Source: Jason Hamlin for Streetwise Reports 11/18/2019

Sector expert Jason Hamlin explores the potential of the current gold bull market by charting the courses of past bull markets.

The gold price bottomed in late 2015 around $1,050 per ounce. It has since advanced to a high of $1,555 in early September, followed by a pullback to the current price of $1,470. Gold is in a well-defined uptrend channel with higher lows and recently higher highs. The breakout above $1,360 this summer was significant and we have seen follow-through buying. The $420 move in the price of gold from the bottom in late 2015 represents a gain of 40% in just under four years.

While this is a respectable gain, it only scratches the surface of the potential move ahead. To understand why, let’s take a look at the last two major bull markets in gold.

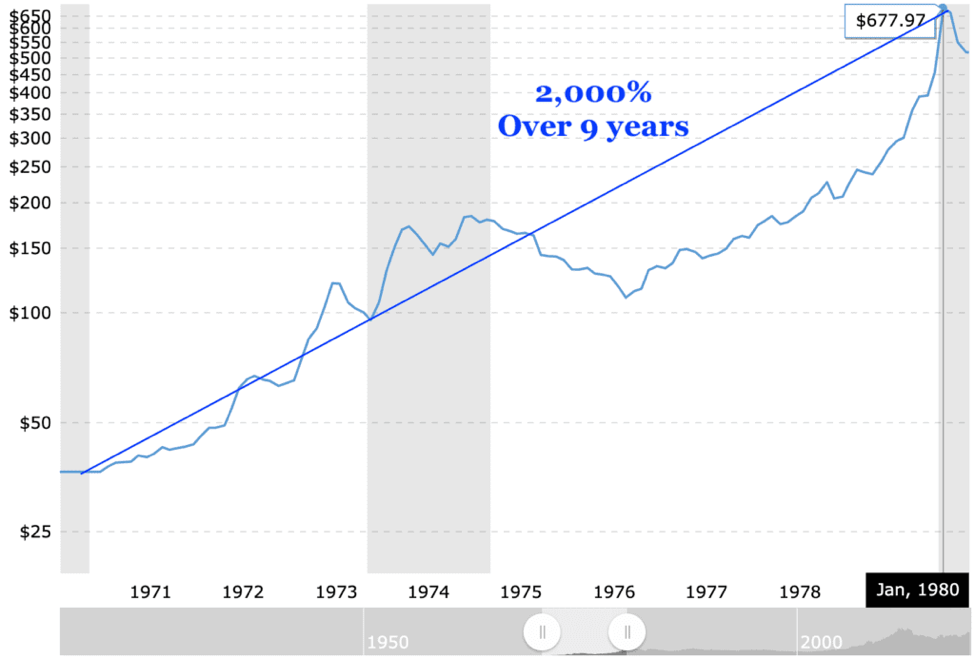

From 1971 to 1980, the gold price rocketed from a low of $35 to briefly peak at a high of around $850 ($678 high on the weekly chart) for a gain of just over 2,000%. It was closer to 850% in inflation-adjusted terms.

Gold Price, Source

Of course, this massive move was driven by the abandonment of the gold standard window by Nixon, a stampede into gold as a safe haven from double-digit inflation, oil price shocks, a weak dollar, and political instability that made investors fearful and nervous.

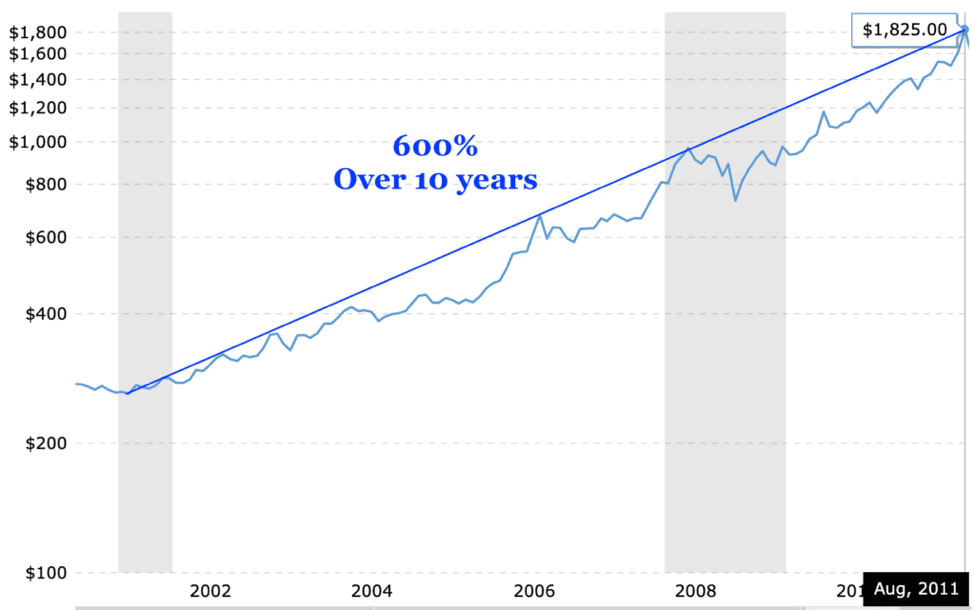

Fast-forward to 2001 and we can see that gold made another impressive move from $250 to a weekly high of $1,825 ($1,920 daily) over the course of roughly the same time period. This represents a gain of around 600% in that decade, or 450% in inflation-adjusted terms.

