Source: The Critical Investor for Streetwise Reports 09/30/2019

The Critical Investor reviews Golden Arrow’s deal with SSR Mining to sell its remaining interest, and also discusses the company’s other projects.

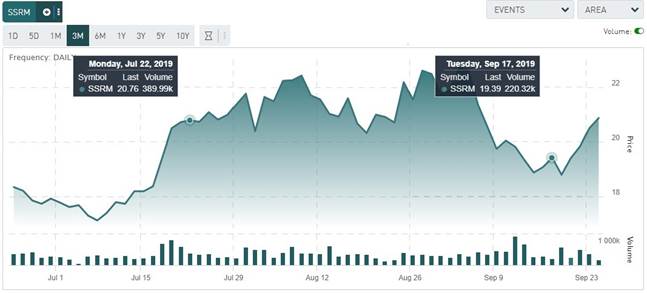

Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE) recently ended the seven-year-long Chinchillas adventure, by closing the deal involving selling its 25% interest in Puna Operations to SSR Mining Inc. (SSRM:NASDAQ) on September 19, 2019. Despite a rising silver price since the announcement of the sale on July 22, 2019, and consequently growing unease among shareholders of Golden Arrow about the appropriate value of the Puna asset, no less than 94.62% of represented voting interest voted in favor of the transaction.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The final specification of the C$44.4 million transaction payment came in as follows:

- C$3.0 million in cash consideration—unchanged

- 1,245,580 common shares of SSRM representing a value of approximately C$25.9 million and calculated using a price per share based on the 20-day volume weighted average trading price of SSRM’s common shares on the Toronto Stock Exchange ending on September 17, 2019—this resulted in an average price per share of C$20.79, compared to an estimated 20d VWAP price per share of about C$19.40 at the time of the announcement at July 22, 2019. If Golden Arrow Resources had been able to fix the price at that day, it would have received 90,000 shares more, currently worth C$27.87 million, a difference of almost C$2 million or 7.7%.

Share price 3 month time frame - Approximately C$15.1 million in cash, which amount was used to repay in full the outstanding principal and accrued interest owed by Golden Arrow under the credit agreement entered into in July 2018 with SSRM—this was C$14.5 million, and the result of additional accrued interest since the announcement

- The return for cancellation, for no consideration, of 4,285,714 Golden Arrow common shares owned by SSRM—unchanged

As we know from my last article about Golden Arrow, SSR Mining did an excellent deal at the bottom of the market, with Golden Arrow having so many financial obligations coming up (not only cash payments to SSR Mining to fund operational deficits, but also upcoming debt payments to SSR Mining and option payments for its other assets in 2020) that it basically had no other choice. For sure the company tried, but as it wasn’t able to raise more money at the time and Puna AISC was projected to remain unexpectedly high for the next quarters, the situation was dire. What seemed like a rock solid leveraged play on silver not too long ago quickly became one big financial liability.

How bad the negotiation position really was showed in the fact Golden Arrow couldn’t even arrange royalty or performance bonuses in case of higher silver prices. Management is no stranger to negotiations, as they for example beautifully worked out a 1% royalty on the Gualcamayo Gold Mine, owned by Yamana, bringing in between $2 million and $3 million annually. On November 12, 2012, they sold the NSR for no less than $17.75 million to Premier Gold Mines, bringing in a pile of cash so they could drill Chinchillas, their new exploration project at the time. One can also wonder why they didn’t negotiate an NSR when the JV was formed and the first 75% optioned out to SSR Mining, when sentiment was still good.

Investors weren’t too happy as the stock is trading even lower than the 2009 post-financial crisis lows, when all Venture stocks hit rock bottom at the time. This was of course well before the discovery of the Chinchillas deposit in 2012.

Share price 10 year time frame

The latest small bull market, which started in 2016, helped sentiment in precious metals, and of course Macri came into power in December 2015 in Argentina, which at the time was seen as a huge economic catalyst for the country, after years of misery caused by Kirchner. Golden Arrow thrived on all this, further fueled by an extensive marketing program. Lots of investors with short horizons bailed out after the Puna JV was announced in March 2017, as they were targeting an outright buyout at a nice premium, and a JV would take many years to crystallize into solid cash flows.

