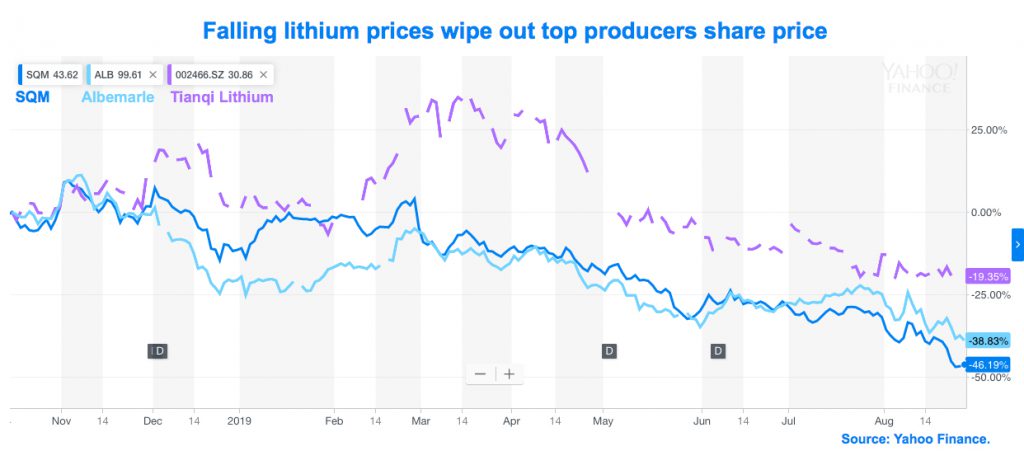

An ongoing avalanche of lithium supply, coming mostly from Australia, as well as cuts to China’s electric-vehicles (EVs) subsidies have caused prices for the battery metal fall more than 40% over the past year, knocking profits for the largest producers and wiping out most of their share price gains since 2016.

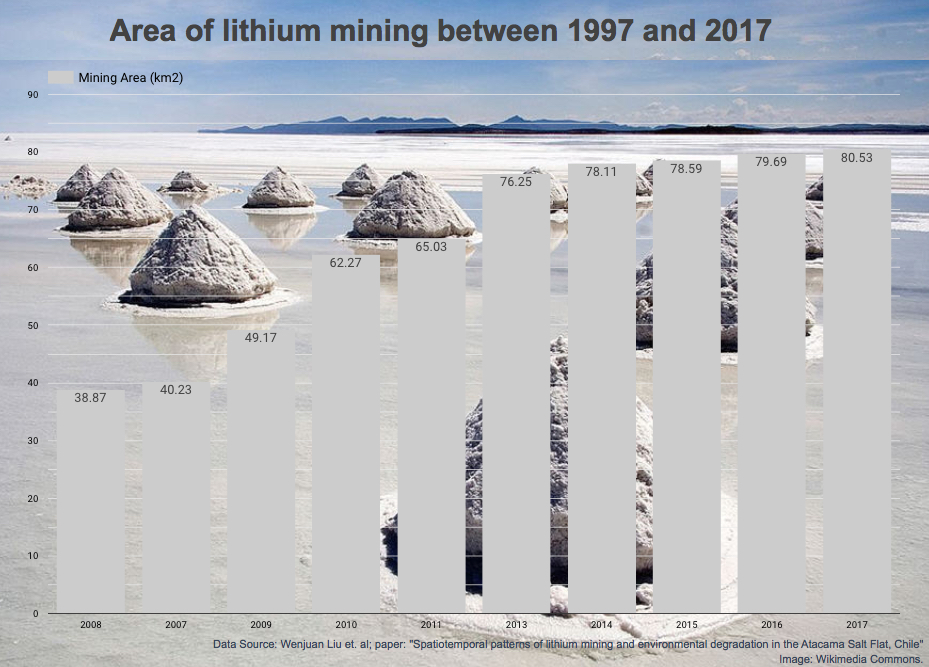

Six new lithium mines have begun operations in Australia since 2017, while Chile — the world’s No.2 producer — has opened the door to foreign companies to explore for lithium in the rich Atacama salt flat, in the country’s north.

Earlier this month, Albemarle Corp

(NYSE: ALB), the world’s No.1 lithium miner, postponed plans to add about 125,000 tonnes of

processing capacity due to oversupply.

The company has also revised a deal to buy into Australia’s Mineral Resources’ (ASX: MIN) Wodgina lithium mine and said it would delay building 75,000 tonnes of processing capacity at Kemerton, also in Australia.

In terms of shares prices, the company stock has lost more than 20% of its value so far this year.

Chile’s Chemical and Mining Society (SQM), the world’s second largest lithium producer, said last week profits for the second quarter had almost halved, to $70.2 million, from $133.9 million a year earlier mostly due to weak prices.

SQM’s shares are down a staggering 40% since the beginning of the year.

In China, Tianqi Lithium, the country’s largest producer, said profits in the first half of the year were down 85.2% from a year earlier. The stock, in turn, has fallen 20% this year.

Despite the weak market, the world’s largest battery makers remain keen on securing future supplies of lithium to meet demand, which is expected to triple and reach a value of $100 billion by 2025.