in 2012 and those who listened, as I was a lone voice in the wilderness, have made a lot of money.

From a technical point of view, Quinton has made incredible progress in a district that everything was known about 135 years ago. Well, almost everything.

He has brought in Newmont Mining; Mark Creasy is still a major investor, as is Eric Sprott and Kirkland Lake Gold, and there is a joint venture (JV) with Sumitomo at Egina. Just lately he has made an announcement that is so giant that it should be on banners being towed behind aircraft over every major city in North America. Mr. Yoshikazu Ishikawa, general manager of the Non-Ferrous Metals Business Department of Sumitomo, has just become a member of the board of directors.

Sumitomo has never done a deal with a junior before.

I like Novo a lot and I understood there was a boatload of gold there ten years ago.

All three companies are advertisers. I am biased. I have both bought shares in the open market and participated in private placements with each of the companies. Do your own due diligence. But keep it simple, not complex.

Irving Resources

$2.90 (Dec 27, 2019); 53.4 million shares

Irving Resources website.

Lion One Metals

$1.52 (Dec 27, 2019); 117.5 million shares

Lion One website.

Novo Resources

$3.74 (Dec, 27, 2019); NSRPF $2.94 OTCQX; 178.8 million shares

Novo Resources website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources, Lion One Metals and Irving Resources. Novo Resources, Lion One Metals and Irving Resources are advertisers on 321gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: Lion One Metals. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources, a company mentioned in this article.

Graphics provided by the author.

( Companies Mentioned: IRV:CSE; IRVRF:OTCBB,

LIO:TSX.V; LOMLF:OTCQX,

NVO:TSX.V; NSRPF:OTCQX,

)