Source: Maurice Jackson for Streetwise Reports 07/24/2019

In this interview with Maurice Jackson of Proven and Probable, the president and CEO of this royalty generator describes the business model and outlook for his firm.

Maurice Jackson: Joining us for a conversation is David Cole of EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American), the royalty generator. Mr. Cole, welcome to the show.

David Cole: Thank you, Maurice, always my pleasure.

Maurice Jackson: Always a delight to have EMX Royalty back on our program. Mr. Cole, we have a number of topics to address today, but before we begin, please introduce us to EMX Royalty, and the opportunity you present to the market.

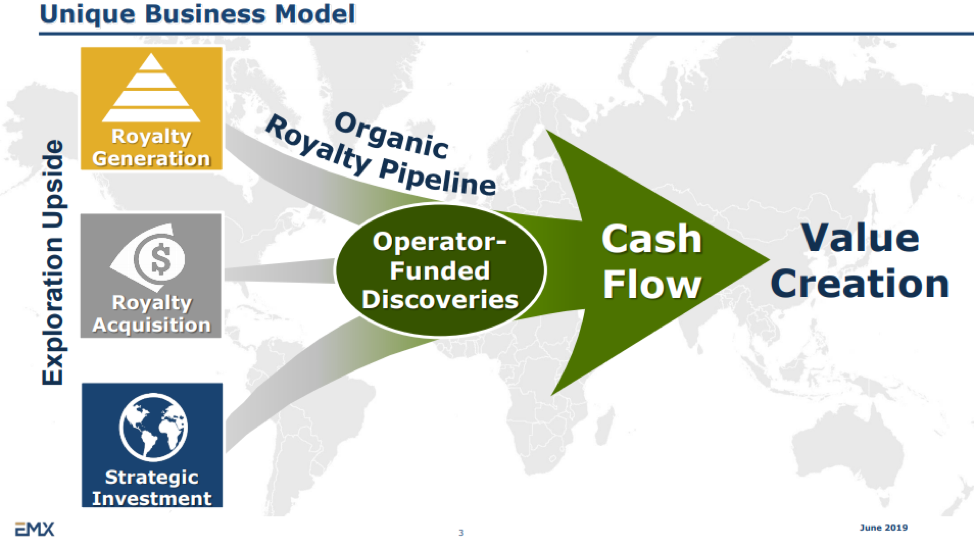

David Cole: You know what, Maurice? It really boils down to the fact that royalties are phenomenal financial instruments that provide optionality of commodity products movements into the future, as well as discovery optionality as those projects are advanced with counterparty funding. And the royalty holder benefits from that without experiencing the risks and the financial burden of investing in those assets.

