Chile’s Codelco, the world’s largest copper producer, will scale back its ambitious $40 billion, 10-year plan aimed at upgrading aging mines after reporting on Friday a 57% drop in pre-tax earnings to September due to a combination of factors including heavy rains, a long-dragged strike at its Chuquicamata mine and lower metal prices.

The company, which may lose its crown as the No.1 copper producer due citizen uprising threatening Chile’s economy, said it would cut spending through 2028 by $8 billion or 20%.

Codelco, which turns over all its profits to the state, will

also have to find a way to generate $1 billion more a year in gross

earnings from 2021 onwards. The company is expected to provide the government with

most of the funds needed to fulfill a long list of spending demands and so

quell ongoing protests.

“We are in a crucial moment in our history,” chief executive officer, Octavio Araneda, said in a statement. “Our obligation is to transform ourselves in order to continue contributing to the progress of Chile for at least 50 years more.”

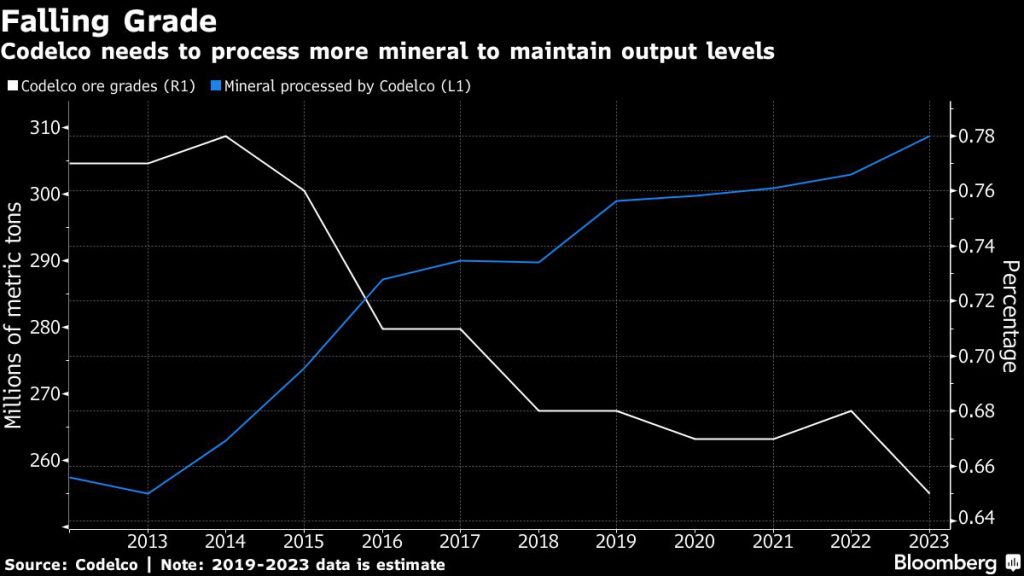

Araneda, who took the post as Codelco’s leader in July, was faced with the immediate challenge of investing billions just to keep up production levels at a time of thin margins in the global copper business.

The wave of protests and riots affecting all sectors of Chile’s

economy has placed an extra layer of stress to Araneda’s already difficult

task.

While Codelco’s production has not been significantly affected by the more than six weeks of unrest shaking the country to the core, the company noted it has felt an impact in inventories due to a delay in ports, where workers have gone on strike several times since late October in solidarity with anti-inequality demonstrators.

The copper giant recently kicked off a $5.6 billion underground expansion of its giant Chuquicamata open pit mine, in northern Chile.

The next major mine overhaul is a new level at El Teniente underground mine, the company’s largest and the world’s No. 6 by reserve size. The project , expected to be completed in 2023, would extend the mine-life by 50 years.

Codelco holds vast copper deposits, accounting for 10% of the world’s known proven and probable reserves and about 11% of the global annual copper output with 1.8 million tonnes of production.

Production decline, together with lower copper prices and higher costs, saw the company’s annual profits drop by a third last year to $2 billion, not counting paper losses worth almost $400 million, as it wrote down the value of its assets, including its Ventanas smelter and the open pit at its Salvador division.