Source: Bill Powers for Streetwise Reports 09/16/2019

Bill Powers of the Mining Stock Education podcast discusses the news flow from this junior explorer.

At the 2019 Beaver Creek Precious Metals Summit last week in Beaver Creek, Colorado, I had the opportunity to meet one-on-one with numerous junior mining management teams. Due to a rising gold price environment, the expectation and general mood among the management teams was much more positive than the previous year.

While there, I interviewed Craig Lindsay, president and CEO of Otis Gold Corp. (OOO:TSX; OGLDF:OTCMKTS), along with Alan Roberts, who serves as the company’s vice president of exploration. Craig summed up the sentiment at Beaver Creek as such: “This is my third year in a row of coming here and it’s great to see a bunch of new names in terms of investors—institutional investors and high net worth investors. There’s pretty much every major mining company here looking for projects. That tells me that we’re on the cusp of a pretty interesting move in the gold market. That alone is going to create some amazing opportunities for investors who want to get into this space, which has been downtrodden for a number of years.”

Both Craig and Alan were not just generally encouraged with the current sector sentiment, but were also specifically enthused about Otis Gold’s prospect of continued success at their flagship Kilgore development project, located in Clark County, Idaho.

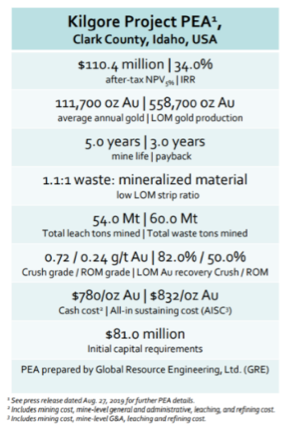

Kilgore’s Impressive Preliminary Economic Assessment

Otis Gold Corp. recently released a positive preliminary economic assessment (PEA) on the Kilgore project based on a resource estimate developed from 381 drill holes and 93,000 meters of drilling, and using an assumed gold price of $1,300/ounce. The 12,000-acre project is located on U.S. Forest Service land, is 100% owned by Otis Gold Corp., and has no royalties on it. While PEAs can be based upon Inferred resource estimates, Kilgore’s PEA is 85% based upon the more certain Indicated resources. The project has an after-tax net present value (NPV5) of US$110.4 million and internal rate of return (IRR) of 34.0 %, with a three-year payback period and five-year mine life. The average annual gold production is estimated at 112,500 ounces and initial capex at US$81 million.

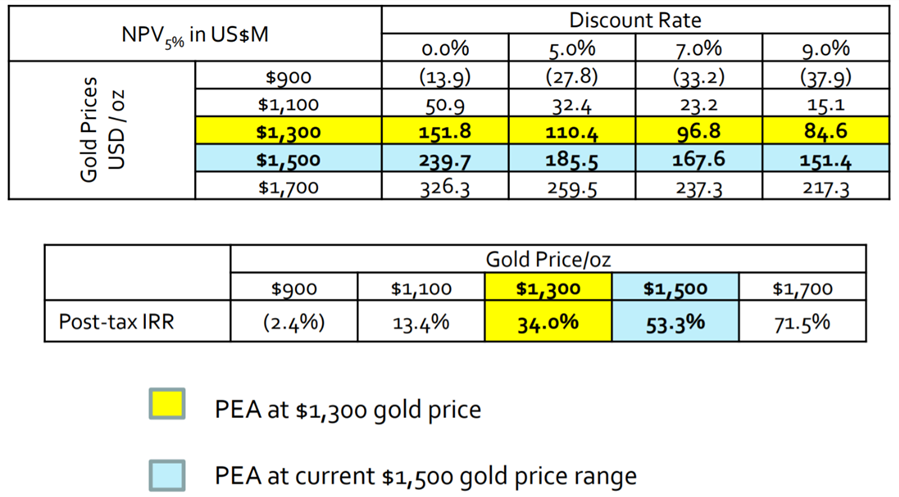

Kilgore’s PEA at $1,500/ounce Gold

When the Kilgore PEA uses the current gold price in its calculation, the project economics move from being impressive to being stellar. At $1,500/oz gold, Kilgore’s NPV5 increases to $185.5 million and its IRR improves to 53.3%.

