Uranium One Group (U1G), a

subsidiary of Russia’s state nuclear company Rosatom, has signed a deal with

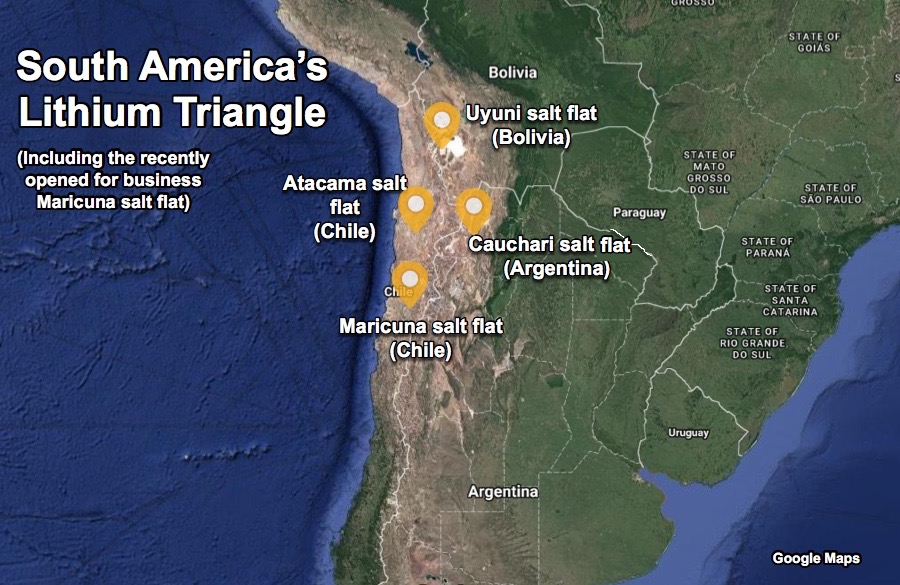

Canada’s Wealth Minerals to buy up to a 51% interest in the company’s Atacama

lithium project, located in Chile’s northern Antofagasta region.

The memorandum of understanding also sets the stage for and increased co-operation between the companies for the development of lithium projects, Wealth Minerals — whose main focus is the acquisition and development of lithium projects in South America — said in a statement.

“Partnering with U1G will help

Wealth accelerate the development of lithium projects by using modern

technology and moving away from outdated solar evaporation to a more efficient

and environmentally friendly sorption technology,” the company’s president, Tim

McCutcheon, said.

The Atacama lithium project covers a 46,200-hectare license in one of the world’s highest grade and largest source of the white metal, which has become an irreplaceable component of rechargeable batteries used in high tech devices and electric vehicles (EVs).

Other companies operating in the

Atacama Salar are world’s no. 2 lithium miner Sociedad Química y Minera (SQM)

and Rockwood.

Market conditions for the battery

metal are not optimal. Oversupply worries and cuts to subsidies for electric

vehicles makers by China, the world’s largest consumer of the metal have

heavily weighed on prices.

After more than doubling in 2016

and 2017, prices for lithium carbonate, the most common type used in EV

batteries, have fallen by more than 40% over the past year.

Free-on board prices of lithium

carbonate from South American brine ponds are down 31% over the past year to average

$10,375 a tonne in September, according to Benchmark Mineral Intelligence data. At the same time,

ex-works prices in China have collapsed from a peak of $24,750 in March last

year to below South America’s export prices.

Producers in Australia now get $325

less for spodumene concentrate (6% lithium used as feedstock for lithium

hydroxide) cargoes than in July last year, when prices were above $900 a tonne,

according to Benchmark’s September assessment. Lithium hydroxide prices

followed carbonate down, but now trade at a premium to the latter at $13,000

FOB North America.