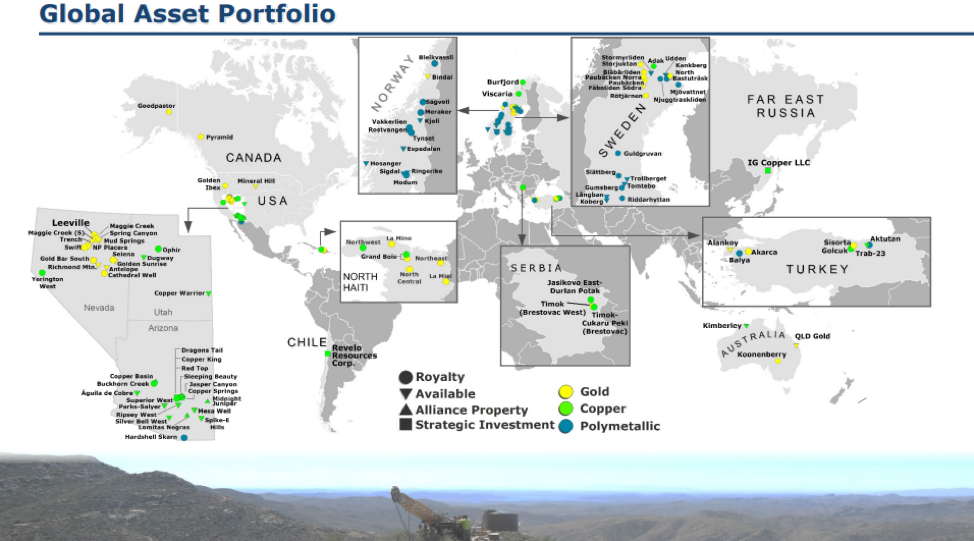

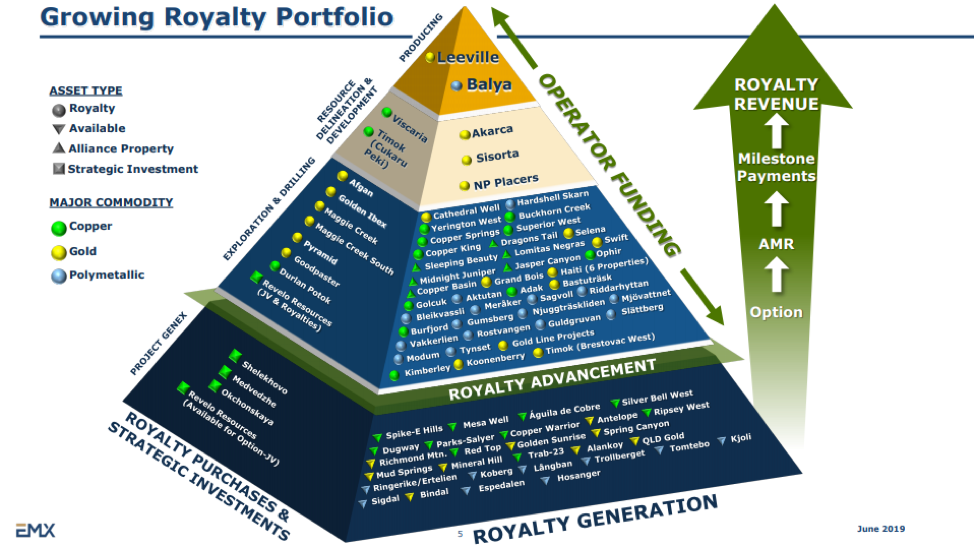

So we’d love to own royalties, and at EMX Royalty, we accumulate royalties. We do that through the prospect generation process, by acquiring prospective mineral rights and selling them on, and keeping royalties on those assets, in addition to outright buying royalties and royalty portfolios. We’ve been doing this for a decade and a half. We have royalties around the world.

Maurice Jackson: Let’s begin today’s discussion on the EMX Property Bank. In the past 18 months, EMX has sold or partnered off an unprecedented 30 properties, which is far more than any other company in the sector during this time period. How has EMX been able to accomplish this when so many other companies have a hard time partnering any of their properties at all?

David Cole: I believe that is an excellent number: We’re very proud of that number. The number of projects that we sell in a year is a key performance indicator (KPI) that we track here. It’s one of the things that drives us. It’s an indicator of our success in the organic growth of the company.

I would attribute the success to the quality of the team, but specifically to their entrepreneurial spirit and to their geological acumen. It’s just entrepreneurial juice combined with geological acumen. These guys are top-notch economic geologists who know how to go out and find and acquire prospective mineral rights, [and] add value by building economic geologic models.

[They can also] present that to an industry that’s hungry for prospect of mineral rights, and get those projects sold. We focus on everything from the early-stage generative work to paper in the final deal and negotiating the terms, and everything in between. We’ve been doing this for a long time, and it’s a good business.

Maurice Jackson: Last year, EMX hit a grand slam with the sale of the project in Russia. How does EMX Royalty expect to allocate the cash realized from the sale of the Malmyzh project? I want to know, specifically, how much cash will be allocated to property acquisition; how much to royalty acquisition? And how much is going to be applied to general and administrative (G&A) expense?

David Cole: Yeah, I get asked this question often. The bulk of our G&A includes the salary for the smart geologists around the world doing the generative work. And the bulk of the funding for the generative work all comes from current income coming in from advanced minimum royalty payments, production royalty payments, lease payments, share payments tied to property deals—all the different ways that we generate income.

