Source: Maurice Jackson for Streetwise Reports 08/16/2019

Roger Moss, CEO of Labrador Gold, sits down with Maurice Jackson of Proven and Probable to discuss his company’s exploration efforts in Labrador.

Maurice Jackson: Joining us for conversation is Roger Moss, the president, director, and CEO of Labrador Gold Corp. (LAB:TSX; NKOSF:OTCQX).

Glad to have you on the program to share the value proposition before us in Labrador Gold. We have a lot of ground to cover today but before we begin, Dr. Moss, please introduce us to Labrador Gold and what is the opportunity you present to the market?

Roger Moss: Well, I think as the name implies, we are a junior mining company. We’re exploring for gold in Labrador. Labrador is part of a province on the eastern seaboard of Canada. It’s an area that has seen exploration in the past, but not for gold to any significant degree. So that’s one of the key factors for us is that looking for gold in under-explored terrains, where we have a good chance to find not just a gold deposit, but potentially a whole district.

Myself and Sean Ryan, who is our technical consultant, between the two of us we have a lot of experience in gold exploration and specifically in discovery of gold deposits. Sean, with his discoveries up in the Yukon on the other side of Canada and myself in Namibia when I was working with Anglo-American back in the in the early ’80s.

So I think that we have great properties in a good jurisdiction, that Labrador is very mining friendly, and it’s politically stable, which of course is very, very important for investors to know, concerning the companies that they’re investing in. So I think we have the properties, we have the people, and we have the jurisdiction, which is a pretty good start.

Maurice Jackson: You referenced one of the merits of Labrador Gold and that is in you’re in a safe jurisdiction, which is Canada. Dr. Moss, takes us to the region of Labrador and provide us with some historical context.

Roger Moss: Labrador, it’s had quite a long history of exploration and mining. Going back to the large iron ore discoveries and subsequent mines in Labrador, in the western Pipe Labrador, significant iron ore mines, which are still operating today. And that’s been going on since the early 1950s.

More recently we had a major copper nickel discovery at Voisey’s Bay in the early ’90s that sparked off an incredible staking rush where junior mining companies came in and staked a large part of Labrador, looking for more of the same kind of nickel and copper deposits.

And then finally, in the 2000s we had another rush for uranium and during that rush there was a small uranium deposit found, which is still not yet in production. So, we’ve had our share of major exploration periods but what you will have noticed is that none of those were really targeted towards gold. So there hasn’t been a sustained exploration for gold mineralization in Labrador to date.

Maurice Jackson: And speaking of gold, why does Labrador Gold have confidence in the probability of finding the next great discovery here?

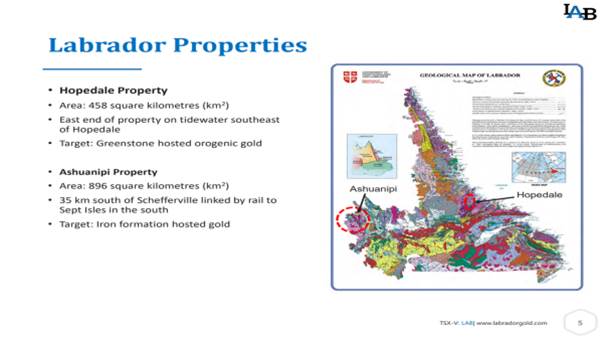

Roger Moss: Well, I think part of it is because there has been so little exploration done in the past. We believe that the two projects that we have are very, very prospective with respect for gold. We expect to find a gold deposit but there’s also the chance that, because of the circumstances, we may actually find a gold district. And I can get into that a little bit more later but right now what we have is we’ve got two projects with gold anomalies, that’s gold in rocks or gold in soils, over tens of kilometers. And that’s really the district scale that we’re looking for.

Maurice Jackson: Let’s visit your project portfolio and take us to your flagship Hopedale Project and introduce us to the potential we have before us.

