Source: Maurice Jackson for Streetwise Reports 11/25/2019

Skyharbour CEO Jordan Trimble discusses uranium supply and demand fundamentals with Maurice Jackson of Proven and Probable and his company’s upcoming drill program in the deep rocks of the Athabasca Basin.

Maurice Jackson: Joining us for a conversation is Jordan Trimble, the president, director and CEO of Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB). Glad to speak with you today to provide shareholders updates on a number of key developments that are currently taking place with Skyharbour Resources Ltd.. Today’s interview will focus on the uranium price and upcoming news flow.

Before we delve into these topics, Mr. Trimble, for someone new to the story, please introduce us to Skyharbour Resources, A Preeminent Uranium Explorer in Canada’s Athabasca Basin, and the opportunity the company presents to the market.

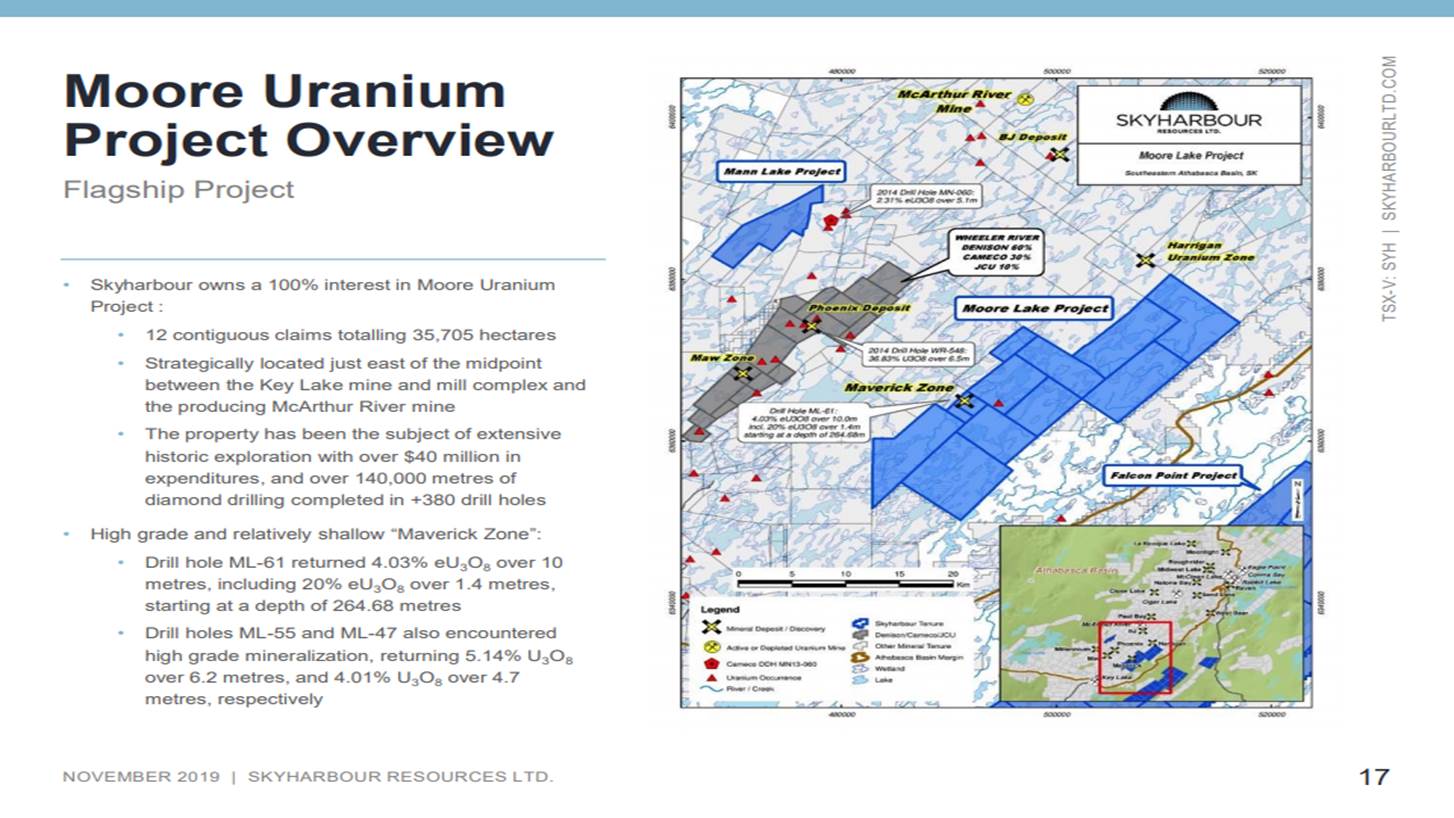

Jordan Trimble: Skyharbour Resources is a high-grade exploration and early stage development uranium company. We have six projects located in the Athabasca Basin, which hosts the highest-grade depository of uranium in the world. Some notable recent discoveries there were made by companies like NextGen, Fission and Denison. The six projects were acquired over the last several years. We spent the first few years when I started running the company acquiring these projects and did a good job of being opportunistic in a tough uranium market wearing our contrarian caps and going out there and buying these projects for really pennies on the dollar. It’s a big land package, about a half a million acres of ground. Again, the various projects are scattered throughout the basin and what’s interesting is two of the projects have deposits, one of which is our flagship project called the Moore Project.