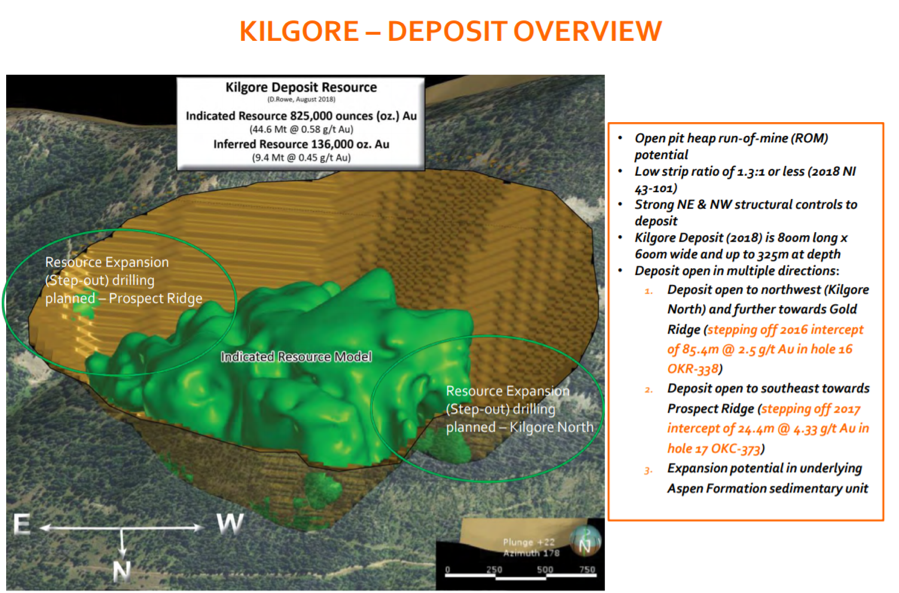

Kilgore’s Expansion Potential

Not only does $1,500/oz gold improve Kilgore’s attractiveness, but both Alan and Craig are confident that Kilgore’s 961,000-ounce gold resource and current five-year mine life will be significantly expanded. Alan stated that he joined the Otis Gold Corp. team last year specifically because of the project’s exploration potential: “I was attracted to the potential size of the Kilgore deposit because of its overall geologic setting.”

Craig, likewise, articulated his confidence that the Kilgore project will continue to expand: “When you look at the fact that we’ve got this new PEA in place that has some very strong economics and you stand on the edge of our deposit and you look out on that 12,000 acres and you see the fact that there is alteration throughout this project. There’s gold in the soils. There’s gold on pretty much every rock you pick up. You really get the feeling and you could see that this story is going to grow.”

Kilgore Could Be A Mini Round Mountain

Both Craig and Alan compared Kilgore’s potential to that of Kinross Gold Corp.’s (K:TSX; KGC:NYSE) massive Round Mountain open-pit mine in Nevada. Alan stated that Kilgore’s most geologically similar deposit is “probably Round Mountain in Nevada.”

Craig concurred and pointed out that Echo Bay Mines, the former owner of the Kilgore project, saw a direct comparison between the Kilgore project and Round Mountain: “What’s interesting from a comparative point of view is that Round Mountain was originally developed by a company called Echo Bay Mines. In the 1990s, Echo Bay was the one that originally started developing the open-pit heap bleach potential at Kilgore. So they saw some direct comparisons to Round Mountain, and Round Mountain has really been one of the most successful volcanic-hosted epithermal gold systems in not just the United States but the world in terms of its historic production and its current production profile. There’s some really fascinating comparisons to that story. I really think in many respects we’ve got a mini Round Mountain and a Round Mountain in the making going forward.”

Kilgore’s Path Forward

There is a fall drill program scheduled at Kilgore, which includes step-out drilling with a potential to increase the project’s resource. Craig also said that the company is planning a significantly larger exploration program for 2020 to further test Kilgore’s exploration targets.

Otis Gold Corp.’s Current Valuation and Investment Opportunity

In the past few years, Otis Gold’s shares have traded mostly between the CA$0.25 and CA$0.40 range. Currently, Otis shares trade at only about CA$0.10. The primary reason, Craig explained, is that “an environmental group has filed a complaint against the U.S. Forest Service with respect to how they have approved the last exploration permit that Kilgore was issued in August of 2018.”

While acknowledging that the environmental group’s filing created some uncertainty around the permit, he noted that “our legal counsel, the U.S. Forest Service and the Department of Justice, who are dealing with this case, are very confident that they’ll reach a resolution of this. It will be in our rear-view mirror, and we’ll be able to advance happily with this project.”

Craig views the current valuation of Otis Gold Corp. as a significant buying opportunity for investors: “Otis is a pretty compelling story. There is a real opportunity here. When we get through this court case, there’s going to be potentially a significant reevaluation in the company. We’re trading at about CA$0.10 a share, so a CA$16 million valuation or US$13 million. Per ounce in the ground, we’re trading at about US$13 an ounce in the ground. The median in the Western U.S. is about $50 to $55 an ounce in the ground. So, there’s some significant upside. . .there is a real unique investment opportunity, I believe, in Otis today at these levels.”

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Otis Gold Corp. is an advertiser on my website, Mining Stock Education.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

( Companies Mentioned: OOO:TSX; OGLDF:OTCMKTS,

)