The U.S. stock market has been hitting new all-time highs thanks to lower rates, positive earnings surprises and optimism that a resolution to the U.S.-China trade war comes sooner rather than later. But don’t let that distract you from exciting things that are happening in overseas markets, specifically in Eastern and Emerging European countries.

Russian stocks, for instance, have been trading at much lower multiples than U.S. stocks, and in many cases, dividends have been very attractive.

But it doesn’t stop there. Below are three European stocks we’re bullish on right now.

1. Gazprom: A Low Valuation/High Dividend Play

First up is Gazprom, Russia’s largest energy company by a huge margin. As controller of all major natural gas fields in Russia, including the prolific Urengoy and Yamburg fields, Gazprom is the world’s largest gas producer, transporter and exporter, and the biggest supplier to Europe. In 2018, it produced some 35 billion cubic feet of gas per day, or about 12 percent of total global output.

We find Gazprom very attractive because it’s incredibly undervalued and has a generous dividend program. Below is WOOD & Company’s forecast of the company’s price-to-earnings (P/E) and dividend yield. At the same time that its P/E is expected to fall, from 3.4 times earnings this year to 3.1 times earnings in 2020, the dividend yield is projected to rise. Gazprom is “one of the cheapest companies in the whole emerging market space,” according to WOOD analysts Ildar Davletshin and Jonathan Lamb.

|

PRICE-TO-EARNINGS | DIVIDEND YIELD |

|---|---|---|

| 2016 | 5.0x | 3.8% |

| 2017 | 5.8x | 3.8% |

| 2018 | 3.1x | 7.9% |

| 2019E | 3.4x | 8.9% |

| 2020E | 3.1x | 11.6% |

| Source: Wood & Company, U.S. Global Investors | ||

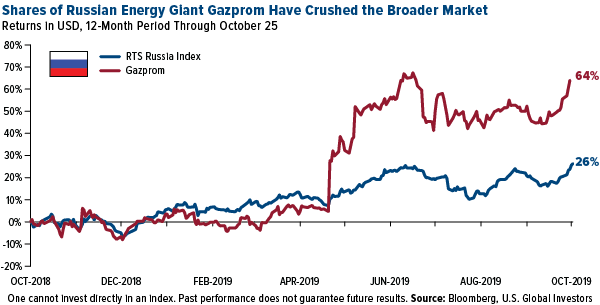

Shares of Gazprom, half of which are owned by the Russian government, exploded as much as 16.4 percent in mid-May after it announced a sharp rise in dividend payments. For the 12-month period through October 25, the company was up 64 percent, considerably higher than the dollar-denominated RTS Russia Index, in which Gazprom has the highest weighting at 15 percent.

Chairman of the Management Committee Alexey Miller told shareholders in June that, based on record sales revenue and profits in 2018, the company was proposing “a record-high dividend payout of RUB 16.61 ($0.26) per share,” more than double the dividend increase compared to the preceding year.

Miller added that this year’s dividend payouts “will be among the largest among all state-owned companies. The overall dividend amount—RUB 393.2 billion ($6.1 billion)—will be the highest in the history of the Russian stock market.”

In a research note dated October 29, Morgan Stanley analysts write that Gazprom has “too much upside to ignore.” They upgraded the company to Overweight, noting that it “remains meaningfully underowned.” Analysts estimate that 64 percent of global emerging market funds had absolutely no exposure to Gazprom shares as of August 31, despite it having the heaviest weighting in the U.S. dollar-converted RTS Russia Index.

2. Norilsk Nickel: Betting on Nickel/Palladium Deficits

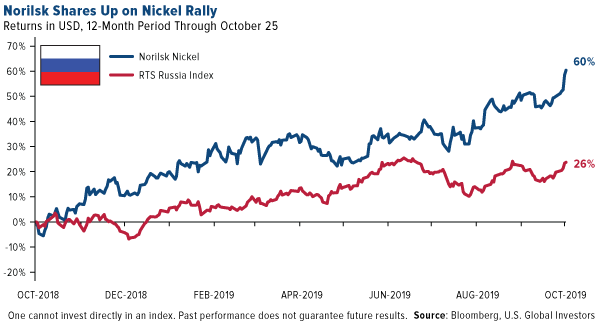

Norilsk—the world’s largest producer of both nickel and palladium, as well as one of the largest copper and platinum producers—is another Russian company that we find very attractive based on its relatively low valuation, growing sales and increasing dividends. WOOD & Company projects the dividend yield to reach 12.1 percent by 2021, which would be an increase of about 60 basis points (bps) from today’s 11.5 percent yield.

