We analysed monthly gold exploration trends from January to June 2019 using data from the Mining Intelligence Data Application. The data used represents reporting companies listed on the following stock exchanges: TSX (+TSX-V), ASX, LSE (+LSE-AIM), NYSE, and JSE.

Mining Intelligence data indicates that old exploration activities have slowed down — to the lowest point since the beginning of 2019, and both the number of drilled projects and the number of completed drillholes have declined.

A shift towards exploration of advanced projects continued in June 2019, signalling that companies prefer to extend a resource base of existing mines and advanced projects rather than invest in much riskier early-stage drilling programs.

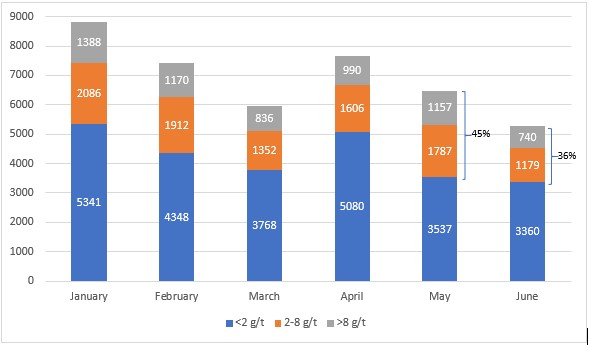

While not yet a

trend, there was a noticeable decline in the quality of drill results, with

mid- and high-grade gold intersections have fallen from 45% of their total

count in May 2019 to 36% in June 2019.

Despite a 6% month-on-month surge in gold prices achieved in June 2019, and overall optimism reviving across gold mining sector, companies are still very conservative when investing in drilling.

However, there is a good chance that gold exploration budgets will be adjusted in the second half of the year to keep up with the improved market conditions that can encourage miners, developers and explorers to take more long-term exploration risks.

Analysis

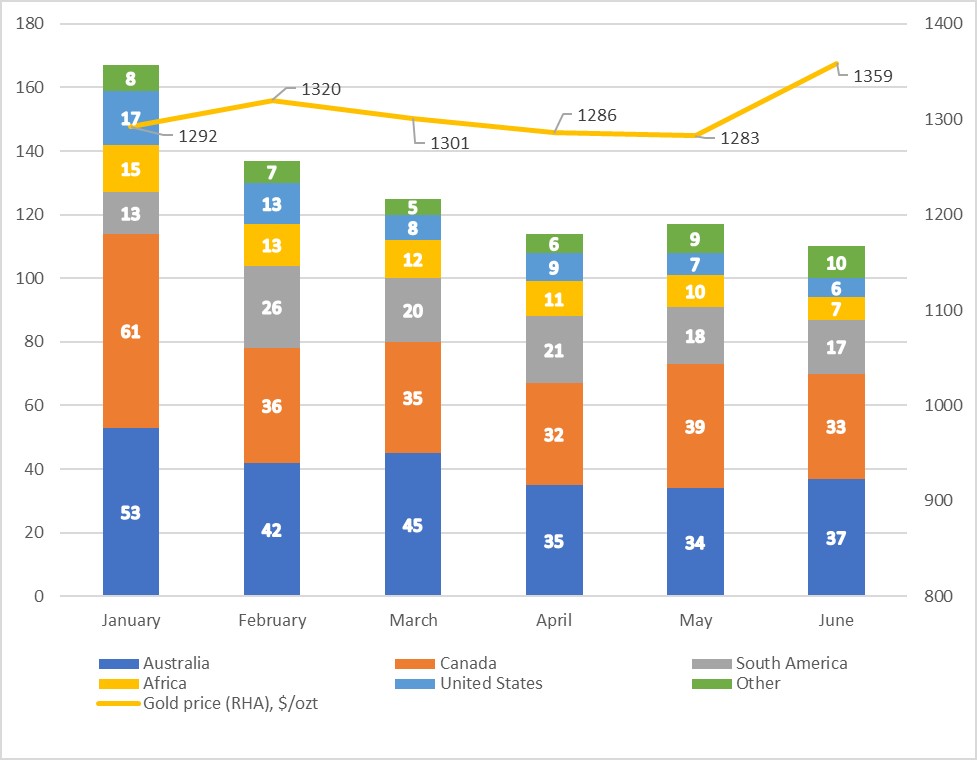

In June 2019, companies reported exploration results for 110 projects (Figure 1), which is the lowest count observed since the beginning of 2019. Australia was the leading country in terms of a number of projects drilled (37), followed by Canada (33) and South America (17).

