Source: Clive Maund for Streetwise Reports 09/09/2019

Technical analyst Clive Maund discusses the factors he sees pulling gold down.

Although a major precious metals sector bull market has certainly started, various fundamental and technical factors came together last week to suggest that a significant correction to the recent strong run-up has now started.

The main fundamental development was the announcement that there will be a Trade War summit between China and the U.S. early next month, with hopes being expressed that this may lead to compromise or some kind of truce. Whilst the chances of improvement may be slim, the market has got what it wants for now which is hope, and this hope should continue at least until this meeting, which provides the excuse for the markets to go “risk on” until then, which is why the stock market broke higher last week, delaying but not eliminating our crash scenario.

A return to “risk on” is clearly not good for the precious metals, which, until last week, had been benefiting from a flight to safety as had the dollar, creating the unusual situation where the dollar and gold were rising at the same time. Now, in a risk on environment they are suddenly out of favor again.

In addition to this fundamental argument we have a range of technical indicators pointing to a correction in the precious metals sector that we will now look at. They include its overbought status, overly bullish sentiment readings and COTs showing extreme readings.

Starting with gold’s 6-month chart, we can see that it doesn’t look too bad—yet, but if we look more closely we can see that it is on the point of breaking down from the rather steep uptrend in force from late May, with it having dropped back on quite high volume the past two trading days, and it is noteworthy that Thursday’s drop was the biggest 1-day drop for a long time, making it more likely that it signals a reversal. In addition, the MACD indicator shows that momentum is starting to flag.

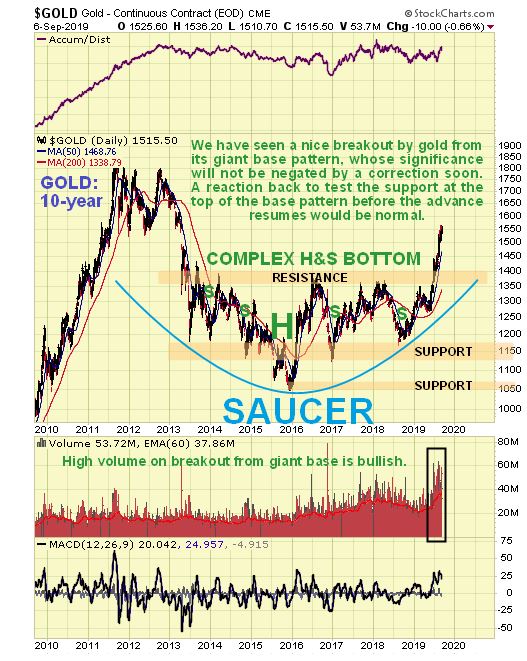

So, how far could gold react back? It happens more often than not that after a price breaks clear out of a giant base pattern, as gold did from its giant complex Head-and-Shoulders bottom or Saucer base shown on our 10-year chart, that it then returns to test support at the upper boundary of the base pattern before turning higher again. That could happen again and it would throw a lot of investors in the sector who are now of the view that we are “off to the races.” So, if it does react back that far don’t be dismayed—on the contrary it would throw up one last great buying opportunity.

We have had a rather unusual situation in the recent past where the dollar and the precious metals have been strengthening together. This is because, in a risk-off environment both have been considered safe havens. In a risk-on environment this logic works in the other direction so that the dollar and the precious metals may both react back together. On the 3-year chart for the dollar index we can see that it is at a good point to turn lower, despite its still bullishly aligned moving averages, as its persistent gentle uptrend has brought it up to the significant resistance level shown.

While precious metal stocks continued to push higher in recent weeks, the decline was losing momentum, as revealed by the downtrending MACD indicator on the 6-month GDX chart below, which led to its breaking down on high volume on Thursday and Friday, and it won’t have to drop much lower to break below its 50-day moving average, that has opened up a rather large gap with the 200-day, a development that is likely to happen soon.

So how about COTs and sentiment? We will now proceed to look at them. We had been wary of calling a top too soon based on the increasingly lopsided COTs, having called a top too soon during the run-up early in 2016, but now, given the other factors that we have considered, in particular the negative developments last week, the latest gold COT, which shows high Large Spec long positions and heavy Commercial short positions, certainly makes a reaction back by gold now or soon a lot more likely…

Click on chart to pop-up a larger, clearer version.

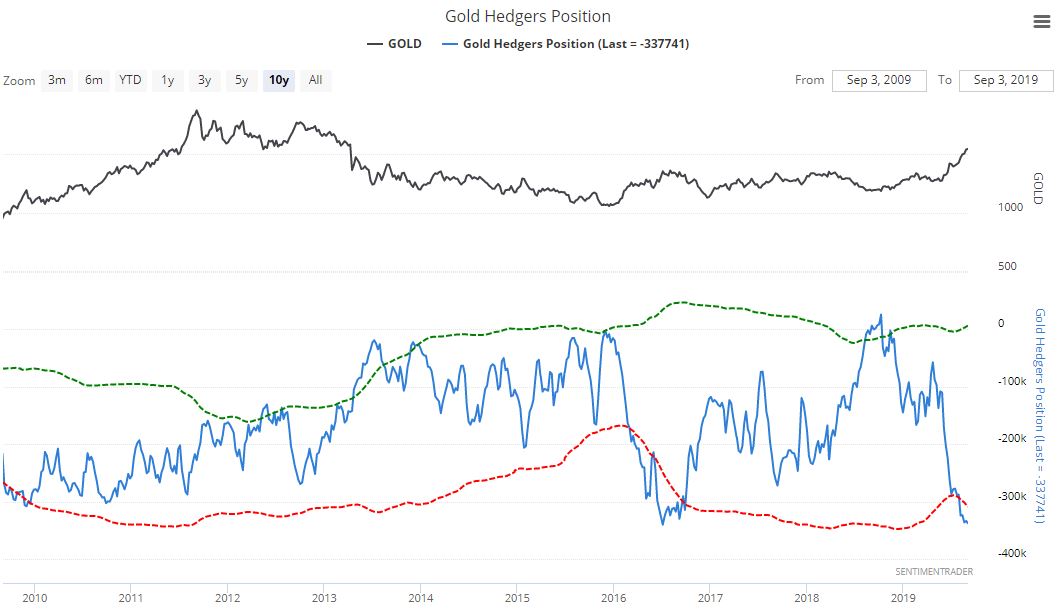

The COT is backed up by the latest Hedger’s chart, that goes back to 2010, which shows that positions match the extreme reached in the summer of 2016, and as we know this was followed by a brutal correction for the rest of the year. While a correction certainly looks likely it shouldn’t be so deep, because there is a big difference this time round, which is that gold has broken out into a major new bull market—it was still in a basing phase in 2016.

Click on chart to popup a larger, clearer version.

Chart courtesy of sentimentrader.com

Lastly, the Gold Miners Bullish % Index is still at 87%, and while we were waiting to see if it would hit 100% as it did in 2016, it doesn’t have to, of course, before a reversal occurs, and 87% certainly shows that enough people are bullish to warrant a trip to the fleecing shed.

Investors in the precious metals sector should therefore take measures to protect themselves, which include stepping aside for a while, or if staying long, hedging with inverse ETFs such as DUST, or options (options are much more cost effective), GLD Puts being very suitable as they are highly liquid with narrow spreads, and then we watch for the expected correction to unfold, aware that when it has run its course, we will be presented with a MAJOR BUYING OPPORTUNITY.

Originally published on CliveMaund.com on September 9, 2019

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.