Source: Maurice Jackson for Streetwise Reports 08/19/2019

Bob Moriarty of 321 Gold explains why he believes the financial outlook is dismal and discusses a handful of resource companies that are on his radar.

Maurice Jackson: Joining for us for a conversation is Bob Moriarty, the founder of 321Gold and 321Energy.

Glad to have you back on the program and long overdue, I might add, sir. We have a number of topics to address, so let’s get right to it. Earlier, you wrote a musing entitled “We Should Let The Banks Burn Down.” Ladies and gentlemen, this is a must read. If you’re trying to make some sense of the dire global financial situation and the direct implications it will have on you and your family, Bob, you’re a big thinker and you have a unique ability to condense a complicated subject into any easy, concise reading. You’re also very strategic, so I know there’s a method to your genius. Readers could literally take that narrative into 18 different subjects. What compelled you to write this musing right now?

Bob Moriarty: I started thinking about the banks and I started thinking about 2008. We had a chance to fix the system in 2008, but we needed to let AIG collapse. We needed to let the banks collapse. We needed to start all over. Now, where this idea came from that you have to keep the crooked banks going is just beyond me. Let me give you an example, and I can’t give you the exact numbers, but Bank of America was going to buy Merrill Lynch, and Merrill Lynch handed out something like $2 billion in year-end bonuses on the 12th of December, 2008. On the 15th of December, 2008, they came out and announced $15 billion in losses. It was a total shock to everybody.

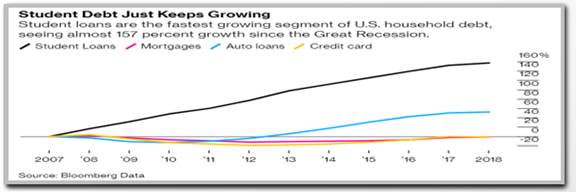

Now, think about that for a minute. The whole concept of giving people bonuses is for doing good work. Why would you give bonuses to people who are losing money hand over fist? It’s beyond me that we have let AIG steal, we’ve let Soros steal, we’ve let Warren Buffett steal, and that’s all it is. Mainstream, the average guy is getting none of the benefit, but they have to pay all the taxes. Now, the 20 Democrats are agreed on only one thing, and that is the student debt should be forgiven to, I think, $50,000, but the whole student debt thing is corrupt. The banks literally bribed Congress and pass a law passed that said you can’t discharge college loans. As a result, the colleges said, “Gee whiz, we can charge anything we want,” and the banks said, “We can give loans to everybody. It doesn’t make any difference whether they are creditworthy or not because we’ve got them in handcuffs for the rest of their life.” Now, the number of people over 60 who are still paying college debts has doubled in 10 years and it’s a crime. It’s that simple.

Maurice Jackson: That’s because also they cosigned either for a grandchild or they had to go back to work essentially. Is that correct?

Bob Moriarty: Correct.

Maurice Jackson: I find it disheartening that to get this information and still have a discussion about it that you have to find it in alternative media. The mainstream media glosses over it. It’s truly frustrating.

Bob Moriarty: No, that’s a good thing. Do you believe that mainstream media told the truth 10 or 20 or 30 years ago? They were liars. They lied about it, everything. I look at CNN and CNBC and Fox think, “Does anybody believe their lies anymore?” Any person with a computer has access to far more information now, and I’m not going to say the web is a cornucopia of wisdom, because it’s not. There’s a lot of goofs posting on the web, but you certainly get access to a lot of valid information. The number of people who read my articles is really quite amazing, and it’s free. It doesn’t cost me but a couple of hours to write it, and a person can sit down in 20 minutes and read something and get a different point of view.

Now, that doesn’t mean that you have to agree with me. I could be dead wrong, but the fact is I’ve got a point of view and I’ve got access to the web and tens of thousands of people read it.

Maurice Jackson: Not to mention, it’s not just your thoughts and opinions, you’re actually providing hyperlinks to take us directly to the source so we can see it for ourselves and make an objective decision here.

Bob Moriarty: You just pointed out something that I hadn’t thought about for a while. There are a lot of people who write articles and they talk about it as if they’re quoting facts, when in fact what they’re doing is expressing opinions. They don’t buttress their opinion with facts and it’s so easy to put in hyperlinks. When I talk about what the cost of student loans is, I can give you the link and the person can go and they can verify that I’m not just blowing smoke, that I’ve got good, accurate numbers and I get the best information that I can and share it. It’s important that articles contain two things in equal proportion. One is facts and the second is logic, and a lot of people are talking about opinion as if it’s factual, which isn’t necessarily true and no logic whatsoever.