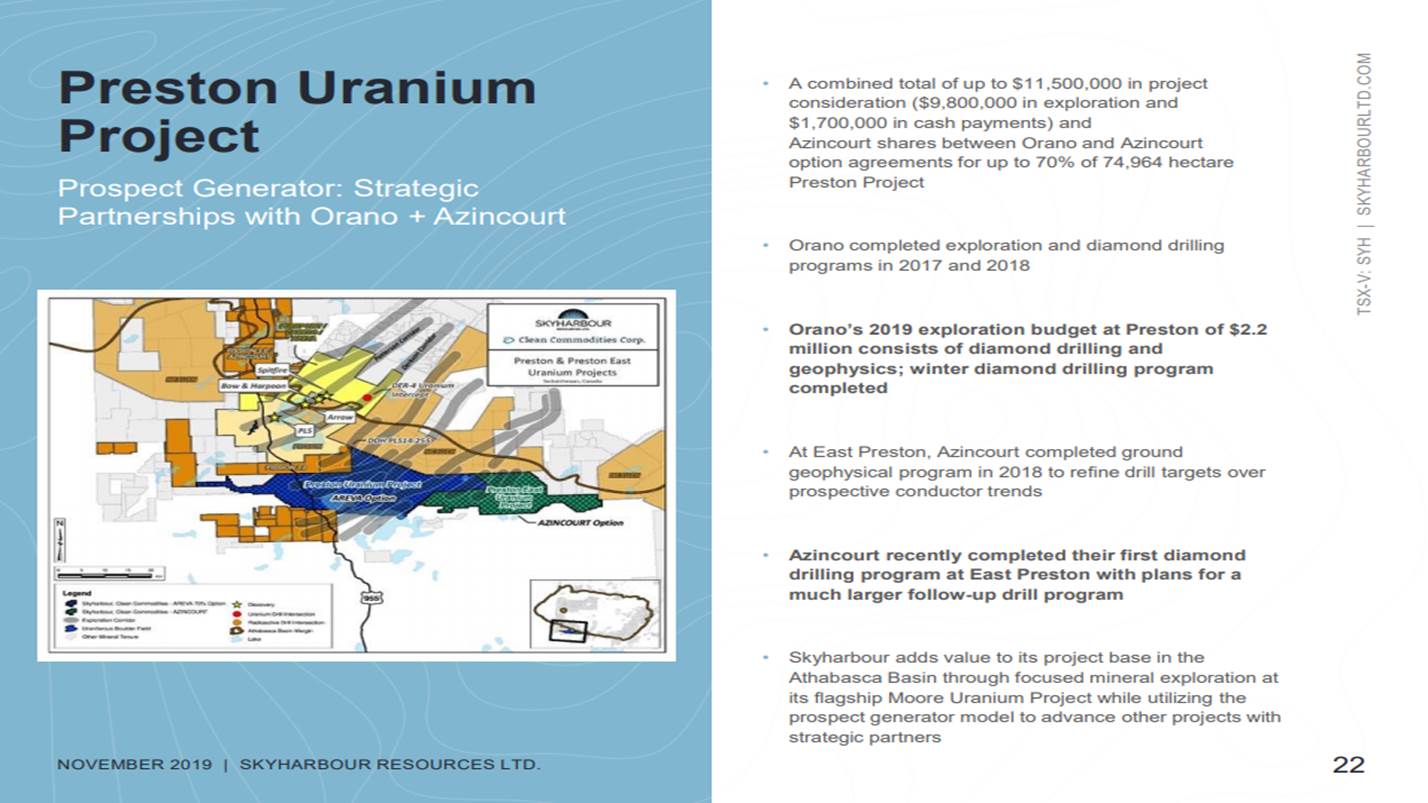

This is on the east side of the Athabasca Basin located proximal to nearby infrastructure and mills. There’s a high-grade mineralized zone there called the Maverick Zone. That’s where we’re going to be drilling in our upcoming drill program. The other projects outside of our flagship project we advance using something called prospect generation. This is a strategy whereby we look to bring in partner companies that can come in, that can fund the exploration. We get some cash and stock payments as well. So that allows us to focus our time, money and efforts on our flagship project really where we feel we have the best chance of adding value and making new discoveries and finding more high-grade uranium while partner companies advance the other projects.

So that’s a high level on the company. A fair bit of news flow coming out over the next six months as we have plans for drilling 2,500 meters at the Moore Project as I mentioned, but we also have two partner companies, Orano, which is France’s largest uranium mining company based in Paris. It’s planning an exploration program early in the new year and our Preston project is a part of its $8 million earn in on that project. Another partner company Azincourt is planning to drill 2,500 meters at our East Preston project. So you’ll have three simultaneous exploration and drill programs underway early in the new year and we feel that the timing couldn’t be better given the rising uranium price. We’ve just started to see the spot price tick up here recently.

