Source: Bob Moriarty for Streetwise Reports 12/01/2019

Bob Moriarty of 321gold discusses the Indonesian government’s actions in the nickel market and how they might affect a company with a project in Norway.

As the world’s largest producer of nickel, the actions of the Indonesian government not only affect those companies working in Indonesia but also half way around the world.

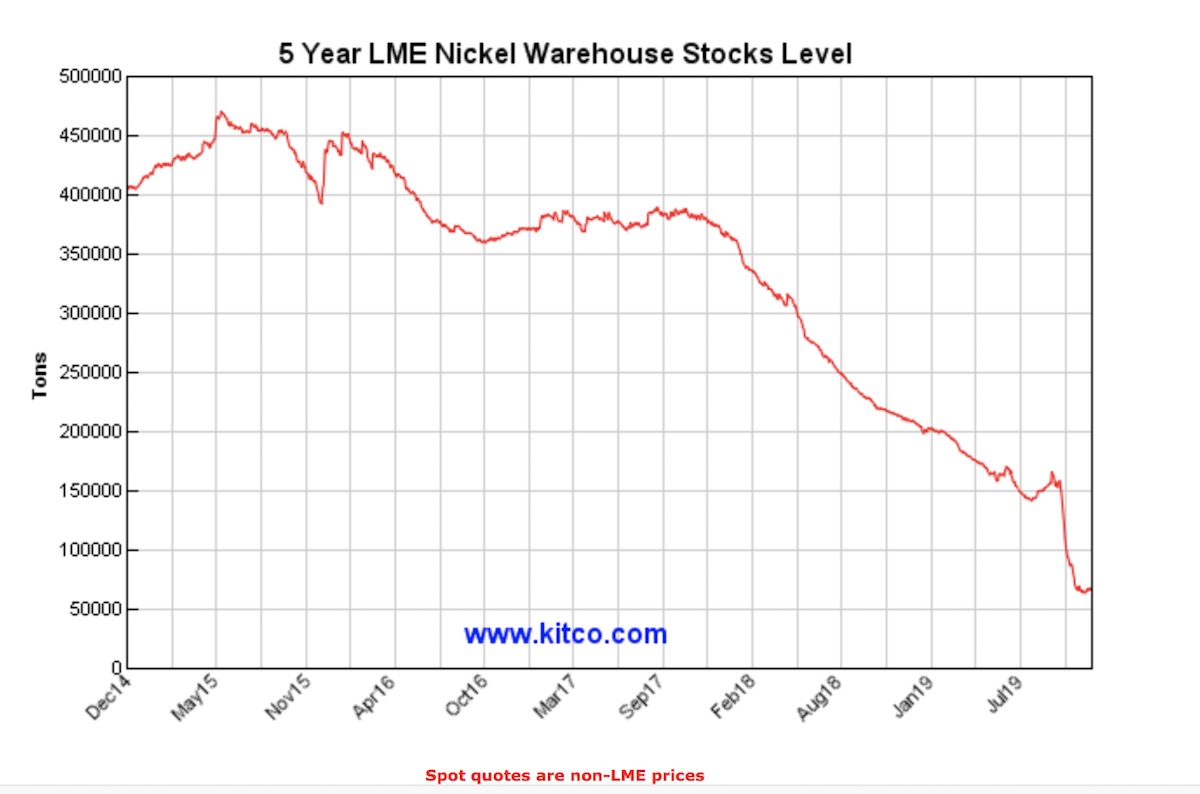

In 2014 the country restricted the export of nickel concentrate in an effort to force producers to construct smelting plants in the country. As a result production dropped from 400,000 tons a year to 100,000. In 2017, Indonesia relaxed the export regulations on the export of low-grade nickel in an effort to stimulate their flagging economy.