I went through two or three emails with a gentleman this last week who was arguing that silver was suppressed from $4 an ounce to $50. I wrote him back and I said, “I don’t know how you did on your logic course, but I know you failed the math course.” That’s the dumbest thing I think I’ve ever heard. That was one of the greatest booms in commodity history and this guy is running around saying, “Oh, no, no. Silver is suppressed.” I read another piece today where somebody was saying that the central banks are losing control over the price of gold and I thought, “God, doesn’t this guy get it? Central banks have been buyers of gold since 2010.” Now, how have they lost control of the price of gold if they’re buyers? It’s crazy.

Maurice Jackson: That is factual information, and by the way, one more caveat to that discussion as well is you’re actually a strong advocate for buying gold, so it’s not that you’re anti-gold or anti-silver, silver at this moment, so it’s not that you’re taking a position that you shouldn’t purchase silver, and we’ll get into that later.

What do you have to say to bankers, Keynesians, and advocates for big government, when they would claim that the banks did what they had to do to save us?

Bob Moriarty: The banks did what they had to do to save them. Don’t confuse them with us. Here’s what they have done. They have loaded the world with something like a hundred trillion dollars in more debt. If you aren’t in the one-tenth of 1%, you didn’t get any benefit out of it whatsoever. I’ll just flat tell you the average person is far worse off today than they were in 1970 and they’re worse off than they were in 2008, and the fact of the matter is, and you’ve picked up on a very important point, all debts get paid.

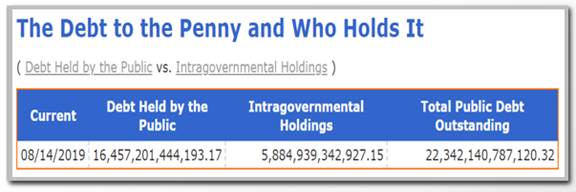

When the United States government goes from say $8 trillion to debt to $20 trillion in debt and has $200 trillion in unfunded liabilities, who do you think is going to pay that? You’re either going to pay it and say, “Taxpayer,” or you’re going to pay it as a beneficiary of Social Security, Medicare or Medicaid when they go bust, but somebody has got to pay it, and it sure isn’t the banks.

https://www.treasurydirect.gov/NP/debt/current.

Maurice Jackson: Amen to that, sir. You also reference a gentleman we all know, and his name is Joe Numbnuts. Now, he’s a fictional character, but we all seem to know him. Who is Joe Numbnuts? What are the odds that he’ll be voting for a Democratic nominee?

Bob Moriarty: Who said he was fictional? I went through boot camp with him in 1964. Joe Numbnuts is just as real a person as you’ll ever meet, and yeah, he’s a Democrat.

Maurice Jackson: I reference Mr. Numbnuts. He’s one of the individuals that acquires these student loans. He is a lifelong student and he feels that you and I should pay for his student debts, so I wanted to kind of take the conversation there. Can you expand on that for us?

Bob Moriarty: Joe Numbnuts is stupid but he’s not totally ignorant. He’s a very skilled underwater basket weaver, and when he finally had to go out and to work, he realized that there is no demand for underwater basket weavers, so the $83,000 he owed in student debt, he just said, “Oops, I can’t pay.” Now, he’s listening to the Democratic Party and there’s only one of them that’s got any sense whatsoever. They’re saying, “We’re going to forgive the debt”, and he says, “I don’t care. I’m not going to pay it anyway. I let my Mom and Dad and uncle and neighbors, I’ll let them pay it.” Joe Numbnuts, he’s not all that dumb.

Maurice Jackson: I don’t know if we addressed this earlier, but student debt, how does that compare with other debt for the United States right now?

Bob Moriarty: It’s bigger than all credit card debt and it’s bigger than all the automotive loans. The student debt is giant debt and if we transfer half of it, $800 billion, to the backs of the taxpayers, that would go from increasing overall debt from a trillion a year to increasing 2 trillion a year. What I write in my musing, none of my stuff is complicated. These are all things that anybody who can think can see for themselves. Those debts are not going to get paid, and then you have to say, “What’s going to happen?” Do you remember what I said about voting to change things? Google and the FBI are now in charge of picking the president, and that’s a real switch. You can forget about having an effect by voting.

