Source: Bill Powers for Streetwise Reports 08/28/2019

In this interview with Bill Powers of Mining Stock Education, Osino Resources CEO and cofounder Heye Daun discusses the company’s recently announced gold discovery, explains the significance of the initial diamond drill core results and shares how Osino Resources plans to continue to advance the project to maximize shareholder value.

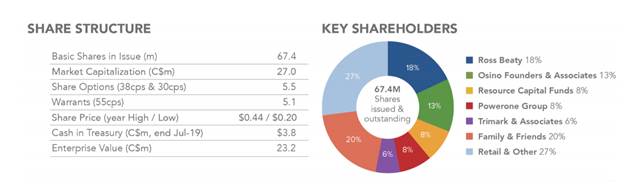

One of Osino Resources Corp.’s (OSI:TSX.V) key founders and financiers is mining entrepreneur Ross Beaty (18% owner). About a month ago, Ross shared with me why he invested in Osino Resources and entrusted his investment with CEO Heye Daun:

“Well, actually Osino is a good example of the things that I actually like and therefore invest in. So I’ve got a handful of investments like Osino, but the very first thing that Osino impressed me with is the CEO. Heye Daun is just a super guy. He’s smart, he’s pleasant, he’s honest, he’s hardworking. All of those things are really, really important. And he’s got lots of experience in the area that not a lot of people know about. It’s an under-explored area, Namibia. Heye lives there. He just lives and breathes and dreams that region. So he’s smart. He’s experienced. It’s really hard to beat that formula.”

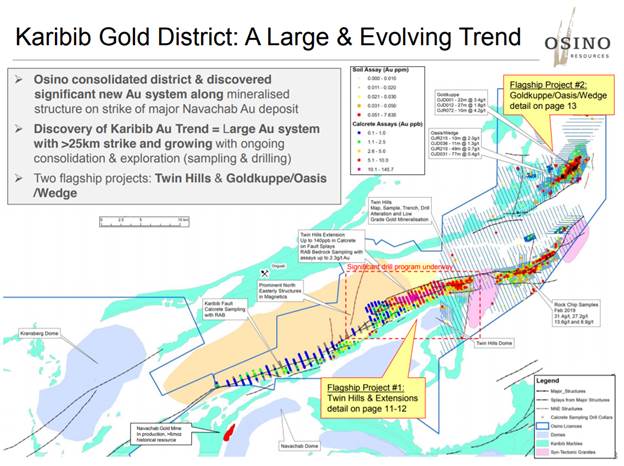

Bill Powers: So to properly understand these drill results, we need to set it in context. Heye, when we talked several months ago over the phone, you set my expectation for what would be successful results for the drill program. And so when I saw the results which just came out, based on my previous conversation with you, I knew they were significant. Let’s begin with you sharing about the simple business plan that you had when you launched Osino and why specifically did you focus on the Karibib trend in central Namibia?

Heye Daun: The business plan was sort of two or three steps. The first one was consolidation, as in putting a sizable land package together, something that has scale just on the map and that gets noticed by majors and mid-tiers. But not just scale on a map, but secondarily also geological scale. Having these pieces in the right places, geologically speaking. We’ve done the first step, we’ve done the second step and the third and I’ll add a fourth step, which is to now prove that we have something real over there and then to find a big brother. And I guess we are somewhere along step three on the way to step four.

Bill Powers: The exit plan as you articulated to me when we first spoke was you plan on defining and then selling this project, not bringing it into production yourself?

Heye Daun: Yes, I would say so. Although I wouldn’t exclude anything. We have to decide when that time arises, but in principle I do believe in that approach. I think there are other companies and entities that are better at building mines than us, even though I’ve done it before. But our key strength is to be entrepreneurial, to raise money, to be flexible, nimble, put these things together, find these things. And I think we’ve proven that and that’s our sweet spot so that’s what we’re going to concentrate on. I think once it gets into construction of mines and stuff, there’s a whole host of other risks that come into play and I think it is appropriate at that time to consider a sales process. Yes, we are working towards that.

