Risks related to occupational health

and safety are more prevalent than human rights abuses and conflict financing

among global artisanal and small-scale miners (ASM), a new study by German

supply chain auditor RCS Global Group has found.

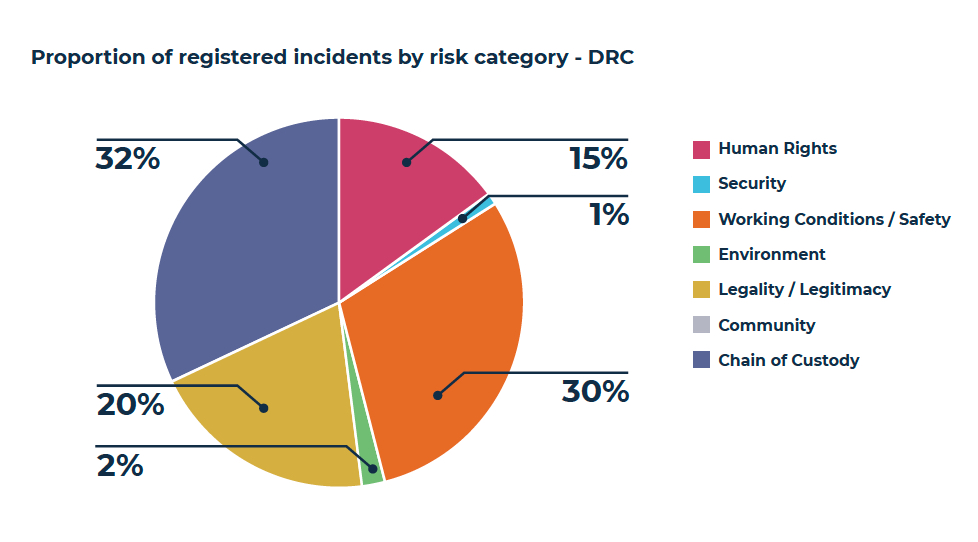

The group’s Better Mining platform, piloted as ‘Better Cobalt’ on a cobalt supply chain from the Democratic Republic of Congo (DRC) revealed that 26% of all registered incidents in the past year were related to health and safety issues, while only 13% had to do rights abuses and minerals financing conflict.

Data came from five separate artisanal and small-scale mining sites in the DRC and Rwanda.

The Berlin-based organization used mobile technology to gather data from from five separate ASM sites in DRC and Rwanda, focusing on informal and small miners digging for cobalt, copper and the so-called 3TG (gold, tin, tantalum and tungsten).

A sophisticated methodology

co-developed with the Responsible Minerals Initiative (RMI) was later applied to

calculates risk levels based on incident and context data.

Since January, deployment of the Better Mining platform, which includes a risk mitigation monitoring process, had led to a reduction in overall risk levels at four out of the five mine sites in the sample, the group says.

The complete eradication of child

labour, however, remains challenging due to the difficulty of controlling

access to mines in large, remote areas, it notes.

The idea is to sell the solution to

companies willing to ensure their raw materials don’t come from mines that use

child labour or fund warlords or corrupt soldiers, RCS Global Group says.

One of its clients is Volvo Cars, the first global brand to actively use Better Mining data. The automaker aims to gain greater insight of the cobalt it uses in the manufacture of lithium-ion batteries for its next-generation electrical vehicles (EVs).

The group wants to open up the platform to other car producers and companies in the supply chain, and expand it to include more metals and raw materials.