Maurice Jackson: It certainly is, and that’s part of the discussion we’ve had in the past and that’s involving the Deep State. Is that correct?

Bob Moriarty: Oh yes, and that’s so spooky because that should be the number one topic in the United States. Who in the world appointed the FBI and the DOJ in charge of picking presidents? Now, the very best analogy to what’s going on today is Gibbon’s book. I think there were like six or so volumes or something like that. “Decline and Fall of the Roman Empire.” Now, do you consider yourself a reasonably educated person?

Maurice Jackson: I would like to consider myself in that category.

Bob Moriarty: I’ll give you a question. It’s not a trick question. If you can answer it, fine. If you can’t answer it, I can understand that. Name one Roman emperor from the year 100 until it collapsed in the Roman Empire. Any of them.

Maurice Jackson: That I can’t do.

Bob Moriarty: You know why?

Maurice Jackson: No, sir.

Bob Moriarty: They were nobodies. They were Bidens, they were Bush, they were Trumps, they were Clintons. They weren’t the best of the best. They were a bunch of bozos and clueless clowns. I can’t name any of them either. They cast no shadow and left no footprints.

Maurice Jackson: Great point.

Bob Moriarty: That’s what you get at the end of the empire. Anybody who doesn’t see that we’re at the end of an empire needs to spend 12 bucks and go read my book, and if you remember, I wrote the book in January. It was published in mid-February, and I predicted we were going to have the crash and the end of empire and the great reset this year. I’m going to tell you, I think I nailed it.

Maurice Jackson: The book that you’re referencing, just for our audience members, earlier this year Bob published the number one selling book on Amazon under commodities trading entitled “Basic Investing in Resource Stocks,” which you may find on our education tab on Proven and Probable. Now, let’s discuss the great reset. What is the great reset?

Bob Moriarty: Well, I read a book about Jubilee by Michael Hudson titled “. . . and forgive them their debts.” That was the concept in ancient times that every 50 years or so you reset your financial system. Now, that’s the fact. Let’s go into the logic. When you issue money, when you make loans, you’re actually creating money.

How could you do that as an individual? Now, I’m going to say I want you to take yourself back 10 or 15 years. When you walked into a store and you paid for something with a check, what did you actually transact?

Maurice Jackson: When I paid for it with a check, not with actual cash, correct?

Bob Moriarty: Correct. What’s the difference between a check and cash?

Maurice Jackson: Well, they’re both promises to pay because the note is on, of course, the currency.

Bob Moriarty: They’re money. It’s a hard concept but it’s a true concept. All money is created by loaning it into existence, and the proof is that you could write a check, and of course, nobody writes checks anymore, but you could write a check and that check, you’ve taken a piece of paper and you turned it into money. Now, obviously, it is a promise to pay and it will be deducted from your bank account, but when banks loan money into existence, they charge interest, right?

Maurice Jackson: Yes, sir.

Bob Moriarty: Let’s take all the banks in the world, and they create a trillion dollars in one year and they charge 5%. Now, if we only look at that one year, how much total money is there?

Maurice Jackson: 1 trillion, and I see where you’re going with this. This is a great point, yes.

Bob Moriarty: How much debt is there?

Maurice Jackson: Well, the debt is the interest rate that you just referenced there.

Bob Moriarty: No, you created the money by loaning it into existence, so the debt is 1 trillion plus the interest rate of 50 million.

Maurice Jackson: Absolutely correct, yes. This is a point basically outlined by Murray Rothbard in “The Case Against the Fed,” am I correct?

Bob Moriarty: The really interesting thing there, and nobody thinks about this. Quinton Hennigh and I spent a lot of time talking about it here recently when I was in Japan. There is always more debt than there is money. Now, if the debt continues to increase and increase and increase and increase, how does it get paid?

Maurice Jackson: Well, it doesn’t, you have to have a reset.

Bob Moriarty: Exactly. Now, I’m not saying there has to be a reset because I believe in Judaism and I believe in the Jubilee or because I feel sorry for the poor debtors. There has to be a reset because mathematically there has to be some way of paying it off, and one of the ways to pay it off is to write it off. Now, that’s going to happen and the book that I was reading is “Forgive Them Their Debts” by Michael Hudson. He pointed out that there are two kinds of loans, two kinds of debt. There is the debt for something productive, and then there is the debt for personal reasons.

