Credit ratings agency Moody’s has lowered its 12-18 month outlook for North America’s coal industry to ‘negative’ from ‘stable’, amid declining profitability, weak export prices and diminishing demand from utilities.

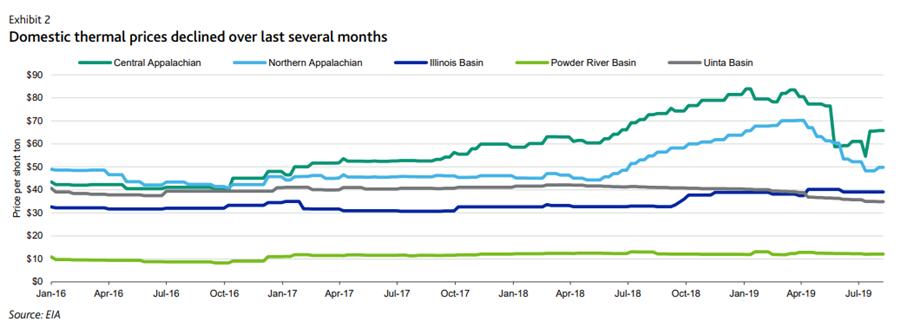

Over the next 12 months, sector EBITDA is expected to fall by more than 3%, driven by a substantive decrease in thermal coal export prices — particularly in Europe, where strict environmental measures are being pushed through — as well as mostly open contract positions for producers.

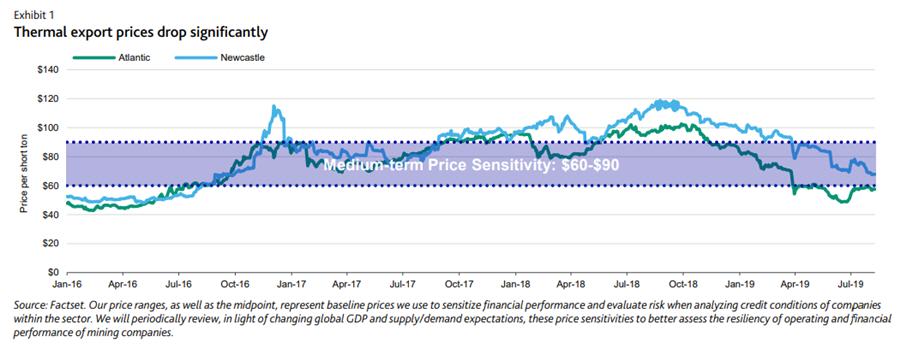

For the medium term, Moody’s price sensitivity range for export coal remains unchanged: $60-$90/metric tonne for Newcastle thermal coal and $110-$170/metric tonne for high-quality met coal. Price volatility for exports is expected to moderate during the next couple of years.

Over a longer horizon, the US coal sector might see a substantial volume reduction for the next decade, as a combination of economic, environmental and social factors continue to push utilities towards renewable energy. There is downside risk in prices as domestic demand for thermal coal declines further and the industry becomes increasingly reliant on exports.

“The combination of a now-weakened export market and significant retirement of coal-fired power plants in 2018 is creating an oversupplied domestic market and could drive prices lower,” says a Moody’s analyst.

Metallurgical coal operations may also take a hit due to weakness in the steel industry, Moody’s added, though pricing remains favorable compared to historic levels.