Gold Price, Source

The current bull market cycle in gold is nearly four years old but hasn’t broken out of the gates yet. The 40% move higher since the start of 2016 is a modest advance relative to the last two bull markets. The gold price is moving higher today, so the chart below shows a 38% gain since the bottom.

The price would still need to go up roughly 15x (1,400%) to match the 1970s bull market, which would take the price to over $22,000! Or it would need to go up another 5.5x (450%) to $8,000 to match the magnitude of gains from the 2001–2011 bull market.

Put simply, the gold price has an explosive move ahead if the current bull cycle is to come anywhere close to the magnitude of the past two bull cycles.

While we don’t have runaway inflation (yet) and we aren’t facing a closing of the gold convertibility window as Nixon did in 1971, we do have quite a few factors that should be supportive of the gold price going forward.

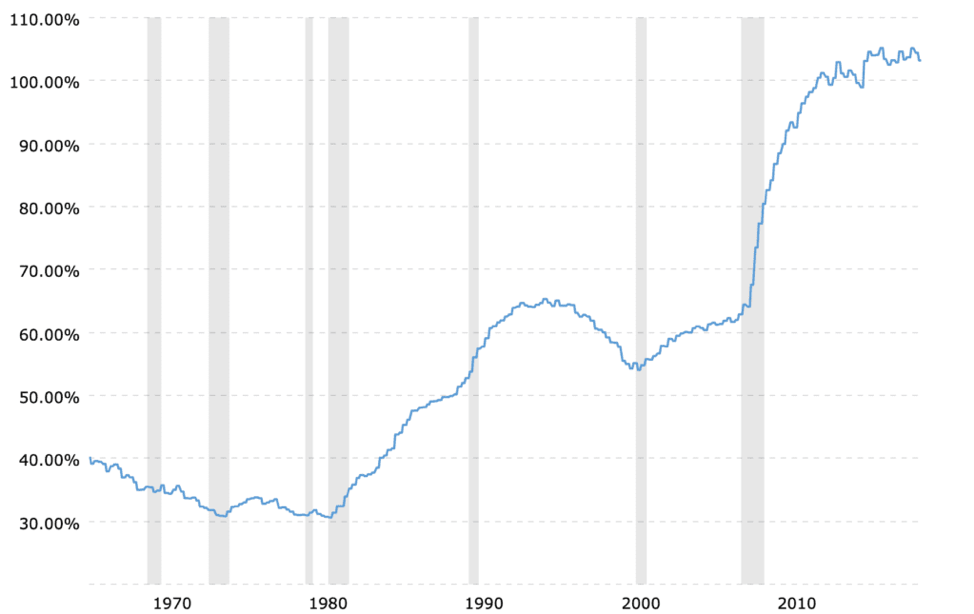

These include record debt and deficits, a record-high debt-to-GDP ratio, interest rates dropping toward zero, the Federal Reserve expanding its balance sheet at twice the pace it was during QE3 (just don’t call it quantitative easing!), the Fed intervening in various markets to provide emergency liquidity, a crisis in confidence in governments and political unrest worldwide, the potential for the impeachment of the United States president, elevated geopolitical tensions between world powers, a global de-dollarization movement that is accelerating, slowing economic growth, historically overvalued equity markets, a record low commodity-to-equities ratio and record-high total stock market cap to GDP ratio.

U.S. Debt-to-GDP, Source

If anything, the underlying conditions that caused the gold price to spike 20x in the 1970s could be viewed as even worse today. We have a massive derivatives issue and corporate debt problem that many view as ticking time bombs. This grand experiment with fractional reserve fiat paper money being used as a world reserve currency is likely coming to an end.

As it does, people will move toward forms of money with a limited supply that are not controlled by centralized authorities. Whether this is gold-backed money, digital currency from a tech giant or increased usage of Bitcoin for reserves and international exchange, the legacy financial system is on the way out.

Assuming another ten-year bull cycle for gold, there are just over six years left in the current move and upside of 5x to 15x the current price. In this environment, cash flows for quality mining stocks will absolutely explode and provide investors with leveraged returns. At a modest projection of just 2x leverage, there exists the potential for 10x to 30x returns in gold mining stocks over the next 5 to 6 years!

This is precisely the type of asymmetric trade that we look for at Nicoya Research. If you would like to receive our top gold stock picks, real-time portfolio, monthly newsletter, and trade alerts, you can sign up for the top-rated Gold Stock Bull subscription here.

Read the original article here.

Jason Hamlin is the founder of Nicoya Research and goldstockbull.com and has published investment research for over a decade. He previously worked in data analytics for Nielsen, the world’s largest market research firm, where he consulted to Fortune 500 companies including Nestlé, Johnson & Johnson and Del Monte. Hamlin’s investment philosophy takes into account political, historical and socio-economic factors to determine macroeconomic trends and isolate the sectors that stand to benefit. He then applies fundamental and technical analysis, as well as proprietary models, to find companies that are undervalued within those sectors. Hamlin is a contrarian, cycles investor and student of Austrian economics.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

Nicoya Research is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities or currencies customers should buy or sell for themselves. All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results. View the full disclaimer and privacy policy.