Source: Clive Maund for Streetwise Reports 09/09/2019

Technical analyst Clive Maund charts silver and explains why he believes it hasn’t hit a final top.

Silver reacted back sharply on Thursday and Friday after a parabolic blowoff top. This was not a final top, but it does indicate that silver needs to take a rest and consolidate/react back, probably for at least several weeks.

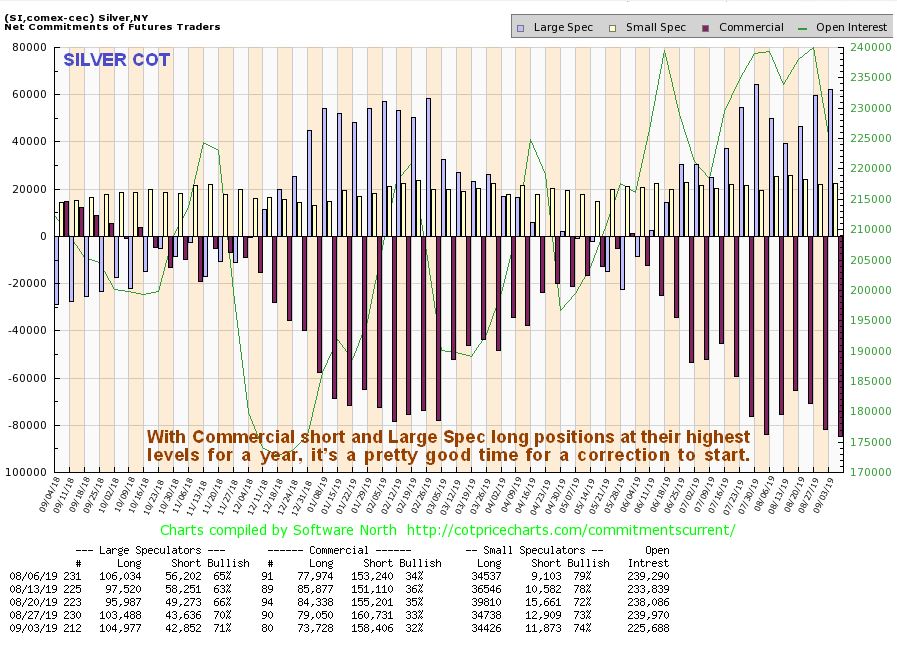

The latest silver COT is also showing a 1-year record extreme for positions, giving grounds for caution…

Click on chart to pop-up a larger, clearer version.

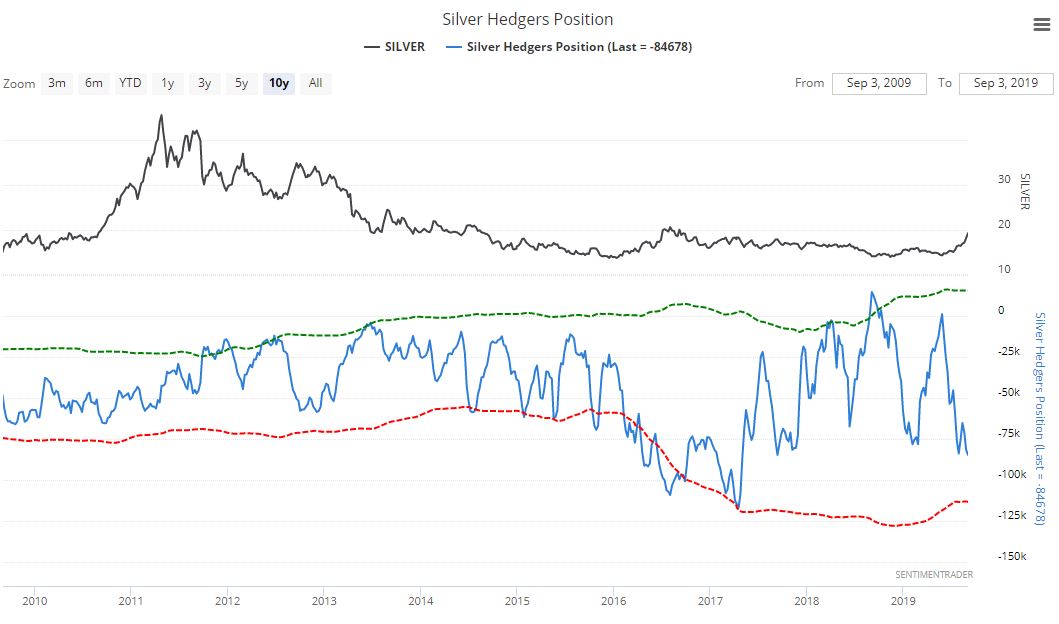

Although the longer-term Hedgers chart for silver is not at the extremes that it reached in 2016 and 2017, readings are also at levels that give grounds for caution, especially considering that silver just did a parabolic slingshot move.

Click on chart to pop-up a larger, clearer version.

Chart courtesy of sentimentrader.com

The conclusion is that silver has started a corrective phase, and, given the nature of the beast, it could be quite scary for the unprepared once it breaches the parabolic uptrend, but with gold especially having signaled the start of a major bull market any such corrective action will be viewed as presenting a rare opportunity to buy silver investments at very good prices ahead of the major uptrend that is expected to follow.

Originally published on CliveMaund.com on September 9, 2019

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.