Source: The Critical Investor for Streetwise Reports 08/30/2019

The Critical Investor details the exploration of a joint ventured copper deposit in Saskatchewan.

Janice Lake copper project, Saskatchewan, Canada; Source: Mining.com/Transition Metals Corp.

1. Introduction

As a pure play uranium explorer since 2004, things looked increasingly grim after Fukushima happened in 2012 for Forum Uranium. After years of struggling, CEO Richard Mazur decided together with the board that they had to change course. On February 28, 2018, the company name was changed into Forum Energy Metals Corp. (FMC:TSX.V), reflecting the new direction into metals needed for the ongoing energy transition from oil to electricity, with new focus on for example copper, nickel and cobalt. Management particularly believes in copper, as only a few new projects have come online, China is planning to ban scrap imports next year, is planning large infrastructure spending and the developing EV market could have a significant impact on demand, all potentially resulting in severe supply/demand tensions in the future. Only three weeks before this, Forum optioned the large Janice Lake sedimentary copper project from Transition Metals Corp. (XTM:TSX.V).

The markets didn’t exactly improve after this, so Forum wasn’t out of the woods yet. Notwithstanding this, it completed a small drill program on Janice Lake, each of four shallow scout holes hitting copper, and two decent intercepts in Q4, 2018. Fortunately for it, giant Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) also noticed these drill results, and took a closer look at them. This resulted in a C$30M JV between Rio Tinto and Forum on May 9, 2019, which was exactly what Forum was searching for, as Janice Lake was a very promising, but also very large scale copper project, way too large to explore by a tiny junior like Forum itself. What Janice Lake is about and what this deal could imply for Forum Energy Metals is something that will be discussed in the following article.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. The company

Forum Energy Metals is an exploration company searching for energy metals, including copper, nickel, platinum, palladium and uranium in Saskatchewan, Canada. In addition, Forum has established a strategic land position in the Idaho Cobalt Belt, in order to find cobalt. Forum originated as a uranium explorer 15 years ago, focusing on the Athabasca Basin in Saskatchewan, but broadened its horizon early 2018. I view the company as a hybrid prospect generator, as it drills its own projects, but also regularly arranges joint ventures with large partners as it has with Rio Tinto earlier this year. Forum has an extensive portfolio of uranium projects, the Janice Lake copper project, the Love Lake palladium project and the Quartz Gulch Cobalt project, but I will be focusing on its flagship Janice Lake copper project in this article.

Saskatchewan is the best jurisdiction for mining projects according to the Policy Perception Index (PPI) of the most recent 2018 Fraser Institute Survey of Mining Companies. It ranks no less than 1 out of 83 jurisdictions worldwide, with a perfect score of 100 out of 100. The PPI is the most important figure of this survey, as it indicates the mining friendliness of a jurisdiction, which encompasses corruption, permitting, speed of administrative processing, politics, local sentiment, etc. The Survey is usually published in the last week of February, and handles the year before.

The management team is led by veteran president and CEO Richard Mazur, P.Geo, MBA, who has 35 years of experience as a geologist, financial analyst and senior executive on a variety of commodities like uranium, gold, diamonds, base metals, coal and industrial minerals. The driving forces on the exploration front are two Athabasca uranium experts: Ken Wheatley, P.Geo, who has 37 years of experience as a geoscientist on uranium projects, and Boen Tan, PhD, who has 35 years of experience as a geologist in uranium exploration, and Ken and Boen are assisted by Jim Atkinson, P.Geo, MSc, geological consultant with over 45 years of experience on base and precious metals deposits and mines. The Board of Directors adds considerable value in the field of financings, law and accounting.

Forum Energy Metals has its main listing on the main board of the TSX Venture, where it’s trading with FMC.V as its ticker symbol. With an average volume of about 89,596 shares per day, the company’s trading pattern is not very liquid at the moment, but I expect this to improve when good drill results will come in from the ongoing program at Janice Lake by JV operator Rio Tinto.