Norilsk shares have benefited in 2019 from the Indonesian government’s decision to ban raw nickel ore exports “in order to incentivize Indonesian producers to build smelting capacity in the country,” according to WOOD analyst Andrew Jones. Indonesia is the world’s largest nickel supplier by capacity, and it’s estimated that the ban could remove some 10 percent from global supply, impacting a market that’s already facing a significant supply-demand imbalance, thanks in large part to a growing appetite for electric vehicles. (Nickel is a key component in lithium-ion batteries.)

The ban was originally scheduled for January 2020, but the Indonesian government surprised markets this week by announcing the policy would take effect immediately. The white metal was up an incredible 65 percent year-to-date through October 29, making it one of the best performing hard assets of 2019.

Norilsk has also benefited from a global palladium shortage. The precious metal, used primarily in the production of pollution-scrubbing catalytic converters, crossed above $1,800 an ounce for the first time this week. The supply deficit is expected to deepen as governments around the world continue to take a firmer stance on vehicle emissions.

3. Pandora: Soft Reboot

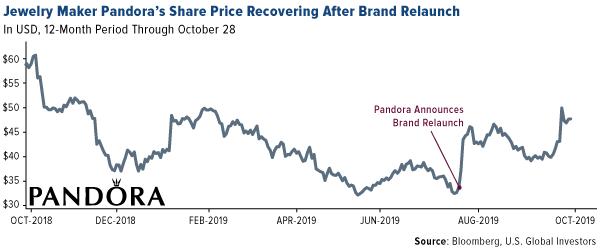

Shares of Danish jewelry maker Pandora are currently down about two-thirds from their all-time high in June 2016, after hopes of growth in China were found to be overstated. We have confidence in the company, however, following the appointment of new CEO Alexander Lacik earlier this year as well as the brand relaunch in August.

Pandora stock jumped as much as 16.09 percent on October 23, one of its best single-day trading sessions.

Codenamed Programme NOW, the relaunch made a number of positive changes, including a new store design “that builds on discovery and collecting,” celebrity endorsements, a fresh product line and the largest marketing boost in company history, according to an August press release.

The company’s new collection—Pandora Me, which is designed to enable “a new generation to create empowering jewelry looks based on the stories that make them who they are”—has been “extremely well received” in a number of markets across the globe, according to Carnegie Research. Its spokesperson, Millie Bobby Brown of “Stranger Things” fame, has helped refresh the brand for younger consumers.

For more on the emerging Europe market, read this interview with U.S. Global Investors analyst Joanna Sawicka by clicking here!

The RTS Russia Index is a free-float capitalization-weighted index of 50 Russian stocks traded on the Moscow Exchange, calculated in U.S. dollars.

The price-earnings ratio, also known as P/E ratio, P/E, or PER, is the ratio of a company’s share price to the company’s earnings per share. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued.

A basis point, or bp, is a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01% (0.0001).

The dividend yield or dividend-price ratio of a share is the dividend per share, divided by the price per share. It is also a company’s total annual dividend payments divided by its market capitalization, assuming the number of shares is constant. It is often expressed as a percentage. There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

International Financial Reporting Standards (IFRS) set common rules so that financial statements can be consistent, transparent and comparable around the world. IFRS are issued by the International Accounting Standards Board (IASB). They specify how companies must maintain and report their accounts, defining types of transactions and other events with financial impact.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This news release may include certain “forward-looking statements” including statements relating to revenues, expenses, and expectations regarding market conditions. These statements involve certain risks and uncertainties. There can be no assurance that such statements will prove accurate and actual results and future events could differ materially from those anticipated in such statements.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 9/30/2019: Gazprom PJSC, MMC Norilsk Nickel PJSC, Pandora A/S.