In as new industry trend analysis, Fitch Solutions lays out the base, bullish and bear case demand trends for EV battery metals over the coming years in Europe, the US and China.

Leveraging its existing electric vehicle (EV) forecasts, Fitch created a new set of assumptions on EV sales, dividing geographic demand for battery metals into direct demand, which refers to demand from any country/region where battery manufacturing takes place domestically and indirect demand, which refers to demand from country/regions where EV sales may stoke demand for batteries containing key metals that are produced elsewhere.

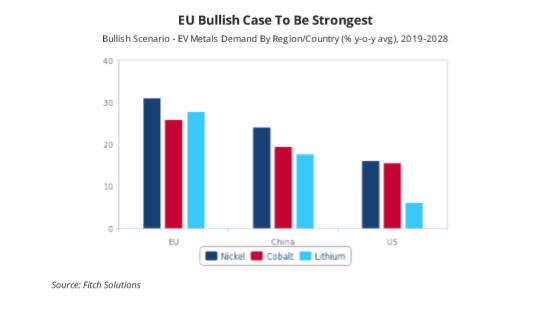

Under its bullish scenario, Fitch forecasts the EU will witness the fastest average growth in indirect demand for cobalt (25.8% y-o-y), nickel (31.0% y-o-y) and lithium (27.9% y-o-y) up to 2028

Fitch maintains that China will remain the key driver of direct EV metals demand across base and bear scenarios on the back of ambitious EV production objectives and government support, but says growth in this regard will tail off from 2025 onwards as automakers’ production targets come to an end.

From the findings, Fitch analysts estimate indirect demand growth for cobalt, nickel and lithium will be the strongest across the EU under the bullish scenario, which is underpinned by favourable policy assumptions.

Indirect demand growth for these three metals will generally lag behind across all scenarios in the US, Fitch says, due to more restrictive EV policy assumptions based on poor support at the federal level.

Direct demand for nickel, cobalt and lithium will remain strongest in China across Fitch’s core and bearish case scenarios over the coming years. The Chinese government has set ambitious EV targets and Fitch retains a positive outlook for China’s EV market as intensifying competition from major vehicle brands will drive down costs and improve choice, which will see consumers become more willing to switch to EVs as traditional automakers offer more credibility than smaller new EV companies.

Under its bullish scenario, Fitch forecasts the EU will witness the fastest average growth in indirect demand for cobalt (25.8% y-o-y), nickel (31.0% y-o-y) and lithium (27.9% y-o-y) up to 2028 – ahead of China and the US, citing one reason is that EU EV sales stem from a lower base in comparison to the US and China and, as such, the potential for growth is higher.

(Read the full report here)