The company currently has 107.49 million shares outstanding (fully diluted 127.365 million), 15 million warrants (the majority is due @C$0.10 or more, of which 4.3 million warrants are expiring in March, April and June 2020, and 11 million warrants @C$0.10 in April 2024) and several option series to the tune of 4.38 million options in total, priced at C$0.10, expiration dates from Nov 2020 onwards. Forum sports a tiny market capitalization of C$5.9 million based on the August 30, 2019, share price of C$0.055.

The company has a healthy shareholder base, as 15% is held closely by Institutionals, 9% by Holystone Energy, 8% by Transition Metals, 3% by Lumina Capital and 6% by management, Board of Directors and insiders. Forum has an estimated working capital position of about C$0.1 million, as it raised C$550,000 in April this year but had C$198,000 left at May 31, 2019, which was the end of Q2, 2019 for the company. Therefore it is raising a small amount of C$75,000 flow through at the moment, so it can explore its Love Lake nickel-copper-PGM project in Saskatchewan by mapping and sampling, while Rio Tinto is doing the heavy lifting at Janice Lake.

Share price; 2 year time frame

As can be seen in the chart, the share price was gradually grinding lower, as both uranium and copper weren’t performing well since the beginning of 2018. Forum started showing up on radars when the Rio Tinto JV deal was announced in May, generating massive volumes for a brief period of time. It seems the share price has bottomed as 3–4 cents are multi year lows, also for the old ticker which can’t be showed at Tmxmoney.com, and I view these levels as a good buying opportunity, as drilling is well on its way now, and results can be expected relatively soon, as mentioned. Let’s have a look at Forum’s flagship project Janice Lake, and the JV itself.

3. Janice Lake/JV with Rio Tinto

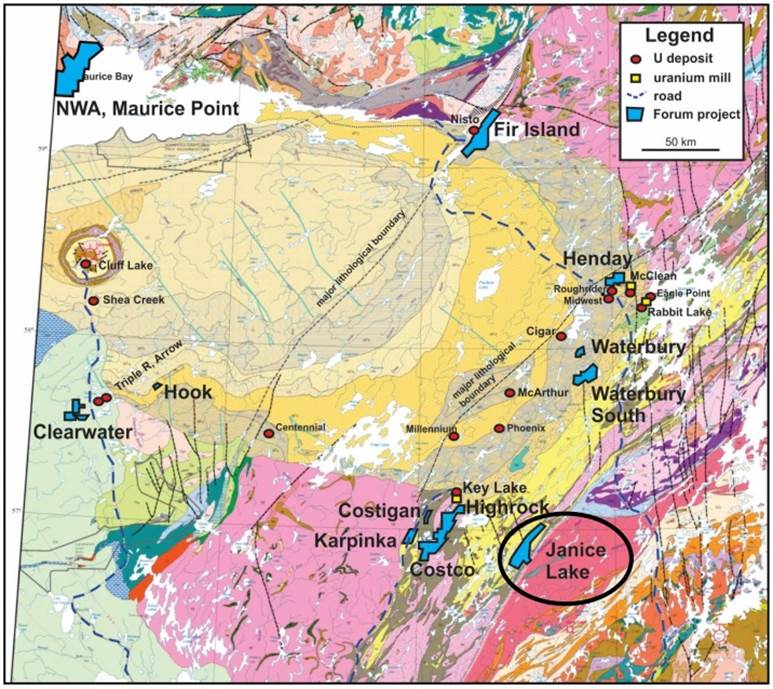

It started all with Forum entering an agreement in February 2018 to acquire 100% of Janice Lake from Transition Metals, for staged payments totaling $250,000 (US$186,000) over four years, spending the same amount on exploration within six months and issuing 8 million shares. The Janice Lake sedimentary copper project is part of the Wollaston Copper Belt, and is located in the south eastern part of the Athabasca Basin in Saskatchewan:

These type of sedimentary copper deposits can be extremely large, with the most significant deposit being Udokan in Russia (1.8Bt @ 1% Cu and 14g/t Ag Measured and Indicated), which is the third largest undeveloped copper deposit worldwide, but they are also found in the DRC and Montana, USA. Forum raised some money, and started drilling the JL-1 target at Janice Lake in August 2018 by itself.