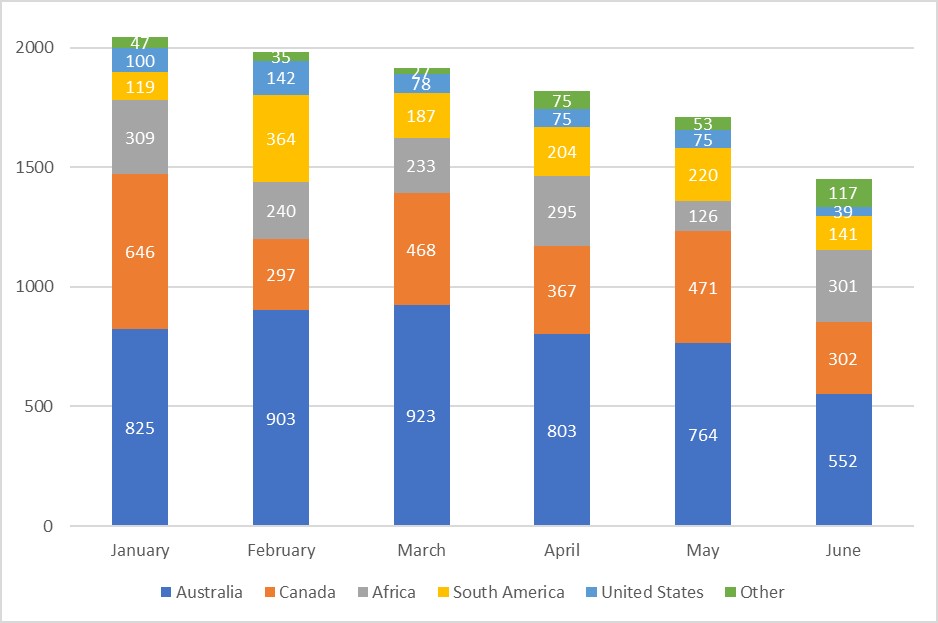

In June, companies reported results from 1,452 drillholes, which is the lowest number yet in 2019 (Figure 2). Amount of completed drillholes was down in all major regions except Africa, where it surged by 139%.