Bill Powers: And you and the key leadership of Osino have done this twice in the last seven years already.

Heye Daun: Yes. One in Namibia. I’m a Namibian citizen and we sold the Otjikoto project to B2Gold Corp. and they built a very successful mine there. That was great for us. It kind of set the scene and it’s our model really. We’re trying do that again and then subsequently with equal gold and copper, which was slightly different, it was also a development asset that got merged into the Ross Beaty company. But that was also absolutely key for us because it was my introduction to Ross Beaty and his group of investors.

Bill Powers: Regarding the geological setting on the Karibib trend in central Namibia, why did you choose this specific geological setting?

Heye Daun: In Namibia or anywhere in the world, you have to work with what you have and the geology is there. Namibia has the Damara orogenic belt, it’s orogenic implying it’s structurally controlled. And that means that there’s a certain exploration approach that you need to take. And it also means that there’s certain areas where you need to look. And that’s how we started off. We tried to consolidate significant ground in the prospective parts of this belt, which is what we’ve done.

Bill Powers: Let’s talk about some of the comparables that you’re looking at to determine a success for your current projects. There’re two gold mines nearby. Talk about those gold mines. What are the size and annual production rates?

Heye Daun: There’s the Otjikoto gold mine, which I’ve mentioned, which is owned by B2Gold Corp. and it produces around 170,000 to 200,000 gold ounces a year. It’s highly profitable and a very important mine to B2Gold that’s in the northeast.

Figure 1: Otjikoto Gold Mine

And then on the other end of the trend is the Navachab gold mine, which used to be owned by Anglo. It’s got a long and distinguished history, it produces a little bit less, mainly because it is a limited by throughput capacity. We are book-ended by these two mines.

Figure 2: Navachab Gold Mine

You asked me earlier why in this area? Well, clearly, even though we have good technical justification for being where we are, but they are near-ology too, there are these two successful gold mines in Namibia, but they always seemed to be oddities. People didn’t kind of look at Namibia as an emerging gold belt. Geologically, the model was not well understood. Now that has changed in the last few years and so we’ve brought very strongly this orogenic approach, the structural approach, which has resulted in some good to exploration success that we’ve been having.

Bill Powers: So it was a new set of eyes with a different approach that has allowed you to even bring the project to the place it’s at now.

Heye Daun: Absolutely. That’s actually what I’m the most proud about because, where we discovered Twin Hills, and where we’ve made this very recent discovery is 20 kilometers from a six to eight million ounce existing mine that’s been mining for 30 years, had exploration by the likes of Anglo, Goldfields and others. And we’ve discovered this undercover. I’m really proud of that. That’s a real achievement. And as it goes worldwide, most significant gold deposits these days are discovered undercover because most of the stuff that’s open has already been found. There are certain techniques that we’ve adapted that are very important that have resulted in this success.

Bill Powers: With the two nearby mines, what type of gold grades are being produced? And what type of widths of intercepts are there?

Heye Daun: Generally, as you know, we are in a sedimentary belt. The type of deposit that we have is a hydrothermal deposit as opposed to epithermal. Generally these deposits are known to be lower grade but have bigger scale. Epithermal typically is smaller, more veiny, higher grade, but less continuous. These deposits lend themselves to big scale. Navachab has as a historical resource of between six and eight million ounces, that’s 20 kilometers away from us and Otjikoto is also a multi-million ounce deposit. That has been our target. Regarding grades, these mines have generally been between 1 g/t to 1.5 g/t resource grade, but the production rate is always higher because they employ selective mining. There’s an element of upgrading.