Now, if I go out and need to borrow $50 million to start a factory to make widgets, that’s a productive debt and interest is appropriate, but if I want to go out and have a nice vacation, that’s entirely voluntary. I would personally argue you should never go on vacations without paying for it directly. The idea of borrowing money to go on vacation, that’s crazy, but people do it because they’re encouraged to and the banks encourage it. The banks say, “Well, gee, you can’t let us go under because where are you going to be then?” The banks are really saying, “What you need to do is let us survive and you should be our slaves.”

I think that’s a bad idea and I think that a lot of the stuff that’s going on in the United States, the anger goes back to people making less and less and less and working harder and harder and harder. Basically they’re debt slaves, and while they may have voluntarily put handcuffs on, they look around and say, “I couldn’t afford all that items I’ve been buying.”

Maurice Jackson: When I look at rush hour traffic and then I hear someone say they love their job, I often ask: “Why don’t you show up two hours early and stay two hours late and not get compensated for it?” The reason you have in my opinion rush hour traffic is what you just alluded to, you’re a slave. You must go to work, and the moment you get an opportunity to leave, everyone rushes to get out. They don’t really necessarily love what they’re doing, they’re slaves and they have to go to work to pay for that debt that you’re referring to.

Maurice Jackson: How much longer can this play out?

Bob Moriarty: Maybe another month or two.

Maurice Jackson: That’s short!

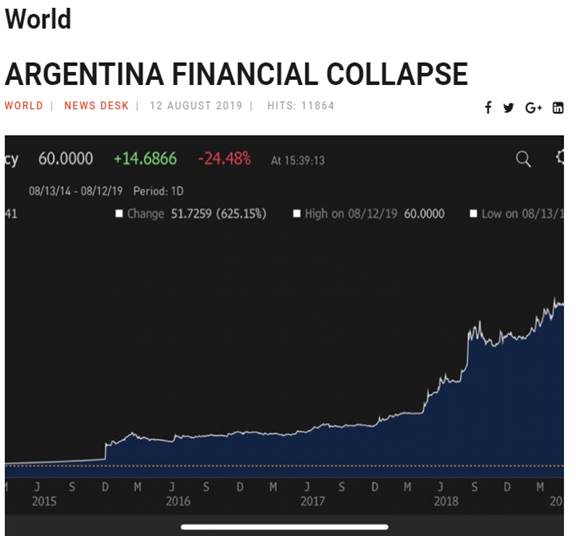

Bob Moriarty: We’ve been talking about this for months where I said that we were going to have a high in the stock market in August, and then we were going to go into a crash scenario in September/October. If you look around at China, if you look at India and Pakistan, if you look at the South China Sea, if you look at Korea and Japan, you look at the Middle East, the debt bomb is blowing up constantly and everywhere. There are so many black swans that you can’t see the sky anymore. It’s happening right now and I think that there’s going to be a liquidity issue and panic in September/October. The stock market right now is supported by nothing but hot air.

Maurice Jackson: All the comments that you were referring to, what you foresaw, just for our audience members, that wasn’t in the interview. Bob and I correspond on a weekly basis and yes, you’ve been spot on every time. We’ve addressed the challenge. What are some solutions?

Bob Moriarty: We need to let the banks go under. We need a debt reset. We need honest money and we need to start all over.

Maurice Jackson: What actions have you taken to prepare yourself for a great reset?

Bob Moriarty: I’m pretty much covered. I accept that in a general total collapse financially, which lots of people see coming, everybody is going to get hurt. Some people will get hurt less than others, so I’m not talking about, “Here’s what to invest in to make your fortune in the crash,” I’m saying, “Here’s what to invest in if you want to partially survive.” The most important thing, the most important asset anybody ever has is their brain. I don’t care what happens, I’ve still got my brain and I can still use it, but I keep silver, gold. I have no debt. You could see what’s happened with gold and silver lately, that isn’t the end of a rally, that’s just the start. People are going to go into gold, silver and platinum and palladium as the asset of last resort, the U.S. government is talking about taking U.S government debts negative.

Maurice Jackson: That’s unheard of.

Bob Moriarty: Do not confuse people in power with people who have sense. I have met and know a lot of people who are very powerful, very rich, and in government in a lot of cases, and you would be amazed at how stupid these people are.

