Source: John Newell for Streetwise Reports 10/18/2019

John Newell of Fieldhouse Capital Management explores the investment opportunities presented by this project generator in a district rich with historic mine strikes.

If the adage in the mining business is “that the best place to find a mine is next to an old mine,” then by extension, the best place to explore for gold is next to a successful exploration play, and GoldON Resources Ltd. (GLD:TSX.V) is a company that we believe deserves a closer look.

Background

In our first Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) article, linked here, we saw a company that checked a lot of the boxes when looking at potentially investing in a gold exploration company. Great historical gold-producing district, where discoveries have been turned into mines for the past century. Great management and geologists. It is also helpful to have tight share structure, with management owning shares so that their goals were aligned with the other shareholders.

When we first started following Great Bear Resources, like most juniors it was hard to raise money. The shares bounced around with the volatility that comes with sector, the company did not have any big investors championing the story, and while we researched the story, we had no idea that everything was about to change.

The now-famous drill results came out, and the famed Red Lake investor and former Goldcorp chairman and founder stepped in and bought ~10%, coupled and with continuous better results, and the rest as they say is history. Great Bear’s share price went from $0.50 to over $9/per share in less than 18 months.

So, we are motivated to look for other companies that could also mirror that kind of success, while recognizing that mineral exploration is a high-risk business, and replicating Great Bears success is a mighty tall order. However, it is also true that it has been success in the discovery phase of a mining project’s lifespan that has created the greatest shareholder wealth in the resource sector. We look for those companies for a part of our portfolio on mining companies, knowing the odds are 1 in 1,000. Our research led us to GoldON Resources Ltd., and we decided to have a closer look.

Who is GoldON?

GoldON Resources Ltd. is a mineral exploration company with a project generator business model. GoldON, as the name reflects, is a company focused on exploration in Ontario, Canada. It is focused on discovery-stage properties with a goal of adding value by defining, or redefining, using new exploration methods and exploration opportunities, and then sourcing a well-financed partner to advance the project by way of option or joint venture participation.

The company has, and continues to, seek and acquire properties by staking or [acquiring an] option in mining-friendly jurisdictions, and is geographically focused on some of the prolific gold mining districts of Ontario, Canada, notably the famous and prolific Red Lake camp.

The Red Lake Camp

Excerpt from the Red Lake Regional Heritage Foundation Web page:

The Legend of Red Lake

According to Ojibway legend, thousands of years ago two warriors of the Chippeway nation came upon a very large moose beside a lake. They believed the beast was Matchee Manitou (evil spirit) and tried to kill it. Wounded, the animal escaped by diving deep into the lake. A large pool of blood colored the water red, and the hunters named the body of water Misque Sakigon, or Color of Blood Lake. Over the years it became known as Red Lake.

While Canada has had many prolific gold- and silver-producing areas discovered over the past 100 years, and many famous gold rushes, few rival the prolific Red Lake District, where some of the richest grades of gold have been found. Gold was first discovered in 1925, and as the word got out it quickly grew. Since 1925 there have been 28 operating mines producing in excess of 25 million ounces with an average grade of 0.5 ounce of gold per ton. Much of the gold deposits are discovered in a greenstone formation that has come from structurally controlled vein-type gold deposits near regional mafic volcanic sediment contacts. Gold will generally occur where the greenstone rocks come together with the sedimentary rocks. At that point, the rocks have been stretched and folded, creating the cracks and openings that can fill with gold.

The Company

GoldON is led by Michael Romanik, who is CEO, president and a director, and has assembled a great management team, geological team, drilling/exploration crew and advisory board. Mr. Romanik has demonstrated the ability to raise capital with strategic investors and leading industry executives, while using the funds on careful, well-researched drill targets, on ground that offers great discovery potential.

GoldON has three main properties we will cover in this market awareness report, Slate Falls, West Madsen and Bruce Lake. The other properties are likely going to wait until next year to see any meaningful work done.

Share Structure

The company has a good share structure, with a focus on discovery-stage projects, with over $1 million in the treasury to complete the upcoming drilling at Slate Falls and the next phase of exploration at West Madsen.