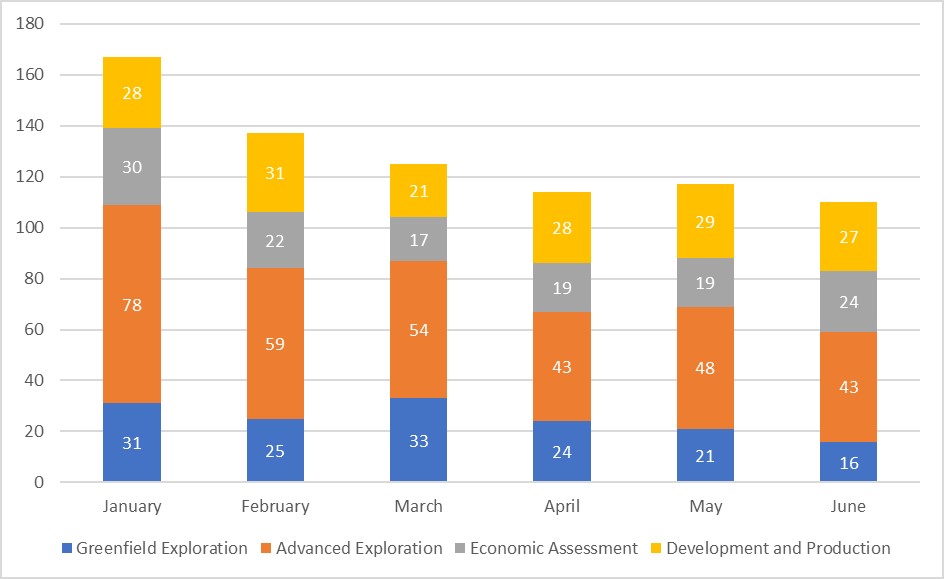

In June, early and

advanced exploration projects were still comprising the majority of total

projects drilled (59 out of 110 projects or 54%, Figure 3), but their share

dropped significantly from the height of 69% reached in March (87 out of 125

projects).

The number of greenfield

exploration projects drilled dropped from 33 in March to 16 in June, which is

the lowest level since the beginning of 2019.

Companies are still very prudent when allocating budgets to exploration campaigns and do prefer to extend resource base of existing mines and advanced projects rather than investing in much riskier early-stage drilling programs.

As for the quality of drill results, there was a noticeable decline in mid- and high-grade gold intersections that fell from 45% of their total count (2,944 out of 6,481) in May 2019 to 36% (1,919 out of 5,279 intersections) in June 2019 (Figure 4). Month-on-month deteriorated quality of gold exploration results is not yet a trend, but, if continued throughout the rest of the year, this could be a significant factor impacting both the gold market fundamentals and economic indicators of future mining projects as well.

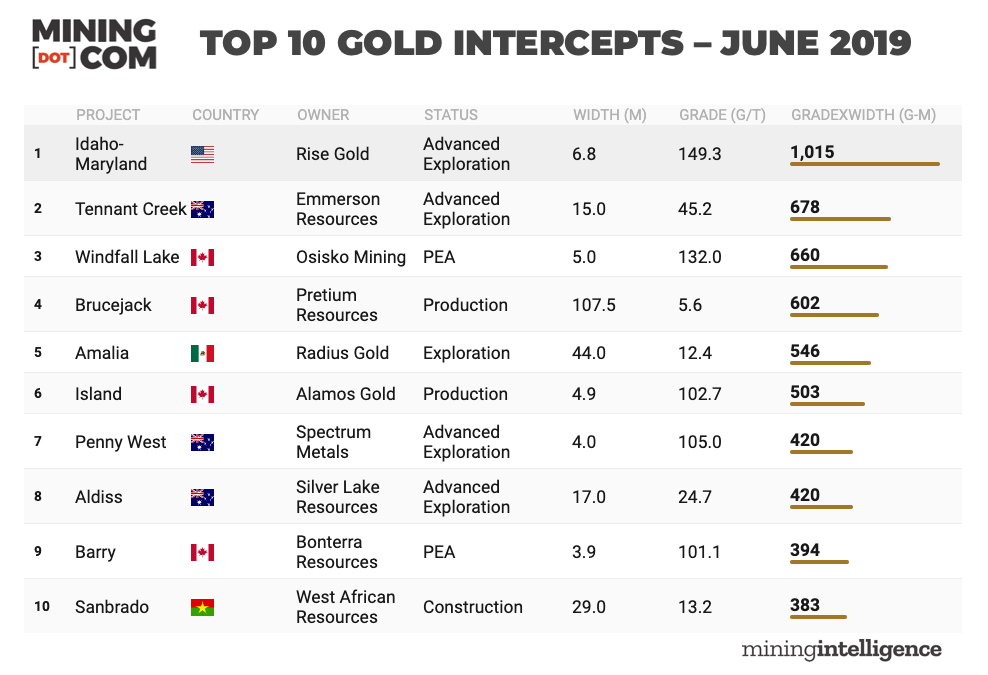

The following is the list of the top highest-grade gold

intersects in June 2019 measured in gram-meters, which is a powerful tool that can be used to compare

drill results released by different companies.

In cases where multiple

high-grade intersections were reported for an individual project during June,

only the best interval has been considered.

