Global mined zinc production is poised for gains over the coming years, according to Fitch Solutions’ new industry analysis. Globally, mined zinc production will continue to ramp up as elevated prices encourage miners to restart idled capacity and begin production at key new mines, Fitch forecasts.

Elevated zinc prices relative to historical levels will incentivise investment in new projects, expansions and restarts as the economics of the projects maintain their attractiveness, market analysts maintain.

Fitch also sees scope for some idled capacity to be restarted, and forecasts global zinc mine production to increase by 2.44% y-o-y in 2020 to 13.5mnt before increasing to 15.7mnt by 2028, averaging 1.97% y-o-y growth.

China will remain the largest global producer of zinc by a wide margin. China’s zinc production will stagnate due to declining ore grades and increasingly stringent environmental regulations, Fitch predicts. The report states the conservation of minerals and increasing consolidation of mining industries outlined in China’s 13th Five-Year Plan will weigh on zinc output in China.

Fitch forecasts Peru to remain a top zinc concentrate producer over the coming years. The country is home to approximately 57 mining firms, according to the Ministry of Energy & Mines (MEM). Despite the large number of players, Peru’s zinc sector is dominated by the Antamina operation which produced 409kt in 2018 and Nexa Resources’ operations of Cerro Lindo and El Porvenir.

Over the short-medium term, Fitch expects Antamina to continue driving production higher as the mine transitions to more copper-zinc ore and less copper- only ore between 2020-2022. Korea Zinc’s expansion at Pachapaqui and Nexa Resources beginning production at the Shalipayco mine will also support growth.

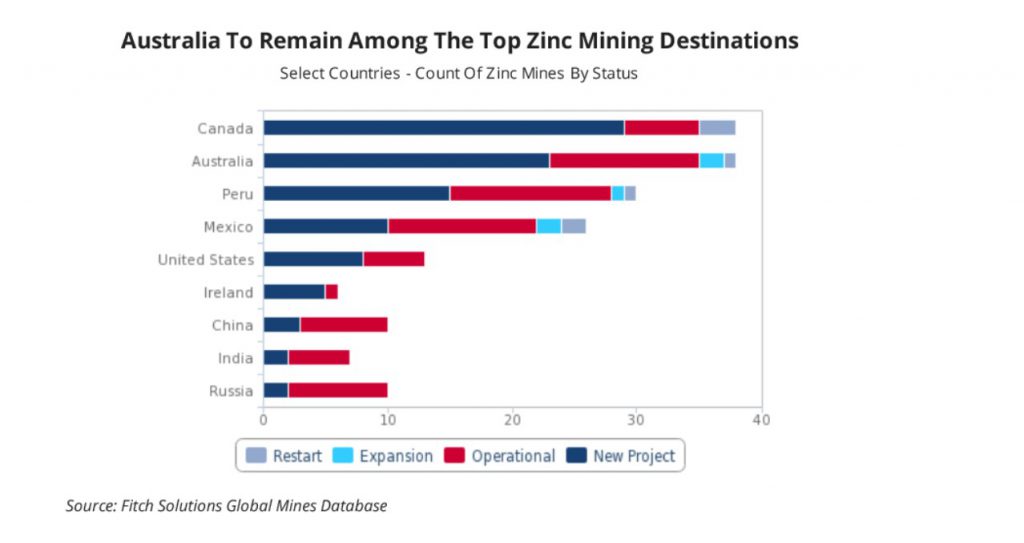

Peru has the third-highest number of new zinc projects in the pipeline at 15, according to Fitch’s Global Mines Database.

Following 2019’s year of robust growth, Fitch analysts expect Australia to maintain its positive trajectory over the coming decade. Over 2019, the ramp-up of MMG’s Dugald River mine and the restart of Glencore’s Lady Lorreta mine at Mount Isa led the increase in Australia’s zinc mine output by an estimated 14% y-o-y.

Given Australia’s healthy pipeline of projects, Fitch expects the country to average the second-fastest growth rate globally to 2028. Analysts forecast the country’s zinc production to increase from 940.0kt in 2018 to 1.3mnt by 2028, averaging 3.6% growth y-o-y, on the back of elevated zinc prices and the solid project pipeline.

Junior miners will continue to advance zinc projects in Australia, Fitch forecasts, given the positive outlook for zinc prices over the coming years. Australia currently holds a combined 26 zinc related new projects, expansions and restarts in Fitch Solutions’ Global Mines Database.

Read the full report here.