- Issued and outstanding: 15,152,282

- Warrants: 3,625,350

- Stock options: 1,561,150

- Fully diluted: 20,338,782

- Insider holdings: ~24%

- Insiders & close associates: ~50%

- Goldcorp. founder and head of McEwen Mining (MUX) (Rob McEwen): ~5%

Slate Falls

GoldON is currently preparing to drill its flagship, 100%-owned Slate Falls property. The 5,687-hectare Slate Falls property is in the Meen-Dempster Greenstone Belt between the Red Lake and Pickle Lake Gold Camps (see location map below).

The Fry Lake-Bamaji Lake Deformation Zone passes through the property, representing first- and second-order crustal-scale structures that cut stratigraphy that is similar to and contemporaneous with the stratigraphy that hosts the past-producing Golden Patricia gold mine, which produced 620,000 ounces of gold at 15 g/t Au between 1988–1997 and lies 30 kilometers to the northeast. Also, the almost 5 million-ounce Springpole project being run by First Mining Gold Corp. (FF:TSX) (news release on Springpole) is ~30 kilometers to the northwest, so we know we are in gold country.

This news release, dated June 25, 2019, strengthens our belief that GoldON is in the right rock type. News release: Selected Rock Grab Samples Assay up to 331.76 g/t Au and 3,025 g/t Ag at GoldON’s Slate Falls Project.

Just as being in the right neighborhood for finding gold gives confidence. So too does good prospecting and fieldwork, sampling, reconnaissance mapping—all are vital to identify quality drill targets while saving time and money, before the drills start turning. Fieldwork in 2019 returned the highest-grade surface sample results to date and turned up priority targets, which include the Trail Zone, where high-grade values up to 861 g/t Au in drill core and 3,025 g/t Ag in surface samples will be included in the current drill program getting underway.

It is also worth mentioning that Mr. Bob Singh did the detailed review and compilation of all historical exploration data on the Slate Falls property, and was the Qualified Person (QP) on the project in 2017. Then his lead role on Great Bear’s Dixie Lake Project required his full attention, and the Slate Falls QP role was handed over to Mr. Mike Kilbourne, P.Geo.

Michael Romanik, president of GoldON states it best:

“We are early in the project life cycle at Slate Falls and the results from our 2019 prospecting and sampling program will be instrumental in guiding our drill plan. We have clearly defined our initial high-grade targets and look forward to commencing our maiden drill program on the Property.”