List of the top highest-grade gold intersects in June 2019, in gram-meters:

#1 Idaho-Maryland – 1,015 gram-meter

Rise Gold’s Idaho-Maryland project is a major past producing high-grade gold mine located near Grass Valley, California, USA. It produced a total of 2,414,000 oz gold with an average mill head grade of 0.50oz/ton (~17g/t) before being forced to shut down by the U.S. government in 1942. Rise Gold believes that Idaho is a Tier 1 gold deposit. Recent exploration drilling demonstrates continuation of bonanza-grade gold mineralization to depths of over 1 km below historic mine.

#2 Tennant Creek – 678 gram-meter

Emmerson Resources’ Tennant Creek Mineral Field is situated approximately 500km north of Alice Springs, Australia. Emmerson intersected bonanza gold grades in all diamond drill holes at Mauretania greenfield discovery. Recent drilling results from Mauretania have increased Emmerson’s confidence in the potential for economic mineralisation in both the shallow oxide and deeper primary gold zones.

#3 Windfall Lake – 660 gram-meter

Osisko Mining’s Windfall Lake project located in the Abitibi greenstone belt 700 kilometres north-northwest of Montréal, Canada. The Windfall Lake Mine Project is a proposed underground gold mine with preliminary assessed AISC of $704/ozt per year.

#4 Brucejack – 602 gram-meter

Pretium Resources’ Brucejack

Mine is a high-grade gold underground mine located in northwestern British

Columbia, approximately 65 kilometers north of Stewart. The mine began

commercial operation in July 2017. Gold production for 2018 was 376,012 ounces

of gold at all-in sustaining costs of $764 per ounce of gold sold. Proven and

Probable mineral reserves in the Valley of the Kings of 6.4 million ounces of

gold make Brucejack one of the biggest gold deposits in the world.

#5 Amalia – 546 gram-meter

Radius Gold’s Amalia Project is

located 25 km SW of the historic Guadalupe y Calvo mining district in Chihuahua,

Mexico. Radius geologists discovered high grade epithermal silver-gold

mineralization in several veins, vein breccias and disseminated zones over

3.5km of strike length and a 750m vertical interval following the trace of a

large regional fault zone. Radius believes the system is wide open and shows

potential for a significant discovery.

#6 Island – 503 gram-meter

Alamos Gold’s Island Gold is a long-life,

high-grade, low-cost underground gold mine located in Ontario, Canada. Island

Gold is one of Canada’s highest grade and lowest cost gold mines. The operation

is undergoing an expansion. The mine also has a large mineral resource base,

strong track record of resource conversion and significant ongoing exploration

potential with the deposit open laterally and at depth.

#7 Penny West – 420 gram-meter

Spectrum Metals’ Penny West project is located 25km south of Youanmi Mining Centre, Western Australia. Penny West is one of the highest-grade open-pit past-producing mines in WA in the modern era. Spectrum continues to expand the Penny North high-grade discovery.

#8 Aldiss – 420 gram-meter

Silver Lake Resources’ Aldiss camp

is third Mining Centre of the company at Mount Monger, Australia. Broad

high-grade gold lodes at Aldiss interpreted to continue down plunge, highly

encouraging for future underground potential.

#9 Barry – 394 gram-meter

Bonterra Resources’ Barry project

is a shear-hosted gold deposit located in Quebec, Canada. The gold

mineralization consists of disseminated sulfides within the shear zones and the

veins with local visible gold. In May 2019, a NI-43-101 mineral resource

estimate completed by SGS states 2,052,000 tons at 5.84 g/t Au for 385,000 Oz.

Au in the Indicated category and 2,740,000 tons at 5.14 g/t Au for 453,000 Oz

au in the Inferred category. The deposit remains open for expansion.

#10 Sanbrado – 383 gram-meter

West African Resources’ Sanbrado

is a high-grade gold project located 90km east-southeast of Ouagadougou, the

capital of Burkina Faso. West African Resources has recently commenced

construction of mine at Sanbrado and first gold is expected in 2020. Optimised

feasibility study revealed All-In Sustaining Costs of US$563/oz over first 5

years and US$633 /oz over life of mine.