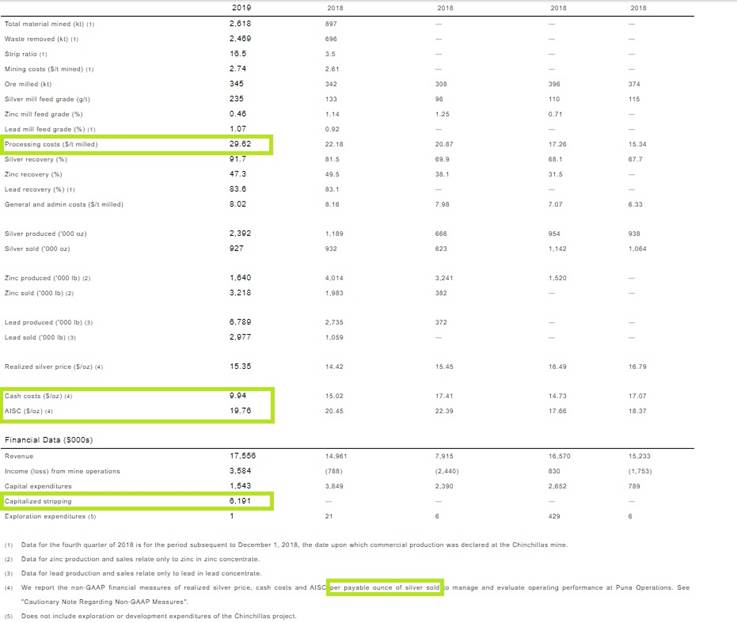

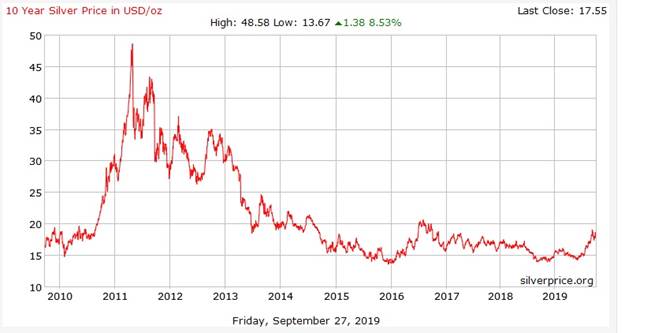

After that sentiment in general gradually slowed down, sending silver to multiyear lows again, as did the perception of Macri and his politics, which wasn’t as effective as hoped by many. As a result, Golden Arrow suffered along with investors, and had to wait for Puna cash flows. Unfortunately and unexpectedly, these never came so far, due to high opex. Instead of the planned PFS opex of US$9.75/oz Ag, cash costs were hovering around the price of silver itself for a long time (US$14-17/oz Ag), and last quarter (first quarter of commercial production) the AISC went considerably beyond that (US$19,76/oz Ag) despite cash cost coming down to US$9.94/oz Ag.

One can imagine for such developments to cause trouble for Golden Arrow, right at the time the company expected to see cash coming in from Puna. But it didn’t stop there, as SSR Mining projected this situation of high costs to last well into 2020, meaning Golden Arrow had to raise C$1–2 million each quarter to satisfy the cash calls from Puna by SSR Mining. This was the primary reason for Golden Arrow to sell its 25% interest, as the needed cap raises were almost undoable, also with the repayment of the US$10 million credit facility coming up in a year. Of course, with a willing JV partner one could roll over/refinance this debt or delay payments, but the cash calls weren’t handled as flexible, unfortunately.

I still have issues with the way SSR Mining handled all this as a majority JV partner. According to management, SSR Mining reportedly had to strip more than planned, and there were also heavy rains and severe lightning, causing problems for hauling ore to Pirquitas.

