Gold managed to trade back above $1,500 an ounce in afternoon dealings in New York on Wednesday, but a new report suggests that’s as good as it’s going to get.

Capital Economics in a note says all the drivers for the rally in the gold price – weakening global growth, safe haven demand and low interest rates – are now baked into the price.

The independent research house argues that gold will end the year around today’s levels and is set to drop by double digits in percentage terms in 2020 based on three factors:

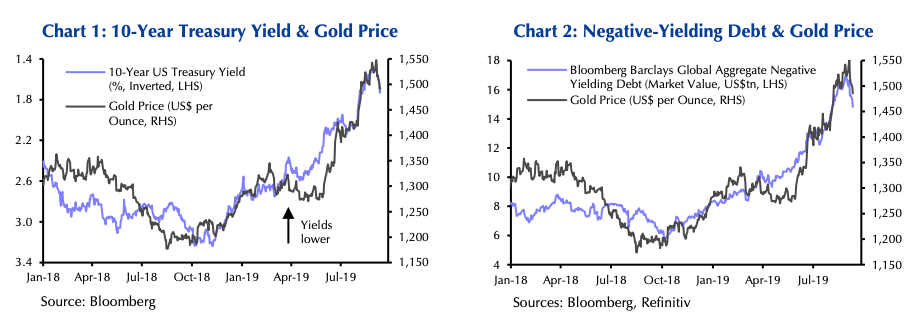

Firstly, US Treasury yields are forecast to recover as “investors’ expectations for monetary easing are disappointed” and the increase in negative-yielding debt (now totalling some $16 trillion), particularly in Europe and Japan, is halted.

Away from paper markets, a third factor depressing prices in 2020 is gold trading at record highs in China, India and more than 70 other currencies

Capital Economics believes global economic growth will be soft next year, but is sanguine about the possibility of an outright recession “currently anticipated by the market.” As a result investor risk appetite should pick up, tarnishing gold’s reputation as shelter in a storm.

Away from paper markets, a third factor depressing prices in 2020 is gold trading at record highs in yuan and in rupee (and more than 70 other currencies). China and India is responsible for the bulk of global consumer purchases of the precious metal and higher import duties in the latter will only hurt demand further.

Capital Economics believes gold will decline to $1,350 an ounce by the end of next year. The decline in silver ($18.20 on Wednesday) will be steeper absent a major factor behind gold’s performance – central bank buying – with the metal down to $15 an ounce by end-2020.

Gold hit an intra-day high of $1,566 one week ago – a six-year peak – but a three-pronged attack by determined bears saw the metal suffering one of its worst falls in history last Thursday.

Not that there’s a shortage of bullish prediction for the gold price, most notably Citigroup which yesterday said $2,000 in the next year or two is a strong possibility.

That would constitute a record price in nominal dollar terms, but adjusted for inflation January 1980’s $850 an ounce remains the all-time high.