Maurice Jackson: I second that one, and Bob, I would have to agree with you a hundred percent regarding this situation, that it will not end well. I also want to give kudos here. My family has benefited time and time again from a number of your predictions and speculations. Of the five precious metals, may I ask, what are you buying right now?

Bob Moriarty: The most important thing a person can do is to buy silver, and that’s not because it will go up the most. I think that platinum will go up the most, but to buy silver because you can buy silver in small quantities. I saw something on a chat board and a guy was arguing that you should be buying gold mining stocks because they will go up because they’re higher leverage than gold, and I thought, “He didn’t understand it.” The very first thing that you want to have in a financial crisis is survival, so physical gold and silver handy is a good idea.

The beauty about silver is that you can pay for a tank of gas with a couple of one ounce bars. You could buy silver without a substantial premium. Everybody has got a different idea of how much they need, but the financial system could be in lockdown mode for six months and you damn sure want to have access to cash money and the best cash money is gold.

Maurice Jackson: If I’m not mistaken, isn’t silver being manipulated? I had to throw that in there (laughs).

Bob Moriarty: I’ve been trying to come up with a list. My next book is going to be about financial instruments that I can guarantee are not manipulated, and I know it’s going to be a bestseller because everybody wants to know something that’s not manipulated. It’s going to be like a really short book. It’s going to be like one page and it’s going to be blank. Everything is manipulated and always will be. The people whining the loudest are trying to manipulate gold and silver themselves.

Maurice Jackson: We touched on gold; the current price right now at $1500. Is that the new floor? Or is this a head fake?

Bob Moriarty: Here’s what’s crazy. There’s a guy in Australia who puts out charts and he calls it Gold Charts R Us. He’s a very bright guy and he puts out charts and everything. He puts out a chart on eight different metals, and the funny thing is, if you go back to 1900, 1910, 1920, 1930, all the way through now, gold has gone up more in most of those timeframes. Now, there are some timeframes say from 1980 to 1985 where that wouldn’t be true because gold actually went down during that timeframe. However, the real key is that talking about the price of gold, if gold doubled in value because of the economic situation, shouldn’t copper and zinc and lead, shouldn’t they double, too? What you’re really talking about there is not the commodity, you’re talking about the currency in which it’s quoted.

Anytime you talk about price, you’re talking about two different things. You’re talking about gold and you’re talking about the value of the dollar. I believe there will be a rush out of currencies, including the dollar and when that happens you might as well quote gold in Zimbabwe dollars because you can’t. Quinton Hennigh and I came up with a system 10 years ago and you wouldn’t quote gold in dollars anymore or pounds or euros. You’d quote it in grams, and that makes infinitely more sense. A gram of gold is worth a gram of gold, and whether it’s a British gram or whether it’s a French gram or whether it was a Japanese gram, a gram of gold is worth a gram of gold.

We need to go back to something that works and what we have now clearly doesn’t work, and we need to come up with something better. A financial system based around gold would mean that politicians can’t spend money they don’t have and instead of quoting in dollars or pounds or yen, quote it in grams.

Maurice Jackson: That’s a very good point. Another source you and I both like is Jake Bernstein’s Daily Sentiment Index. What is that telling you about the gold price?

Bob Moriarty: It says it’s time for a correction.

Maurice Jackson: That’s very key for people to understand. That doesn’t mean that you’re expecting a crash, but it’s just time for a correction. I think sometimes we get over-exuberant. I just came back actually last week from Vancouver from the Sprott Natural Resource Symposium and you could certainly feel the energy in the room because the gold price was at a six-year high and a hundred dollars even higher now. When you have a price move that fast, you should expect a correction. That’s very responsible, so thank you for sharing that.

Moving on to junior mining companies. Which ones have your attention at the moment?

Bob Moriarty: You’re going to hate me for this. The biggest piece of crap, crooked management, cheap stock under 10 cents.

Maurice Jackson: Well, that’s easy to find. That’s about 90% of the issuers out there, huh?

Bob Moriarty: You want the ones run by crooks because they’re going to go up the most. It really appears to me as if we have panic behind the curtains and since this is just starting, New Zealand dropped its interest rates half a percent and it was expected to drop a quarter percent. India dropped its interest rate half a percent and it was expected to drop a quarter percent. I think Taiwan dropped a quarter percent and it wasn’t expected to drop at all. This is the rush to the bottom and the thing to think about gold, silver, platinum, and palladium, it is a little, tiny space. When everybody tries to slip through that door at the same time, it’s going to get crowded. The beauty about gold mining companies, the juniors, is that you can take a stock that’s 6 cents today and you can make it $60 bucks a share if you want to. That absolutely could happen.