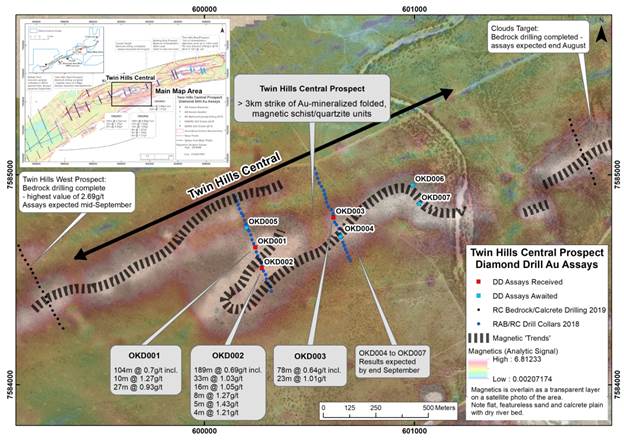

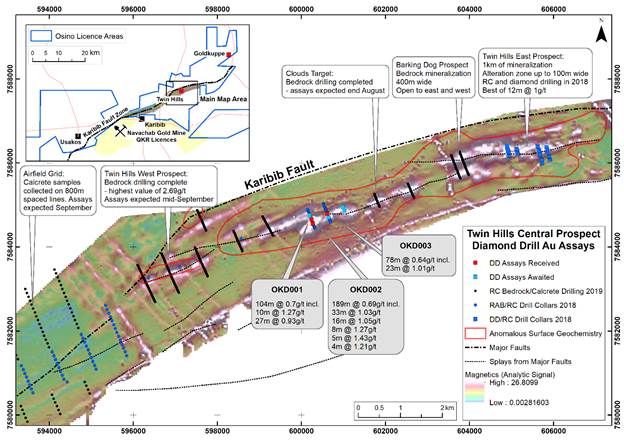

If you relate that back to the intersections we’ve just announced in this discovery, the grades are still lower, but that’s entirely okay because we haven’t discovered the high grade shoots yet that usually form part of these systems and we’ll get there. But what’s different, which is highly encouraging for us, is the fact that our intersections are so long, 189 meters. The average intersection length at Otjikoto’s probably around 50 meters, so it’s very significant and I think especially technical groups who understand this will take note.

Bill Powers: Heye, what I recalled from our conversation months ago was that you told me, “Bill, if you see in the first initial results about 50 meters of anything around 1 g/t or a little less, that would be considered a success.” And so when I saw you put out 104 meters at 0.7 g/t, 189 meters at 0.69 g/t and 78 meters at 0.64 g/t, I knew that that was very positive.

Heye Daun: Yeah. That’s just the intersections for the central part of the system. I’m just reminding you and your readers that we, the Twin Hills system, the entire gold system is about 11 kilometers long as expressed by its surface anomaly and by some bedrock targets that we’ve identified along this trend. Now, the drilling that we announced yesterday applies only to Twin Hills central, which is sort of the heart of the anomaly. But Twin Hills central in itself has significant potential, but so do the other targets along the rest of the trend. I think it’s clear to us at least, it’s very clear that Twin Hills as a camp, or as a system overall has a lot of legs still. We really do believe that we’ve got the dragon by the tail and now we need to slay it. It’s going to take a lot of drilling and we are already gearing up for that.

Bill Powers: You saw some high grades within your highest individual meter assays were 5.7 g/t and 4.76 g/t, 3.08 g/t, 2.84 g/t and 4.29 g/t over a meter. Could that potentially indicate a high grade shoot nearby? Or what type of widths and grade would you want to be seeing to determine if you’ve hit a high grade shoot?

Heye Daun: They may or may not be a high grade shoot, but it doesn’t really matter at this stage. The reason we included them in the press release is just to indicate to mostly the North American Canadian audience that this project has the potential for higher grades. Now when you ask me what kind of high grade shoot would we like to see? Of course as high as possible, but that’s maybe wishful thinking. We need to be realistic. We’re looking at analogs, for example, the Otjikoto mine, which is to the northeast, the B2Gold mine has some high grade shoots that go significantly higher, up to 10 g/t, 5 g/t, 3 g/t. Basically my low water mark here is I need to deliver a gold resource that has a million ounces plus at a resource grade of 1 g/t to 1.5 g/t.