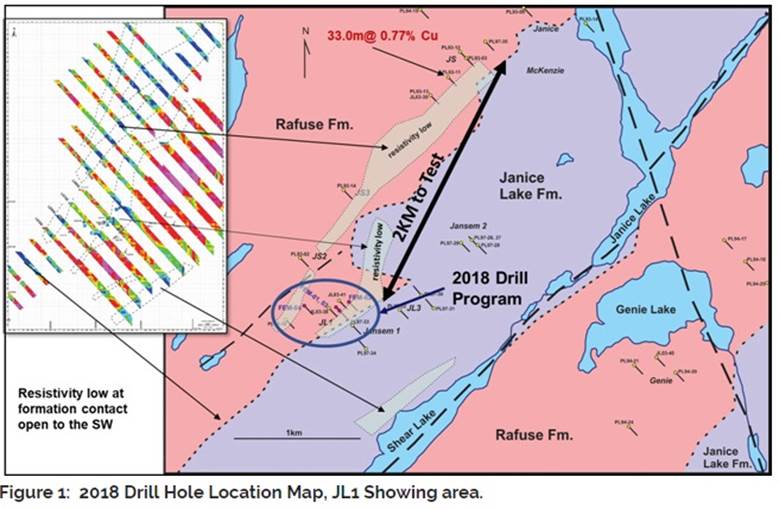

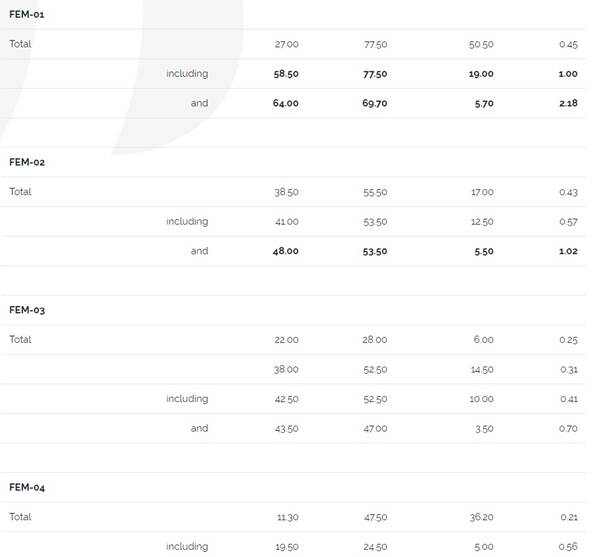

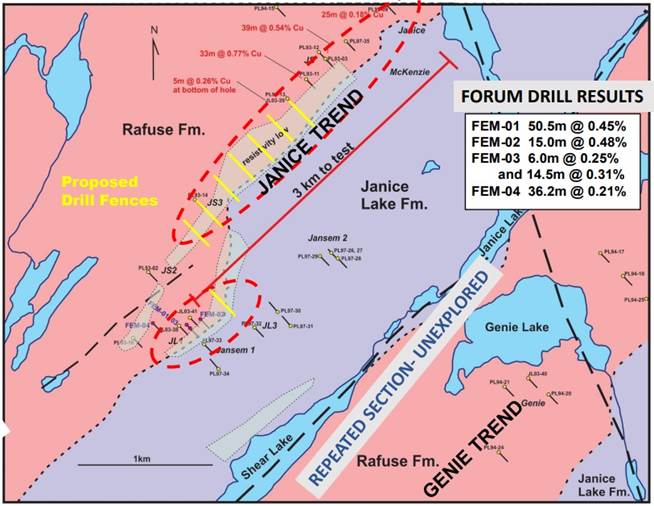

The results, which were announced in Q4, 2018, were not spectacular but decent:

These assays were almost true width, with a margin of +/-10%. Hole FEM-01 and FEM-02 are just economic, comparable (or better) with gold at 1g/t open pit and a 5:1 strip ratio. Final assaying delivered some low grade zinc, lead and silver as well. Mineralization seems to increase in grade and depth to the southwest. This is the reason CEO Mazur was asked by Rio Tinto to stake an additional 30km of claims on strike in this direction. According to Mazur, Forum was targeting 100Mt @0.4-0.6% Cu at the time, but Rio Tinto is aiming at an at the very least five times bigger target now.

