White Gold Corp. [TSX.V: WGO, OTC – Nasdaq Intl: WHGOF, FRA: 29W] is pleased to announce diamond drill results on the Vertigo target, located 25km north west of the Company’s flagship Golden Saddle & Arc deposit, on the road accessible JP Ross property, in the prolific White Gold District, Yukon, Canada. The Vertigo is one of the Company’s recent high-grade, near surface, gold discoveries generated through its methodological data driven exploration strategy. Drilling to date has encountered significant high-grade gold structures within a broad mineralized zone which remains open in all directions. The Vertigo is comprised of a 1.5km mineralized trend forming part of a 250km2 mineralized system with numerous newly identified targets. White Gold Corp’s fully-funded $13 million 2019 exploration program backed by partners Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corp (TSX: K, NYSE: KGC) includes diamond drilling on the Vertigo target (JP Ross property), Golden Saddle & Arc deposits (White Gold property) as well as soil sampling, prospecting, GT Probe, trenching and RAB/RC drilling on various other properties across the Company’s expansive land package located in the prolific White Gold District, Yukon, Canada.

Highlights Include:

• Successfully confirmed continuity of high-grade, near surface, gold mineralization at the Vertigo target consisting of multiple high-grade mineralized structures open along strike and at depth hosted within a broad shallow dipping mineralized zone.

• All Vertigo diamond drill holes completed intersected gold mineralization, and a minimum of 6 high-grade mineralized structures have been identified.

• Drill hole JPRVER19D0049 returned 4.31 g/t Au over 11.60m from 31.00m depth.

• Drill hole JPRVER19D0050 returned 2.6 g/t Au over 3.1m from 13.1m depth, 15.85 g/t Au over 0.5m from 25.5m depth and 0.86 g/t Au over 53.6m from 48.00m depth.

• Previously released Phase 1 diamond drill highlights included hole JPRVER19D0005 returning 9.61 g/t Au over 4.15m from 20m depth, including 94.2 g/t Au over 0.32m from 21m depth, and hole JPRVER19D0015 returning 0.42m of 141 g/t Au within a broader envelope of mineralization that averaged 11.64 g/t Au over 5.34m from 3m depth, and 18.46 g/t Au over 2.48m from 92m depth(1).

• 10 additional gold targets identified to date across the JP Ross property, including Sabotage, Topaz, Stage Fright, Frenzy and multiple others.

• Results continue to validate a robust 250km2 area with multiple known zones of mineralization hosted by regional scale structures in a prolific placer mining camp, including the 15km Vertigo trend.

• Additional regional drill results from the JP Ross and White Gold property targets to be released in due course.

Images to accompany this news release can be found at http://whitegoldcorp.ca/investors/exploration-highlights/.

- See White Gold Corp. News Release dated August 8, 2019, available on SEDAR.

“We are very pleased with the abundance of gold mineralization encountered at Vertigo to date, highlighted by the presence of multiple high-grade structures which continue to remain open in all directions. These results validate the Vertigo target to be a structurally controlled mineralized zone forming part of a regional-scale system, including the recently discovered Sabotage, Topaz, North Frenzy and multiple other gold targets across our JP Ross property. To date at least 10 gold targets have been identified over a 250km2 area on the JP Ross property, with Vertigo being the first to have received follow up diamond drilling,” stated David D’Onofrio, Chief Executive Officer. “These results have provided valuable insight into the nature and geometry of the mineralization and a better understanding of the local geology. These results in addition to previously completed regional exploration have also provided increased confidence in our methodologies as well as the potential for additional discoveries as our exploration team continues to explore the other targets on the JP Ross and our other properties. We look forward to the results from the exploration performed to date on these other targets and following up on the success of this program.”

Vertigo Target – Current Interpretation

Mineralization at the Vertigo is hosted within a network of WNW trending, moderate to steeply south dipping, shallow structures that are subparallel to topography. Individual structures are typically up to 3m and host high-grade mineralization associated with quartz veining, brecciation, and strong sericite-quartz alteration with local fine-grained visible gold, disseminated to locally massive arsenopyrite, galena, chalcopyrite and pyrite. The high-grade intervals pinch and swell both laterally and vertically with the strongest mineralization occurring where the structures cross lithologic contacts; particularly fine-grained amphibolite and felsic gneiss. The high-grade mineralization occurs within broader envelopes of lower grade mineralization (<0.1 g/t Au) that define a SE plunge to the overall system. The system also appears to have been cut by at least 3, late, NE oriented structures which have locally truncated and offset the mineralization. To date the drilling has defined the system approximately 300m along strike, 200m in width, and 275m down-dip. The system is open along strike and down plunge to the SE with strong potential for expansion.