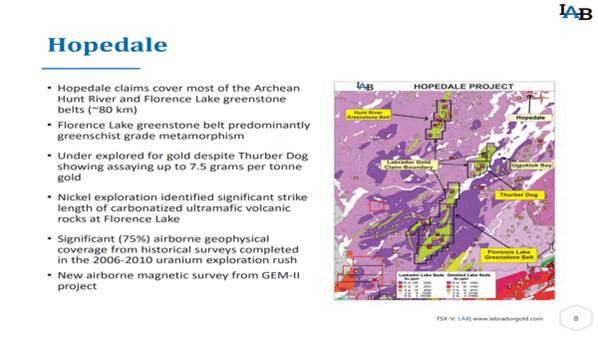

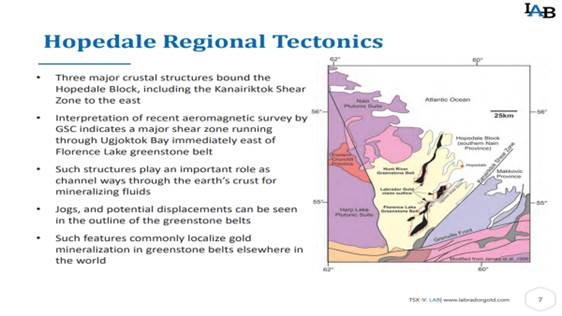

Roger Moss: Hopedale is a great example of what I was just talking about, the district scale. The Hopedale Project consists of basically licenses and claims that cover two greenstone belts, 90% of the two greenstone belts, the Hunt River Greenstone Belt and the Florence Lake Greenstone Belt. And greenstone belts are incredibly prolific hosts of gold mineralization in Canada and elsewhere in the world. And most of our work has been targeted towards the Florence Lake Greenstone Belt to date because that appears to be the most prospective from our initial work. And so we’ve now have approximately 50 kilometers of strike length, which has excellent prospectivity for gold.

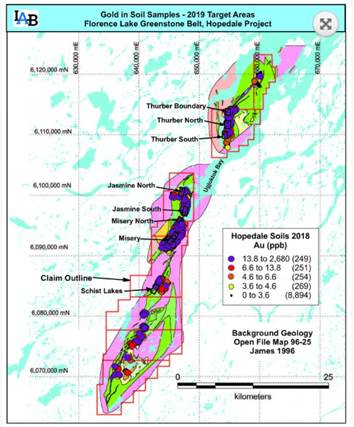

That’s what we’ve been targeting and our targeting has really been focused on where along that 50 kilometer length are the best areas for us to really explore intensively to find that gold deposit. Now as I mentioned, we are looking at districts scale. 50 kilometers is a lot of ground to cover. We have anomalies all along that 50 kilometer length, they’re associated with geological contacts, which is typical of gold deposits in greenstone belts, so we’re very encouraged that this belt has the potential to provide not just a gold deposit, but potentially a gold district.

Maurice Jackson: The company has taken a systematic approach to gold exploration. Walk us through the process and share some of the results.

Roger Moss: The systematic approach is based on what our technical consultant Sean Ryan has done up in the Yukon. He’s had a lot of success up there as I mentioned earlier, and his work really revolves around taking these large areas and narrowing them down systematically. And there are only a few ways you can do that.

One way is to use airborne geophysics to look at where the structures might be on the ground and the other way is to use geochemistry and different types of sampling media that will get you into the area that you want to be in to focus your efforts. And the key here is to get to that area quickly and effectively. And both Sean and I have had really good success with using soil geochemistry, soil sampling, going from a very regional scale onto a very detailed scale to home in on the areas that have the best gold potential.

So that’s really the way that we’ve been working in the Florence Lake Greenstone Belt. Of course geology comes into it. We have used the airborne geophysics that’s available to us. So, these things also come into it but it’s really the geochemistry and the soil samples in particular that enable us to narrow down that 50 kilometer strike length to areas that have the highest potential.

