This post Until the Tax Man Do Us Part appeared first on Daily Reckoning.

Are you planning a wedding for this year? Congratulations!

Whether it’s going to be one with hundreds of guests in a grand setting or something much more intimate… like a ceremony on the beach with a few close family members and friends… you have a lot going on now.

What to wear, whom to invite, what to serve, where to go on a honeymoon are surely on your checklist.

Furthest from your mind is what getting married will mean for your income taxes. But between now and next April, it will pop up. So the sooner you know what to expect, the more time you’ll have to plan, which could be especially important when it comes to…

The Marriage Penalty

If the two of you will pay more taxes as a married couple than you would if filing as two single persons, you are getting hit with the marriage penalty.

The Tax Cuts and Jobs Act that took effect last year eliminated the marriage penalty for many couples. Others might still feel the pain.

Let’s Start with the High Earners…

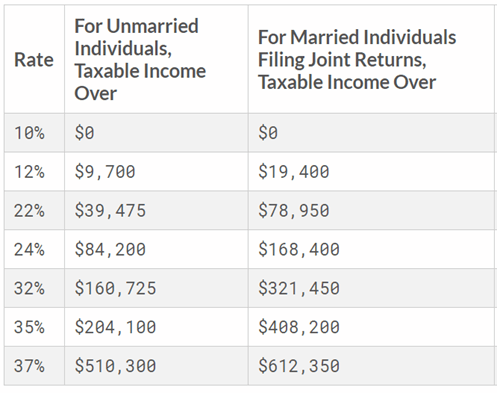

Two people without children each earning $500,000, taking the standard deduction, and filing as singles would be in the 35% bracket. If they marry, their combined income will be $1 million. That will push them into the 37% bracket and translate into $7,264 of additional income taxes.

Source: Tax Foundation

For our million-dollar couple and those with slightly more modest incomes, the 0.9% Medicare surtax could consume a piece of their paycheck. When single, the threshold amount was $200,000. For a married couple it’s $250,000.

So two singles each earning $150,000 don’t have to worry about this tax. Once they are married, though, their combined income will be $300,000 — exceeding the threshold by $50,000.

Additional tax: $450

Then there’s the Net Investment Income Tax (NIIT).

The NIIT is a 3.8% tax on certain sources of income, including: interest, dividends, and capital gains.

As a single-filer, you’ll owe this tax if you have net investment income and your modified adjusted gross income (MAGI) is more than $200,000.

After you’re married and file jointly, the tax kicks in when the two of you have a combined MAGI of $250,000.

Now let’s look at…

Lower Income Folks…

Perhaps you’re not in the million-dollar club or even close to it. In fact, you’re way at the other end of the scale.

Then you might be familiar with the earned income tax credit. Keep in mind that a credit is different from a deduction in that a credit could result in a refund even when your tax bill is zero.

This credit is available to low earners and qualified working taxpayers with children.

The maximum amount of the credit is:

- $529 with no children

- $3,526 with one child

- $5,828 with two children

- $6,557 with three or more children

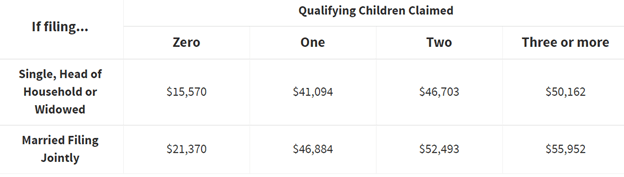

Say you and your future spouse each earn $40,000 annually and each have a child. In 2018, you were both eligible for a $3,526 tax credit since the threshold was $41,094 for a single filer. In other words, the two of you received a total of $7,052 in tax credits.

However, when you file for 2019, your combined income will be $80,000 — far exceeding the $52,493 married filing jointly limit.

So you can kiss that $7,052 goodbye.

Source: IRS

Tax Implications for Retirees…

Retirees tying the knot could see more of their Social Security benefits taxed.

If you file as an individual and your provisional income (total adjusted gross income, nontaxable interest, and half of your Social Security benefits) is less than $25,000 — you won’t owe tax on your benefits.

Provisional income between $25,000 and $34,000 will mean up to 50% of your benefits will be taxable. If your income is more than $34,000, up to 85% of your Social Security is subject to tax.

Logic would tell you that after you’re married these thresholds would double to $50,000 and $68,000 respectively.

Sorry, but logic plays no role here.

In fact, for married couples filing jointly the initial threshold is only $32,000. Between $32,000 and $44,000, you may have to pay tax on up to 50% of your benefits. And if it’s more than $44,000, up to 85% could be taxable.

|

Filing status |

Provisional income |

Amount subject to income tax |

|

Single |

Under $25,000 |

0 |

|

$25,000 – $34,000 |

Up to 50% |

|

|

Over $34,000 |

Up to 85% |

|

|

Married filing jointly |

Under $32,000 |

0 |

|

$32,000 – $44,000 |

Up to 50% |

|

|

Over $44,000 |

Up to 85% |

Regardless of your Income…

The amount you can deduct for state and local taxes (SALT) is capped at $10,000 for singles and married couples. This would only affect you if you itemize, which few do since the standard deduction is now $24,400 for married filing jointly.

Still, single taxpayers who do itemize and live in high tax states, like California and New Jersey, could see part of their deduction disappear after they tie the knot.

The Tax Policy Center has a handy tool that will calculate how much federal income tax two people might pay as individuals vs. as a married couple.

If you find that your taxes will increase after marriage, you could look into ways of reducing taxable income such as contributing to a traditional IRA or your employer’s qualified retirement plan, like a 401(k).

Also if there will be a big difference in the amount of tax you’ll owe, you should fill out a new Form W-4 so you don’t get any surprises come tax time.

To a richer life,

— Nilus Mattive

Editor, The Rich Life Roadmap

The post Until the Tax Man Do Us Part appeared first on Daily Reckoning.