If I can deliver that, then I think we could say that we have a potential mine. I think we’re still some way off that. But certainly what we’re seeing now indicates that that’s very much possible if not probable that we’re going to find that. What the actual grade of the shoots will be, we have no idea. It could be anything. And with this drilling we didn’t specifically target high grade shoots. We understand that these deposits are structurally controlled. We are gaining a better and better understanding of the structure of this deposit. And as that happens, our targeting ability will improve. The next steps certainly will include specifically targeting higher grade shoots. But that was not the intent of this initial drilling. Initial drilling was to just prove significant mineralization in general and that we’ve achieved

Bill Powers: What type of assay results should investors expect from the company over the next few months? And what about our drill program for Q4?

Heye Daun: Of course, I cannot predict assay results just because there’s a geological endowment and I can’t influence that. But I would certainly say that investors should expect similar results to these going forward. Although the length of these intersections is quite exceptional, I think if we match them again that would be, as I say, exceptional, but certainly they should be interspersed with higher grades. I want to see some 2 g/t, some 3 g/t, some 4 g/t in shorter intersections where it’s within a wider halo of low grades. That will ultimately constitute a mineable resource.

Bill Powers: There are some assay results pending and what is the time frame for their release?

Heye Daun: The timeframe is short; within the next two weeks to three months. And just to remind your readers and you, we are doing different types of drilling in the sort of integrated program that we’re running. We’re doing percussion drilling, RC drilling and diamond drilling. The percussion drilling is there to prove up mineralization at bedrock to determine when we are through the cover. And the RC and diamond drilling are to then convert that bedrock mineralization into real intercepts.

The results we just announced are the real intercepts. We announced three out of seven, so another four are expected. There will be one hole hopefully in the next week or two and the remaining three holes will be middle of September. That’s for the diamond drilling, which will further confirm or enhance the current discovery already announced. In addition to that, there will be further bedrock percussion drill results, which will prove additional targets along the Twin Hills trend. Basically making the whole Twin Hills system better, those are also expected in the next four weeks.

And then we are now already planning a follow-up drill program to do infill drilling, step out drilling, extensions on strike and also to look for high grade shoots. Now that drilling will probably commence around about middle of September after we’ve received all the current results. And the results will be incoming during October and November. Fairly constant stream of exciting news coming up basically until the end of the year.

Bill Powers: This is exactly what mining stock speculators want to hear with this steady flow of drill results. But it takes cash to do it. Talk to us about the cash in the treasury, your burn rate and what it costs to drill in Namibia.

Heye Daun: We have about CAD$4 million in the bank right now. We’re going to spend $4.3 million this year, which is if you go on our website presentation, that’s the number that is always mentioned. Of course around three of that has already been spent. We got another $2 million to go between now and the end of the year, which enables us to conclude what I’ve just told you, which is a range of drilling between now and the end of the year. And then we’ll end the year with about two and a half million dollars. That is not a huge amount. But remember we are Namibia and we’ve got a very significant exchange rate kicker, so we can do a lot of damage with $2 million.

But having said that, that’s not where I want to be. My ideal sweet spot is to do a significant additional premium financing in the foreseeable future to cash us up so that we can rev up our program because these results very clearly tell us we need to do a lot more drilling. Even over and above what I’ve just told you. That’s what we’re planning to do.

There are different ways of raising that money. Of course, the market is much more receptive these days. We’ve got very good shareholders who stand behind us. But also I’m interested to talk to strategic investors because I think for a company like ours, we have such a big land position, so many projects, a lot of stuff I haven’t even mentioned, which we are advancing. All of that takes cash. I would be quite happy with a strategic partner at the 10% to 20% level at this stage. And we are actively working on that. We’re talking to a couple of entities who could come in and be the anchor for a significant premium financing.

Bill Powers: And that, of course, will protect shareholders against dilution.