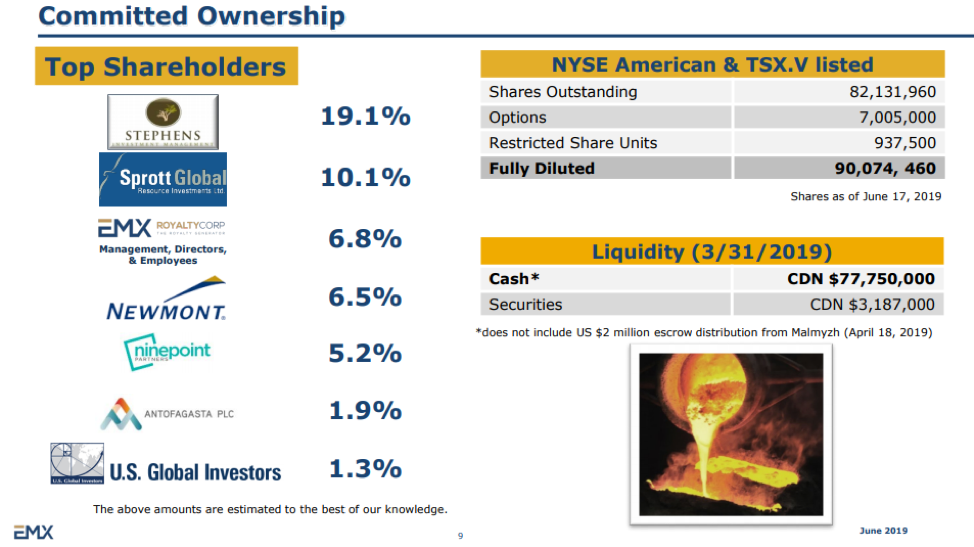

The super majority of the money that we have in the bank that’s resulted from the success in Russia is intended to be allocated toward cash-flowing royalties or streams. That’s a key focus of ours right now. We’re in an enviable position to have a substantial treasury. It’s over CA$70 million in the bank, no debt.

We’re being shown a plethora of opportunities, and we have the fail-fast team. [A] team of engineers and geologists and finance people and a great attorney are working through the opportunities that we’re being shown and quickly failing the ones that don’t meet our filter. It’s all about astute allocation of capital.

So, to specifically answer your question, the bulk of our ongoing business expanse in the organic growth that built this company is paid through the ongoing income streams that we have. And the money in the bank is earmarked for purchase of additional new cash flowing royalties and streams.

Maurice Jackson: How many projects are in the Property Bank?

David Cole: We have over 90. It’s got to be getting close to 100.

Maurice Jackson: How many active royalties does EMX have?

David Cole: Sixty-five.

Maurice Jackson: Let’s look at some numbers. Mr. Cole, please provide us with the current capital structure for EMX Royalty.

David Cole: We’ve been able to keep it quite tight over the years. It’s been a business for a decade and a half, 82 million shares issued and outstanding, 90 million fully diluted. Over CA$70 million in the bank, no debt.

Maurice Jackson: I’ve also noticed here, in the last a week or two, increased volume activity. What do you attribute that to?

David Cole: Smart money buying the stock.

Maurice Jackson: Couldn’t agree with you more than on that one, sir.

David Cole: Yeah, we know that to be the case.

Maurice Jackson: Multilayered question: Looking forward, what is the next unanswered question for EMX Royalty? When can we expect a response, and what determines success?

David Cole: Success is continued cash-flow growth, and that’s going to come from two places, Maurice. It’s going to come from organic growth of the existing portfolio as these assets move forward and continue to increase their cash flow. I’m very bullish about the existing portfolio. And it will come from the purchase of new cash-flowing assets from our treasury.

Maurice Jackson: Where do you see EMX Royalty in one year and in five years?

David Cole: Within five years, we should be half a billion to a billion-dollar company. And with substantial cash flow that will justify that market capitalization. I don’t intend for that to happen simply by willy-nilly issuing shares. We intend for that to happen through astute allocation of the capital that we have in the bank and continued growth emanating from the optionality of our existing portfolio.

Maurice Jackson: Does a sustained gold price of $1,400/ounce or above $1,400, I should say, change any strategies for EMX?

David Cole: For the most part, within the metal space we’re commodity agnostic, and we try not to get caught up in short-term moves in metal price. This is a long-term game. We believe that in the long-haul prospective, mineral rights go up in value. And we think that copper and gold are great commodities.

We’re happy to be in lead, zinc and silver as well. We’re happy to have exposure to cobalt and nickel—all good metals to have. But we don’t substantially change our strategy based upon a small or a large move in metal price.

We stay the course, acquire prospective mineral rights, add value by building economic geologic models, [and then] sell those on to an industry that’s hungry to acquire prospective mineral rights. And we always keep a royalty.

Maurice Jackson: Last question, sir. What did I forget to ask?

