In this special weekend edition, MINING.com partnered with Global Business Reports to spotlight the opportunities and challenges of mining in the Democratic Republic of Congo (DRC).

From GBR: By halfway into 2019, it appeared that the DRC has finally reached the end of a very bumpy road. After a delayed election result, outsider Felix Tshisekedi was finally sworn in as president in January. Despite disputed election results and allegations of a back-room deal between former President Joseph Kabila and Tshisekedi, the country experienced its first election undertaken without widespread violence.

For the mining sector, opposition leader and former Exxon Mobil director Martin Fayulu was the preferred choice as anticipated to revise the new mining code signed into law by former President Joseph Kabila. In March, Tshisekedi agreed to form a coalition government with Kabila, whose FCC party holds an absolute majority in Parliament. While the union of the two leaders should suspend any hopes of regulatory alterations, it will allow the mining sector to establish a foothold after a long period of tension. Investors are still likely to approach the DRC with a certain degree of trepidation until the dust settles, but the country’s mining sector has demonstrated a resilience in riding out a long storm of political and regulatory uncertainty, in addition to plummeting commodity prices.

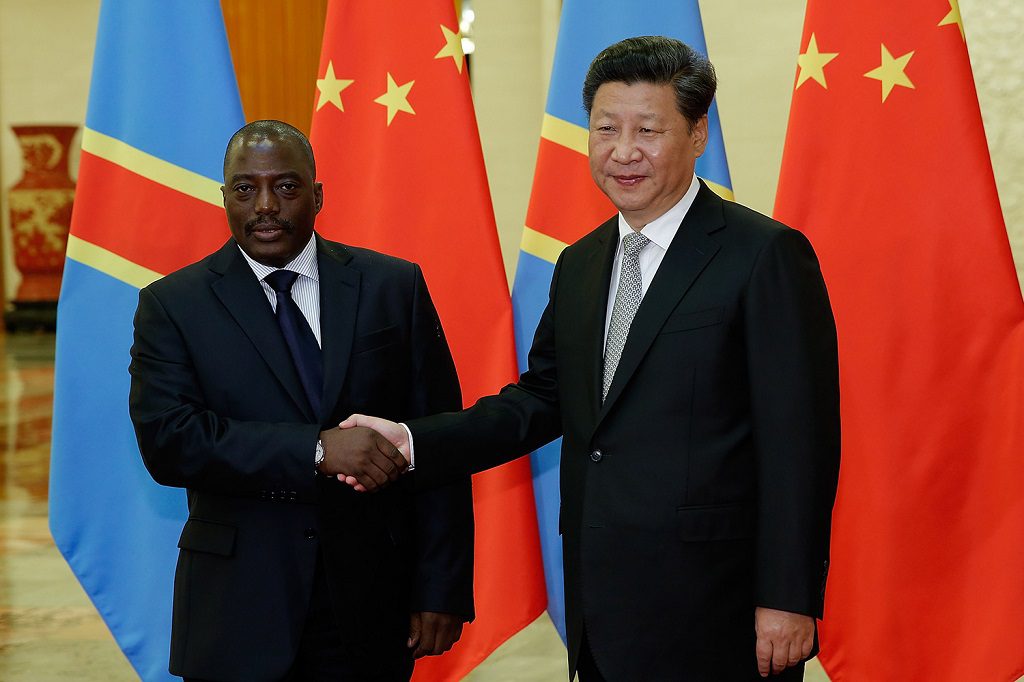

The Chinese power grab: Tracking the complicated evolution of Sino-Congolese relations

Global Business Reports examines how, although Sino-Congolese relations dates back to the mid-1960s when the Chinese Communist Party encouraged and offered support in the Congolese struggle against capitalism and American imperialism, China’s more palpable influence was marked by the 2008 infrastructure-for-minerals deal that attributed mining rights to China in exchange for substantial investment into the DRC’s war-torn infrastructure.

In late 2007, a joint venture was set up to execute the terms of the agreement. It was named Sino Congolaise des Mines (Sicomines) and established with a Chinese majority shareholding of 68%. The Chinese $6-billion investment was to be evenly divided between mining projects and the development of roads, railways, schools, hospitals and dams.

Doing business in DRC: Questions about the controversial new mining code persist:

Congo’s new mining law raised royalties on minerals across the board and removed a clause that protected miners from changes to the fiscal and customs regime for 10 years.

Questions about the controversial new mining code persist, Global Business Reports outlines how, after a century of Western oppression followed by the most broadly-encompassing civil and interstate war in African history, it should come as little surprise that the DRC is not yet a functioning democracy.

After a century of Western oppression followed by the most broadly-encompassing civil and interstate war in African history, it should come as little surprise that the DRC is not yet a functioning democracy. The nation is rife with corruption, poverty and failing infrastructure. However, it also holds half the world’s cobalt and vast copper deposits, in addition to some 1,100 other mineral resources as estimated by the World Bank.

More companies to reconsider investments in DRC, says MMG exec

In this exclusive Global Business Reports interview with Miles Naude, General Manager, MMG Limited, discusses investment opportunities in the DRC , providing a production overview of MMG’s Kinsevere copper mine in the DRC and a project update. MMG’s Kinsevere project currently produces 80,000 million tonnes of copper per annum. Mining will continue through 2021, after which processing will continue through 2023. The miner is nearing the end of the feasibility study for the proposed Kinsevere expansion project.

New DRC mining code ‘far from striking a good balance’ — Barrick CEO

Following the merger between Randgold and Barrick Gold, CEO Mark Bristow discusses with Global Business Reports the strategy of the new entity, and argues that the New DRC mining code is ‘far from striking a good balance.’ Bristow says the DRC has a long way to go and there is an understanding that some of the amendments to the mining code have been damaging. The DRC’s mining industry has constantly been tied up by the restating and changing of fiscal legislation – it is true that the country is well-endowed with minerals, but if the investment is not attracted to discover and develop these deposits and with them roll out and improve the necessary infrastructure, the true value of the natural resources and associated sectors will never be unlocked for the benefit of the Congolese people.