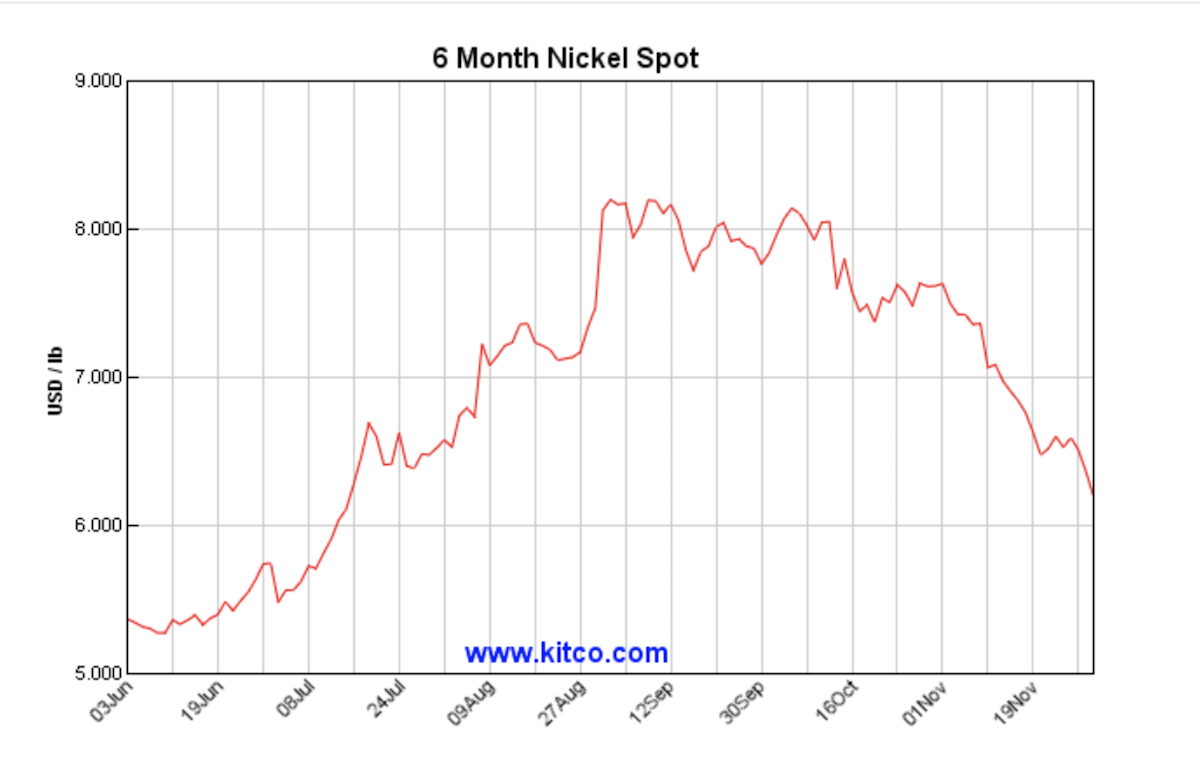

The actions of Indonesia regarding permission to export nickel concentrate have caused great confusion in the nickel market with warehouse stocks of nickel dropping almost 90% and the price of the metal bouncing up and down.

No one is certain what the Indonesian government will do next but their convoluted behavior has opened new opportunities along with new danger in the nickel market.

Playfair Mining Ltd (PLY:TSX.V) is a micro-junior with aspirations to advance three base metals projects in Norway. The company announced an option on March 1st of 2019 to pick up 100% of three contiguous nickel/copper/cobalt properties in an historic mining district in south central Norway. The terms are a little convoluted but basically say that Playfair will issue over time 9.9% of their shares and spend a certain amount of money in exploration to own 100% of the projects subject to a 3% NSR.