Vertigo – 2019 Diamond Drilling

A total of 9,568m of diamond drilling over 46 holes was completed on the Vertigo in 2019. The drilling was conducted over 2 Phases, as discussed below, with a focus on defining the geologic and structural controls on mineralization in the area and follow up drilling on significant mineralized zones as warranted.

Phase 1 of diamond drilling at Vertigo was completed on 3 drill fences (Sections VER-000, 100W, & 200W) that transect across the core of the Vertigo target area at an azimuth 020°, establishing the geometry and vertical and lateral continuity of geology and mineralized structures originally intersected in 2018 RAB/RC drilling. The fences consisted of 4 – 6 drill set-ups per fence, spaced approximately 110m apart, with two holes drilled per set-up at angles of -45° and -60°. Partial results from Phase 1 drilling were previously released, and included hole JPRVER19D0005 returning 9.61 g/t Au over 4.15m from 20m depth, including 94.2 g/t Au over 0.32m from 21m depth; and hole JPRVER19D0015 returning 0.42m of 141 g/t Au within a broader envelope of mineralization that averaged 11.64 g/t Au over 5.34m from 3m depth and 18.46 g/t Au over 2.48m from 92m depth.1

Phase 2 of diamond drilling at Vertigo was to follow up on drill holes completed on the fences mentioned above, in an effort to refine geology and continuity; along the west-northwest structural trend. The holes are discussed below in numeric order, with their positions referenced to Holes xD0005 and xD0006 which were drilled beneath the original Vertigo discovery trench (Trench2) from pad VER19-A/B. All holes were drilled at an azimuth of 020° degrees with the exception of hole xD0050, which was drilled at an azimuth of 200°. Assay values for individual samples for the reported intercepts ranged from trace to 32.5 g/t Au. There is not enough information to estimate true thickness of the intercepts at this time.

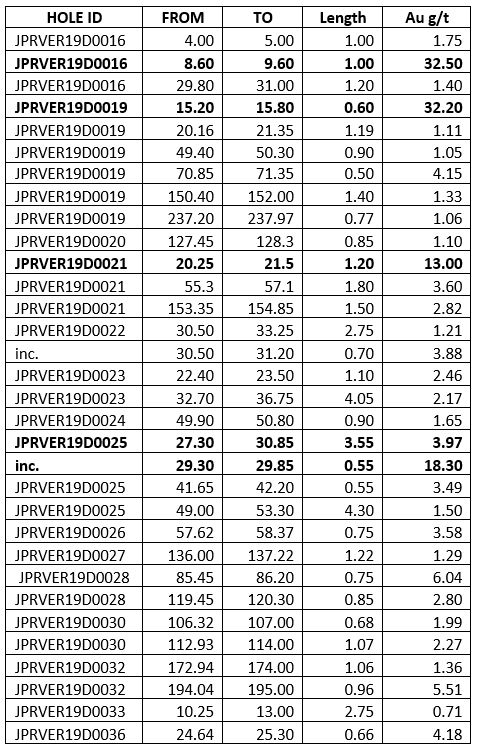

Vertigo – Phase 1 Diamond Drilling Highlights

The below table consists of new diamond drilling results from the Phase 1 fence drilling completed in 2019.

