Africa-focused Rainbow Rare Earths (LON:RBW) has acquired ten mining claims in northern Zimbabwe as part of its mounting efforts to expand operations beyond Burundi, where it runs Gakara, Africa’s only producing rare earths mine.

The company said the properties, covering 12.6km squared, have

previously been explored for phosphate, used as fertilizer. One of them, the Kapfrugwa

(also known as Gungwa) deposit has been identified by the US Geological

Survey as potentially hosting Cerium and Lanthanum

The licences will be held 100% by Rainbow Zimbabwe, the company said, adding that it plans immediately start an exploration program that will include geological mapping, sampling and assaying.

Rainbow already has a mine in Burundi, Gakara — Africa’s only producing rare earths operation.

The goal, Rainbow said, is to conclude an interpretation

report with focus on rare earths potential in terms of sizes, grades and mineralogy.

The miner began production of rare earth concentrates at Gakara mine in late 2017. The asset, located 20km south of Burundi’s capital Bujumbura, holds some high-grade rare earth elements, including lanthanum, cerium and neodymium, which are expected to become essential for the manufacturing of batteries, magnets and electric vehicles.

Partly thanks to Gakara, Burundi’s mineral exports has overtaken tea and coffee as the major source of foreign exchange for the East African nation.

Hot Commodities

The strategic importance of rare earths, a group of 17

minerals used in everything from high-tech consumer electronics to military

equipment, has increased this year amid fears that top producer China will

restrict supply to the United States as a retaliatory measure for tariffs imposed

by Washington earlier this year.

Despite their name, rare earths are not rare. According to

the United States Geological Survey (USGS), they are roughly as common as

copper. But, because rare earth ores oxidize quickly, extracting them is both

difficult and extremely polluting.

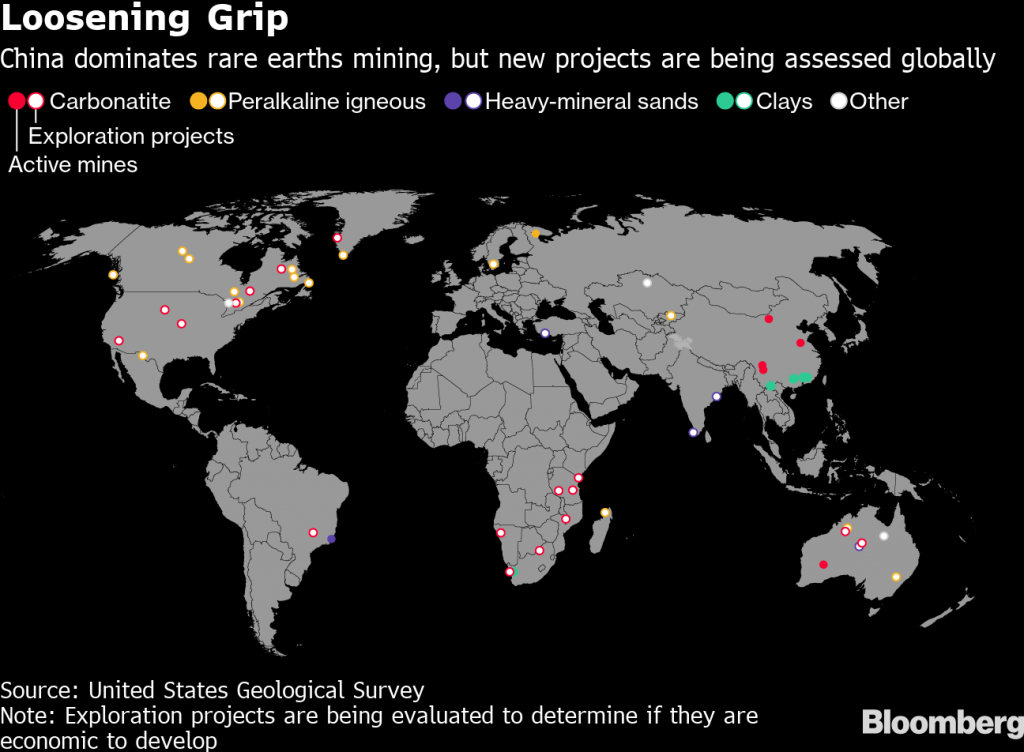

China currently accounts for 70% of global production, but has lately reduced domestic production as the government cracks down on illegal mining and pollution.

That explains why speculation of supply cuts to the US, a major buyer, has opened opportunities in other jurisdictions and boosted companies including Australia’s Lynas, the only major rare earth producer outside China.

Last year, China produced about 120,000 tonnes of rare

earths, while the totals of the next two leading producers — Australia and the US

— were 20,000 and 15,000 respectively.

In the past three months, The Trump administration has stepped up efforts to ensure the supply of critical minerals from

outside China. As part of those initiatives, it recently signed a memorandum of

understanding with Greenland to conduct a hyper-spectral survey to map the

country’s geology.

Washington has also gained the support of Australia, which has committed to facilitate potential joint ventures to improve rare earth processing capacity and reduce reliance on Chinese rare earths. The mineral agencies of the both countries signed a research agreement on Tuesday to quantify their reserves of critical mineral reserves.