Australia’s Lynas Corp (ASX: LYC) reported Monday a drop in sales revenue and production of rare earths due to ongoing trade tensions between China and the United States, which have negatively impacted Beijing’s demand.

The company, the world’s largest rare earths miner outside

China, noted it would continue to reserve production of neodymium and

praseodymium (NdPr) for its “strategic customers” given the volatile

conditions of market.

Last month, the miner announced it was stockpiling output amid concerns that Beijing was planning to stop exporting rare earths as a weapon against the US, which imports about 80% from China.

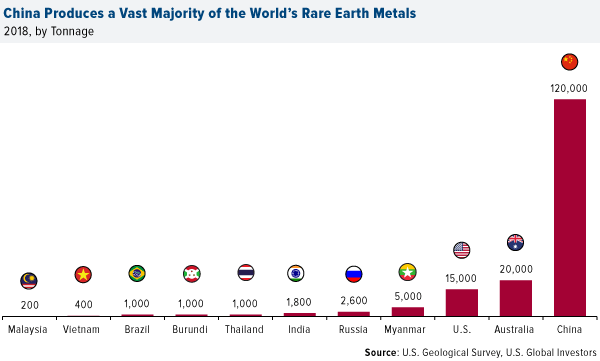

The nation has used its rare earths dominance to make a

political point in the past. It blocked exports to Japan after a maritime

dispute in 2010, though the consequent spike in prices triggered a race to

secure supplies elsewhere.

Experts believe that would be the risk again if Beijing

follows through with its threat of retaliation.

Breaking China’s dominance?

Media reports following Lynas publication of its June

quarter results say the company has set a “three-nation alliance” involving US

and Japanese companies to break China’s dominance in the rare earths sector.

According to the Nikkei Asian Review, the Australian miner and its partner, Texas-based Blue Line, will build a heavy rare earths separation facility in the US, which should begin operations by 2021.

Lynas has recently signed a revised loan agreement with its

Japanese backers, which extended their priority rights on production from 2025

to 2038. The deal also cleared the way for the company to self-fund its capital

works program by accumulating cash from operations.

The two agreements parallels the Asia-Pacific region’s security landscape, where the U.S., Japan and Australia are allied to confront China’s military expansion, the article noted.

Pending licence renewal

The miner, which extracts rare earths Western Australia to process

them in Malaysia, continues to sweat on a licence renewal for its

processing plant in country, where it has faced several issues related to the

storage of low-level radioactive waste.

Late last year, Malaysia’s Atomic Energy Licensing Board

(AELB) told Lynas it had to remove 450,000 tonnes waste stockpiled at the

local facility by Sept. 2., when the company’s licence is up for renewal.

It ended up committing in May to build a first-stage processing plant in one of two preferred sites in Western Australia, where its Mt Weld mine is located. Downstream processing, however, will continue to happen in Malaysia.

The Sydney-based miner noted the Southeastern Asian country’s

environment minister had told parliament conditions for the renewal would be

decided by Cabinet and announced mid-August.

Lynas

reported a 4.6% fall in revenue for the three months to June 30 to A$87.5 million ($60.5

million), lower than the A$91.7 million it earned in the same period last year.