Private equity firm Orion Mine Finance has reduced its stake in Armenia-focused Lydian International (TSX:LYD) to 11.7% from 13% after selling 10 million shares in the gold developer at C$0.10 each.

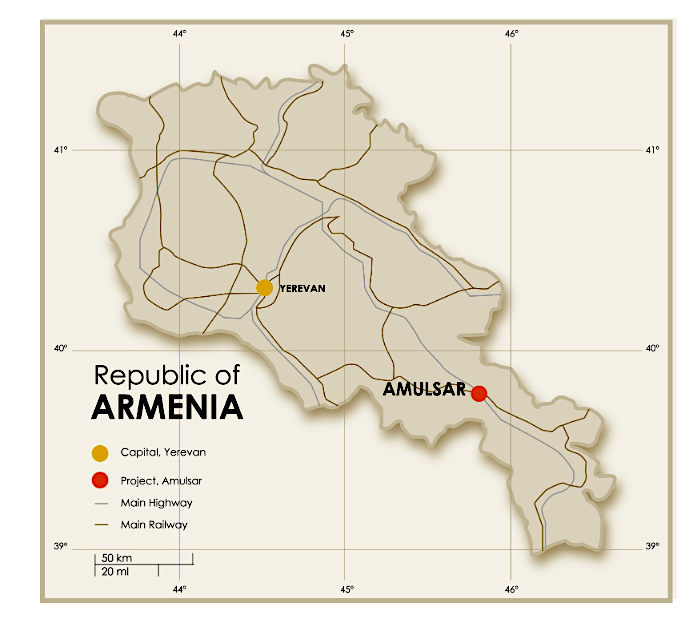

Lydian has been trying to advance its Amulsar gold project in a mountainous area in the country’s south for over a year, when opponents blocked access to the mine site.

While the miner filed a complaint with local police to get protestors removed, officials declined to launch a criminal investigation on the issue. They said at the time that there was no basis for the removal of dissidents, their vehicles, tents and trailers.

The company’s Amulsar project has been halted since mid-2018, when protestors blocked access to the site.

Lydian then went the legal way,

applying for a reversal of the police’s decision.

In January this year, Armenia’s

highest court of appeal ruled in the company’s favour, but law enforcement

officers have yet to restore uninterrupted access to the project site.

Opponents claim Amulsar would

threaten several endangered animal species that live in the area, including the

world’s rarest big cat, the Caucasian Leopard, of which there are thought to be

only 10 left in Armenia.

The mine site sits above a tunnel

that supplies water to Lake Sevan, the largest freshwater lake in the whole

Caucasus region. Scientists have warned that acidic drainage from the

mine would inevitably seep into the lake, posing a threat to Armenia’s water

system.

Amulsar is also next to Jermuk, a spa town built around mineral springs, and an economy is based on health tourism. Detractors claim dust from construction has curbed the influx of visitors and also affected crops and grazing. Cattle, they say, have increasingly refused drinking water from streams on the mountain since construction started, affecting local livelihoods.

Rivals’ campaign

The conclusions of the report published last month, however, suggest that after taking additional safety measures recommended in the document, Lydian should be permitted to resume its operations.

“The Government of Armenia has said publicly that Lydian and the Amulsar Project have been the subject of a campaign by rival mining companies providing support to opponents of the Amulsar Project,” Lydian said in an August statement.

“Armenian society has been

dragged into an endless discussion around an audit which had no legal grounds

to question Lydian’s rights to operate in the first place. When will the

Government of Armenia identify the rival mining companies conducting this campaign,

how much has been paid to oppose the Amulsar Project and who has been

paid?”

According to industry-known Inca Kola News, German miner Cronimet, which owns the Zangezur copper-moly mine in the former Soviet republic, is the main company behind Pashinyan’s change of hearts.

The report claims Cronimet has been “bribing the Armenian government at Environment ministry level” as well as providing cash and food to the protesters blocking the site.

Fresh roadblocks

The most recent barrier to Lydian’s project came from an outside group, Earth Link & Advanced Resources Development (ELARD), which has said the company’s application was deficient.

In the weeks since, the country’s Prime Minister Nikol Pashinyan has shifted position more than once, between assuring Armenians the gold project is safe and casting doubts on the government’s own positive environmental assessment of Amulsar.

Construction is expected to restar by April or May next year, with Amulsar producing its first ore by late next year or early 2021.

Earlier this week, Pashinyan met with both activists and Lydian’s interim president and CEO, Edward Sellers, who agreed to allow independent monitoring of the site.

Two days later, the nation’s leader

took to social media to ask protestors to clear the blockade.

The company says that even if they wanted to restart right away, that’d be impossible. It doesn’t expect to resume work at Amulsar until next April or May, though it will carry some rehabilitation and earth moving in the meantime.

Production, in turn, will start late

next year or in early 2021, depending on how construction advances, it noted.

Minerals and metals make up about half of Armenia’s exports and mining accounted for about 3% of the country’s economic output in 2017, government data shows.

Lydian foresees Amulsar as a large-scale operation with annual gold production averaging around 225,000 ounces over an initial 10-year life. Estimated mineral resources contain 3.5 million measured and indicated gold ounces and 1.3 million inferred gold ounces as outlined in the Q1 2017 technical report.