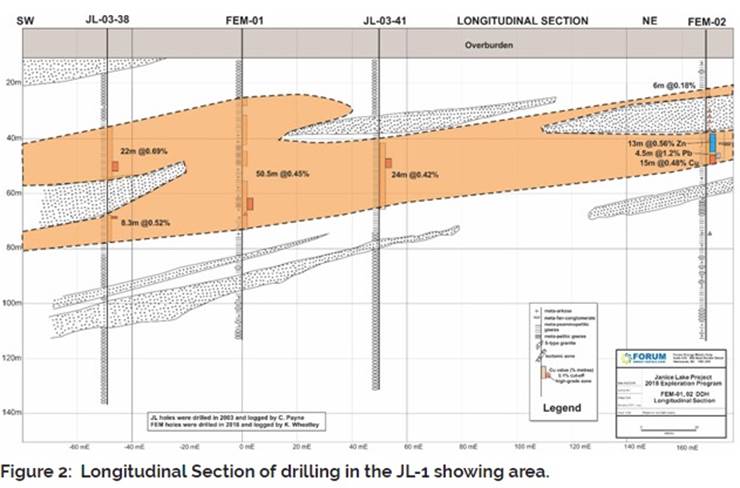

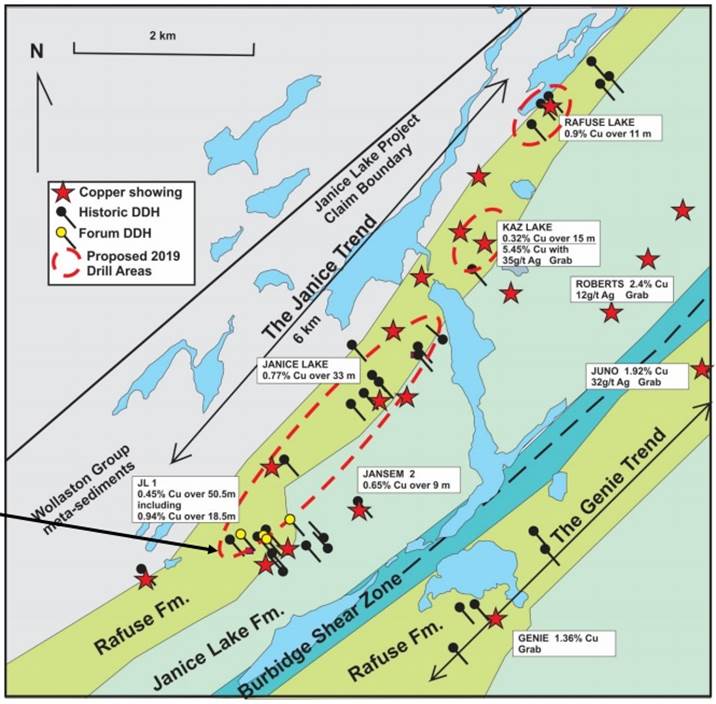

As can be seen in the following section of several hundred meters long, combined with comparable historical drill results by Noranda, Phelps Dodge and the Saskatchewan Government up to 6km to the northeast, indicated that there is potential for discovering a very large, near surface mineralized envelope:

As can be seen, the interpreted orange mineralized zone seems to be layered now and then. This seems to be only the tip of the proverbial iceberg. The company describes this as follows:

“Logging of the drill core and petrographic studies suggest that mineralization is hosted by mafic-rich stratigraphy within more felsic units, opening the possibility for multiple layers of copper mineralization.”

This is probably the key in understanding Janice Lake correctly, and also the potential cause for operators like Noranda and Phelps Dodge for not seeing economic potential earlier. As VP Exploration Ken Wheatley states in this interview:

“I think we have multiple horizons of copper mineralisation that were not necessarily recognised by previous operators. They drilled along strike, but I do not think they realised that that was just one of the layers of copper. We see a series of layers of mineralisation. So, the whole area is mineralised. If we can find some sweet spot areas, then it will help to understand the area better,’ he says. ‘The trick now is going to be getting some grade holes to show that it is economical. The next stage will be hundreds of thousands of metres of drilling to prove up an orebody. That is what it takes to get to pre-feasibility. We think the potential here is to develop an open pit mining resource and mine a lot of tonnes of copper.”