Maurice Jackson: Is Labrador Gold actively drilling there now?

Roger Moss: No, not right now. We have been exploring over the last two years and, as I mentioned, our strategy is to systematically reduce the areas that we want to focus on. And, of course, when you get to the point where you’re drilling, you have to be very focused.

So what we’re doing this year, right now in fact, is we’re looking at eight areas that we have picked out from that 50 kilometer strike length and we’re focused on those areas. And out of those eight areas, we expect to find targets that we will be able to drill. We will be drilling later on in this season or early next season and it’ll be one or more of those eight targets that we’ll be drilling.

Maurice Jackson: You reference greenstone belts. Why are they important to this discussion?

Roger Moss: I’m a big fan of greenstone belts. I’ve worked quite a bit on greenstone belts in Canada, in Northern Ontario and in Quebec. And people in Canada understand them. They know what to look for when they’re investing in greenstone belts or companies exploring greenstone belts. And the reason for that is that in Canada, for example, the Abitibi Greenstone Belt in Ontario and Quebec has production and resources of over 200 million ounces, which is incredible. I mean it’s a large area, but still 200 million ounces is significant.

And one part of that greenstone belt, a small part of it, the Larder Lake gold camp, has produced about 14 and a half, 15 million ounces. And that footprint of that Larder Lake gold camp would fit in to the northern part of the Florence Lake Greenstone Belt. So again, we have similar rocks, we have gold mineralization, and we have the signs for not only a gold deposit, but for a gold district. So that’s why, to me, gold deposits in greenstone belts are so interesting.

Maurice Jackson: Let’s discuss some important topics germane to the Hopedale Project. Beginning with reversionary interests, are there any on the Hopedale Project?

Roger Moss: Yes, there are. Our partner Sean staked the ground, so we have an option from Sean. We are in the second year of four years, after which we would own 100% subject to a 2% royalty that Sean retains.

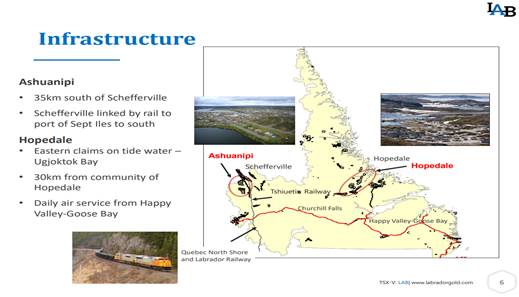

Maurice Jackson: We’re going to get into some numbers later in this discussion, but from a capital expenditure standpoint, how is infrastructure on your project?

Roger Moss: Well, the infrastructure is actually pretty good. Most people when they think of Labrador and until recently, myself included, would consider that it’s way out in the middle of nowhere. But in the Hopedale Project, the greenstone belt lies along the eastern part of a bay which comes in from the Atlantic. So we are right on tidewater. Which obviously if you have a mine, or even an advanced project, is a huge plus because you can bring in supplies, fuel, equipment by boat rather than having to fly everything in to the camp or to the project.

So I think that while there are no roads, we do have that ability to bring equipment in and ship material out along that bay, which is right at, connects right to the Atlantic. So I think looking down the road, if we are successful there, any kind of mining project would be able to get the product out pretty easily.

Maurice Jackson: What is your relationship with First Nations?

Roger Moss: Our relationship with the First Nations is good. Right now of course our exploration is still in the early stage so there are no real bones of contention that come up at this point. But we do have a good relationship. We keep them informed of what we’re doing, we give them the results of what we’ve done. I usually go up to the community, give them a presentation both before and after each field season. And they’re generally very supportive.

We try as much as we can, despite being early-stage exploration, to hire the locals and they are appreciative of that. And also in the case of the Hopedale Project, we deal with the Nunatsiavut Government, which is a self-governing Inuit government. And that’s really good because we can also then hire some of their companies to do the support work for our exploration. So overall, yes. Very good relations.