West Madsen

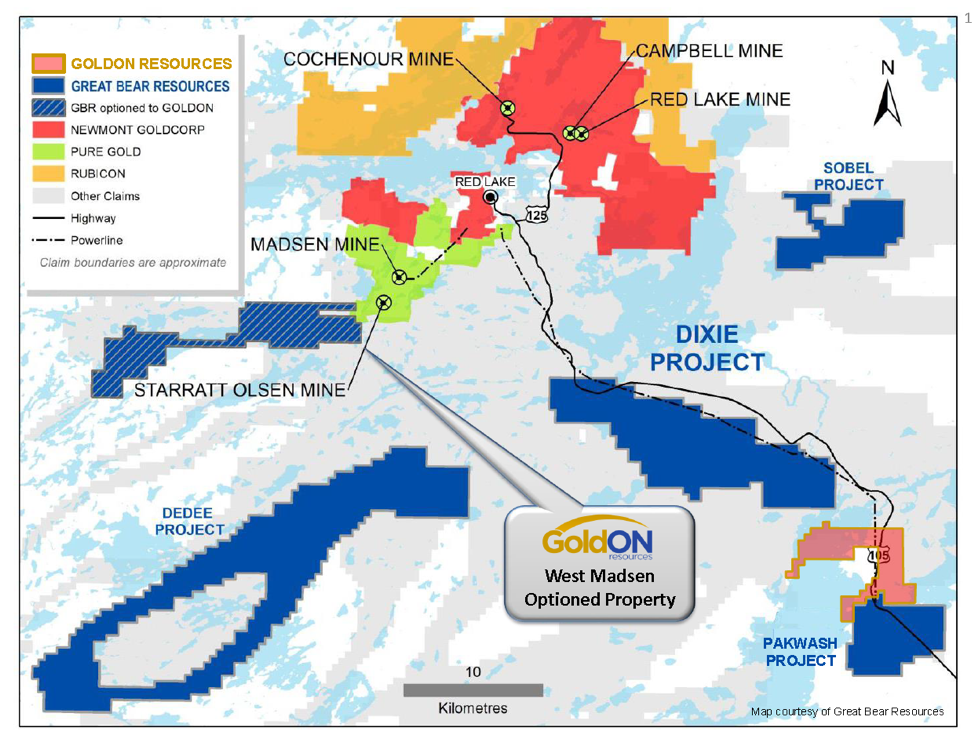

Sometimes you’re smart or lucky in mining, and whichever it is in GoldON’s case, we’ll take it. With Great Bear Resources very busy with their new, ever-expanding discovery at their 100%-owned Dixie Lake Project, only 20 kilometers away, Great Bear optioned off its other 100%-owned, royalty-free West Madsen properties to GoldON, whereby GoldON has the option to earn a 100% interest in Great Bear’s West Madsen gold property (see GoldON’s news release from May 28.)

The West Madsen property is on strike to the historical, past-producing Madsen and Starratt Olsen mine, which is directly contiguous to Pure Gold Mining Inc.’s (PGM:TSX.V; PUR:LSE)‘s Madsen property, which is Canada’s highest-grade development gold project, currently being developed. Pure Gold is fully funded, with planned production for late 2020.

