Gold may be off its 52-week highs, but the precious metal is still up more than 15 percent for the year through September 17. This appears to put gold on a path for its best year since 2010, when it gained just under 30 percent. (Click here to see our interactive Periodic Table of Commodity Returns, which goes back to 2009.)

I believe buying the dips in gold right now could turn out to be a wise investment decision. I see a lot happening at the moment—from an unprecedented $17 trillion in negative-yielding bonds worldwide to heightened geopolitical threats—that might boost investors’ appetite for the metal, which has a history of holding its value in times of crisis.

Read on for three reasons why I believe there’s further upside to gold prices, and how you can participate!

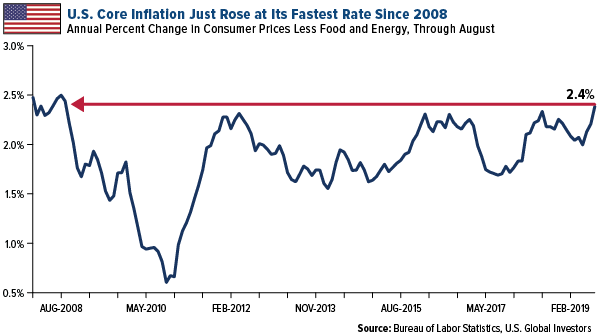

1. U.S. inflation is finally starting to heat up.

When President Donald Trump took office in January 2017, many market watchers expected consumer prices to climb rather quickly due to his protectionist policies and general skepticism of free trade agreements. Except for a blip here and there, inflation has remained pretty steady, even after hefty tariffs were imposed on goods imported from China.

That may be set to change, though, if the August inflation reading is any indication. “Core” consumer prices—which exclude volatile food and energy prices—rose to an 11-year high of 2.4 percent growth year-on-year. Not since September 2008 have prices expanded so fast.

Also of note: August saw the biggest monthly rise in medical care costs since 2016 as well as record increases in health insurance prices.

And remember, this doesn’t include the effects of the 15 tariffs on $112 billion in Chinese goods that the U.S. imposed on September 1.

In the past, faster inflation has been constructive for gold prices. That’s because inflation, by its nature, destroys your purchasing power, and to limit these losses, investors have traditionally turned to the yellow metal as well as gold mining stocks.

So if you believe inflation is prepared to surge even more, it might make sense to add gold to your portfolio.

2. Negative yields in the U.S.?

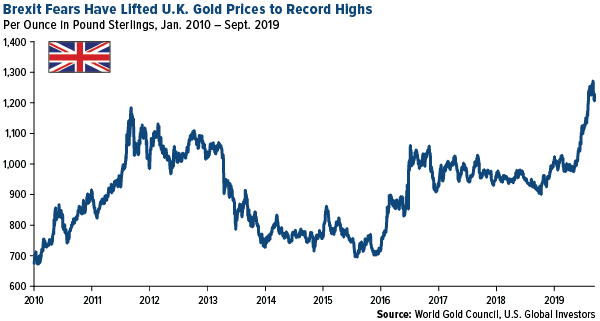

As I mentioned earlier, as much as $17 trillion in debt around the world right now trades at a negative yield. This has recently pushed the price of gold to new all-time highs in a number of currencies, including the British pound, Japanese yen and Canadian and Australian dollars.

So far we haven’t seen the negative-yield phenomenon in the U.S., at least not nominally. But it could only be a matter of time before U.S. fixed-income yields turn subzero—especially if Trump gets his way.

The Federal Reserve has been under immense pressure to drop rates to a level that, in Trump’s eyes, is more competitive with those in Europe, Japan and elsewhere.

“The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt,” Trump tweeted on September 11. “The USA should always be paying the lowest rate.”

I’m writing this a day before the Fed is widely expected to trim rates for the second time this year, and many analysts now believe as many as two more cuts could happen in 2019. Should U.S. rates drop to “ZERO, or less,” to quote Trump, then I believe Treasury bonds and investment-grade corporate debt would lose their appeal as stores of value, and gold would be a direct beneficiary.

And if you’re doubtful that negative yields could possibly occur in the U.S., consider the recent words of one Alan Greenspan, former Fed chairman: “There is no barrier for U.S. Treasury yields going below zero. Zero has no meaning, besides being a certain level.”

If you believe U.S. yields could soon break below this “barrier,” then gold might be a prudent investment decision.

3. Geopolitical and economic risks raise the demand for a safe haven.

There are a number of geopolitical and economic risks right now that have triggered gold’s “fear trade.” Economic growth is slowing worldwide as a result of trade tensions. Global factories, as measured by the JPMorgan Global Manufacturing PMI, have been in contraction mode for two straight months as of August.

Investors in the U.K. and elsewhere have turned to gold as the October 31 deadline for Brexit looms ever closer. With it looking more and more likely that the U.K. will leave the European Union (EU) without a deal, the price of gold in pound sterlings rose to an all-time high of 1,282 on September 3, an increase of more than 27 percent for the year.

Other geopolitical concerns, including unrest in Hong Kong as well as last Saturday’s attack on Saudi Arabia’s oil facilities, have helped support gold demand.

Such concerns also help explain why global central banks have been net buyers of the yellow metal since 2010. The Netherlands’ central bank (DNB) recently explained why it continues to hold gold:

“Shares, bonds and other securities are not without risk, and prices can go down… If the system collapses, the gold stocks can help serve as a basis to build it up again. Gold historically bolsters confidence in the stability of the central bank’s balance sheet and creates a sense of security.”

HOW YOU CAN PARTICIPATE

One of the best ways to get exposure to gold, I believe, is with our two specialty funds, the Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX).

Although both funds invest in companies involved in the exploration and production of gold and precious metals, USERX focuses on the larger-cap “seniors” while UNWPX provides investors with increased exposure to the “juniors” and intermediate miners.

We have a long history of gold investing at U.S. Global Investors, and I’m very happy with our track record. USERX holds five stars for the five-year period from Morningstar as of June 30 in the Equity Precious Metals category. It also holds four stars for the three-year and 10-year periods, as well as overall.

Ready to get started? Learn more about both gold funds and request an information kit today by clicking here!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

![]()

| Overall/65 | |

| 3-Year/65 | |

| 5-Year/63 | |

| 10-Year/46 |

Morningstar ratings based on risk-adjusted return and number of funds

Category: Equity Precious Metals

Through: 6/30/2018

Click here to see USERX performance.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The JPMorgan Global Manufacturing PMI is compiled by IHS Markit, based on the results of surveys covering over 13,500 purchasing executives in over 40 countries. Together these countries account for an estimated 98% of global manufacturing output.