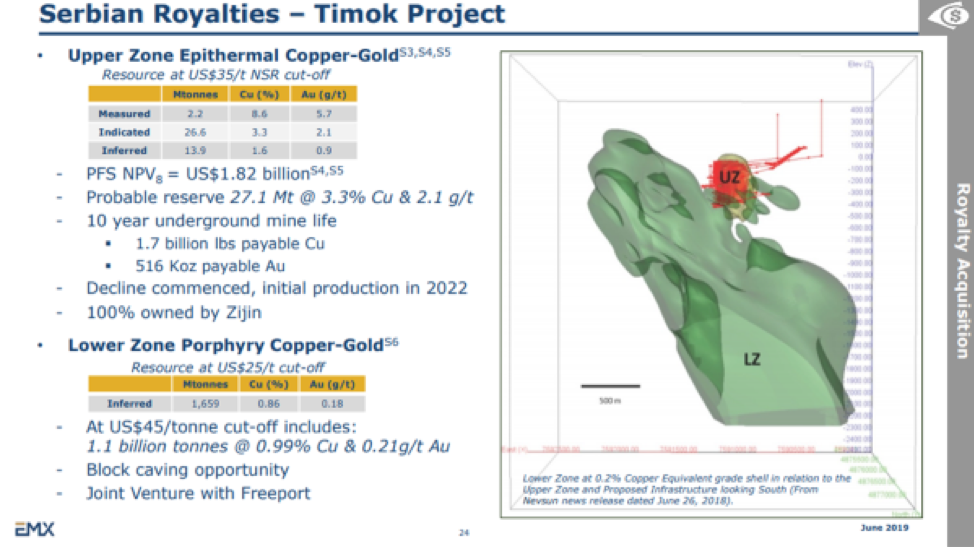

David Cole: It’s always fun to talk about one of the key projects that’s advanced in the portfolio. We could talk about the royalty on the Timok Project, which we’ve talked about before. That’s a company maker that’s embedded in the portfolio.

We’re very excited as that one continues to produce great results. They’re advancing the decline to develop the underground infrastructure to start production on that property in 2022. We’ve heard some rumors that they’re talking about actually bringing that into 2021, but let’s say 2022 for now.

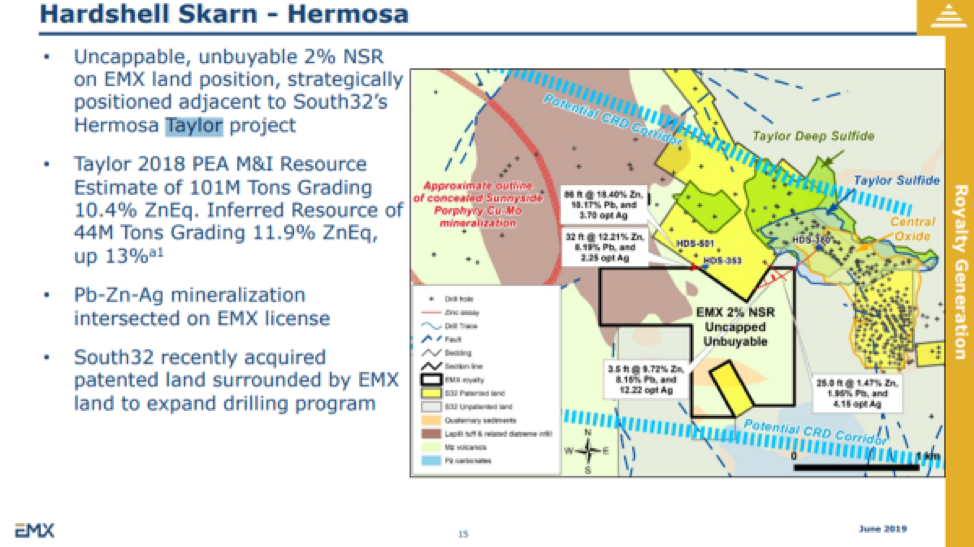

Another property that we’re very excited about is one [where] the counterparty is South32 Ltd. (S32:ASX) and it’s advancing the big Taylor lead/zinc/silver discovery in Arizona. We have a 2% royalty on a nice claim block that is the full extension. And the mineralization, high-grade mineralization, is completely open-ended onto our property and we’re very bullish about that one.

I’m hoping that we’ll see some strong drill results emanating from that project in the near future. South32 is a great operator, happy to have a key asset developing from our portfolio. It’s just a great example of the optionality embedded in our royalty portfolio, with dozens of counterparties out there working and spending money on our assets, not to our account, only to our benefit. The discovery that’s eminent on the Taylor extension property is a great example of that.

Maurice Jackson: Mr. Cole, if investors want to get more information on EMX Royalty, please share the website address.

David Cole: Emxroyalty.com.

Maurice Jackson: For direct inquiries, contact Scott Close at (303) 973-8585or you may e-mail sclose@emxroyalty.com. EMX Royalty trades on the TSX.V: EMX|NYSE: EMX.

Just for the record, for every bullion purchase I make this year, I’m matching with shares in EMX Royalty. EMX Royalty is a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed in today’s message.

As a reminder, I’m a licensed representative for Miles Franklin Precious Metals Investments. But we provide a number of options to expand your precious metals portfolio from physical delivery, off shore depositories, precious metal IRAs, and private blockchain-distributed ledger technology.

Call me directly at (855) 505-1900 or you may email maurice@milesfranklin.com. Finally, we invite you to visit provenandprobable.com, where we provide Mining Insights and Bullion Sales.

David Cole of EMX Royalty, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: EMX Royalty. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: EMX Royalty is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Millrock Resources and EMX Royalty, companies mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: EMX:TSX.V; EMX:NYSE.American,

)