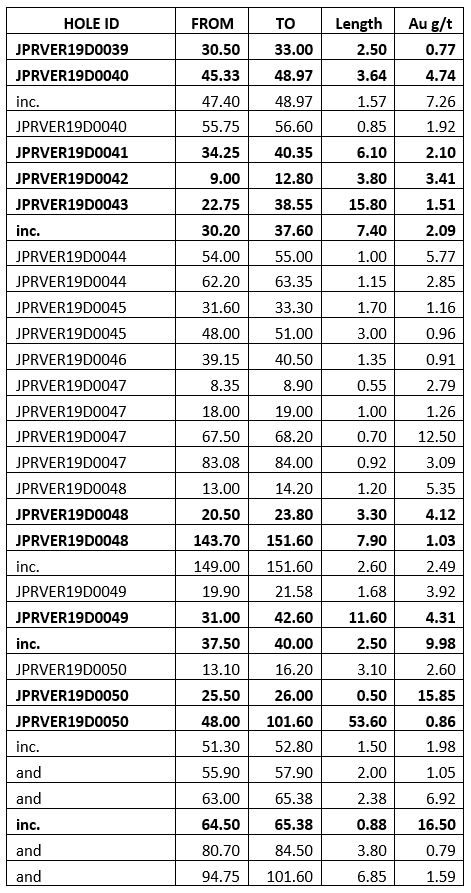

Vertigo – Phase 2 Diamond Drilling Highlights

The below table consists of diamond drilling results from the Phase 2 targeted drilling completed in 2019.

Fence section VER-000W

• Consists of holes JPRVR19D0005, 6, 7, 8, 9 11, 12, 14, 32, 34 & 35

• Results for JPRVER19D0005, 6, 7, 8, 9, 11, 12, 14 were previously released(1).

JPRVR19D0032, 34 & 35

Holes x032, 34, and 35 were drilled from the same pad and are located at the north end of the section, 95m to the north of holes x009 and x011. Hole x032 was drilled at a -45° dip and intercepted two short intervals of mineralization including 1.06m of 1.36 g/t Au from 172.94m and 0.96m of 5.51 g/t Au from 194.04m.

Hole x034 was drilled at a -60° dip but failed at 30m, so a second hole, x035 was drilled at -60°, which intersected several narrow, anomalous zones with Au values of up to 0.218 g/t Au.

Fence section VER-100W

• Consists of holes JPRVR19D00010, 13, 15, 16, 22, 24, 36 & 38

• Results for JPRVR19D00010, 13, 15 were previously released(1).

JPRVR19D0016

Hole x016 was drilled at a -60° dip from the same pad as, and undercutting, x015. It intersected the same shallow, high grade zone as intersected in x015 (0.42m of 141.0 g/t Au), returning 1.0m of 32.50 g/t Au from 8.60m. Lower in the hole it intersected 3 gold bearing zones with anomalous gold values but did not return any zones >0.2 g/t Au.

JPRVR19D0022 & 24

Holes x022 and x024 were drilled from the same pad 105 metres to the south of x015/x016. Hole x022 was drilled at -45° and intersected 2.75m of 1.21 g/t Au from 30.50m. Hole x024 was drilled at -60° and intersected 0.90m of 1.65 g/t Au from 49.90m. These two intersections may represent a steeply northerly dipping mineralized zone.

JPRVR19D0036 & 38

Holes x036 and x038 were drilled from the same pad 205 metres to the north of x015/x016 and are the two northernmost holes on this section. Hole x036 intersected 0.66m of 4.18 g/t Au from 24.64m and encountered 2 other narrow gold bearing zones with values of up to 0.267 g/t Au, all at depth of 70m or less. Hole x038 was a -60° undercut hole which intersected 3 gold bearing zones with anomalous gold values up to 0.368 g/t Au.

Fence Section VER-200W

• Consists of holes JPRVR19D0017, 18, 19, 20, 21, 23, 25, 26, 27, 28, 29, 30, 31 & 33.

• Section is 105 m to the west of section VER-100

JPRVR19D0017, 18 & 20

All three of these holes were drilled from the same pad, 110m northwest of holes JPRVER19D022 and 024, which are on section VER-100W. Hole x017 failed at 19m and was re-drilled as x018 at a -60° dip and hole x020 was drilled at a dip of -45°. Hole x020 intersected 0.85m of 1.10 g/t Au from 127.45m, otherwise both holes intersected 3 narrow gold bearing zones each, with values of up to 0.577 g/t Au.

JPRVR19D0027 & 29

Holes x027 and x029 were drilled from the same pad 106 m to the south of JPRVER19D017, 018 and 020. X027 was drilled at a -45° dip and x029 at a -60° dip. Hole x027 intersected 1.22m of 1.29 g/t Au from 136.005m, otherwise 3 narrow gold bearing zones with values of up to 0.693 g/t Au were intersected between the two holes.