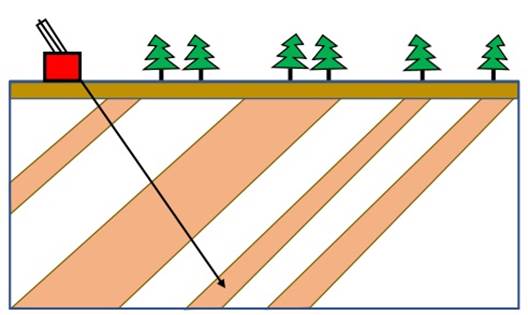

Wheatley thinks as most layers dip 40 grades to the northwest, that the thickness of the entire package of layers is at least 500m, visualized by this schematic section:

In order to be economic at extrapolated depths of around 300m and deeper, grades and thickness have to increase significantly as it would indicate partially underground mining, but it is still early days. On top of this, Wheatley also thinks there is a second, parallel trend alongside Janice Trend:

“In addition, a second mineralized trend, named the Genie Trend, parallels the Janice Trend. It appears to be a repeated section by faulting of the prospective stratigraphy, significantly expanding the potential for further copper mineralization.”

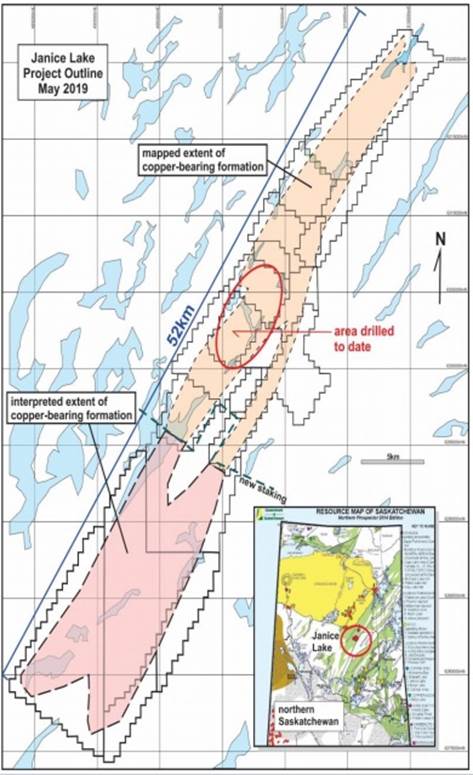

And let’s not forget how large this Janice Lake project really is, as Forum has staked claims along a 52km trend now, including the entire Wollaston Copper Belt mentioned earlier:

After finishing this drill program, and pitching the story successfully, Forum was able to announce a JV agreement with Rio Tinto Exploration Canada Inc. (“RTEC”) on its Janice Lake sedimentary copper project in Saskatchewan.

These are the highlights of the JV terms, per the news release of May 9, 2019:

- RTEC will commit to $3 million in exploration over the next 18 months.

- RTEC has been granted a four year option to acquire a 51% interest in the Janice Lake Project by spending $10 million in exploration, making $490,000 in cash payments, and servicing the remaining $200,000 in underlying cash payments to Transition Metals Corp. as per the terms of the Forum/Transition Option Agreement dated February 5, 2018, to earn 100% interest in the Janice Lake Project.

- RTEC has a second option to earn a further 29% interest (total 80% interest) by spending a further $20 million in exploration over a three year period (total $30 million) and making further cash payments of $150,000 (total $640,000).

- Upon RTEC vesting an interest, it may elect to form a joint venture on terms agreed to by the parties. Under the joint venture, a party whose interest is diluted below 10% is converted to a 1% Net Smelter Return Royalty capped at $50 million.

- Forum has staked a further 19,312 hectares to the southwest, which doubles the size of the property to 38,250 hectares and covers the entire 52 km of the Wollaston Copperbelt. These new claims have been added to the Option Agreement.