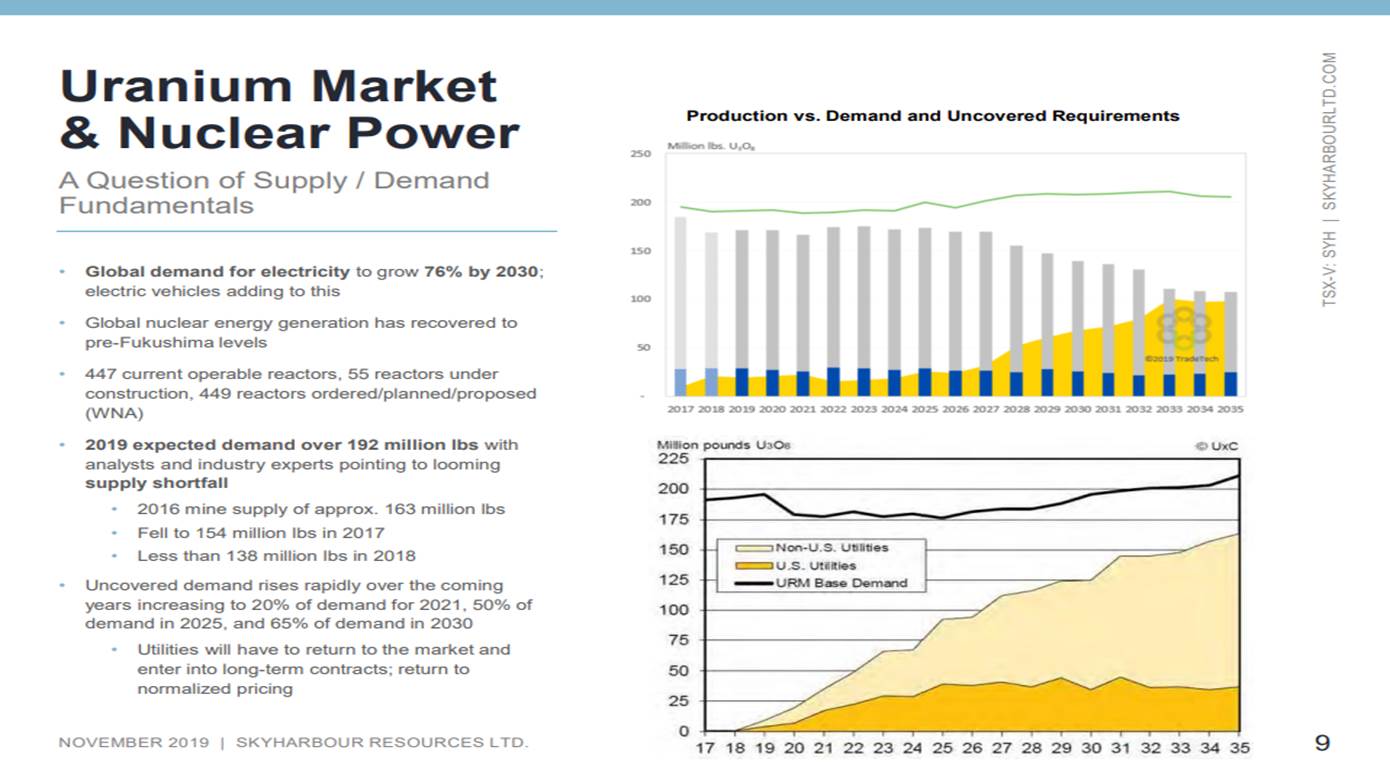

Maurice Jackson: That set the stage for today’s discussion regarding some key fundamentals in the uranium sector. Jordan, regarding react requirements, what is the annual global demand for uranium?

Jordan Trimble: Right now, it is well over 190 million pounds, close to about 195 million pounds. Again, that’s in a nuclear reactors globally and that’s been steadily increasing. There’s a fallacy out there that this industry is in decline; that’s not the case. It’s very much still a growth industry in places like China and India. I was at a conference earlier in the fall in London, the World Nuclear Association, whereby they came out with their biannual nuclear fuel report, which for the first time since Fukushima had increasing demand in all three scenarios, an upper-case, a mid-case and a lower case. In the upper and mid-case or base case, there was quite significant increase in demand. So we see demand continuing to grow.

Maurice Jackson: Now let’s juxtapose that with the primary mine supply, which is?

