A glut of minerals used to power electric

vehicles (EVs), particularly cobalt and lithium, is expected to slow down the

adoption of such cars by between 15% to 25% through 2021, even as larger

batteries are being developed, experts at BMO Capital Markets say.

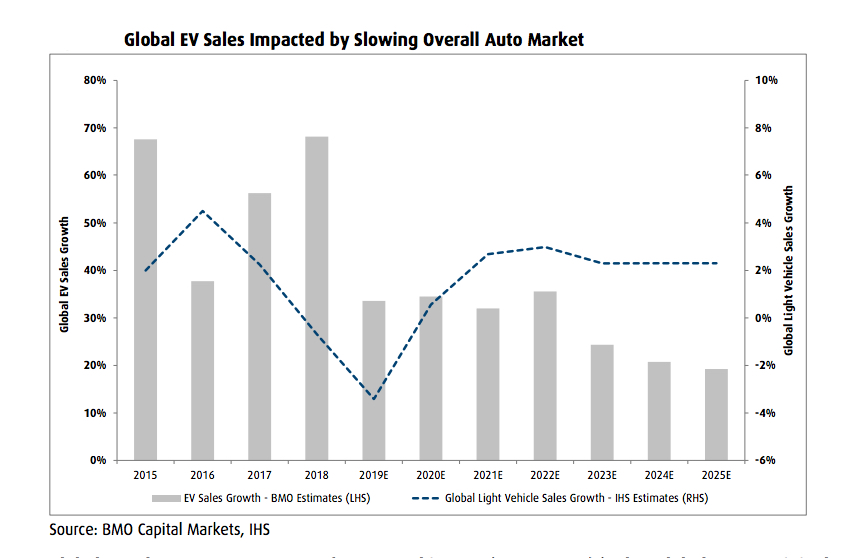

The bank has also lowered its anticipated

global light vehicle penetration to reflect a 7% drop in electric cars sales

this year to end of July.

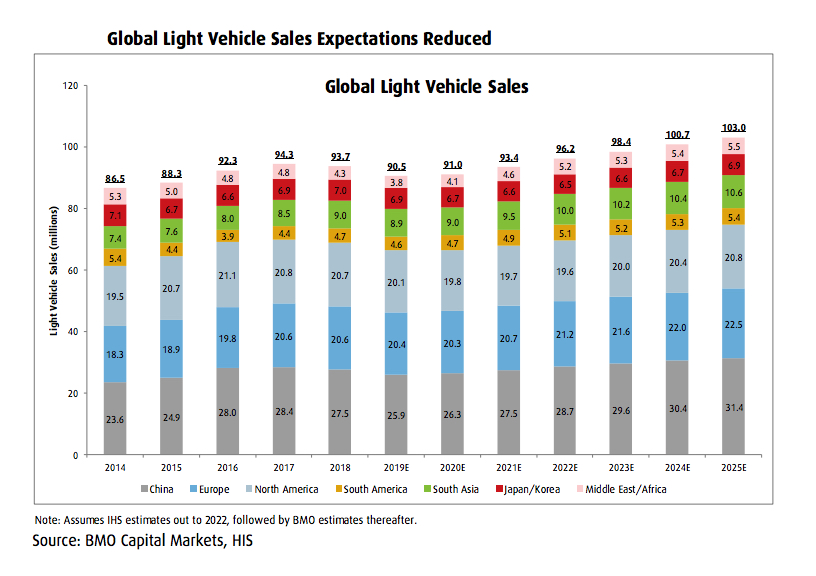

BMO now estimates that total global light EVs sales will drop by 8 million this year, totalling 90 million. By 2025, they will only reach 103 million, instead of the 110 million units previously forecast.

Global light EVs sales will drop by 8 million this year to 90 million and will reach only 103 million in 2025.

“We now see cobalt oversupplied until 2023 (assuming Glencore’s Katanga operation ramps up). For nickel, slower EV penetration will allow more time for the necessary growth in new supply projects, particularly from high-pressure acid leach (HPAL) operations,” analyst Colin Hamilton said in a note to investors Friday.

The analyst also sees Chinese battery producers as favoring nickel-free lithium-iron-phosphate (LFP) batteries once more, particularly as the government’s decision to reduce state subsidies for electric cars and other vehicles with alternative driving systems using nickel-manganese-cobalt (NMC) technologies has made them relatively more competitive.

“That said, NMC cathode chemistry

will still take the majority of market share in 2025,with NMC532/NMC622 being

the dominant chemistries,” Hamilton notes.

BMO believes global cobalt consumption

by the EV sector will hit 86,000 tonnes in 2015, down from the 97,000 tonnes previously

anticipated.

“Even with the cut to Glencore’s Mutanda operation, we see a relatively substantial market surplus over 2020-21 (…) The best hope for cobalt may be a turnaround in global smartphone demand (where LCO cathodes still dominate), which has been a drag over the past two years,” BMO says.

For nickel, electric vehicles

represent a much smaller proportion of overall market demand. However, BMO’s

forecast 2025 consumption in this area has now dropped by over 50,000 tonnes to

347,000 tonnes in 2025, with EVs consume 11% of the total supply, down from 13%

previously.

The bank doesn’t expect to say significant impact on prices,

as Indonesia — the world’s top nickel miner — said this week it would

stop nickel ore exports from Jan. 1, 2020, two years earlier than initially

indicated.