Nine years after the implementation

of a law requiring publicly traded companies to ensure their raw materials don’t

come from mines that use child labour or fund warlords and corrupt soldiers,

companies’ efforts to comply continue to fall short.

According to the annual report by the Responsible Sourcing Network (RSN), now in its sixth edition, companies’ attempts at talking the issue and report their practices have decreased.

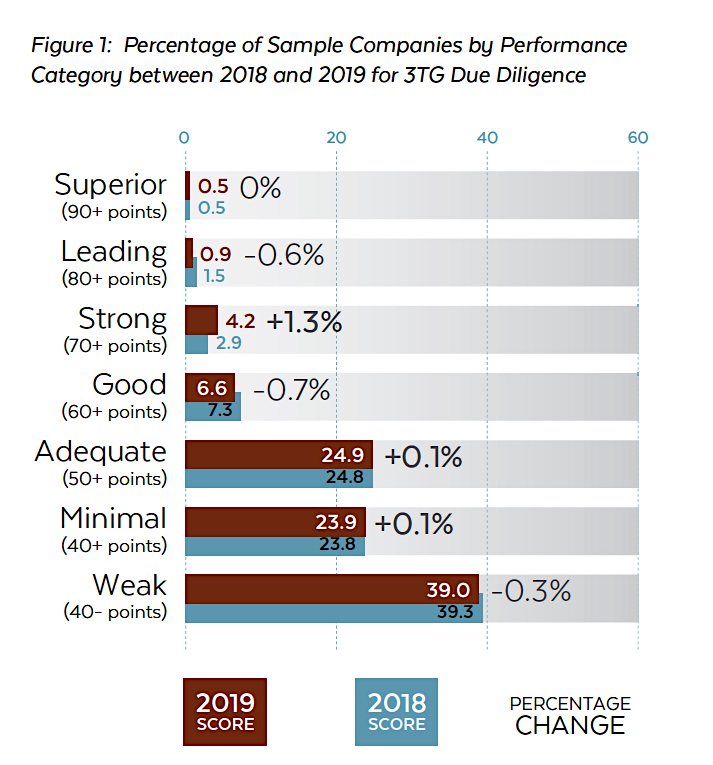

The study, which analyzed 215 companies’ actions around tin, tantalum, tungsten, and gold (3TG), said firms scored 39.8 points in the last 12 months, down from 40.3 points they achieved in the same period the previous year.

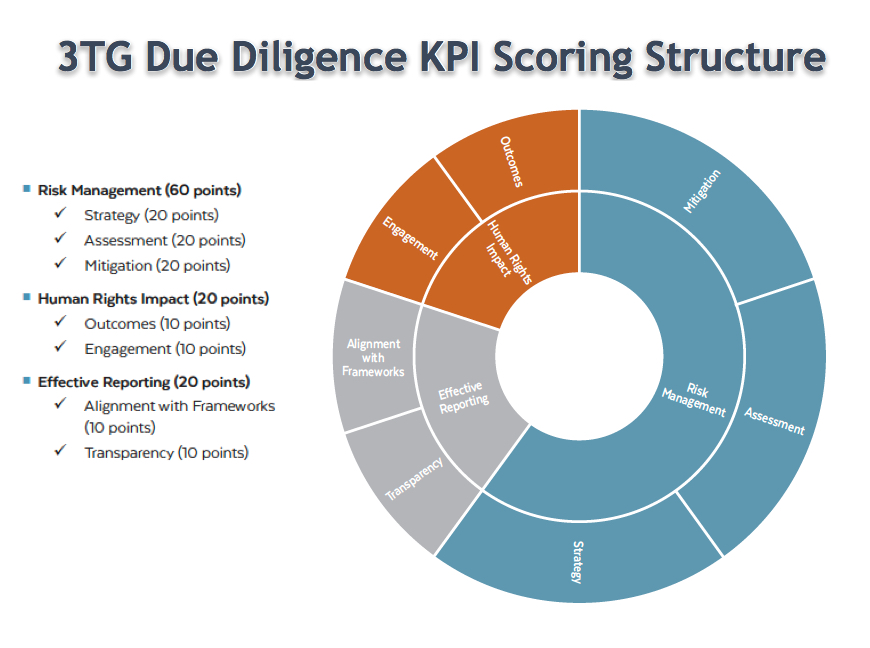

The rating system is based on 24 performance indicators (KPIs) divided across three themes, analyzing disclosures to the US Securities and Exchange Commission (SEC), conflict minerals policies, and any other conflict-minerals-related documents or descriptions of activities on company websites.

Each KPI is weighted according to its significance and in relation to the number of sub-indicators for each theme. For companies to earn points for a KPI score, the corresponding information must be publicly available.

“The comparison regrettably shows the lack of efforts of a large number of companies, highlighted by the decline or stagnation of 59.8% of the sample, and, even more regrettably, 63% of the sample scores at mediocre levels (categories of minimal and weak),” RSN, a body that aims at ending human rights abuses and forced labour related to the extraction of raw materials, says.

