The following is the analysis of

monthly gold exploration trends from January to July 2019 using data from

the Mining Intelligence Data Application. The data used represents reporting companies

listed on the following stock exchanges: TSX (+TSX-V), ASX, LSE (+LSE-AIM),

NYSE, and JSE.

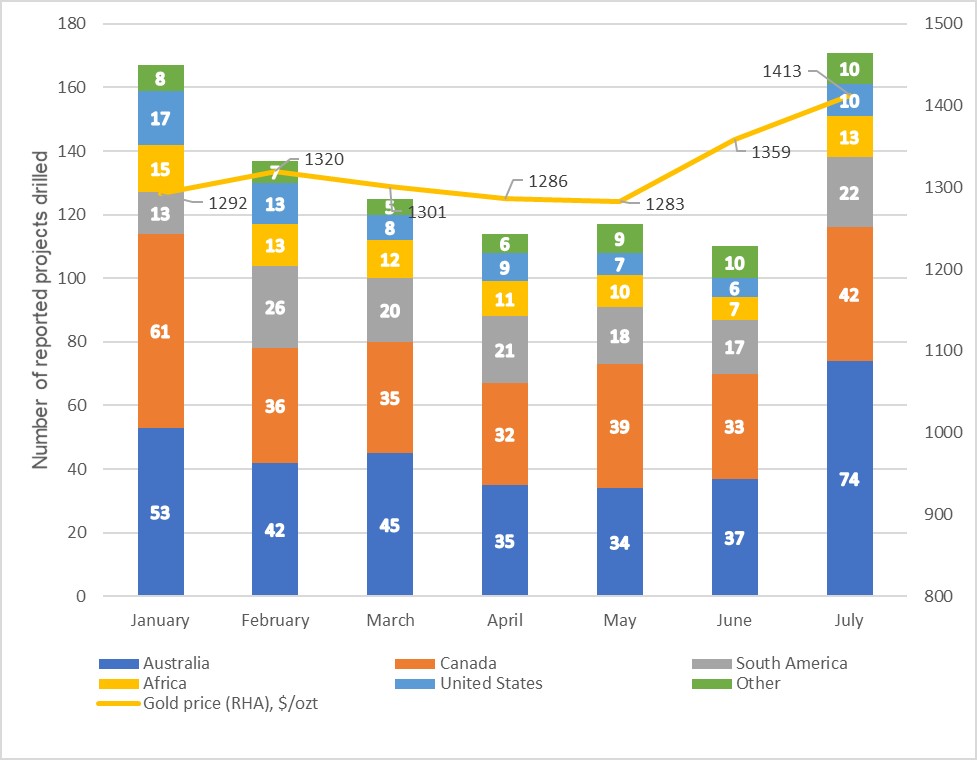

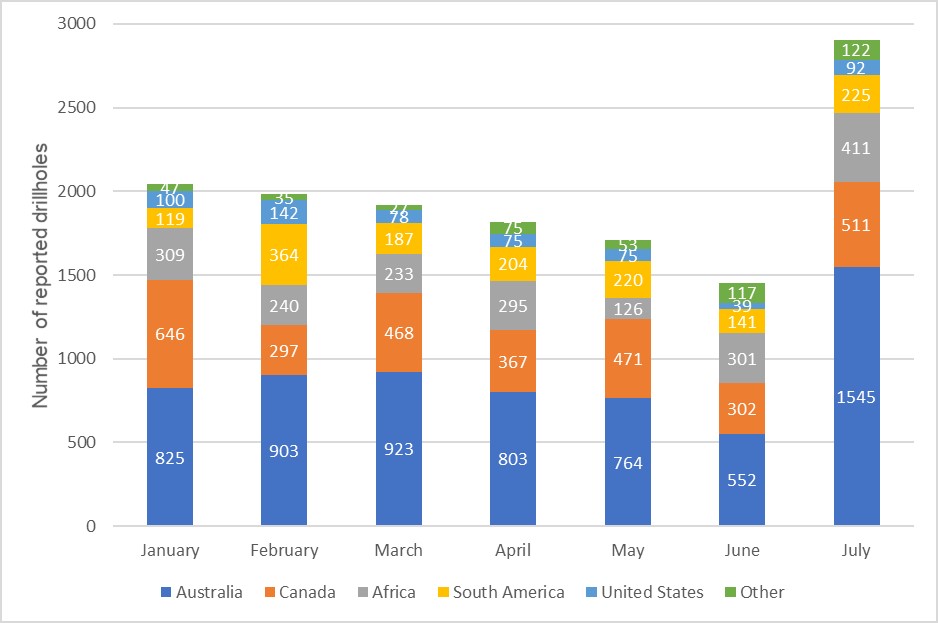

Mining Intelligence data indicates that exploration activity in the gold sector jumped in July — to the highest point since the beginning of 2019, and both the number of drilled projects and the number of drillholes reported in July, were up in all major regions.

