Multi-commodity developer Savannah Resources

(AIM:SAV) is looking into maximizing value at its Mina do Barroso lithium

project in Portugal by identifying other products present in the

concession.

Unveiling a maiden resource for elements other than lithium, the London, England-based company said that the Grandao deposit, which is part of its lithium project, contains 4.79 million tonnes of quartz and 6.11 million tonnes of feldspar.

The co-products can be used in industries such as glass-making and ceramics, Savannah said, generating “significant” extra income for the company.

Co-products will initially be sold to ceramics industry customers in Portugal and in neighbouring and Spain.

“They will not only help our bottom line but will help to reduce the volumes of materials that will need to be emplaced as waste on site thereby reducing our environmental footprint and costs,” chief executive, David Archer, said in the statement.

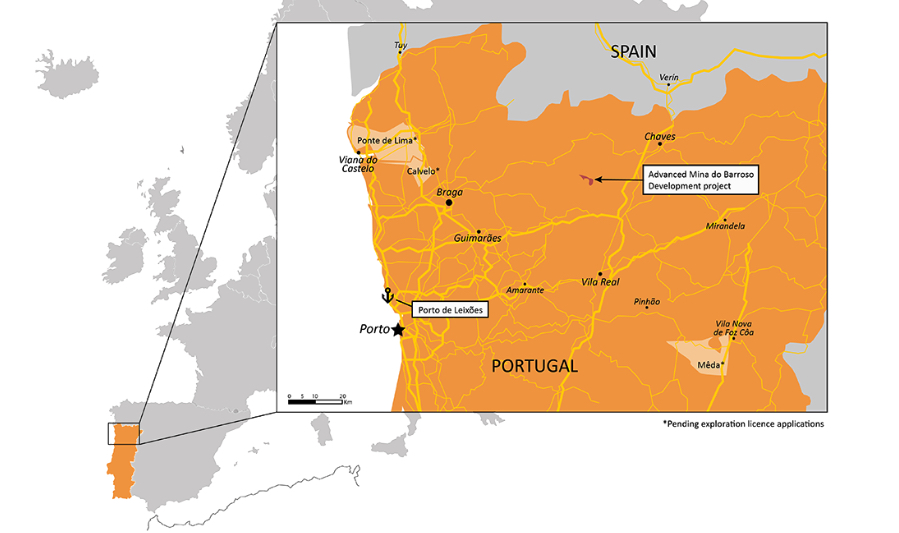

Mina do Barroso, arguably one of the most advanced lithium

mining concessions in Europe, is expected to become the continent’s first

significant producer of spodumene, a hard-rock form of lithium.

Savannah, which acquired a majority stake in the project in

May 2017, has maintained a fast paced development approach since.

The company estimates the whole project, in northern Portugal, holds a resource estimate of 20 million tonnes with over 200,000 tonnes contained Li20.

Additionally, metallurgical test-work results have produced an “excellent” 6% Li20 low impurity concentrate, which according to Archer, is “ideal” for the EV battery industry, further validating the project.

Mina do Barroso open pit mine is set to initially produce 6% Li2O spodumene concentrates destined to China.

Portugal produces about 11% of the global lithium market, but its output is entirely used to make ceramics and glassware. That’s why Europe relies on lithium imports from Latin America’s “Lithium Triangle,” as well from Australia and China.