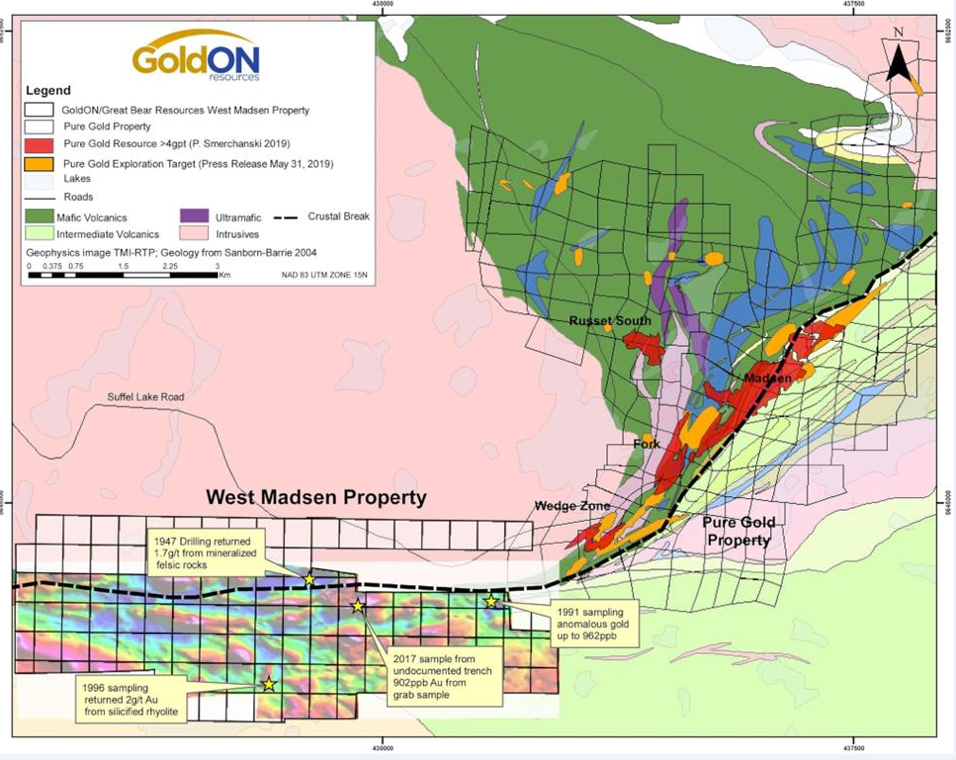

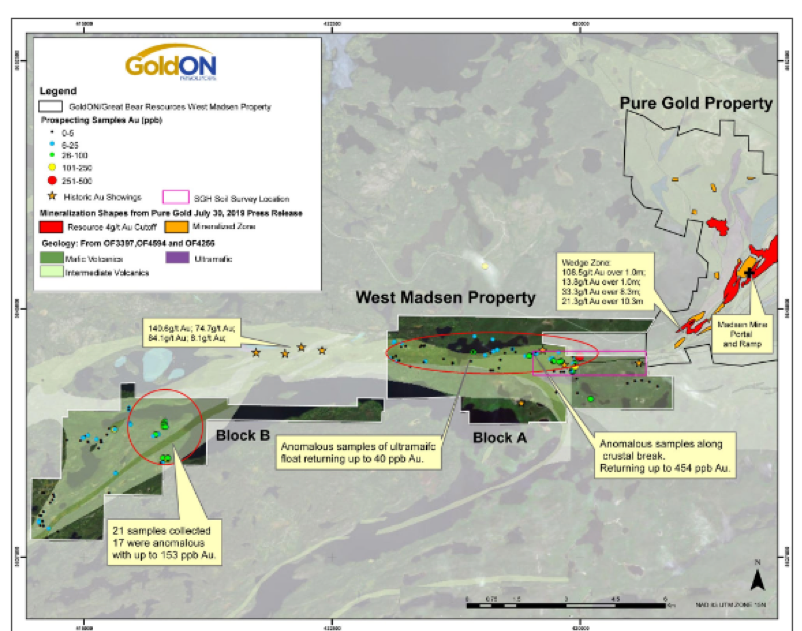

West Madsen is composed of two contiguous claim blocks (Blocks A and B; see slide below), each roughly 6 kilometers (6 km) by 3 km in size, for a total area of 3,860 hectares. GoldON has hired the Red Lake specialists Rimini Exploration as project manager for West Madison. Their work is so respected at the now-famous Dixie Lake Project of Great Bear that the company had the Bear-Rimini zone named after them.

Also, the multitalented VP Exploration, Mr. Bob Singh, from Great Bear Resources, will act as a technical advisor, along with Mr. Perry English, often referred to as a one-man prospect generator in the Red Lake District, who will join as a strategic advisor.

Pure Gold’s Madsen Project includes the Madsen deposit and the Fork, Russett South, and Wedge deposits. Pure Gold announced bonanza-grade gold results from the Wedge deposit on July 30, 2019, and the expansion of their 2019 exploration drilling program (from 12,000 to 20,000 meters) on October 9, with the aim of making new discoveries and continuing to grow the resource base.

This high-grade discovery is less than two kilometers away from GoldON’s Madsen’s Block A, with the best grades at the southwest end of the strike. Pure Gold’s exciting discovery and continued drilling success appears to be getting closer to GoldON’s property boundary.

More evidence that a major crustal break between Balmer Assemblage rocks and Confederation Assemblage rocks is interpreted to trend from the Pure Gold land package onto the West Madsen property.

Within the Red Lake Greenstone Belt, these major crustal breaks are associated with extensive gold mineralization, hosted both in the Balmer Assemblage and within the felsic to intermediate volcanic rocks adjacent to the interpreted fault zones, as recently identified by GoldON’s option partner, Great Bear Resources at their Dixie Project (see Great Bear’s press release from May 28, 2019).

GoldON’s phase I fieldwork on the West Madsen property in summer 2019 included a property-scale, grassroots prospecting and a 3D spatiotemporal gas hydrocarbon (SGH) soil survey. SGH is an extractive procedure that releases organic compounds absorbed on B-horizon soil samples. The SGH procedure provides a highly focused and sensitive method that measures compounds in the C5–C17 range down to the low parts-per-trillion (ppt), which has been effectively used at Great Bear’s Dixie Lake discovery. A drilling program to follow up on the gold zones identified from the SGH surveys is planned after further prospecting and mapping work.

As Pure Gold’s new discovery, and continued and expanded drilling success, continue to find more high-grade gold, it seems likely that the rich gold-bearing zone could continue across the property line to include both the historic and current work that has returned gold at West Madsen. GoldON appears to be in the right rocks and getting the right evidence, which could lead to a significant discovery at West Madsen.