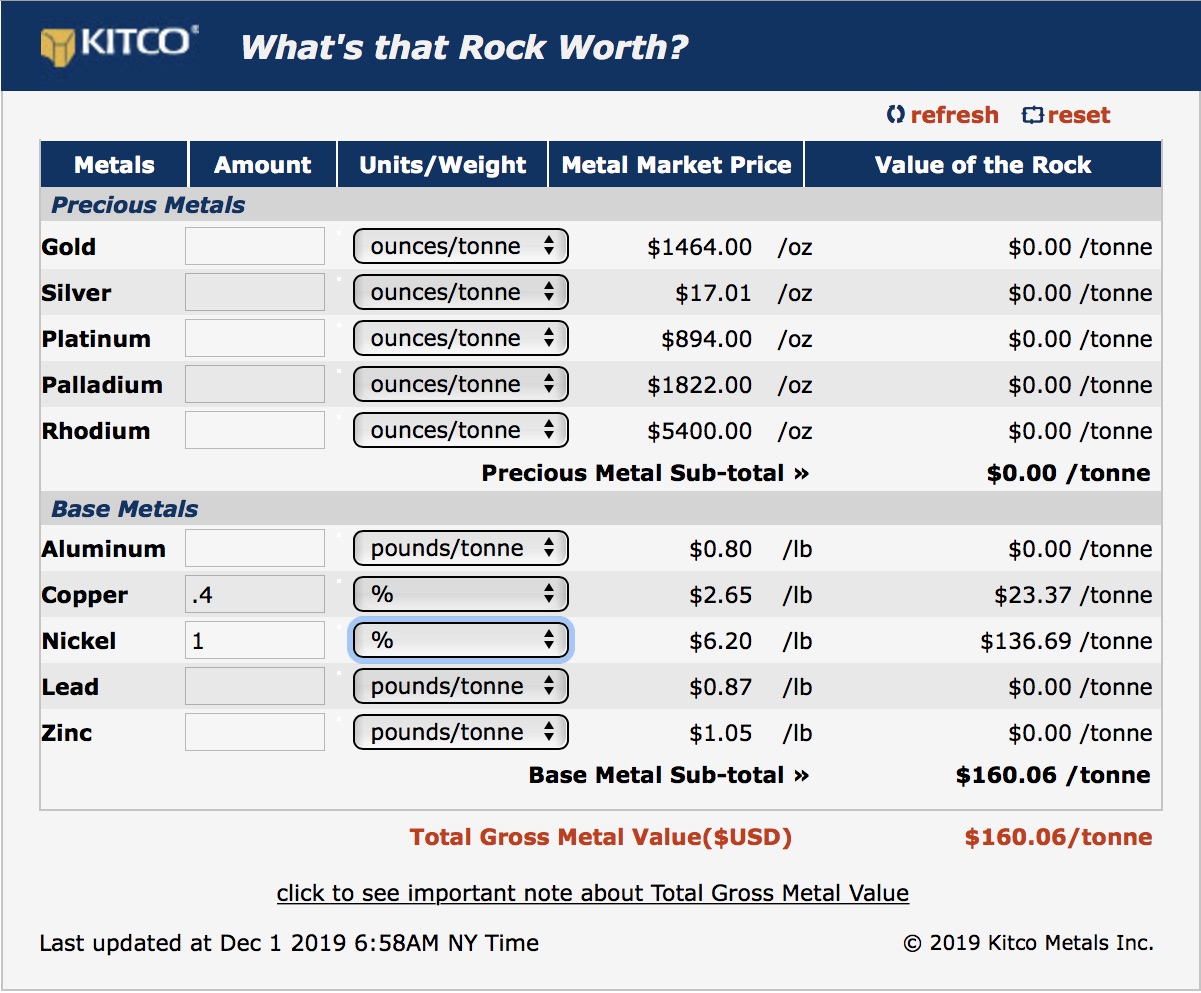

What Playfair calls their RKV target included two past producing copper VMS mines and a nickel/copper deposit with an historic, non-43-101 resource of 400,000 tons of nickel and copper. The gross metal value in the non-43-101 resource produced by Falconbridge based on 109 drill holes would total about $64 million. So it is an indication of potential.

Playfair has conducted a custom MMI survey over the property. MMI is a patented geochemical process owned by SGS to locate deep buried mineral deposits. The company released what appears to be highly successful results in early November of 2019.

VMS deposits tend to occur in clusters so finding a group of them in an area is an indication that there easily could be more. And their nickel target already had a significant resource albeit historic but from one of the giants in the industry, Falconbridge.

Playfair has done what they said all along they would do. Their next step is to conduct a scout drill program where drill results will dictate what happens next. With a $3.2 million market cap, there just isn’t much of a risk to the stock. It either goes to zero or up a lot.

Playfair is an advertiser. I have participated in the last PP and I look forward to the upcoming drill program. Do your own due diligence.

Playfair Mining

PLY-V $0.045 (Nov 29, 2019)

PLYFF-OTCQB 73 million shares

Playfair Mining website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Playfair Mining. Playfair Mining is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: PLY:TSX.V,

)