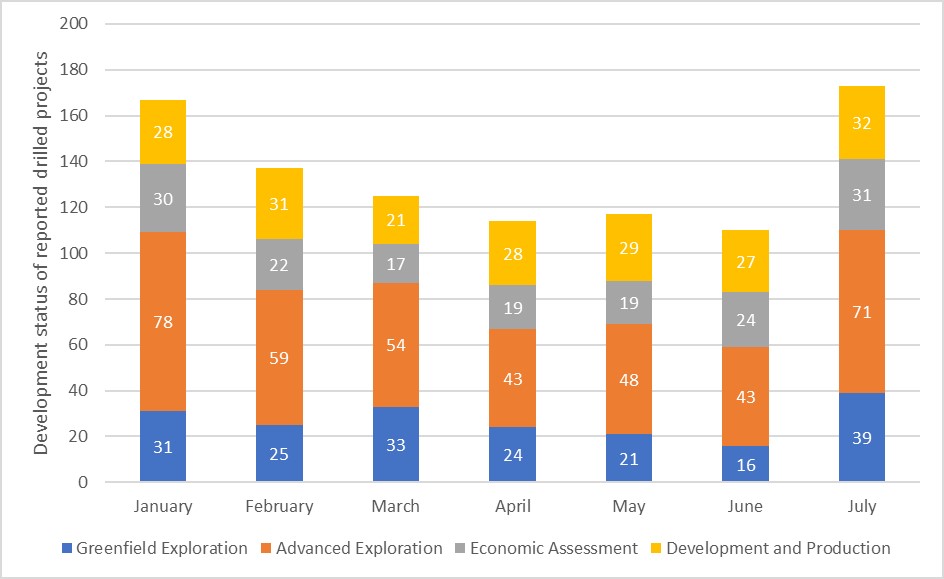

A trend towards exploration of advanced projects, rather than greenfield opportunities, was reversed in July with companies willing to take on more early-stage exploration risks.

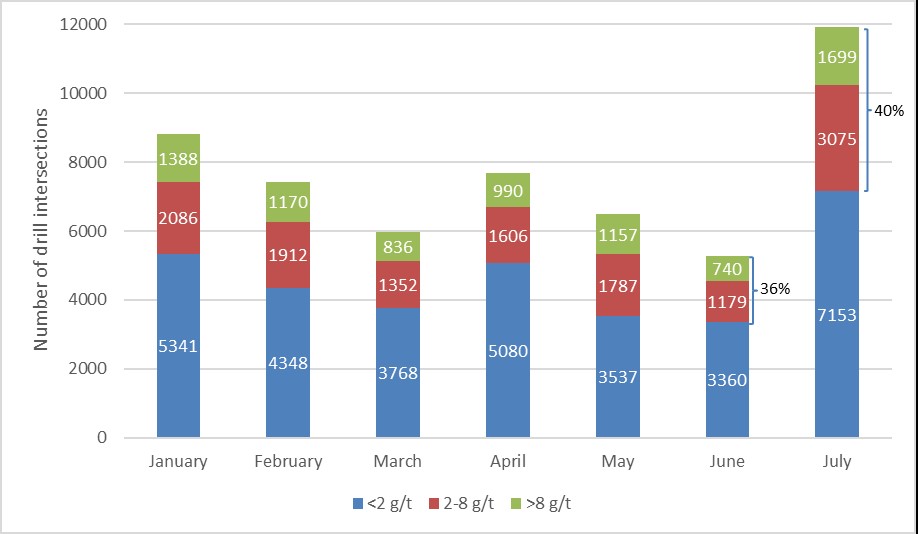

There was a noticeable improvement in overall drill intersection grades,

with reported gold intersections with grades greater than 2 g/t have risen from

36% of their total count in June to 40% in July 2019.

Surge in gold prices and overall optimism reviving across the gold mining sector have finally encouraged miners, developers and explorers to pour more money into drilling campaigns.

Analysis:

In July 2019, companies reported exploration results for 171 projects (Figure 1), which is the highest count observed since the beginning of 2019. Australia was the leading country in terms of a number of reported drilled projects (74), followed by Canada (42) and South America (22). The number of reported drilled projects was up in all major regions, with Australia doubling their count.

Source: Mining Intelligence

In July, companies reported results from 2,906 drillholes, which is twice more than in June (1,452 drillholes), and the highest number yet in 2019 (Figure 2). The amount of reported drillholes was up in all major regions and surged by a staggering 139% in Australia.

Source: Mining Intelligence

Weight of early and advanced exploration projects in their total count increased

from 54% in June to 64% in July (Figure

3).

The number of greenfield exploration projects drilled reported in July was 39, which is 144% more than in June, and the highest number since the beginning of 2019. While still being prudent when allocating budgets to exploration campaigns, companies have noticeably shifted focus towards much riskier early-stage drilling programs.

Source: Mining Intelligence

As for the drill intersections grades, there was an increase in grades greater than 2 g/t that have risen from 36% (1,919 out of 5,279 intersections) in June to 40% of their total count (4,774 out of 11,927) in July 2019 (Figure 4).

