Mining and commodities trader giant

Glencore (LON: GLEN) has taken a small stake in an Irish zinc project located

next to its own Pallas Green lead-zinc development by investing

C$1 million in Group Eleven Resources’ (TSX-V: ZNG) Stonepark

deposit.

Glencore’s funding gets it an 11.58% stake in the Canadian explorer, which co-owns the Stonepark deposit with Irish gold and zinc junior Arkle Resources.

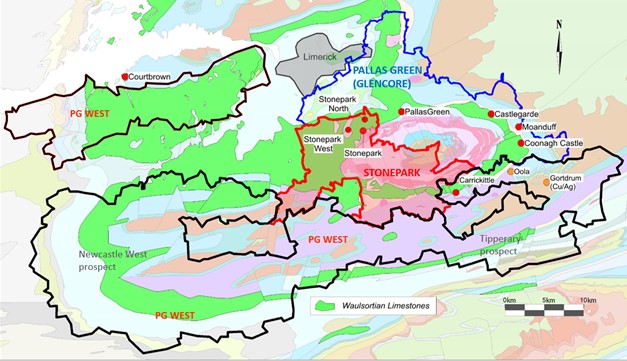

Stonepark is located next to Glencore’s own Pallas Green lead-zinc development.

“We are excited to have Glencore

join our group of strategic shareholders,” chief executive of Group Eleven, Bart

Jaworski, said. “Glencore’s extensive experience in Ireland, especially at

the Pallas Green zinc project, will provide an important dimension to Group

Eleven’s ‘Big Think’ strategy.”

The asset, located in Ireland’s southwest county of Limerick, is a 5.1 million-tonne zinc deposit grading 8.7% zinc and 2.6% lead in the Inferred resource category.

The deal sees Glencore Canada

purchasing 8.4 million units of Group Eleven priced at C$0.12 each for a

total consideration of just over C$1 million, an equity ownership of 11.6%.

Each unit consists of one share and

one half of one warrant exercisable at C$0.24 each for 35 months following the

closing date.

Glencore, one of the world’s

largest zinc producers, also has the right to add one member to Group Eleven’s

board and participate pro-rata in future financings, provided its ownership

remains above 10%.

Ireland is one of Europe’s largest

zinc producers and host to some of the world’s largest deposits of the metal.

Zinc’s primary market is for

strengthening steel. In 2016, commodities analysts began warning of a looming

zinc shortage and soaring prices. In 2018, it hit $1.60 per pound, but it has

since dropped to about $1 per pound.