Bruce Lake

GoldON recently signed an option agreement to acquire a 100% interest in the Bruce Lake property (news release of March 28, 2019). This road-accessible property with hydro lines running through it sits in between Great Bear’s major Dixie Lake discovery and Great Bear’s 3,100-hectare Pakwash property.

GoldON’s Bruce Lake property consists of seven claims covering 2,490 hectares in a structurally active area spatially associated with east-west trending deformation zones and northeast-trending faults. These faults have been central for gold mineralization to occur. This ground is unexplored, with gold anomalies yet to be explored; however, lake sediment results along with MMI (mobile metal ions) is especially well suited for deeply buried mineral deposits. MMI measures metal ions that travel upward from mineralization to unconsolidated surface materials such soil, till, sand and so on. Using careful soil sampling strategies, sophisticated chemical ligands and ultra-sensitive instrumentation, work suggests the property could be a source of gold.

The Technicals

After a sharp run up in the price in early to mid-2019, Goldon has pulled back ~60% from the initial move off the 2018 lows. This could represent a good entry point in the company as it ramps up exploration on at least two significant exploration properties this year and next.

The chart of Great Bear, below, is a reminder that the path to higher is sometimes volatile and ~60% corrections are not uncommon before a move higher.

In Summary

While the company’s exploration efforts are still early days, GoldON has assembled at least three high-priority properties that after preliminary and advanced geological work, are drill ready. GoldON has assembled a technical team with deep experience in the Red Lake area, a tight share structure with much of the shares owned by management, friends and family who believe in these projects. The company can run cost-effective exploration on all their road-accessible projects with a ready, experienced workforce and infrastructure including power and roads nearby.

GoldON has positioned itself in a mining region that has been turning discoveries into mines for a century. Given the recent drop in the share price, this area could be a good time for patient investors, with some risk tolerance, to look at GoldON Resources Ltd.

John Newell is a portfolio manager at Fieldhouse Capital Management. He has 38 years of experience in the investment industry acting as an officer, director, portfolio manager and investment advisor with some of the largest investment firms in Canada. Newell is a specialist in precious metal equities and related commodities and is a registered portfolio manager in Canada (advising representative).

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosures:

1) John Newell: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: GoldON. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of GoldON, a company mentioned in this article.

Additional Disclosures and Disclaimer from John Newell, Fieldhouse Capital Management

Legal Notice / Disclaimer:

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

John Newell has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

John Newell makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of John Newell only and are subject to change without notice. John Newell assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, John Newell, assume no liability for any direct or indirect loss or damage or for lost profit, which you may incur because of the use and existence of the information provided within this Report.

It should not be assumed that the methods, techniques, or indicators presented in these pages will be profitable or that they will not result in losses. Past results are not necessarily indicative of future results. Examples presented on these pages are for educational purposes only. These set-ups are not solicitations of any order to buy or sell. The authors, the publisher, and all affiliates assume no responsibility for your trading results. There is a high degree of risk in trading.

Hypothetical and historical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical and historical performance results and the actual results subsequently achieved by any trading program. One of the limitations of hypothetical and historical performance results is

that they are generally presented with the benefit of hindsight. In addition, hypothetical and historical trading may not present the financial risks and returns for future trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which

cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect actual trading results.

Disclaimer: This Publication is protected by Canadian and International Copyright laws. All rights reserved. No license is granted to the user except for the user’s personal use. No part of this publication or its contents may be copied, downloaded, stored in a retrieval system, further transmitted, or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means without prior written permission. This publication is proprietary.

Neither the information, nor any opinion expressed constitutes a solicitation for the purchase of an investment program. Any further disclosure or use, distribution, dissemination or copying of this message or any attachment is strictly prohibited; such information, whether derived from Fieldhouse Capital Management or from any oral or written communication by way of opinion, advice, or otherwise with a principal of the company is not warranted in any manner whatsoever, is for the use

of our customers only and may be obtained from internal and external research sources considered to be reliable.

Charts and images provided by the author.

( Companies Mentioned: GLD:TSX.V,

GBR:TSX.V; GTBDF:OTCQX,

PGM:TSX.V; PUR:LSE,

)