Maurice Jackson: Are you fully permitted?

Roger Moss: Yes. We have to permit each year, prior to undertaking exploration. And again in the case of Hopedale, not only do we have to get permits from the Newfoundland and Labrador Department of Natural Resources, but also from the Nunatsiavut Government. And they are quite rigorous but we have all the permits that we need for this year.

Maurice Jackson: Is the ultimate goal for Labrador Gold to build a mine or make a discovery and then sell the Hopedale Project?

Roger Moss: Well as you can tell, we’re really explorers and not miners. I’ve never been involved in mining, I’ve always been an explorer throughout my career. And I think that companies can get into trouble if they switch from doing pure exploration and get into development and mining. So our ultimate goal would be to make a discovery and then advance it to the point where a gold mining company would be interested in taking it over. So yes, that’s the goal.

Maurice Jackson: We’ve discussed the good, let’s address the bad. What can go wrong and what is your action plan to mitigate that wrong?

Roger Moss: Well, I guess despite our best efforts, we could come up short and not find a gold deposit or even a significant gold mineralization. So that’s probably the worst case scenario. And, but in order to try and mitigate that, we have what I’ve laid out as our systematic exploration programs.

So we plan the program in such a way that at the end of each stage we can analyze the results and decide on whether to proceed or to leave it. And I think that’s important because if things aren’t turning out as well as you would like, you have to be willing to let it go sooner rather than later. There’s nothing worse than then holding onto a dead project for too long. So I think that both Sean and I and have the discipline to be able to do that. Obviously we still believe that we’re going to find something in Labrador. And I think that our exploration, as we’ve done to date, is still leading us that way.

And we’ll keep doing that. And, but if it does turn bad, we’ll be the first to say, “Okay we need to move on.” So I think it’s a discipline that one needs in order to assess the project, the stage that they’re at, and to make the decision unemotionally stay or move on.

Maurice Jackson: And I would add to that there’s nothing worse than an ego.

Roger Moss: Yes, I mean I think both Sean and I are fairly fortunate. We work well together and we don’t have too much ego, at least not that comes into decision making regarding our exploration.

Maurice Jackson: Switching gears, let’s discuss the people responsible for increasing shareholder value. Dr. Moss, please introduce us to your board of directors.

Roger Moss: We have four people on the board, in addition to myself. And they have diverse backgrounds. Jim Borland is well known in the mining industry here in Canada. He was the editor of The Northern Miner newspaper for a long time. He’s been leading junior mining companies in management positions and been on the board of directors of many junior mining companies and is currently actively involved with the Prospectors and Developers Association of Canada, who many of your readers may know put on the very popular PDAC conference every year in March, here in Toronto.

Trevor Boyd is an exploration geologist who I’ve known since we were at university together here in Toronto. He has a lot of experience in Canada and especially in greenstone belts, so he’s a very precious, precious addition to our board in that he’s available for me to bounce ideas off and I certainly take advantage of that. And I’ve also had Trevor out in the field looking at the rocks and getting his take on what they look like.

Then we have what I would call up two young guns, Leo Karabelas and Kai Hoffmann. Both of them are entrepreneurs in the mining industry. They have lots of experience in marketing in the mining industry and they help us in that respect. Kai, of course, is probably well known to some of your listeners as a speaker at a many mining and exploration conferences. And he also has a company called Soar Financial, which does a lot of marketing, a lot of putting together financial information, and especially with respect to the mining industry. So I think between the five of us, it’s a very rounded board and one that’s certainly focused on delivering value to our shareholders.

Maurice Jackson: Who is Dr. Roger Moss and what makes him qualified for the task at hand?

Roger Moss: Well, I’m an exploration geologist, as I mentioned. I’ve been involved in the mining industry for some time and worked worldwide. And as I mentioned earlier, we involved in the discovery of the Navachab gold deposit in Namibia, which went into production in 1994, I think, and it’s still in production now. It’s a multimillion ounce deposit and one that I’m proud to have been a part of.

