The price of copper surged on Friday after reports showed the US economy in robust health on the back of strong payroll numbers – the best reading since January – and progress in trade talks with China.

In afternoon trading in New York, copper for delivery in March continued to climb, hitting $2.7535 a pound ($6,070 a tonne), up 3.4% on the day and the highest since July.

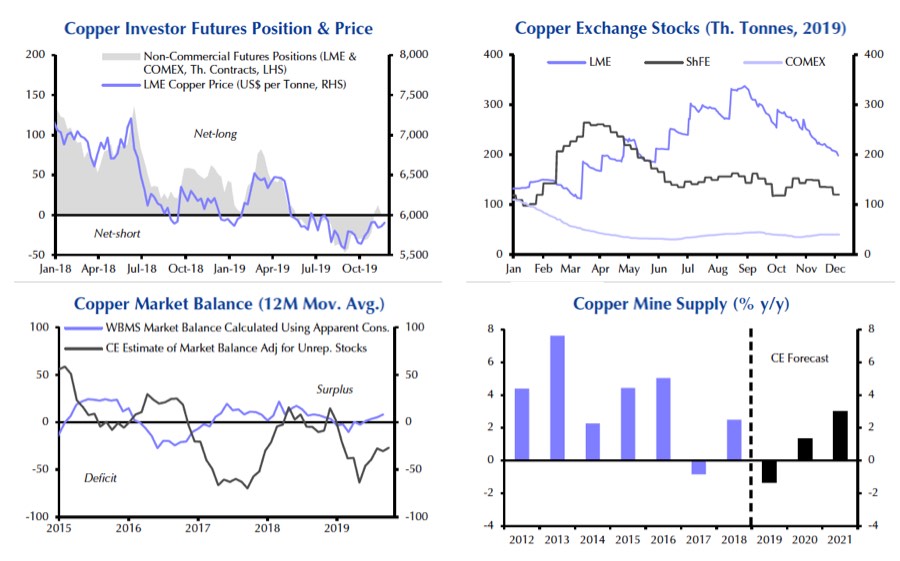

Copper was also buoyed by an improvement in sentiment among large-scale investors in copper futures like hedge funds and a drawdown of stocks, a note from Capital Economics on Thursday points out.

The combined position on the LME and COMEX futures markets switched to a net long recently after hitting a record number of net shorts (bets that copper could be bought back at lower price in future) at the end of the third quarter.

Caroline Bain, Chief Commodities Economist at the London-HQed firm, says the prospects for copper prices in 2020 are positive:

For one, copper supply is probably less ample than the “apparent consumption” data indicate.

And while mine supply growth is likely to recover in 2020 and 2021, it should remain weak by past standards.