JPRVR19D0019 & 21

Holes x019and x021 were drilled from the same pad 94m to the north of JPRVER19D017, 018 and 020. Hole x019 was drilled at a -45° dip and intersected high-grade mineralization consisting of 0.60m of 32.20 g/t Au from 15.20m. The hole also intersected several other gold bearing zones the most significant of which were 0.90m of 1.05 g/t Au from 49.4m, 0.50m of 4.15 g/t Au from 70.85m and 1.60m of 1.33 g/t Au from 150.4m. These gold bearing zones are broader (4.0m – 6.0m) when low grade material (0.10 – 0.50 g/t) is considered.

Hole x021 was drilled at a -60° dip and also intersected several zones including, 1.20m of 13.0 g/t Au from 20.25m, 1.80m of 3.60 g/t Au from 55.3m and 1.50m of 2.82 g/t Au from 153.35m. The upper high-grade zone correlates well with the high-grade intersection at the top of x019.

JPRVR19D0023 & 25

Holes x023and x025 were drilled from the same pad 196m to the north of JPRVER19D017, 018 and 020. Hole x023 was drilled at a -45° dip and intersected 3 gold bearing zones the most significant consisting of 1.10m of 2.46 g/t Au from 22.40m and 4.05m of 2.17 g/t Au from 32.70m.

Hole x025 was drilled at a -60° dip and intersected 4 gold bearing zones the most significant being 3.55m of 3.97 g/t Au from 27.93 including 0.55m of 18.30 g/t Au from 29.30m, 0.55m of 3.49 g/t Au from 41.65m and 4.30m of 1.50 g/t Au from 49.00m.

JPRVR19D0031 & 33

Holes x031and x033 were drilled from the same pad 296m to the north of JPRVER19D017, 018 and 020. Hole x031 was drilled at a -45° dip and intersected 4 gold bearing zones however none of the values were significant.

Hole x033 was drilled at -60° and intersected 3 gold bearing zones the most significant of which was 2.75m of 0.71 g/t Au from 10.25m.

JPRVR19D0026, 28 & 30

These holes were all drilled from the same pad, the northernmost on section VER-200, 396m to the north of JPRVER19D017, 018 and 020. Hole x026 was drilled at a -45° dip and intersected several gold bearing zones the most significant of which was 0.75m of 3.58 g/t Au from 57.62m.

Hole x026 was drilled at -60° and intersected 4 gold bearing zones the most significant of which were 0.75m of 6.04 g/t Au from 85.45m and 0.85m of 2.80 g/t Au from 119.45m.

Hole x030 was drilled at -70° and intersected 4 gold bearing zones the most significant of which were 0.68m of 1.99 g/t Au from 106.32m and 1.07m of 2.27 g/t Au from 112.93.

JPRVER19D0039 & 40

Holes xD0039 and xD0040 were drilled from the same pad 47 metres southeast of pad VER19-A/B. Hole xD0039 was drilled at -50° and intersected 1 gold bearing zone of 2.50m of 0.77 g/t Au from 30.50m. Hole x0040 was drilled at -85° and intersected two gold bearing zones the most significant consisting of 3.64m of 4.74 g/t Au from 45.33m, including 1.57 metres of 7.26 g/t Au from 47.40m.

JPRVER19D0041 & 42

Holes xD0041 and XD0042 were drilled from the same pad 46 metres northwest of pad VER19-A/B. Hole xD0041 was drilled at -50° and intersected one gold bearing zone consisting of 6.10m of 2.10 g/t Au from 34.25m. Hole xD0042 was drilled more steeply at -80° and also intersected one gold bearing zone consisting of 3.80m of 3.41 g/t Au from 9.00m.

JPRVER19D0043 & 44

Holes xD0043 and XD0044 were drilled from the same pad 78 metres southeast of pad VER19-A/B. Hole xD0043 was drilled at -50° and intersected one broad gold bearing zone consisting of 15.80m of 1.51 g/t Au from 22.75m. Hole xD0044 was drilled at -85° and intersected two gold bearing zones the most significant consisting of 1.00 metre of 5.77 g/t Au from 54.00m.