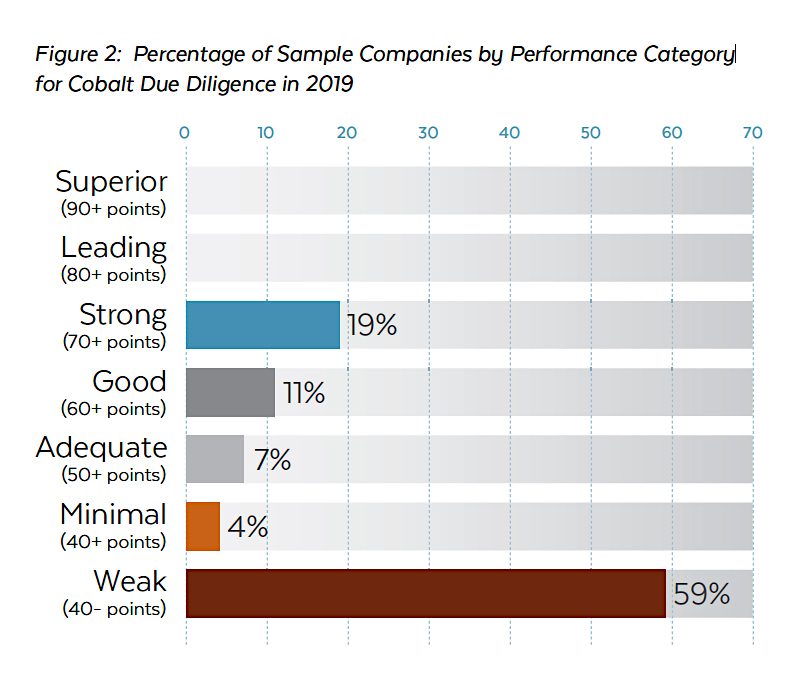

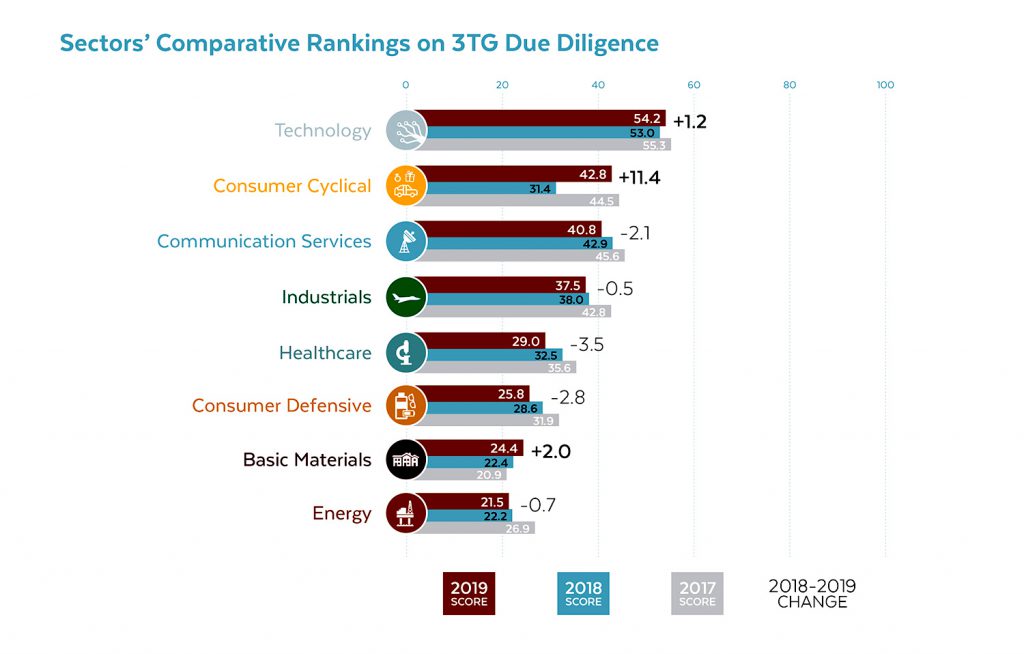

The report, which also ranks the efforts of 27 companies to address child labour and other human rights abuses in their cobalt supply chains, as established by the Dodd Frank Act Section 1502, shows that the technology sector remains as leader on the topic.

Companies achieving a score of 70

or higher have shown their ability to innovate beyond simple compliance, accomplishing

an integrated and robust response to conflict minerals risks, the report says.

The six leading companies, Intel, Microsoft, Apple, Ford, HP, and Dell Technologies, have adopted proactive, due diligence-based strategies and lead the way in terms of transparency.

It doesn’t mean, however, that

supply chains are free of conflict minerals, particularly of those coming from

the resource-rich, but impoverished Democratic Republics of Congo (DRC).

Pressure builds

Allegations of abusive mining

practices in Congo came to light in 2015, largely focusing on informal, or

artisanal, small scale mining (ASM). The country’s cobalt — a key component in

the batteries used in electric vehicles and smart phones— is said to be mostly mined

by hand, in often dangerous conditions and sometimes by minors.

According to Amnesty International, children as young as seven have been found scavenging for rocks containing cobalt in the DRC. The group also claims to have evidence that the cobalt those miners dig has been entering the supply chains of some of the world’s biggest brands.

Traditionally, artisanal miners

have sold their ore to local cooperatives, which then sell it to local

merchants and traders. They, in turn, sell to international traders or

operating mines with established transport links and that cobalt ends up being

exported mostly to China.

Those and other allegations have put pressure on companies and on traders. The London Metal Exchange (LME), the world’s biggest market for industrial metals, has plans to ban metal tainted by human rights abuses. The initiative to ensure responsible sourcing originally had 2022 as the deadline, but LME will now wait until 2025.

Dodd-Frank legislation requires

companies operating in conflict areas such as the DRC to conduct due diligence

to establish their commodities are conflict-free. The minerals involved are

tin, tantalum, tungsten and gold.

The European Union in May 2017 passed a regulation to stop mine workers being abused and conflict minerals being exported to the EU. The requirement to ensure mineral imports are responsibly sourced will become effective on Jan. 1, 2021.