I’ll stick with my prediction. I’ve got it in writing a number of times. We’re going to have a crash this fall. I think this is the start of the big one and we’re going to see panic in markets.

Maurice Jackson: Well, for a speculator like myself, I look forward for times like this because I’ve been stockpiling. Let’s talk about Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX).

Bob Moriarty: NOVO is going to surprise everybody. They got the goods. Quinton… it was absolutely proven there’s gold throughout the Pilbara. He has got this giant land position. He is coming up with stuff with Egina that surprises him. Now, I’m not going to quote grade because I don’t know what the grade is, but he has literally had to reinvent the wheel and come up with ways of measuring this alluvial floodplain. He has done a pretty good job and they’re coming up with some amazing stuff. They have figured out how to locate the high grade. I don’t know what the grade is. Every assay lab in the world is backed up. Takes two months to get assays now. However, they’re coming up with some very interesting stuff, to the extent that he has like four hundred square miles of ground. Novo, going to be a big hit.

Maurice Jackson: How about Irving Resources Inc. (IRV:CSE; IRVRF:OTCBB)?

Bob Moriarty: Oh, I love Irving. If you saw the rock that I had, you would be so jealous. You would hate me.

Maurice Jackson: Well, you and I were there together two years ago, actually.

Bob Moriarty, Brent Cook, Maurice Jackson – Irving Resources (Japan) Site Visit

Bob Moriarty: Yeah, we were there, but the rock that we saw two years ago was only worth about $25,000, and Quinton showed me some rock that was worth about $50,000. Nah-nah nah-nah nah-nah!

Maurice Jackson: I tell you, I’m jealous right now.

Bob Moriarty: You should be.

Maurice Jackson: The value proposition of Irving Resources, share it with us because I think it’s had an impressive move, but I don’t think it’s on everyone’s radar.

Bob Moriarty: Well, that’s just fine with me. It’s the tightest-held stock I’ve ever seen. 90% of the shares are in the hands of the top 15 shareholders. You couldn’t buy a million shares if you wanted to because it’s just flat not out there for sale. They have brilliant management. We were in and out of the main office and it was really funny to me because we’re in mud and 20 minutes later we’re back in the office tromping mud through the room. I’m thinking, “I’m wondering who is going to sweep this up?” I turned around and there is Akiko Levinson, president of the company, marvelous woman. She had a broom and she was sweeping up behind us. Now, if you ever go to a company and you find a company that the president of the company is willing to do the dirty work like sweeping the floor, that’s a company you want to invest in.

I talked to her, it’s really funny, Akiko is cheap. She squeezes every penny, and that’s a really wonderful thing. There are two companies operating in Japan. There’s Japan Gold and there is Irving. I’ve read the literature on both of them, seen Akiko, seen what Irving has, and one company that is spending $400,000 a year on salaries and the other company is spending $3 million a year on salaries. Now, which would you invest in?

Maurice Jackson: The one with prudent capital, which would have to be Irving Resources.

Bob Moriarty: Well, it gets better. While I was there, of course, Newmont has put I think 6 million into them and they’ve got the option of putting some more in higher prices down the road. They sent some of their top geophysical people from Australia to do a CSAMT survey for NOVO for free.

Newmont is so secure at what Irving has that they are literally donating the services of their top people. As a junior, you have to watch your money very carefully because most juniors state, “We’re going to do this first and then we’ll do this and then we’ll do this.” If you’re in Newmont or you’re Barrick or Goldcorp, you want to put your top technical people in there and do a lot of technical stuff first and then drill, but if you’re a junior, you better go out there and drill.

Irving has been drilling, but because of this two-month delay, they haven’t gotten their assays back. I’m going to tell you, the technical people that Newmont had were absolutely superb and they are given Quinton and Akiko some of the most valuable data that you could ever possibly want. Everybody agrees that Quinton’s theory of the gold-rich sinter is absolutely accurate and they know somewhere down there they’re going to tap into the feeders.

