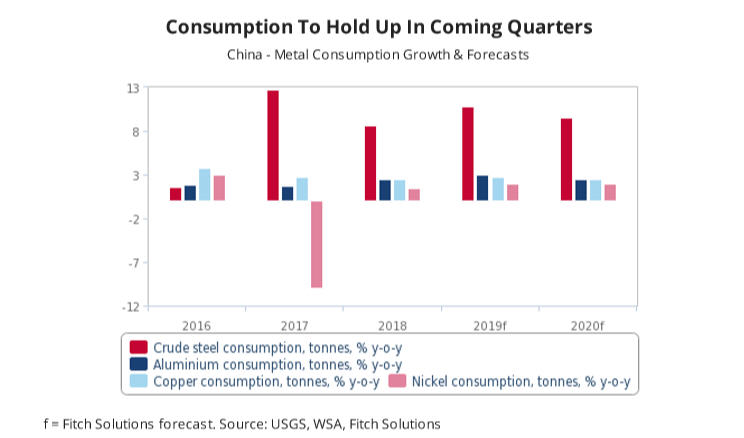

The outlook is positive on overall Chinese demand for metals for the coming quarters, despite increasing risks to the global and Chinese economies as the trade dispute between the US and China rolls on with bouts of escalation and de-escalation, Fitch Solutions analysts maintain in their latest China metals demand tracker.

Fitch believes the increased government support to domestic industries since H218, that will likely only intensify as macroeconomic headwinds build, will support demand for base metals in China.

The measures aimed at boosting infrastructure are already feeding through with the start of construction works for a number of projects in recent months. Iron ore and steel will see sustained demand growth in the coming quarters from the infrastructure sector, Fitch forecasts.

Copper and aluminium demand growth will only post a modest recovery from current levels, as the autos and consumer sectors that account for a large portion of non-ferrous metals demand will only improve marginally in 2020 compared to the infrastructure sector.

China’s domestic demand for industrial metals will be supported in Q419 and 2020 as the government gears up to provide additional targeted stimulus to the infrastructure sector in the face of a protracted trade dispute with the US, a view Fitch analysts have held since H218.

The prospects of a trade deal between the US and China have worsened, with both parties adopting hardliner stances in recent weeks and the fundamental differences between them remaining wide, and Fitch says this means the world will continue to see policies supporting the heavy industries to bolster economic growth throughout 2020.

Read the full report here.