World number one mining company BHP (ASX, NYSE:BHP) is said to be mulling options to divest its thermal coal business, which includes assets in Australia and Colombia.

The Melbourne, Australia-based giant took a first step away from thermal coal last year, by leaving the World Coal Association (WCA). The miner, which publicly supports the Paris climate accord, cited differences on climate change as the main reason to end its membership in the lobby group.

Rival Rio Tinto sold its last coal mines last year.

It added that any present and future affiliations should align

with the company’s climate and energy stance, which includes tackling global

warming through emission reductions.

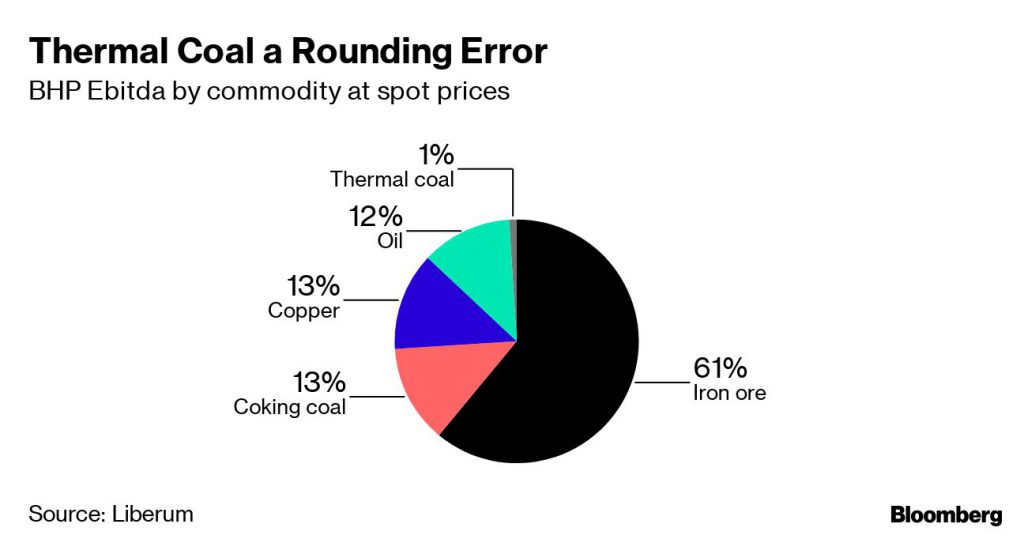

The miner has two thermal coal units — NSW Energy Coal in

Australia and Cerrejón in Colombia —, which are expected to generate just 4% of

the company’s earnings this year.

Chief financial officer, Peter Beaven hinted earlier this

year that BHP was looking at alternatives to remove the fossil fuel from its

portfolio “potentially sooner than expected.”

Beaven noted at the time the company would rather focus on commodities that allow the electrification of transport and the decarbonization of stationary power, such as copper and nickel.

Macquarie Group Ltd. and JPMorgan Chase & Co. are seen as frontrunners to run a sales process for the assets, people familiar with the matter told Bloomberg News.

BHP move would mirror those of its main rivals, Rio Tinto and Anglo American, which recently offloaded all or part of their coal assets, as a result of increasing pressure from institutional investors concerned about global warming.

The world’s largest trust, Norway’s $1 trillion sovereign wealth fund, recently announced it would no longer invest in companies that mine more than 20 million tonnes of coal a year or generate more than 10 gigawatts (GW) of power from coal.