Growing global demand for batteries that power electric vehicles (EVs) and high tech devices is set to cause a supply crunch of lithium, cobalt and nickel by mid-2020s, global consultancy Wood Mackenzie predicts.

The firm’s latest research shows

that sales of passenger EVs, including hybrid electric vehicles (HEV), jumped

by more than 24% last year. And while HEVs had the smallest growth, they made

up over 60% of EV sales.

WoodMac expects global sales of EVs

to account for 7% of all passenger car demand by 2025, 14% by 2030 and 38% by

2040.

“Battery pack sizes continue to trend larger through the medium term, resulting in overall greater battery demand. We have seen the first announcements of the commercialization of NMC 811 cells in EVs,” says Gavin Montgomery, WoodMac research director.

We expect to see an increased nickel demand at the expense of cobalt, and to a lesser extent, lithium

Gavin Montgomery, WoodMac Research Director

Unsurprisingly, Montgomery notes, China

was the first market mover, but a number of other

nations and companies are moving towards mass production of 811 cells before

the end the year.

South Korean SK Innovation, for

once, is already in talks to set up separate battery-making joint ventures with

Volkswagen AG and Chinese partners, as part of the petrochemicals producer’s

aggressive plans to tap into the EV market.

“While still conservative on mass

market uptake for [811 cells], we are more optimistic in regards

to

adoption. As such, we expect to see an increased nickel demand at the expense

of cobalt, and to a lesser extent, lithium,” the analyst says.

Most car makers, including Volkswagen, Ford Motor, Toyota and BMW have already stated they would go completely electric by 2050.

WoodMac warns that, unless battery

technology is developed, tested, commercialized, manufactured and integrated

into EVs and their supply chains faster than ever before, it will be impossible

for many EV targets and ICE (Internal Combustion Engines) bans to be achieved. “This

will pose issues for current EV adoption rate projections,” Montgomery says.

Lithium prices to fall further

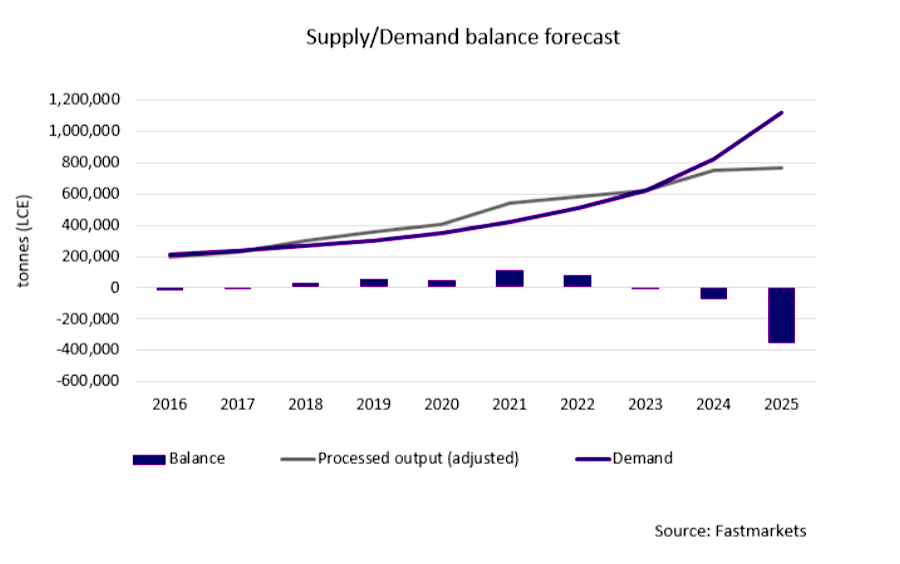

In the past year, spot prices for lithium carbonate have fallen by just under $7000 a tonne, affecting top producers and juniors alike.

“This is in an environment where the major brine producers in South America have failed to ramp up capacity. Clearly, the first responders to the lithium boom – Australian hard rock mines – have the capability to quickly deliver the required tonnages. Meanwhile, the bottleneck in Chinese conversion capacity that was supporting prices is giving way as China emerges as a net exporter of lithium chemicals to the region.

“It has only taken a few years for

the battery sector to become the largest demand driver for lithium. Lithium’s

use in every lithium-ion battery type means it will have double-digit annual

growth, making up over 80% of total lithium demand by 2030,” Montgomery adds.

The study also reveals that the cobalt market will see

an oversupply of intermediate products such as hydroxide until at least 2024.

The firm also suggests that investment in new nickel projects

are needed now as mines can take up to 10 years to develop.