This is, of course, a very interesting deal for Forum, as it had issues raising cash throughout 2018 and 2019, and an amount of C$3 million would have been out of reach for sure in the current subdued base metals sentiment, preventing Forum from doing serious drilling and solid news flow.

RTEC has planned a high-resolution airborne magnetometer survey over the entire extent of the property and approximately 7,000 meters of drilling in 25–30 holes in 2019 to meet its first year exploration commitment. The survey has been completed, target holes have been defined and drilling is on its way.

As Forum has added this map to their presentation, it could very well be that Rio Tinto is following its strategy of proposed drill fences (in yellow), which I already discussed with Mazur in January around the VRIC conference:

But Rio Tinto has enough knowledge and experience in-house to determine the best exploration strategy for themselves, of course. I expect Rio to release all results at once in one batch, and shortly afterwards reveal if it is going to continue with the JV or bail out. But as the trends are so large, it could be that it takes another shot at it next year, who knows. To be balanced about this, the same situation could be observed at the BHP-Aston Bay JV, on the equally large Storm Copper project, but BHP chose to return the project to Aston Bay after just one limited (but very expensive as it was more Nordic) drill program, so it is possible. I must say that BHP, more than Rio Tinto, is pretty risk averse and has very high standards regarding deposits and success rates, so this might help Forum in seeing Rio taking multiple shots at Janice Lake.

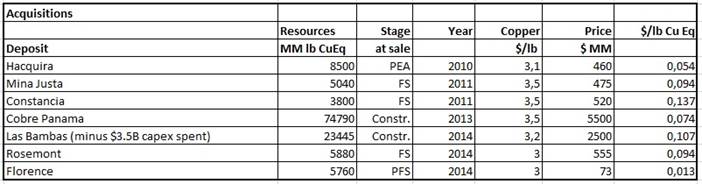

In order to err on the safe side, I am treating this as a binary play, but an interesting one as Rio obviously isn’t killing time, and not seeing this as some kind of recycled stranded asset, and the upside seems to be very significant. If this really appears to have Tier I potential, maybe think Reservoir Minerals upside (acquired in 2016 by Nevsun for US$365 million) in 4–5 years from now, although Timok Upper Zone wasn’t even Tier I. I pulled some old numbers from my spreadsheets to give a further impression of what copper assets could fetch, although copper prices were much higher at the time of course (now US$2.56/lb Cu):

For example, a 500Mt target @1% Cu generates 11B lb Cu, and if this is economic at C$2.56/lb Cu it might be able to be valued at an arm-waving US$200-250 million, if for example Rio decides to buy Forum out. For something of another comparison, Teck sold a 30% stake in Quebrada Blanca to Sumitomo, which is basically an earn-in for US$1.2 billion, as Sumitomo pays for most of the expansion capex here. The mine is scheduled to produce 16.5B lb Cu for the remaining life of mine. So big copper is a game of big numbers, if Rio really strikes it big, all Forum has to do is keeping the lights on by doing a few small raises, until Rio is ready for a buyout. I should put in a little disclaimer about this, as I, for example, don’t know if Forum has to fund pro rata economic studies and permitting. But I can imagine Rio Tinto doing in-house studies for such a potentially large project, and probably providing Forum with an offer they can’t refuse, well before Rio Tinto wants to develop this all the way into feasibility study, etc.

4. Conclusion

It is rare to see a super major like Rio Tinto doing a JV with a (at the time) C$4 million market cap junior, worth C$30 million. In my view, there must be a reason why Rio is so interested in Janice Lake. I am very curious if the new theory of Forum VP Exploration Ken Wheatley will solve the puzzle that the likes of Noranda and Phelps Dodge couldn’t solve in the past. Rio Tinto is drilling now, and the big question for me is, aside from the impending results of course, which I assume as probably being consistent and economic but not earth-moving at first sight, what its thresholds will be. Hopefully, we are about to find out in a month or two. I am curious.

Janice Lake project; Source: Transition Metals

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

The Critical Investor Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. All facts are to be checked by the reader. For more information go to www.forumenergymetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Rio Tinto, a company mentioned in this article.

Charts and graphics provided by the author.

( Companies Mentioned: FMC:TSX.V,

RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK,

)