I’ve also been involved in senior management of junior mining companies probably for the last 18 years or so and I’ve seen a lot of rocks and I think that’s one thing that you want in, certainly in a geologist. And to be able to have a good sense of what makes a project and what doesn’t. And really I think those are my main qualifications. The experience in both geology and in management positions of junior mining companies I think is really what I bring to the table.

Maurice Jackson: Who is on your management team and what skill sets do they bring to Labrador Gold?

Roger Moss: Our management team is a very small. It’s just myself, as president and CEO, and Aurora Davidson, the CFO. Aurora is a chartered accountant. She has significant experience in the mining industry and both in junior mining companies and in producing mining companies. And so she’s a great asset and makes sure that all our accounts and spending is on track and not going to go awry.

Maurice Jackson: Who do you have on your technical team?

Roger Moss: Well, I think I mentioned both Trevor and Sean already and so that’s basically the three of us. Sean and I generally work together to put together our exploration programs each year. Sean obviously has a lot of experience on the soil sampling side, but he’s also very good at thinking outside the box. I know that’s a cliché term, but he really does. And he comes up with innovative ways to advance exploration to the point where we can make that decision. So instead of going through the normal procedure, if there’s a way to get to the answer quicker, then Sean usually manages to come up with it. So it’s been great working with Sean.

As I mentioned myself, I’m more in the geological and on the geological side. So putting in the geological context. And I think the three of us together, Sean and I are doing the planning, Trevor reviewing the plans, adding his comments, I think that it’s a really good technical board and I think that’s why we’ve seen the success that we’ve had to date.

Maurice Jackson: Let’s get into some numbers. Please share the capital structure for Labrador Gold.

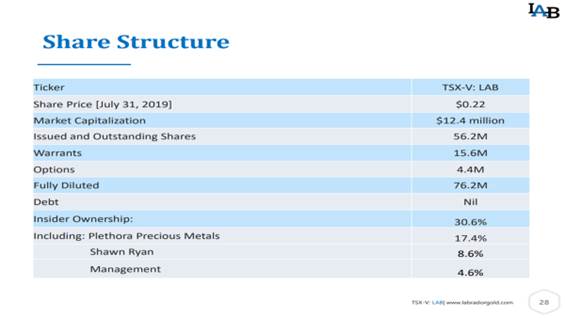

Roger Moss: Right now we’re sitting at 56 million shares outstanding. We have just over 15 million warrants, about four and a half million options, so we’re looking at about 75 million shares fully diluted.

Maurice Jackson: How much cash and cash equivalents do you have?

Roger Moss: Right now we have on the order of about CA$900,000. All the prices are in Canadian dollars, by the way.

Maurice Jackson: How much debt do you have?

Roger Moss: No debt.

Maurice Jackson: What is your burn rate?

Roger Moss: Our burn rate is on the order of $15,000 to $20,000 a month. It’s pretty lean. We keep it that way and we’re very fortunate that we can get it down that low. Me, being a geologist, I like to see as much money going into the ground as possible because that’s really what we’re trying to do here. We’re trying to invest in putting money into the ground and finding a deposit.

Maurice Jackson: Who are your major shareholders?

Roger Moss: Our major shareholder would be Plethora Precious Metals Fund. They’re based in the Netherlands and they own about 17% of the company. They’re very supportive, they’ve been shareholders for now for probably five or so years. They were very helpful in getting Labrador Gold started and introducing Sean and myself, so they’ve been a big part in how Labrador Gold looks today.

We also have some large high-net-worth investors and together they control about 35% and they’re also very supportive of our strategy. They like what we’re doing and they like the systematic way that we are, that we’re going about the exploration.

Maurice Jackson: How about management? How much do they own?

Roger Moss: Management probably owns about 4%.

Maurice Jackson: And what is the float?