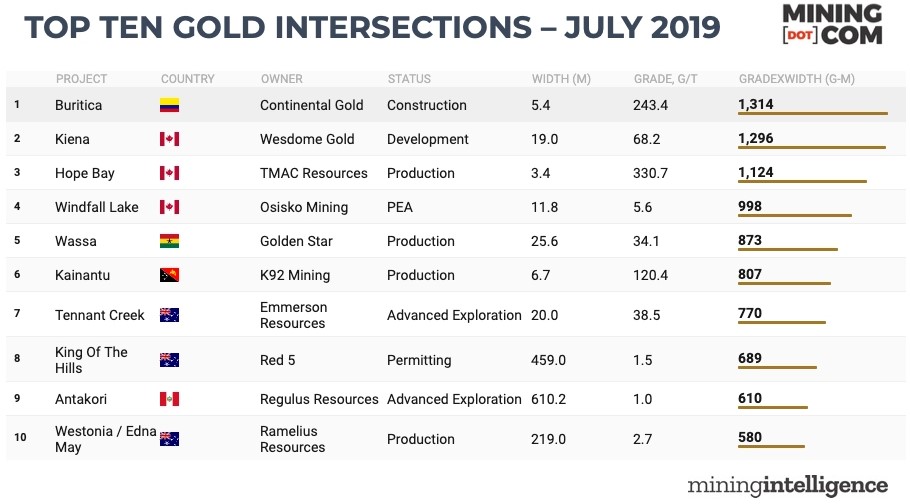

List of the top highest-grade gold intersects in July 2019, in

gram-meters:

Grade width is calculated at width at the drill interception (in metres) multiplied by the grade (in grams of gold per tonne). Where multiple high-grade intersections were reported for an individual project, only the best interval has been considered.

#1 Buritica – 1,314 gram-meter

The Buriticá project is Continental Gold’s 100%-owned flagship high-grade gold project located in the middle Cauca belt in the northwest region of Colombia. The mine is currently under construction and on schedule for 2020 production. The Feasibility Study suggests that the Buriticá project will be a lowest quartile cost producer.

The Kiena Complex is located

in Val D’Or, Quebec. On March 7, 2013, Wesdome Gold announced suspension of

mining activities at the Kiena mine due decreasing recovered grades and

persistent industry cost pressures. Despite this suspension, Wesdome considers

the Kiena Complex a premiere brownfield exploration and development

opportunity.

#3 Hope Bay – 1,124 gram-meter

TMAC Resources’ 1,101 square kilometre Hope Bay Property (approximately 80 km by 20 km) is located in Nunavut, Canada. The Hope Bay Property is a high-grade gold district located approximately 160 km above the Arctic Circle.

#4 Windfall Lake – 998 gram-meter

Osisko Mining’s Windfall Lake project is located in the Abitibi greenstone belt 700 kilometres north-northwest of Montréal, Canada. The Windfall Lake Mine Project is a proposed underground gold mine with preliminary assessed AISC of $704/ozt per year.

#5 Wassa – 873 gram-meter

Wassa mine located in south-western Ghana, approximately 40 km from the Prestea Gold Mine. Golden Star commenced production from the surface operation at Wassa in 2005 and commercial production was achieved at Wassa Underground on January 1, 2017. In early 2018, Wassa transitioned into an underground-focused operation. The recent exploration campaign aimed to increase LOM of Wassa.

#6 Kainantu – 807 gram-meter

K92 Mining’s Kainantu Gold Mine is located in the Eastern Highlands province of Papua New Guinea. Currently, Kainantu is one of the highest-grade gold mines in the world.

#7 Tennant Creek – 770 gram-meter

Emmerson Resources’ Tennant Creek Mineral Field is situated approximately 500km north of Alice Springs, Australia. Emmerson intersected bonanza gold grades in all diamond drill holes at the Mauretania greenfield discovery. Recent drilling results from Mauretania have increased Emmerson’s confidence in the potential for economic mineralisation in both the shallow oxide and deeper primary gold zones.

#8 King Of The Hills – 689 gram-meter

Red 5’s 100%-owned King of the Hills (KOTH) Gold Mine is located 80km south of the Company’s Darlot Gold Mine and 28km north of the town of Leonora in the Eastern Goldfields region of Western Australia. Mining at KOTH has traditionally been focused on extracting high-grade gold veins, with the ore currently trucked to Red 5’s nearby Darlot Processing Plant for processing. Red 5 has identified the potential to pursue a bulk mining operation and the ongoing exploration campaign is aiming to outline significant quantities of lower-grade gold mineralisation located between the high-grade veins.

#9 Antakori – 610 gram-meter

Regulus Resources’ AntaKori Cu-Au-Ag project is located 60

km north of the city of Cajamarca in the Hualgayoc District, northern Peru. The

project sits in a world-class Au-Cu province which hosts a number of nearby

renowned deposits, including Yanacocha, Cerro Corona and Tantahuatay mines.

#10 Westonia / Edna May – 580

gram-meter

The Edna May deposit is located within the Westonia Greenstone Belt, within the Southern Cross Province of Western Australia’s Archaean Yilgarn Craton. Ramelius acquired the Edna May Gold Mine on 1st October 2017 from Evolution Mining. Edna May is an operating open pit. In October 2018, the Edna May underground project was approved by the Ramelius Board and operations aimed to commence in 2019.