Less than four years after China vowed to limit the use of coal and cancelled more than 100 coal power projects, a new study shows the nation — the world’s largest greenhouse gas emitter — is back in love with the fossil fuel.

According to the latest report by Global Energy Monitor, a non-profit group that tracks coal stations, the Asian giant is set to fire up enough coal-based power plants to match the entire capacity of the European Union, which currently sits at 149 gigawatts (GW).

Across the country, 148 GW of

coal-fired plants are either being built or are about to begin construction,

the study shows. The figure is also higher than the combined 105 gigawatts

under construction in the rest of the world, it notes.

While coal’s share of the country’s total energy has fallen from 68% in 2012 to 59% last year, absolute consumption of the fossil fuel has continued to increase in line with a rise in overall local energy demand.

To meet internal needs, the world’s second largest economy has approved new 40 coal mines in the first nine months of this year, while continuing to make use of “green” financing to support coal-related projects.

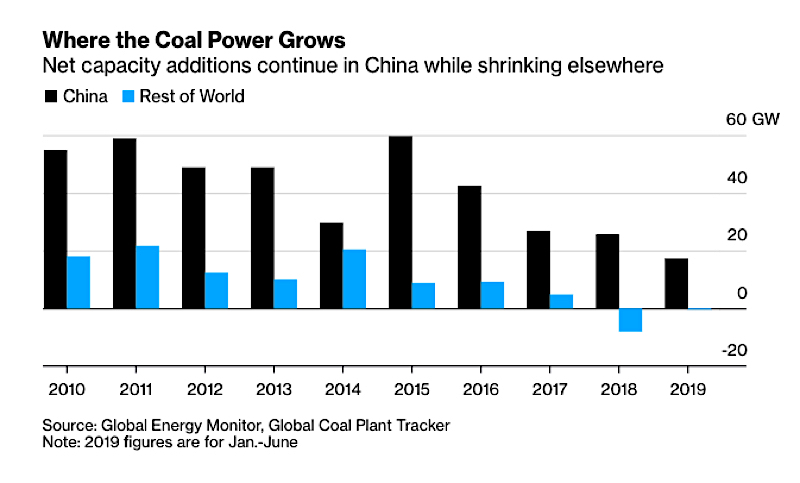

Last year China’s net additions to

its coal fleet were 25.5GW, while the rest of the world saw a net decline of

2.8GW as more plants were closed than were built.

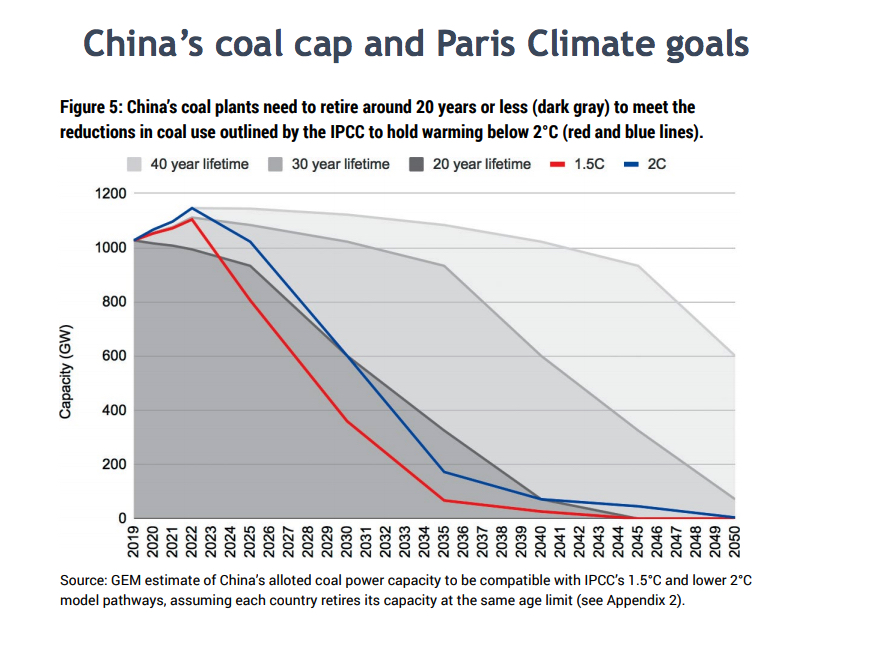

“To meet Paris climate goals, climate scientists say global coal power needs to be reduced 70% by 2030 and phased out completely by 2050,” Christine Shearer, one of the authors of the report, said. “China’s proposal to continue adding new coal power capacity through 2035 flies directly in the face of these needed emission reductions, and jeopardizes global climate goals.”

Miners take the lead

Top mining companies have

been reducing or eliminating their exposure to coal on

environmental grounds. Rio Tinto (ASX, LON: RIO), the world’s second largest

miner, fully exited the coal sector in March 2018, with the

sale of its Kestrel coal mine in Australia to private equity manager EMR

Capital and Indonesia’s Adaro Energy for $2.25 billion.

Rival BHP (ASX, NYSE:BHP) took a

step in the same direction in July, revealing it had been mulling options

to divest its thermal coal business, which includes assets in

Australia and Colombia.

Shareholders at world’s largest

mining company, however, don’t seem too keen to ditch coal. In early November,

Australian investors voted against a plan that would have seen BHP leave

lobby groups that promote policies at odds with the goals of the Paris climate

accord. The agreement, signed in 2016 by almost 200 nations, aims at reducing

emissions of gases that contribute to global warming.

Australia’s South32 (ASX,

LON, JSE:S32), which spun out of BHP in 2015, is another company to have

recently kissed the fossil fuel goodbye. Last week, it sold its thermal coal operations to Seriti Resources and

two trusts, for 100 million rand ($6.78 million) upfront.

Last week, Anglo American (LON AAL) became the latest top miner to signal a departure from coal in the near future. The company, already on a trajectory away from thermal coal lowered its 2021 target for the commodity to 26 million tonnes from a previous goal of as much as 30 million tonnes.