Roger Moss: Well when you add it all up and subtract the remainder, we have about 35% in the float.

Maurice Jackson: Are there any redundant assets on the books that we should know about?

Roger Moss: Nope.

Maurice Jackson: Are there any change of control fees and if yes, what is the compensation?

Roger Moss: Yes, I have a change of control clause in my management contract and that’s equivalent to about six months of fees.

Maurice Jackson: Is management charging a consultant fee for any services?

Roger Moss: Yes, both the CFO and I charge consulting fees.

Maurice Jackson: Can you expand on that sir?

Roger Moss: Together we charge about $10,000 a month.

Maurice Jackson: In closing, multilayer question here, what is the next unanswered question for Labrador Gold? When can we expect a response and what determines success?

Roger Moss: Well, obviously the big question that we’re trying to answer is where is that significant gold deposit. And I think that the next step for us is we have to define the drill targets in order to get the draw on the property and test our theories, test the exploration that we’ve done to date. That work is underway right now. We expect results by the end of the month, let’s say end of August.

And success in that will allow us to undertake a drill program in the fall that should test one or more of those targets that come out of the current exploration. So, ultimately in order to discover that deposit, which is what we’re trying to do, we need to intersect some significant gold mineralization and drill program. So if we can do that, that will be success in my mind.

Maurice Jackson: What keeps you up at night that we don’t know about?

Roger Moss: Well, I sleep pretty well.

Maurice Jackson: Good.

Roger Moss: I’m not usually up at night. But one of the big things for me is always finding enough money to keep the exploration going. And I, as I said, we’re not big spenders on General & Administrative costs, but having significant exploration programs, that needs to be funded. So financing is always, always on my mind and I just want to make sure that we have the funds to be able to do the exploration that we need to do to find that deposit.

The other thing that, it doesn’t really keep me up at night but it’s something that I think about often, is the fact that a lot of the shareholders in Labrador Gold I know personally; they’ve been with us for a long, long time and so I don’t want to let them down. And so I want to make sure that what we’re doing as a company is going to generate returns for them.

Maurice Jackson: Dr. Moss, last question and that is what did I forget to ask?

Roger Moss: Well, I think it’s been pretty thorough. The only thing I would probably add is that, just mention the financing. And we will be doing a financing in the near term here to fund our ongoing exploration. And so we’ll be expecting to announce the terms of that financing soon. Other than that, I think your listeners have got a good introduction to Labrador Gold and our properties and I hope that they’ve got some information to think about.

Maurice Jackson: Well, Dr. Moss for someone listening that wants to get more information about Labrador Gold, please share the website address.

Roger Moss: Oh, it’s pretty simple, it’s www.labradorgold.com. And for those of you out there using social media, we’re also on Facebook and on Twitter at @LabGoldCorp.

Maurice Jackson: For direct inquiries, call (416) 704-8291 or you may email info@labradorgold.com.

Labrador Gold trades on the TSX.V: LAB | OTCQX: NKOSF.

Before you make your next bullion purchase, make sure you call me. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provided a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs, and private block chain distributed ledger technology.

Call me directly, at (855) 505-1900 or you may email maurice@milesfranklin.com. Finally, please subscribe to provenandprobable.com for mining insights and bullion sales.

Dr. Roger Moss of Labrador Gold, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a U.S. based media company that has a dual prong approach. The first prong identifies undervalued junior mining opportunities, conducts site visits around the world, and interviews CEOs of companies that are on major world stock exchanges and some of the most respected names in the natural resource space. The second prong, Proven and Probable is an independent licensed representative of Miles Franklin to sell physical precious metals in a number of options to expand a precious metals portfolio, offering physical delivery to home or business of gold, silver, platinum, palladium and rhodium, a fully insured offshore depository, as well as precious metals IRAs, and ledger private blockchain distributed ledger technology stored at the Royal Canadian Mint.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

( Companies Mentioned: LAB:TSX; NKOSF:OTCQX,

)