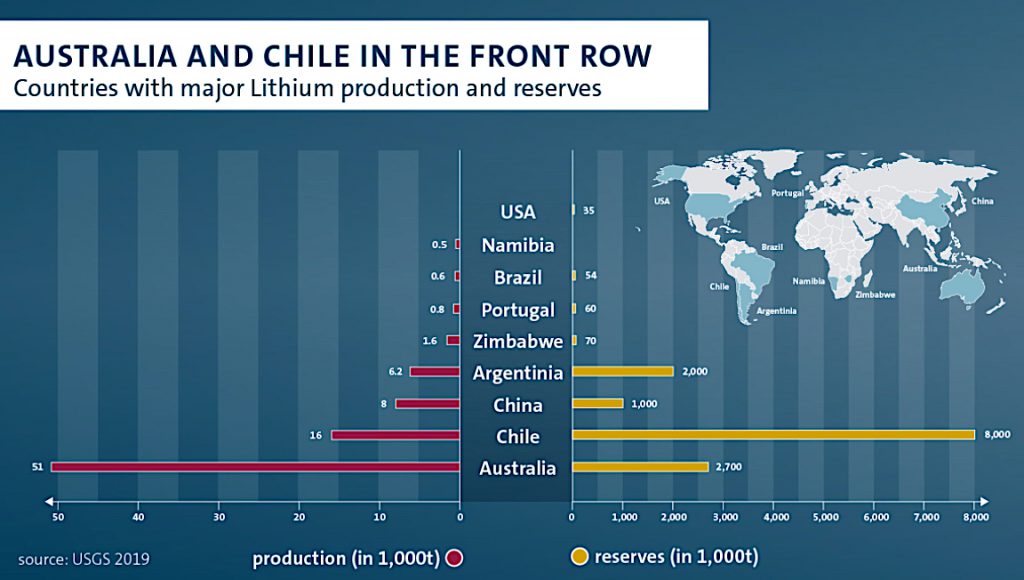

An ongoing avalanche of lithium supply, coming mostly from Australia, as well as cuts to China’s electric-vehicles (EVs) subsidies, is set to keep prices for the coveted battery metal in the single digits for longer than expected, analysts at commodity research group CRU warn.

Prices for lithium carbonate, the most common type used in the batteries that power electric cars, doubled over 2016 and 2017, but have fallen by more than 40% over the past year, crashing through the $10/kg mark at the end of July.

While many market players continue

to forecast long-run prices in the mid-teens, based on bullish forecasts for

sales of EVs and energy storage systems, CRU analysts remain unconvinced.

Based on previous experience in other commodities, the experts believe that “hype” has met “reality”, adding that refinery bottlenecks and the potential for ramp-up delays in the mining and refining sector are not enough reasons to forecast a quick price recovery.

CRU says that lithium prices will continue

to be governed by cost fundamentals, which will keep them in the single-figures.

“This is the same message we have continually conveyed to CRU clients since November 2017,” they say.

Cutbacks

The analysts’ view seems to be

backed by the main producers. Earlier this month, Albemarle Corp (NYSE: ALB), by

the world’s No. 1 lithium miner, postponed

plans to add about 125,000 tonnes of processing capacity due to

oversupply.

The company has also revised

a deal to buy into Australia’s Mineral Resources’(ASX: MIN)

Wodgina lithium mine and said it would delay building 75,000 tonnes of

processing capacity at Kemerton, also in Australia.

In November, the miner put plans on

the back burner to increase output capacity at its operations in Chile beyond

2021. That project would have produced lithium carbonate.

Chile’s Chemical and Mining Society

(SQM), the world’s second largest lithium producer, foresees strong

long-term demand for the white metal, but has said it expected sales volume

this year to rise slightly from 2018.

“It is very difficult to predict

our sales volume for 2019 and 2020, it depends on supply and demand equilibrium,”

the company’s new chief executive, Ricardo Ramos, said

in February.

“The timing of the start and the

ramp-up of new projects is also difficult to assess,” he noted.

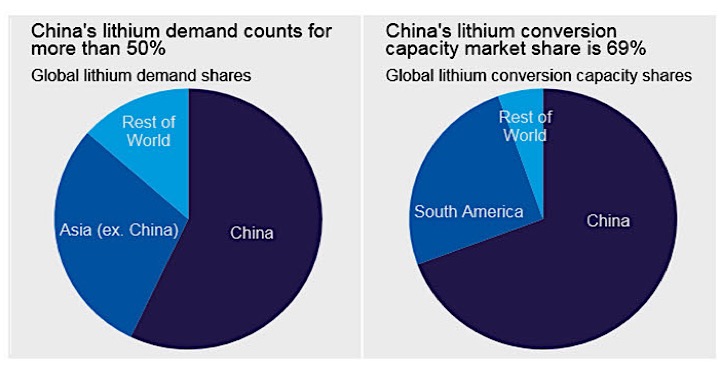

Lithium carbonate prices in China, the world’s top consumer, have dropped by nearly 20% since the beginning of 2019 to RMB 65,000/t, equivalent to $9.25/kg lithium carbonate equivalent (LCE), according to CRU’s price estimates. Lithium hydroxide has fallen by 30% to RMB 74,500/t.

China is also the

biggest supplier of lithium converted products.

“Many market players look to nation’s lithium spot prices as a bellwether of market health and therefore the continued decline of lithium prices has put mounting pressure on the global lithium market,” CRU concludes.