But the main difference in costs appeared to be in Processing, as reported in the SSR Mining Q1 news release, and this is something that is completely controlled by SSR Mining as the operator. Processing costs almost doubled compared to the PFS figures for Q1, as Golden Arrow provided the following numbers: Q1: Mining 2.74 USD/t-mined, Processing 29.62 USD/t-mined and G&A at 8.02 USD/t-mined versus PFS: of 2.52 USD/t-mined, Processing 15.08 USD/t-milled and G&A of 6.16 USD/-milled. This would have resulted in AISC being higher to the tune of an estimated $4/oz, which is substantial.

A lot of the high AISC could have to do with the lower sold ounce number, but then again cash costs are very low anyway, so something else is going on.

When looking closely, the realized stripping wasn’t out of the ordinary as it was planned to be (very) high the first commercial quarters in the PFS. When looking at PFS table 16.3, the stripping for Y2Q1 (Y2 is 2019) and Y2Q2 is indeed very high (16.51 and 14.42) as planned, but coming down fast in Y2Q3 and further (5.90, 4.32, 3.75, 5.7). The realized stripping was 16.5, so almost exactly as planned.

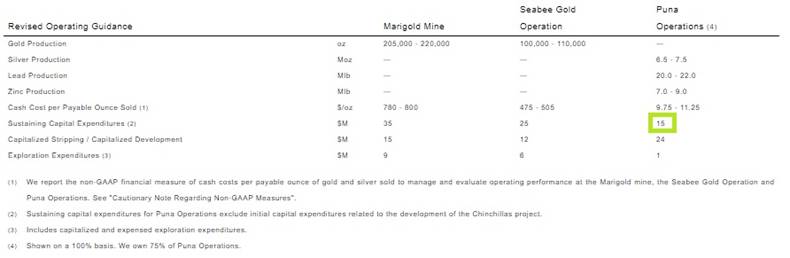

It seems as if sustaining capital was high for Q1, to the tune of an estimated $7–8 million, compared to a total forecasted sustaining capital outlook for 2019 of just $15 million:

Maybe my biggest issue with SSR Mining is why it didn’t sell more ounces of silver, as it produced 2.39Moz Ag and sold just 0.927Moz Ag. Zinc and lead evened out a bit more but also contributed to higher AISC. When you sell just 39% of the silver you produce it is only logical to expect huge pressure on cash flows in a ramping up operation. Golden Arrow did all it could, as it paid for all pre-production capital expenditures pro rata before the end of Q1. In my view, and of course I am biased, SSR Mining is at least partly responsible for the developments that forced Golden Arrow into selling their share in Puna.

One could say that the silver price didn’t cooperate, contracts are contracts and ramping up operations always has teething problems, but what is happening here is not making too much sense to me if SSR Mining really had a good, long-term relationship with Golden Arrow in mind. I do believe this could affect future JVs for SSR Mining, as potential JV candidates will undoubtedly have the Golden Arrow case vividly on their radar for many years to come.

Of course the timing couldn’t have been better for SSR Mining, as the silver price just started something of a recovery, slowly following gold in its footsteps:

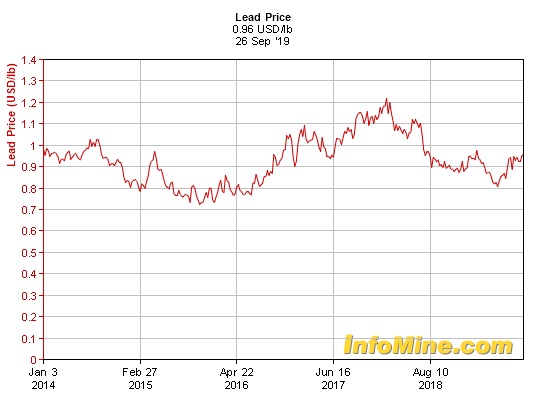

The lead price isn’t doing too much lately although it isn’t very volatile in general, at least much less compared to its sister zinc:

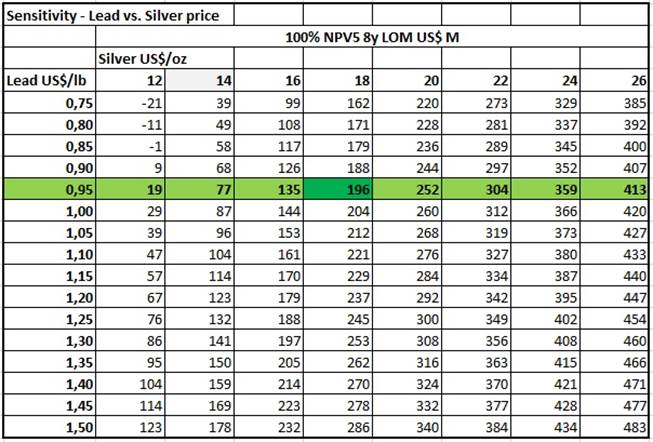

With silver at US$17.55/oz Ag, and lead at US$0.96/lb Pb, the NPV5 comes closer to PFS base case figures, based on US$19,50/oz Ag and US$0.95/lb Pb. A discount of 5% is warranted despite the jurisdiction, as commercial production has been reached and the original Pirquitas operation has been operating without major issues throughout its life of mine. Here is the sensitivity table:

The NPV5 at spot prices comes in at US$180 million, as I didn’t add full capex and pre-stripping to the NPV figures. It’s all subjective, but personally I never value a constructed plant at full capex value, as the minute one dollar is spent it is depreciated, as you can never get that dollar back in full. So I don’t automatically add full capex to NPV when construction is finished and commercial production starts. Another small item is the already extracted metals, of which potential cash flows have to be subtracted from the LOM production in the DCF model. When NPV5 is divided by 4, the 25% ownership of Golden Arrow attributes to US$45 million, which is C$60 million, so SSR Mining could already be sitting on C$15 million paper profits here. This is of course without calculating further upside, as the current resource easily enables a 50% longer life of mine, and potentially doubles it if almost all resources can be converted to a higher category. And of course, as Golden Arrow was one of the—if not the—best leveraged plays on silver in my view, a rising silver price could turn things even more interesting for SSR Mining.

As Golden Arrow has lots of SSR Mining equity at its disposal now, a stronger silver price will undoubtedly have some positive influence, of course heavily watered down by the predominantly gold leveraged flagship assets. However, if silver does well, gold usually does even better these days, so as long as SSR’s gold mines keep on track I don’t see many issues here. What will Golden Arrow do with its current assets?

Nowadays, Golden Arrow has a significant portfolio of exploration assets, managed by fully owned subsidiary New Golden Explorations. It recently completed a sampling program at its Atlantida gold/copper project in Chile, which sports a 427Mt @0.43% CuEq historical resource, with the following highlights:

- 216 meters averaging 0.25 g/t Au in trench 2, including 48 meters averaging 0.53 g/t Au

- 74 meters averaging 0.66 g/t in trench 7

- 52 meters averaging 0.34 g/t Au and 10 meters averaging 0.96 g/t Au in trench 5

- 20 meters averaging 0.72 g/t Au in trench 4

The company is looking for large copper porphyries, which can be found all over the region, and has started a six-hole RC drilling program, aiming at completing 1,000 meters of drilling by the end of September. Management anticipates to be able after this to make a decision on the upcoming cash payment of US $0.4 million by October 3 for Atlantida. The project is made up of a collection of concessions, Atlantida being the largest. It has a 100% earn-in for US$6 million over four years. Even if the company decides to drop Atlantida it will retain other concessions in the area.

