Sirius Minerals (LON:SXX), the British company building a huge fertilizer mine beneath a national park, lost almost more than half of its market value on Tuesday after it announced it had cancelled plans to raise the $500 million needed to move ahead with the Woodsmith project.

The company has said in August it was “delaying” the bond offering due to turbulent global markets, including Brexit and the UK government refusal to back the polyhalite mining project.

The decision casts serious doubts on the mine’s future and it could leave Sirius, as some analysts half-joking have said, with a “huge and useless hole in the ground.”

The London-based firm had said it had enough cash to last only until the end of September. That’s why the miner now has no other option than to slow down the pace of construction and so gain some time to “assess and incorporate optimizations to the project development plan and to develop a different financing structure for the funds required,” as the company’s chief executive officer, Chris Fraser, put it.

The miner noted it had sufficient

liquidity — about £180m ($223m) in cash reserves — to explore all of its options

during a six-month strategic review period.

It would, however, return the

proceeds of a $400m (£322.2m) bond issued in May 2019 to investors, it said.

The company hinted it wouldn’t be

in the position it is today have the UK government not turned down a request to

guarantee $1bn of bonds. That would have “enabled the company’s

financing to be delivered as planned,” it said.

Sirius’ shares fell as much as 63% in early trading to 3.69p, taking the year-to-date value drop to 83%. About 14 years ago, the stock was changing hands at 6.46p. In 2016,it hit 45.23p, and by early afternoon London time, it was at 4.63p, less than half its closing price on Monday.

SIRIUS’ WOODSMITH MINE is set to BE ONE OF THE WORLD’S LARGEST IN TERMS OF THE AMOUNT OF RESOURCES EXTRACTED — around 10 MILLION TONNES PER YEAR OF POLYHALITE, A FORM OF POTASH USED IN PLANT FERTILIZERS.

“Sirius Minerals’ decision to cancel its high yield bond undoubtedly represents a major blow to the company’s plans to develop its ambitious Woodsmith polyhalite mine,” Humphrey Knight, senior potash analyst at CRU told MINING.COM.

“Although the company pointed to

challenging market conditions, the high yield nature of the bond demonstrates

that the project has numerous risks associated with it, many of which are

unique,” Knight noted.

The CRU potash expert highlighted among the Woodsmith project’s unique

challenges the fact that the market for the commodity it will produce, polyhalite,

remains very small.

“Sirius’ planned production is

around 30 times larger than the total polyhalite market size in 2018. The

company’s plan to rapidly increase production to over 10 million tonnes only a

few years after starting operations also added to concerns of significant

disruption to wider fertilizer markets — even with its numerous offtake

agreements,” Knight warned.

He noted that while Sirius may come up with new, less risky

financing routes, the underlying uncertainties around polyhalite, such as

potential market size and pricing, will remain.

Russ Mould, from investment

platform AJ Bell, said the Sirius decision to scrap the planned bond

sale was “devastating”.

“It’s terrible news for a very

large number of retail investors who had put their faith in the company,” Mould

said. “Many of these shareholders live close to the mine and invested as a show

of support in a project that had the potential to greatly improve the local

economy.”

World’s largest polyhalite mine

The Woodsmith mine, poised to be

one of the world’s largest in terms of the amount of resources extracted,

is set to generate an initial 10 million tonnes per year of polyhalite a form

of potash that is used in plant fertilizers. Output is forecast to reach 13

million tonnes in 2026.

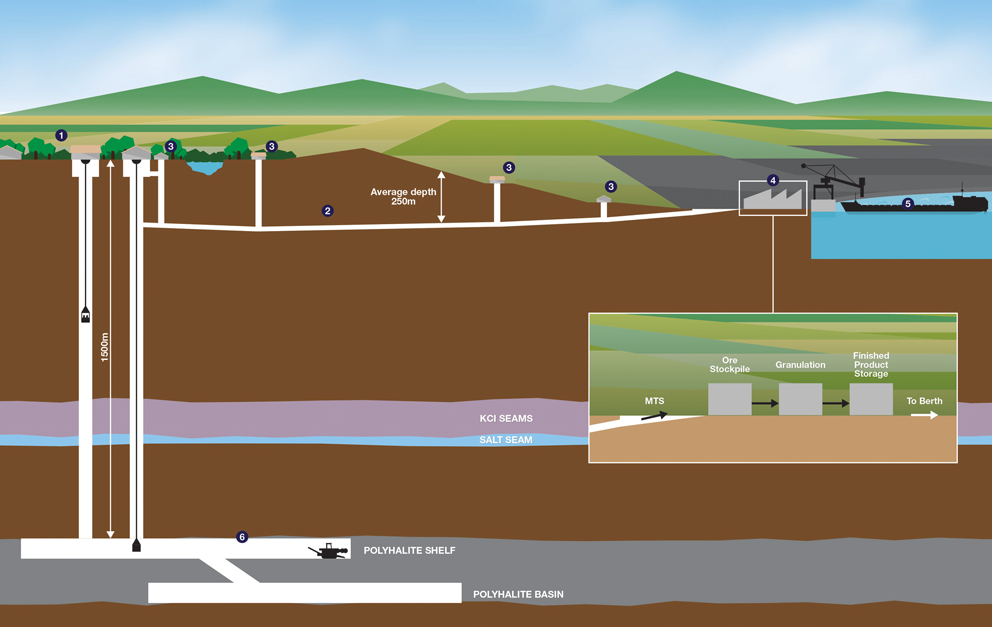

The operation involves sinking two

1.5km shafts below a national park on the North York Moors and is expected to

create about 1,800 jobs during construction, as well as 1,000 permanent

positions once it opens in May 2021.

The ore will be extracted via the two mine shafts and transported to Teesside on the world’s longest underground conveyor belt, via a 37km-underground tunnel. It will then be granulated at a materials handling facility, with the majority being exported to overseas markets.