Heye Daun: Yes, although in this regard, we are not a prospect generator. In all of the projects that we have, there’s always the risks of dilution because, of course, we need to raise equity and issue shares in order to keep going. That’s what we’ve done so far. And because we have such a diversified portfolio of assets, there’s quite a strong argument to be made that we could farm out some of those. Let’s say the non-core ones we could farm out to others and we will consider that going forward but we still need to add a bit of value to what we have in order to make these projects real.

That would be one way of minimizing dilution but at the same time if you have success and you own your projects 100%, I argue that being as we are, which is 100% owners and operators of our projects, I think is a better place to be than if we were a prospect generator now, where we would be dependent on other people’s drive and determination. I’m quite happy where I am but of course it does mean some dilution, but I think dilution doesn’t have to be a dirty word. If the dilution happens at higher prices and you generate value that way, then I think it is more acceptable.

Bill Powers: Let’s talk about Namibia. When I spoke with you on the phone for the first time you referred to Namibia as the Switzerland of Africa and you also compared it to Texas, which as an American I’m familiar with. Why do you use those two analogies?

Heye Daun: Well, when we’re looking at jurisdictions, I think there are a couple of things you need to take into account, but the key ones for mining speculators or minings investor are riskiness and ease of doing business. Riskiness refers mainly to political risk, which is uncertainty, political uncertainty, change of regulations, maybe losing your licenses, that sort of stuff. In that regard, Namibia can easily be compared to Texas or Switzerland even to some extent, in that mining regulations are very stable, have been very stable for a long time and appear to continue to be stable going forward. Another important consideration is, of course, ease of doing business. Can you find services, goods and services? Can you access your sites? What is the weather like? In that regard, Texas is probably a better comparable because, yes, Namibia is great. We don’t even have snow.

We can access our drill sites all year round. We have a weak currency at the moment, which is good because it keeps our costs down as we raise our money in Canadian dollars. We get a lot more bang for our buck. Yes, I still maintain that Namibia’s a great place to operate. We are very happy there and it’s definitely one of the top exploration jurisdictions or mining jurisdictions, I would say. Of course, I have to say, there are always some issues, there are always some elements that could be improved and we are working with the government to do so through the Namibian chamber of mines. But that’s just in the normal course of business.

Bill Powers: As you progress the company forward, what would be some of the key things that would hinder your progress?

Heye Daun: Of course, sentiment, externally speaking, I cannot influence that. To a large extent we are dependent on, I guess, President Xi and President Trump. What happens with the trade war and there are other commentators that can put that into perspective much better than I can. At the moment, we have positive sentiment and improving sentiment and that’s good for us. But ultimately we are dependent on that sentiment, especially when it comes to financing because financing is driven by share price. Share price is driven by sentiments. I would say that’s a key outside factor.

Internally, I guess, one of the things we will be working towards is this company is very intimately linked to me as a person because I have track record in Namibia. I’ve done this before, I’ve raised money, sold companies, etc. And so a lot of people associate Osino with me personally. But of course there’s a much bigger team around me. I’m not the one that makes the discoveries, I’m just the one that sets the strategy and raises the finance. But we are looking at, as we grow, strengthening the team. I think that’s important for a small company. I would say those are probably the key factors that investors need to consider.

Bill Powers: As we conclude, Heye, are there any final thoughts that you’d like to share with investors?

Heye Daun: I’m excited. We looking forward to the future. I’m going to Vancouver next week to the Metals Investors Forum. The week after is the Beaver Creek Precious Metals Summit where we’re meeting a range of investors, brokers, mining companies, so I think the next two or three weeks are going to be good for us. And then, of course, in the medium term, we are very excited to get going on the follow-up drill programs and it’s so much easier to project that excitement when you have conviction, and with these results, our conviction has just grown tremendously, so looking forward to the future. Thank you.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Osino Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Osino Resources is an advertiser of Mining Stock Education. Additional disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

Graphics provided by the author.

( Companies Mentioned: OSI:TSX.V,

)