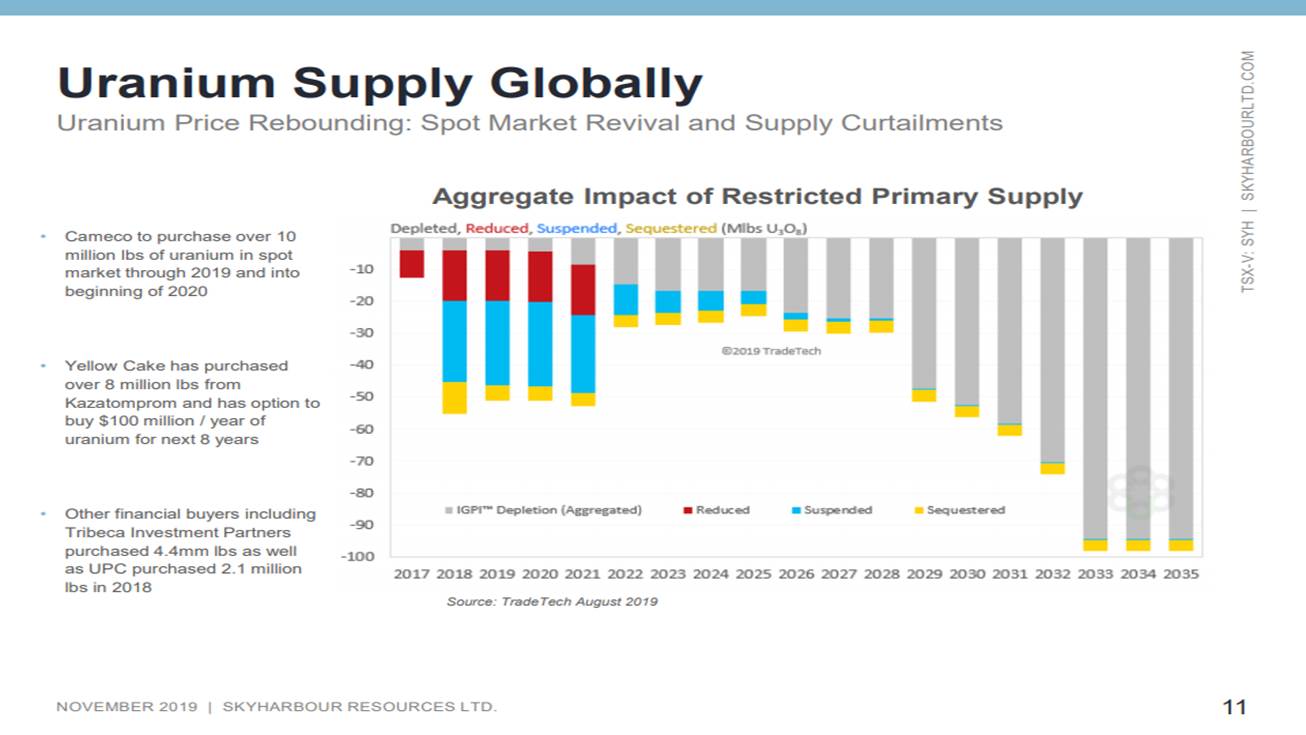

Jordan Trimble: A lot lower. We’re now producing less than about 135 million pounds annually. That’s down from about just over 160 million pounds a couple of years back. We’ve seen some major supply cuts, project deferrals. We’ve seen funds that have come in in the last year, year and a half, that have sequestered a new supply coming online that have bought pounds. All of this has led to a very large decrease in the amount of supply that’s out there. So a major structural supply deficit that’s forming will continue to eat away inventories and secondary supply. My sense of the market right now is you’ll probably see that coming to an end and we’ll start to see those supply cuts have a major impact on the spot price, and the contract price going forward.

Maurice Jackson: Let’s let that sink in for a moment. There’s an approximately 55 million pound supply deficit in the uranium sector for reactor requirements. That’s quite significant. Let’s see how this may increase the price of uranium and equally, if not more, reward the shareholders of Skyharbour.

Sir, last month we had the pleasure of having you on the program in which you noted some near-term catalysts that have your attention that may propel the price of uranium before the year end. Looks like the price movements you referenced may be coming to fruition as the price of uranium is up about 75 cents since we last spoke. What are the near-term catalysts and can you provide us with some updates since we last spoke?

Jordan Trimble: We are seeing the price move. There’s a handful of catalysts. We’ve touched on a few of them in the last interview, but just to reiterate some of the main drivers right now. One, seasonality. Seasonality in this sector with the price of the commodity and typically with the share prices as well. We see November through February and March as relatively strong months. Usually there’s outperformance. We’ve seen that just start to pick up in the last few weeks. It really started with Cameco’s quarterlies a few weeks back that the market liked and there was some notable positive commentary from Cameco, which is surprising given that the market commentary from them hasn’t been as upbeat over the last several years. So seasonality is one and we’ll see that continue I think into the new year. Two, getting back to Cameco and we talked about this in the last interview (Click Here). Cameco, having shut down the world’s largest uranium mine at McArthur River, has to source millions of pounds of material to fulfill its contracts and its deliveries.

