Gold has continued to hit new six-year highs and was trading at $1,544 per ounce as of August 29. The yellow metal has surged so far in 2019 in part due to global economic concerns like the U.S.-China trade war, record levels of negative-yielding debt globally and signs of manufacturing slowdowns in major economies – to name a few. Fear of uncertainty often drives investors to perceived safe haven assets, such as gold.

There are a number of ways to play the gold rally, including physical bullion, gold stocks and funds that invest in related securities. Is it too late to get in?

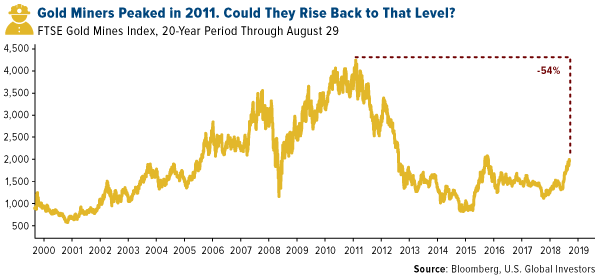

Not with gold mining stocks. As measured by the FTSE Gold Mines Index, gold miners are down 54 percent from their peak in 2011. Miners have been rising in 2019, but they would still have to jump a whopping 117 percent to reach their former record highs. This could be attractive to some investors and I think there’s strong upside potential.

Gold Producers Have Risen Along With the Price of Gold

Gold was up 20.06 percent year-to-date as of August 29. Sound impressive? Miners were up more than double that at 42.94 percent over the same period. Since miners’ margins are highly leveraged to the price of the metal they produce, these companies have historically appreciated alongside gold.

Looking at some of the larger gold stocks –SSR Mining, Wheaton Precious Metals and Centerra Gold – all were up significantly in the last 12 months as of August 29, but of course past performance is no guarantee of future results. SSR Mining has operations at all stages of development in the Americas and was up 83.82 percent. New York-listed Wheaton Precious Metals, which is actually a royalty and streaming company, was up 67.21 percent. Lastly, Centerra Gold was up an astounding 118.40 percent due to strong production results.

Junior miners have also seen performance far greater than that of physical bullion. Wesdome Gold Mines was up 122.56 percent while Lundin Gold was up 72.60 percent – both listed in Toronto.

All of the stocks mentioned above were held in one of our gold funds as of the most recent quarter end. In fact, Wesdome was the top holding in both funds: The Gold and Precious Metals Fund (USERX) focuses on senior gold producers while the World Precious Minerals Fund (UNWPX) leans more toward small-cap and junior producers.

If gold continues on this run, I believe gold stocks will too.

When Vanguard Backed Away From Gold

However, not everyone is a gold bull. Vanguard, the world’s largest fund company, slowly moved away from the yellow metal.

In 2001 Vanguard removed the word “gold” from what was then the Gold and Precious Metals Fund. Then just last summer, Vanguard announced that the Precious Metals and Mining Fund would drop its exposure to metals and mining from 80 percent to just 25 percent.

Was this a good decision on Vanguard’s part? We can’t say for sure. But take a look at the chart below. When Vanguard changed the name of the fund, it coincided with a decade-long precious metals bull run that saw gold rally from an average price of $271 an ounce in 2001 to an all-time high of more than $1,900 in September 2011. That’s more than a sevenfold increase.

And what did gold do after Vanguard stepped away in July 2018? At the time the yellow metal was trading below $1,200 and many thought it had hit a bottom with another rally just around the corner. Turns out that was true as gold has since rallied to $1,544 as of August 29.

At U.S. Global Investors we’ve been gold believers since 1974 when we opened the USERX fund and even more so in 1985 when we created the UNWPX fund.

Learn more about gaining exposure to gold mining stocks through our gold funds by clicking here to see performance, full holdings and more.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metals Fund and World Precious Minerals Fund as a percentage of net assets as of 3/31/2019: SSR Mining Inc. (2.67% in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund), Centerra Gold Inc. (3.44% in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund), Wheaton Precious Metals Corp. (3.55% in Gold and Precious Metals Fund, 0.00% in World Precious Minerals Fund), Wesdome Gold Mines Ltd. (8.05% in Gold and Precious Metals Fund, 5.70% in World Precious Minerals Fund), Lundin Gold Inc. (0.00% in Gold and Precious Metals Fund, 3.47% in World Precious Minerals Fund).

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Past performance does not guarantee future results.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The index benchmark value was 500.0 at the close of trading on December 20, 2002. The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable and attributable gold production of at least 300,000 ounces a year, and that derive 75% or more of their revenue from mined gold.