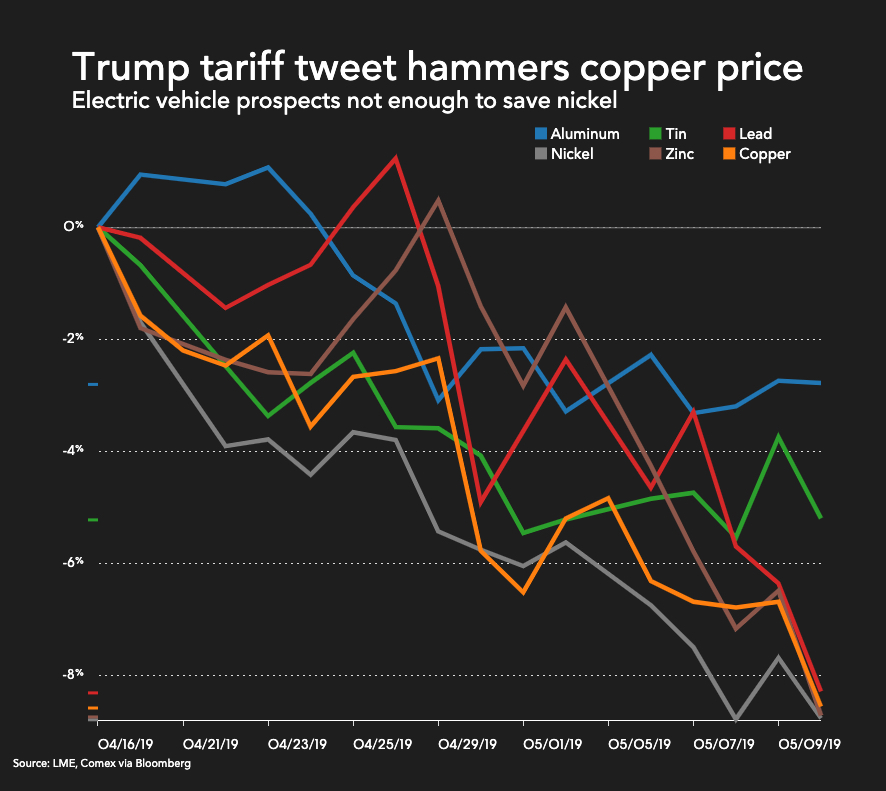

The price of copper was hammered on Friday amid an escalating trade war between the world’s two largest economies and a global economic slowdown.

In early afternoon trading in New York, copper for delivery in July touched a low of $2.5685 a pound ($5,660 a tonne), down 3.6% from Thursday’s settlement to its weakest point for 2019.

The chances of a compromise deal are remote given that China is unlikely to accept US demands for a fundamental change to its industrial policies

Caroline Bain, Chief Commodities Economist – Capital Economics

Copper is now trading 23% below levels seen June last year, technically placing the bellwether metal in a bear market.

US President Donald Trump said on Thursday he would impose an additional 10% tariff on $300 billion worth of Chinese imports starting September 1, meaning effectively all Chinese export are now subject to tariffs of at least 10%.

Chief commodities economist Caroline Bain of independent research firm Capital Economics says “the chances of a compromise deal are remote given that China is unlikely to accept US demands for a fundamental change to its industrial policies:

We anticipate that all Chinese exports to the US will be subject to a tariff of 25% by mid-2020.

While we forecast that a full-blown trade war would mean that the level of global GDP would be 0.5% lower than it would otherwise have been by end-2020, we think the impact on metals demand will be more severe, which is a key reason why we expect most metals prices to fall further this year.