Therefore, we know that in the next several months there’s still a fair bit of material and uranium that Cameco has to acquire. If it can’t source that from secondary supply sources, it will be in the spot market buying. It looks like they are coming in some estimates of upwards of 8 million pounds. Just to put some perspective on that, that amount of uranium that they bought in mid to late 2018 helped drive the uranium price up into the high $20s and we saw all the share prices respond positively hitting 52-week highs. Cameco spot market purchasing will continue into the new year. That’s a big driver. Another one too and more recently has been an increase in the price of conversion and enrichment. And so these prices have been increasing. The fuel cycle has been tightening. That’s usually a good leading indicator. We’ve seen that here over the last year in particular.

Then last but not least, and this actually just come out here in the last few days. There was the non-renewal of key sanction waivers on Iran and on some of its conversion enrichment facilities. That has been recently announced in the U.S. and that also tightened up the market because the implications of that could affect companies in Europe, in China, and in Russia that deal with Iran and deal with Iran’s nuclear program, but also deal with the U.S. and sell uranium and products to the U.S.. What we’re seeing right now across the board is a tightening of the market and this is all positive for the spot price and ultimately the contract price going forward for uranium. As we see the price of the commodity move up, we will see that the share prices move up as well.

Maurice Jackson: Now germane to the spot price, can you provide us with the current contract price for uranium?

Jordan Trimble: The contract price is still hovering in the low $30s, and just to note on the spot versus the contract price. Historically most uranium is traded and bought and sold through long-term contracts. So that’s important to note. We have seen more recently, in particular in 2018, a lot of volume transacted on the spot market. That’s a good indicator in itself. The market’s cleaning up, but it’s important to note, and this is relevant in the U.S. where we’ve had this ongoing Section 232 and subsequent investigation and then the subsequent nuclear fuel working group, which we’re still waiting to hear back on really any day now.

As a result of that, we’ve seen really the largest buyer of uranium globally in U.S. nuclear utilities more or less forced to the sideline. There hasn’t been a whole lot of contracting as a result of that. Utilities are looking to get some clarity on where they have to be buying or not buying from. So you know when that’s finally put to bed over the coming weeks here, I think that that will clear the air, especially for U.S. nuclear utilities to step back into the market. When we’re looking at the contract versus the spot price, the spot price, yes, it’s been ticking up but we’re still in the mid-$20s. It’s still relatively low. So I think there’s a chance you see utilities come back and buy initially in the spot market and then ultimately we’ll see the market go back to more contracting and you’ll see the contract price pick up as well.

Maurice Jackson: Having a 55-million pound deficit to meet reactor requirements in and of itself may be a very rewarding proposition for shareholders in the future, but when one factors in the strategic moves that Skyharbour Resources will be making in their property bank, the story gets even more compelling. Speaking of Moore, sir, the company has a dual prong business model and the first being an exploration company. Take us to your flagship Moore Lake project, which is known for its rich, high-grade uranium and provide shareholders with an update there and the projected news flow that may be anticipated.

Jordan Trimble: I mentioned earlier and just to re-highlight some of the key upcoming catalysts. The big one is a drill program that we have planned early in the new year, 2,500 meters at our flagship Moore project. In our previous drill program earlier this year, we tested what’s called the basement rocks. This is the same geological setting where you’ve had recent major discoveries like NextGen, like Fission, like the Gryphon deposit at Denison’s Wheeler project. More recent exploration has been focused in these underlying basement rocks and that’s where you get the source rock in the feeder zones for high-grade uranium mineralization. So we really just scratched the surface down there. We know we have high grade up to 21% U308 in the sandstone, but there hasn’t been much drilling underneath in the basement rock. Now we did drill a few holes in our last program and our best drill hole, which was one of our last drill holes, we hit multi-percent uranium mineralization over about 2.5 meters.