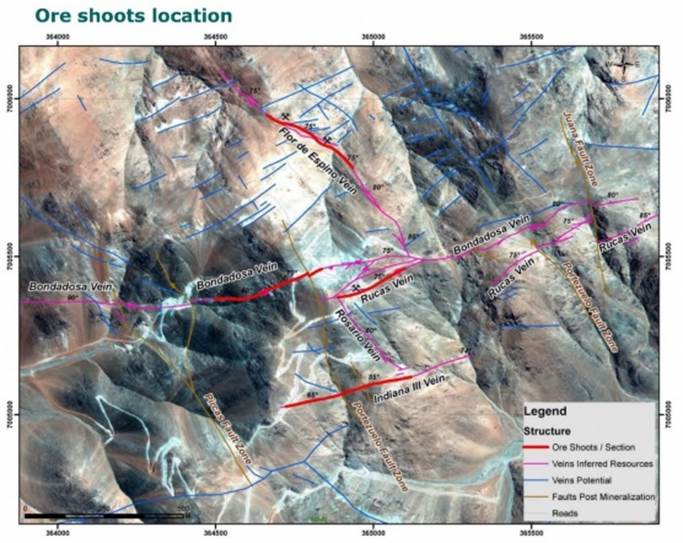

Another very interesting project the company optioned last year is the Indiana project, located about 35km from the Atlantida project, also in Chile. Indiana contains an historical, near surface Inferred resource of 600koz @4.7g/t AuEq (2.8g/t Au and @1.6% Cu), with high recoveries for both gold (90%) and copper (92%), with significant potential to increase resources. A two-stage drill program is planned, a 12-hole, 3,000m program is planned for ore shoot delineation and starts in October 2019, and a second program will follow this, testing potential expansion and new targets. A cash payment of US$1 million is due before year-end here.

Here the company has a 100% earn-in for a massive US$15 million over four years, with a last payment of US$7 million at the end of year 4. This sounds like a lot, but if it can prove up the historical resource as such, which could be all open pittable, and appears to have a low strip ratio, then this project will be very economic, as a small-medium sized 1.3-1.5g/t Au open-pit project can have a strip ratio of 4:1 and still be economic at US$1300/oz Au. If the section below is any indication, it seems that a strip ratio of 4:1 is definitely achievable.

Combined with the significant upside exploration potential this seems like a more interesting project than I previously thought. If the company manages not only to prove up the 600koz, but can expand it to, say, 1Moz at roughly the same grade, a hypothetical NPV8 of US$150–200 million isn’t out of the question. If I were management, I would make this the flagship project.

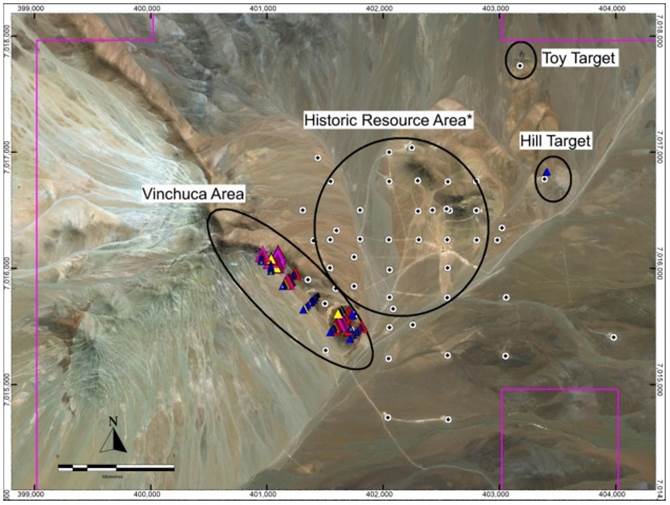

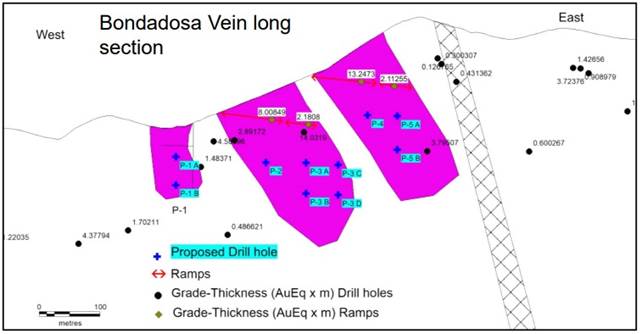

Besides the Chilean projects, Golden Arrow optioned the Tierra Dorada project in Paraguay. This project doesn’t have a historical resource estimate on it, but has seen lots of sampling and some RC drilling, with results up to 148.4g/t Au, over a 2.5km sub-outcropping trend, and its geology is predominantly based on quartz veins.