JPRVER19D0045 & 46

Holes xD0045 and XD0045 were drilled from the same pad 43 metres southwest of pad VER19-A/B. Hole xD0045 was drilled at -50° and intersected two gold bearing zones the most significant consisting of 1.70m of 1.15 g/t Au from 31.60m. Hole xD0046 was drilled at -85° and intersected one gold bearing zone consisting of 1.35m of 0.91 g/t Au from 39.15m.

JPRVER19D0047, 48 & 49

Holes xD0047, xD0048 and xD0049 were all drilled from the same pad 150 metres west of pad VER19-A/B. Hole xD0047 was drilled at -50° and intersected four gold bearing zones the most significant consisting of 0.7m of 12.50 g/t Au from 67.50m. Hole xD0048 was drilled at -70° and intersected three gold bearing zones including 3.30m of 4.12 g/t Au from 20.50m and 7.90m of 1.03 g/t Au from 143.70m. Finally, xD0049 intersected two gold bearing zones, the most significant consisting of 11.60 metres of 4.31 g/t Au from 31.00m, including 2.50m of 9.98 g/t Au from 37.50m

JPRVER19D0050

Hole xD0050 was drilled 70m east-northeast of drill pad VER19-A/B. It was drilled at an azimuth of 200° and a dip of -45°. The hole intersected three gold bearing zones including 3.10m of 2.60 g/t Au from 13.10m, 0.50m of 15.85 g/t au from 25.50m, and a broad interval consisting of 53.60m of 0.86 g/t Au from 48.00m that includes 0.88m of 16.50 g/t Au from 64.50m and 6.85m of 1.59 g/t Au from 94.75m.

QA/QC

The analytical work for the 2019 drilling program was performed by ALS Canada Ltd. an internationally recognized analytical services provider, at its North Vancouver, British Columbia laboratory. Sample preparation was carried out at its Whitehorse, Yukon facility. All RC chip and diamond core samples were prepared using procedure PREP-31H (crush 90% less than 2mm, riffle split off 500g, pulverize split to better than 85% passing 75 microns) and analyzed by method Au-AA23 (30g fire assay with AAS finish) and ME-ICP41 (0.5g, aqua regia digestion and ICP-AES analysis). Samples containing >10 g/t Au were reanalyzed using method Au-GRAV21 (30g Fire Assay with gravimetric finish).

The reported work was completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified standard, blanks and duplicates into the sample stream.

About White Gold Corp.

The Company owns a portfolio of 21,207 quartz claims across 33 properties covering over 422,730 hectares representing over 40% of the Yukon’s White Gold District. The Company’s flagship White Gold property has a mineral resource of 1,039,600 ounces Indicated at 2.26 g/t Au and 508,800 ounces Inferred at 1.48 g/t Au. Mineralization on the Golden Saddle and Arc is also known to extend beyond the limits of the current resource estimate. Regional exploration work has also produced several other prospective targets on the Company’s claim packages which border sizable gold discoveries including the Coffee project owned by Newmont Goldcorp Corporation with a M&I gold resource(2) of 3.4M oz and Western Copper and Gold Corporation’s Casino project which has P&P gold reserves(2) of 8.9M oz Au and 4.5B lb Cu. For more information visit www.whitegoldcorp.ca.

(2) Noted mineralization is as disclosed by the owner of each property respectively and is not necessarily indicative of the mineralization hosted on the Company’s property.

Qualified Person

Jodie Gibson, P.Geo., Technical Advisor, and Andrew Hamilton, P.Geo., Exploration Manager, for the Company are each a “qualified person” as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, and each has reviewed and approved the content of this news release.

Potential quantity and grade is conceptual in nature. There has been insufficient exploration to define a mineral resource at the Vertigo target, and it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Contact Information:

David D’Onofrio

Chief Executive Officer

White Gold Corp.

(647) 930-1880

ir@whitegoldcorp.ca

Cautionary Note Regarding Forward Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “proposed”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include; expected benefits to the Company relating to exploration conducted and proposed to be conducted at the Company’s properties; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; and those factors described in the most recently filed management’s discussion and analysis of the Company. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither the TSX Venture Exchange (the “Exchange”) nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this news release.