Resource nationalism in mining jurisdictions in Africa is set to increase, but the volatility will fall in higher risk countries, a new report by global consultancy Verisk Maplecroft finds.

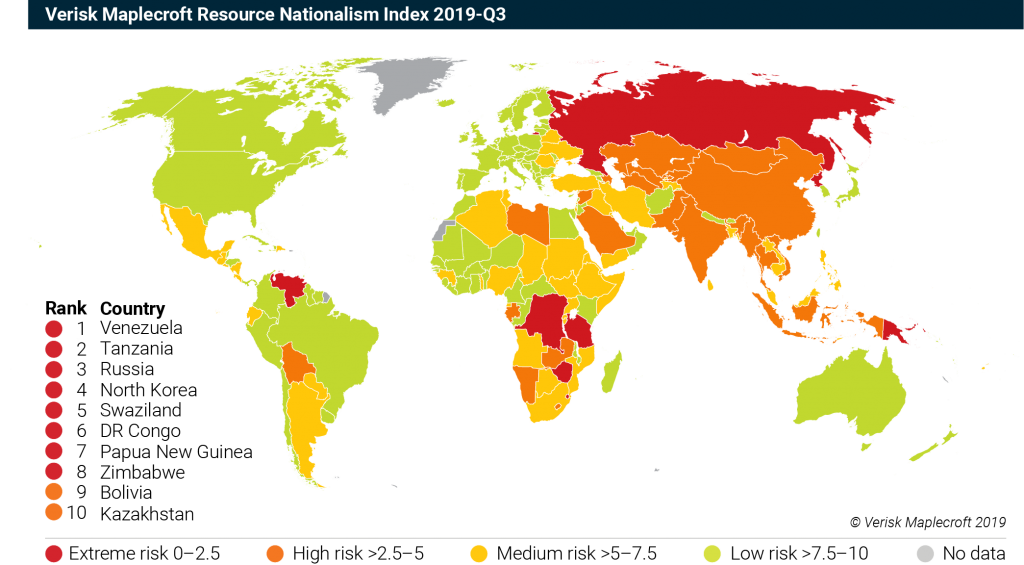

Verisk Maplecroft’s Resource Nationalism Index (RNI) serves as an objective barometer of current and future expropriation risks in the mining sector.

Tanzania is the biggest mover in the last three years, dropping from ‘medium’ to ‘extreme’ risk

Verisk Maplecroft

According to Verisk’s latest release of its 2019-Q3 dataset, out of the top ten highest-risk ranked countries, Africa holds 4: Tanzania is ranked no. 2, Swaziland no. 5, the Democratic Republic of Congo (DRC) no. 6, and Zimbabwe no. 8.

Tanzania is the biggest mover in the last three years, dropping from ‘medium’ to ‘extreme’ risk.

Central Africa’s copperbelt, straddling the border between northern Zambia and southern DRC and Tanzania capture the bulk of resource nationalism risks, while West Africa is relatively benign, Verisk notes.

“Tanzania’s trajectory is most astounding, dropping two risk categories during that period. Upon coming to power in October 2015, President Magufuli adopted a populist line on the mining sector, introducing an export ban on unprocessed copper and gold,” the firm says.

The ban disproportionately targeted one Acacia Mining, which was unable to export its output for three years. Magufuli then introduced a new mining code in 2018-Q1, and in Acacia’s case was confiscated without compensation, which forced miners to cede a 16% share in assets to the state, the report reads.

Barrick’s full acquisition of Acacia was completed this month.

Resource nationalism is far more complex an issue than preconceived notions about anti-investor sentiment in Africa, Verisk asserts.

In the last three years, the prole of resource nationalism in 10 of Africa’s core mining economies has shifted, and most governments on the continent are competing to attract foreign direct investment and therefore must accommodate the needs of private capital, Verisk says.

“Countries that have become dependent on the extractive industries often incline towards resource nationalism, especially when commodity prices are high, political competition fierce, and revenues low.”

The analysts point out that elections have some influence on the course of resource nationalism, but says the direction is difficult to predict.

Looking forward, one certainty, Verisk notes, is that resource nationalism in these jurisdictions will remain a dynamic issue that continues to affect mining companies.

Read the full report here.