That’s the hole that we’re going to go back and follow up on. We’ve done some more geophysics, which we did over the last few months. We’ve gotten some new geological modeling. So we’ve refined the targets in the basement rocks and in particular following up on that high-grade intersection in one of the last holes from the last program. We think there’s a much larger structure and zone of mineralization just a little bit deeper down. We’re going to be drill testing that. It’s also opened a lock strike. This is the main Maverick quarters, about 4 kilometers long, only about half of that’s been systematically drill tested. So we’re going to have some drill holes that that we spot along strike and last but not least a couple holes, small amount within that program that’s going to be testing a new target that we made a new discovery on earlier in the year called the Otter Grid.

So there’ll be a couple shallow holes there, but the main focus is going to be continuing to follow up on high-grade basement hosted uranium mineralization. We really believe that we’re right on the cusp of finding something much larger in these basement rocks and feeder zones. That will be a key catalyst for us. Really one hole makes a big difference for a company of our size. We also have, as mentioned, partner companies Orano and Azincourt that are planning exploration and drill programs early in the new year as well that they’re funding. Collectively you have, as I mentioned earlier, three programs that will be underway. Just under $3 million planned in exploration, the bulk of that funded by partner companies. A lot of news flow coming up over the next six months.

Maurice Jackson: Switching gears. I’d like to take a moment to remind our audience when you have a compelling thesis and a low share price, that’s called a sale. The goal for any investor and speculator should be to buy low and sell high. Jordan, please share the current price of Skyharbour Resources.

Jordan Trimble: We are trading around 16 cents Canadian. We talked about it in the last interview; we’ve had some pressure over the course of the year. A big part of that is this Section 232 non-decision where we saw a lot of money flow out of the uranium space. It hit us in our peer group and we also have some tax loss selling. I’ve been very active buying in the market. I bought shares as recent as today. I think at these prices and I call it a $10, $11 million Canadian market cap. I see there being a lot of upside from here and putting my money where my mouth is. So it’s definitely worth taking a look at it. Again, I think the value proposition given the catalysts we have coming up, given the uranium market in particular in the near term, I think the value proposition is as strong as it’s ever been.

Maurice Jackson: In closing, sir, what keeps you up at night that we don’t know about?

Jordan Trimble: We are an exploration company so you are going and you’re looking to make new discoveries and there’s no guarantee of success. I will say that we’ve done a lot of work in the last five and a half, six months refining these basement hosted targets. If we have as good of a shot as we’re ever going to have, it’s going to be in this drill program and that’s just one of again, three programs that are going to be underway come the new year.

Maurice Jackson: Mr. Trimble, last question. What did I forget to ask?

Jordan Trimble: I think that covers it all. It’s definitely worth people taking a look at, especially if these prices and given what we have coming up.

Maurice Jackson: Well, I want to share in reference to the prices. We will be active buyers of Skyharbour Resources as well during this time period as we love the value proposition and the strategic moves that the company is making. Mr. Trimble, for someone listening that wants to get more information about Skyharbour Resources, please share the website address.

Jordan Trimble: www.skyharbourltd.com.

Maurice Jackson: For direct inquiries, contact Jordan Trimble at 604-639-3856. Or you may email jtrimble@skyharbourltd.com. Also you may reach Simon Dyakowski at 604-619-7469 or you may email sdyakowski@sentenialmarket.com. Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB). Skyharbour Resources is a sponsor of Proven and Probable.

Before you make your next Precious Metals purchase, call me. I’m a licensed representative for Miles Franklin Precious Metals Investments where we offer a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs, and private blockchain distributed ledger technology. Call me directly at 855-505-1900 or you may email maurice@milesfranklin.com. Finally, please subscribe to Provenandprobable.com for Mining Insights and Bullion Sales.

Jordan Trimble of Skyharbour Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Skyharbour Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Skyharbour Rresources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

( Companies Mentioned: SYH:TSX.V; SYHBF:OTCQB,

)