Maurice Jackson: For anyone not familiar with the name Akiko Levinson, please do your research. She is one of the more successful individuals in the natural resource base. Proven pedigree, first class act. She is just amazing. You hit the nail right on the head. That actually describes Akiko.

Bob Moriarty: She is great with a broom, too.

Maurice Jackson: Let’s talk about one more company, also affiliated with Dr. Quinton Hennigh, and that is Miramont Resources Corp. (MONT:CSE).

Bob Moriarty: Miramont right now is a work in progress. They have a project in Peru. There were great expectations for the project. There was one rotten drill program and how it was announced, but there were enough sniffs that it was worth putting some more money into the ground. The second drill program just simply didn’t come up with anything of any value. It would be a good project for a major with lots and lots of money that wants a big copper project, but a really dangerous project for a junior.

Quinton has put that on the back burner. The company has $3 million in cash. I know darn well that someday they’re going to figure out where they can put that $3 million that will be beneficial to the Miramont shareholders, but today Miramont has an enterprise value of about $3.5 million and they got $3 million in cash. The risk is near zero. They got six cents in cash and the stock is selling for 10 cents, and the Spanish term for that is it’s called “El Goodo Dealo.”

Maurice Jackson: Well said. How about Metallic Group of Companies headed by Greg Johnson?

Bob Moriarty: I like Greg a lot. Novagold was the first company that I wrote about and there were only I think four employees or five employees total, but they did great work, stock went from 9 cents a share U.S. to about $20 bucks a share. People made a lot of money if they had the sense to sell. Greg moved on. He actually has three companies in his stable now, a copper company, a silver company, and the platinum/palladium company. I think that all three companies will do well, but the beauty of it is it gives you the choice of the same management, but do I want to invest in silver? Or, do I want to invest in platinum? Or, do I want to invest in copper? All three companies are really solid companies and I think they will all do well.

Maurice Jackson: I share the same sentiment with you. Speaking of copper, how about Nevada Copper Corp. (NCU:TSX; NEVDF:OTC)? They’re going to up production here Q4 this year.

Bob Moriarty: That’s the dumbest story I’ve ever heard. They’re cashed up, they have excellent management. They have share structure under control. They’re going into production of a commodity that everybody accepts is way too cheap and you can’t give their shares away. Now, that situation is not going to last for long. The stock is absurdly cheap. I love the management. I love the plan. I was actually on that property I think three or four years ago and they were talking about, “We’re going to do this and we’re going to do this and we’re going to do this,” and they’ve done all of that. The really funny thing is, since I was there, all of their plans call for production of X pounds of copper a year, but I know damn well if they had extra money, they could drill off a lot more copper than they’ve got.

It’s a pure bet on a really highly leveraged copper play. If you think copper is ever going to be worth anything, it’s a great company to own.

Maurice Jackson: I’d have to agree. I was on the site visit there a year ago and I had an opportunity to meet Matt Gili, the CEO, and he has done a remarkable job there. Every timeline, he’s superseded that and the results are just magnificent of what is going to happen here with Nevada Copper.

One last company, Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTCQB).

Bob Moriarty: They had a great drill hole. Stock shoots higher. They raise some money. They release some more drill holes that were only average and the stock plummeted, but clearly they are in a good district, good management, money in the bank, and I think they’ll be fine. The drill, it’s called the truth detector, or the lie detector. Sometimes you hit, sometimes you don’t. I think Aben is going to be a hit.

Maurice Jackson: The CEO there is James Pettit and he is doing a remarkable job as well, and they’re also in the Golden Triangle, British Columbia.

In closing, Bob, we referenced one of your number one-selling books, “Basic Investing in Resource Stocks,” but you also have another book that is a household favorite in the Jackson family. My nine-year-old twin son Braden has been reading it now for over a year, which is entitled “Nobody Knows Anything.” Ladies and gentlemen, you may purchase both of these books on our education tab.

We do not benefit financially from your purchase, but we have benefited financially from the content, and I want to foot stomp. You owe it to yourself and your family to get a copy. Each member in my family has their own copy. Bob, is there anything you want to share about those books? Or have I said enough?

Bob Moriarty: Actually, you left one thing out. How long has your son been reading the book?

Maurice Jackson: He’s been reading it for one year, sir.

Bob Moriarty: You might want to sign him up for a speed reading course.

Maurice Jackson: Yes, you’re right, because this is the critical age.

Bob Moriarty: No, if it takes a year to read the book. I may have made it a little too complicated.