To have an idea, historical drilling highlights include:

- 6.1m @ 1.12 g/t Au, including 1.5m @ 3.32 g/t Au in SM-H3 starting at 12.2 meters depth

- 3.05m @ 2.87 g/t Au, including 1.5m @ 3.74 g/t Au in SM-H4 starting at 19.8 meters depth

- 4.57m @ 1.72 g/t Au, including 1.5m @ 2.85 g/t Au in SM-H5 starting at 9.2 meters depth

- 3.05m @ 1.35g/t Au, including 1.5m @3.6g/t Au in SMH6 starting at 27.5 meters depth

A reconnaissance exploration program including sampling, mapping, trenching and surveys has started a week ago, in order to define drill targets. This project has no cash payments due for year-end. There is a 100% earn-in for US$2 million over six years.

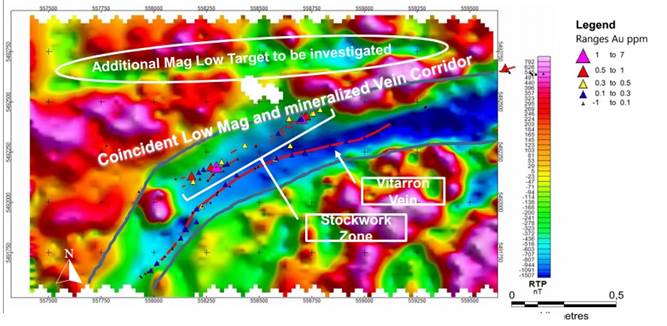

Finally, the company isn’t abandoning its long-time home base Argentina, as it still has five early-stage exploration projects in this country. The Flecha de Oro Gold project located in the Rio Negro province is more or less its flagship project over there. Gold mineralization has been found through sampling at numerous trends of quartz veins and stockworks. A surface sampling and mapping program, combined with a ground magnetic survey, will take place in Q4, starting next month. This project has a 100% earn-in for US$2.1 million over seven years.

Regarding cash payments, Golden Arrow had another project that has seen significant exploration spending and cash payments on it the last few years, and this is the Antofalla project in Argentina. However, management determined that results weren’t promising enough and didn’t justify further spending, and elected to opt out of this project.

Although Golden Arrow missed out on a golden opportunity (with no silver lining, unfortunately) to enjoy the Puna cash cow for a long time, not having to go back to the markets again for the foreseeable future not all is lost here. I view the Atlantida and especially the Indiana project as worthy successors of Chinchillas, with in my opinion Indiana definitely as the more economic prospect of the two, potentially even much more economic than Chinchillas itself. The company wasted no time and has started several exploration programs, which will generate news flow in a month or so.

Conclusion

Golden Arrow Resources seemed to have picked a very solid and trustworthy JV partner with SSR Mining, but unfortunately when things got difficult for the tiny junior, the mid-tier producer didn’t hesitate to add more pressure, in order to rip the 25% interest out of the hands of Golden Arrow at a bargain. I still have several question marks about proceedings, and I am certainly not blaming Golden Arrow management for all of this, although I feel they should at least have negotiated a royalty, either at the 75% sale or the 25% sale. Also agreeing to the non-solicitation clause was something that proved to be decisive, as discarding it could have saved Golden Arrow when silver prices went up and alternative financings could have presented themselves, but this is all in hindsight, of course. For now, the company is still very much alive, has a decent war chest that will last it at least well into 2021, is diversifying out of Argentina, which is going nowhere, and has a few very interesting exploration projects that will generate drill results pretty soon.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

The Critical Investor Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Arrow Resources, a company mentioned in this article.Charts and graphics provided by the author.

( Companies Mentioned: GRG:TSX.V; GARWF:OTCQB; G6A:FSE,

SSRM:NASDAQ,

)