Maurice Jackson: Oh, no. He’s re-read it. I’m sorry. He recycles it. He really likes the content. Just to give you a quick example here, we were kind of stuck in some traffic coming home from a weekend trip and he said, “Dad, why don’t we take an exit here and stop being part of the herd? That’s what Bob Moriarty would say.” Lo and behold, we took the exit and I said, “That’s pretty smart thinking, son.” We got home right on time as if we would have stayed on the main highway there had there been no traffic jam. He employs the contrarian point of view and his vocabulary is such of that of someone who has read the book, and he is actually doing his very book to employ the strategies. He was asking me yesterday about market capitalization of some companies. I was like, “Way to go, son.” That’s what I’m talking about.

Mr. Brayden Jackson: “Way to Go, Son!”

Bob Moriarty: That gives me more satisfaction. The reviews from the last book are really quite incredible. Amazon USA, there were 31 five-star ratings out of 31, which is the highest rated book that I’ve ever seen, and if you read the reviews, you realize people have got a lot out of the book. More than anything, I want to encourage young people to learn to think for themselves. This isn’t rocket science. This isn’t difficult. We have access to far more information than we have ever had before in all of history and if you use that information wisely and with some logic, you can do quite well. I love the junior space. People can succeed and they can take a company from a $6 million market cap to a $60 million market cap with one drill hole. Where can you do that?

Maurice Jackson: Well, he’d love to hear that because, again, he was asking me about market capitalization and the calculation for it yesterday.

Sir, before we close, last question. What did I forget to ask?

Barbara Moriarty: The latest fake news, 321Gold is going to buy Deutsche Bank.

Maurice Jackson: I caught part of that. Could you restate that, please?

Bob Moriarty: Barbara says: “The latest fake news is 321Gold is going to buy Deutsche Bank.” That is absolutely fake news. You couldn’t give me Deutsche Bank.

Maurice Jackson: I could see you buying them for one ounce of gold. Correction one ounce of silver.

Bob Moriarty: You’d waste one ounce of gold or silver. Do you understand the basic difference between an asset and a liability? Deutsche Bank is a liability.

Maurice Jackson: You certainly don’t want a liability, so then I could see you walking away from that. Ladies and gentlemen, if you do see that on the headline news, that would be fake news.

Bob, for someone that wants to get more information on your work, please share the websites.

Bob Moriarty: 321Gold and 321Energy, and all you have to do is put my name in at Amazon and it will bring up half a dozen books that I’ve written.

Maurice Jackson: Before you make your next bullion purchase, make sure you call me. I’m your licensed representative for Miles Franklin Precious Metals Investments. We provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs, and private blockchain-distributed ledger technology. Call me directly at 855-505-1900 or you may email, maurice@milesfranklin.com.

Finally, please subscribe to provenandprobable.com for Mining Insights and Bullion Sales.

Bob Moriarty of 321Gold and 321Energy.com, thank you for joining us today on Proven and Probable.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Miramont Resources, Irving Resources, Novo Resources, Aben Resources, Nevada Copper, Granite Creek Copper, Group Ten Metals and Metallic Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Miramont Resources, Irving Resources, Novo Resources, Aben Resources, Nevada Copper, Granite Creek Copper, Group Ten Metals and Metallic Minerals are sponsors of 321 Gold and/or 321 Energy.

2) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Miramont Resources, Irving Resources, Novo Resources, Aben Resources, Nevada Copper, Granite Creek Copper, Group Ten Metals and Metallic Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Miramont Resources, Irving Resources, Novo Resources, Aben Resources, Nevada Copper, Granite Creek Copper, Group Ten Metals and Metallic Minerals are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Aben Resources, Group Ten Metals, Granite Creek Copper and Metallic Minerals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aben Resources, Group Ten Metals, Granite Creek Copper and Metallic Minerals. Please click here for more information.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources, Miramont Resources, Aben Resources, Granite Creek Copper, Group Ten Metals, Metallic Minerals and Newmont Goldcorp, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

( Companies Mentioned: ABN:TSX.V; ABNAF:OTCQB,

GCX:TSX.V,

PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE,

IRV:CSE; IRVRF:OTCBB,

MMG:TSX.V; MMNGF:OTCMKTS,

MONT:CSE,

NCU:TSX; NEVDF:OTC,

NVO:TSX.V; NSRPF:OTCQX,

)